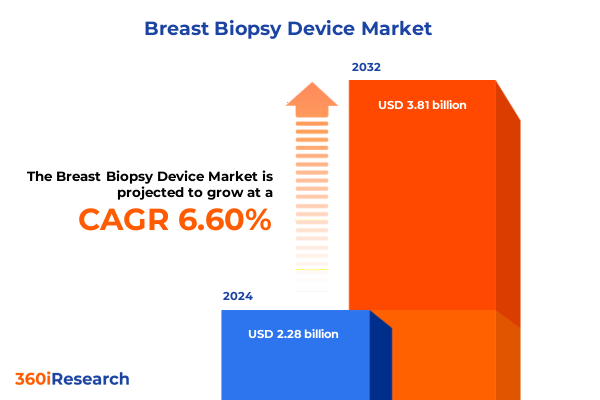

The Breast Biopsy Device Market size was estimated at USD 2.42 billion in 2025 and expected to reach USD 2.57 billion in 2026, at a CAGR of 6.70% to reach USD 3.81 billion by 2032.

Groundbreaking Innovations and Clinical Imperatives Shaping the Modern Breast Biopsy Device Landscape and Driving Unprecedented Diagnostic Excellence

In recent years, the breast biopsy device sector has experienced a remarkable convergence of clinical demand and technological ingenuity, propelling the field toward new frontiers of diagnostic precision. As early detection remains the cornerstone of positive patient outcomes in breast oncology, clinicians and healthcare institutions are increasingly prioritizing tools that combine high image fidelity with minimally invasive workflows. Consequently, manufacturers have intensified efforts to integrate advanced imaging modalities, improve ergonomic designs and elevate safety profiles to align with evolving physician expectations.

Furthermore, regulatory bodies worldwide have tightened quality and performance benchmarks, underscoring the necessity for seamless traceability, rigorous validation and adherence to international standards. As a result, collaboration across multidisciplinary teams-including radiologists, pathologists, biomedical engineers and regulatory specialists-has become indispensable. This intersection of clinical rigor and cross-functional cooperation sets the stage for a dynamic landscape, where innovation is not merely a differentiator but a prerequisite for sustained relevance.

Given these dynamics, stakeholders must stay attuned to emerging trends, policy shifts and patient-centric imperatives. By synthesizing the latest advancements in biopsy instrumentation, procedural techniques and digital integration, this executive overview provides a foundational context for understanding the forces that will shape breast biopsy device strategies in the years ahead.

Emergence of AI Integration and Advanced Imaging Modalities Redefining Breast Biopsy Procedures through Enhanced Precision and Workflow Optimization

Transformation within the breast biopsy device ecosystem has been driven primarily by breakthroughs in imaging convergence and data analytics. Artificial intelligence-powered imaging software now enhances lesion detection accuracy, enabling physicians to pinpoint suspicious tissue with unprecedented granularity. At the same time, the integration of real-time feedback loops between imaging platforms and biopsy instruments has streamlined procedural efficiency, reducing the need for repeat interventions and elevating patient comfort.

Simultaneously, the advent of novel guidance systems-ranging from tomosynthesis-guided solutions to MRI fusion platforms-has expanded the procedural toolkit available to clinicians. These complementary modalities not only enhance spatial resolution but also facilitate targeted sampling of lesions previously considered challenging or inaccessible. As a corollary, device manufacturers are increasingly embedding smart sensors and haptic feedback mechanisms into biopsy needles and tables, offering operators enhanced situational awareness and procedural control.

Moreover, the proliferation of minimally invasive techniques marks a pivotal shift toward reducing patient trauma and accelerating recovery timelines. Whether through vacuum-assisted tissue retrieval systems or ultra-fine gauge needles, procedural refinements emphasize both diagnostic yield and patient experience. In this new era, the fusion of imaging innovation, digitization and ergonomic design heralds a transformative chapter in breast biopsy care.

Assessing the Cumulative Influence of United States Tariff Policies in 2025 on the Cost Structures and Supply Chain Dynamics of Breast Biopsy Devices

The cumulative impact of United States tariff policies in 2025 has introduced nuanced cost pressures across the breast biopsy device supply chain. Tariffs on imported steel and aluminum components have elevated base material costs, prompting manufacturers to reassess sourcing strategies and pursue domestic partnerships. Concurrently, Section 301 levies on specific equipment imported from certain regions have increased the landed price of imaging guidance modules, leading to careful calibration of procurement timelines.

In response, original equipment manufacturers have intensified efforts to diversify their supplier networks, exploring near-shoring initiatives and fostering strategic alliances with regional fabricators. This shift toward localized assembly has mitigated exposure to import duties while enhancing supply chain resilience. Yet, these benefits are counterbalanced by the need for rigorous quality audits and compliance verification to ensure that alternative vendors meet stringent regulatory and performance standards.

Furthermore, the tariff environment has catalyzed dialogue between industry associations, regulatory agencies and policy makers regarding potential exemptions for medical instrumentation. Although some relief measures have been proposed, advocacy groups continue to emphasize the importance of safeguarding access to critical diagnostic devices. As stakeholders navigate this complex terrain, the interplay of trade policy and clinical imperatives underscores the necessity for agile, cost-efficient operational strategies.

Uncovering Actionable Segmentation Insights across Product Categories, Procedure Types, Techniques, Application Scenarios, End Users and Distribution Pathways

A nuanced examination of product classifications reveals the distinct roles of assay kits, biopsy needles, tables, guidance systems and localization wires in shaping procedural efficacy. Assay kits enable precise molecular analysis, establishing a direct link between sampling devices and downstream pathological diagnostics. Biopsy needle innovations, characterized by variable gauge options and reinforced shafts, cater to lesion-specific requirements, while ergonomic table designs support patient positioning stability and operator access.

Considering procedural diversity, core needle biopsy remains a workhorse for tissue extraction in palpable lesions, whereas fine needle aspiration offers a lower-trauma alternative for cytological sampling. Vacuum-assisted biopsy techniques, however, have gained traction in non-palpable or microcalcified lesion contexts due to their ability to procure larger contiguous specimens with fewer passes. This procedural layering highlights the importance of aligning device selection with lesion complexity and patient comfort objectives.

Technique variations further diversify the landscape, spanning MRI-guided systems for deep-seated lesions, stereotactic approaches for calcification-targeted biopsies, tomosynthesis-guided solutions for enhanced three-dimensional visualization and ultrasound-guided platforms known for real-time imaging and accessibility. In parallel, the dichotomy between automated and manual biopsy devices reflects a trade-off between procedural consistency and cost considerations. Application insights distinguish devices optimized for benign lesion assessments from those engineered for comprehensive malignant tissue characterization.

End-user segmentation spans ambulatory surgery centers that prioritize throughput efficiency, diagnostic imaging centers that value advanced imaging compatibility and hospitals that demand comprehensive interoperability with broader clinical workflows. Finally, distribution channels range from traditional direct-sales engagements offering hands-on training to digital platforms enabling remote ordering and rapid restocking. Taken together, these segmentation dimensions furnish a granular perspective on the multifaceted nature of the breast biopsy device ecosystem.

This comprehensive research report categorizes the Breast Biopsy Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Procedure Type

- Technique

- Category

- Application

- End User

- Distribution Channel

Evaluating Distinct Regional Dynamics Shaping Breast Biopsy Device Adoption and Innovation Trends Throughout the Americas, Europe Middle East & Africa and Asia Pacific

Regional dynamics in the Americas are characterized by robust reimbursement frameworks and strong uptake of premium imaging-guided biopsy solutions. In North America, healthcare providers leverage a well-established network of radiology centers and ambulatory surgery facilities to deliver same-day diagnostic resolution, driving demand for streamlined, interoperable devices that integrate with electronic health record systems. Meanwhile, Latin American markets are gradually embracing high-precision biopsy platforms, balancing cost constraints with growing awareness of early breast cancer detection programs.

Across Europe, Middle East & Africa, the interplay of publicly financed healthcare models and evolving private sector participation shapes device procurement strategies. Western European nations lead in the adoption of tomosynthesis-guided and MRI-integrated solutions, supported by national screening initiatives and rigorous clinical guidelines. In contrast, Middle Eastern centers of excellence focus on hybrid diagnostic suites that combine stereotactic and ultrasound-guided capabilities to accommodate diverse patient populations. Throughout Africa, access challenges spur the development of mobile biopsy units and low-cost device variants that maintain core safety and efficacy standards.

Asia Pacific presents a heterogeneous mosaic of adoption rates and investment priorities. In advanced East Asian markets, research consortia and device manufacturers co-develop next-generation robotic guidance systems and AI-driven analytics platforms. At the same time, Southeast Asian and South Asian regions witness accelerating procurement of manual and semi-automated biopsy devices aligned with public health screening expansion. Across the region, efforts to standardize training protocols and leverage telemedicine for remote guidance further enhance procedural consistency and diagnostic reach.

This comprehensive research report examines key regions that drive the evolution of the Breast Biopsy Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders Driving Innovation, Strategic Partnerships, and Competitive Differentiation within the Breast Biopsy Device Ecosystem

Industry leaders have adopted diversified strategies to secure competitive differentiation and drive innovation. Hologic distinguishes itself through a vertically integrated approach, coupling proprietary guidance systems with AI-enabled image analysis to streamline diagnostic workflows and enhance lesion targeting accuracy. Becton Dickinson leverages its extensive distribution network and regulatory expertise to support rapid market access for novel biopsy needles and vacuum-assisted platforms, emphasizing uniform quality standards across regions.

Collaborations between diagnostic imaging pioneers and instrumentation specialists continue to reshape the competitive environment. Siemens Healthineers has partnered with specialized needle manufacturers to co-engineer integrated biopsy modules that seamlessly interface with its tomosynthesis and MRI solutions. Similarly, GE Healthcare’s alliance with digital pathology firms enables cloud-based image sharing and remote consultation, augmenting the value proposition of its biopsy tables and guidance systems.

Emerging players have carved niches by focusing on affordability and modularity. Select biotech firms have introduced customizable assay kits that align with existing biopsy workflows, enabling diagnostic laboratories to expand molecular profiling capabilities without extensive capital investment. Meanwhile, regional device developers in Asia Pacific and Eastern Europe emphasize rapid regulatory approvals and localized service offerings to capture growth in underserved markets. Together, these multi-pronged strategies underscore the importance of cross-industry collaboration, continuous R&D investment and adaptive go-to-market models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Breast Biopsy Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advin Health Care

- Argon Medical Devices, Inc.

- Becton, Dickinson and Company

- Cook Group Incorporated

- Danaher Corporation

- FUJIFILM Corporation

- General Electric Company

- Halma plc

- Hologic, Inc

- INRAD Inc.

- Medline Industries, LP

- Medtronic PLC

- Merit Medical Systems, Inc.

- Ningbo Xinwell Medical Technology Co., LTD.

- PAJUNK GmbH

- Planmeca Oy

- Point Blank Medical

- Siemens AG

- SNVL Varay Laborix

- STERYLAB S.r.l.

- Suretech Medical Inc.

- Thermo Fisher Scientific Inc.

- Trivitron Healthcare

- Vector Medical, Inc.

- Zamar Care

Implementing Strategic Initiatives to Enhance Operational Efficiency, Regulatory Compliance, Technological Integration and Value-Based Care in Breast Biopsy Practices

To bolster procedural efficiency and clinical accuracy, manufacturers should prioritize partnerships with AI and imaging analytics providers, integrating deep learning algorithms directly into guidance platforms. This fusion will reduce operator dependency and standardize tissue sampling outcomes. Simultaneously, device developers must diversify supply chains by forging alliances with domestic fabricators, thereby mitigating tariff-induced cost fluctuations and enhancing production agility.

Healthcare institutions are advised to implement comprehensive training programs that marry virtual reality simulations with hands-on workshops, ensuring that radiologists and technicians develop proficiency in advanced modalities such as tomosynthesis and MRI guidance. In parallel, cross-functional teams should collaborate on value-based care initiatives, aligning procedural reimbursements with patient-centered outcomes and fostering transparent communication with payers regarding long-term cost benefits.

Regulatory affairs specialists can streamline approval pathways by engaging early with governing bodies, advocating for harmonized standards that expedite market entry for breakthrough biopsy devices. Finally, sales and marketing organizations should leverage digital platforms to facilitate remote ordering and post-sale support, reducing downtime and enhancing client satisfaction. By executing these strategic initiatives, industry players will be well positioned to navigate evolving clinical demands, regulatory landscapes and global trade dynamics.

Detailing Rigorous Research Methodology Incorporating Primary Interviews, Secondary Data Triangulation and Quantitative Qualitative Analysis to Ensure Robust Findings

This analysis synthesizes insights from a comprehensive research framework combining primary qualitative interviews with radiologists, interventional oncologists, pathology directors and device engineers alongside secondary research from peer-reviewed journals, industry white papers and regulatory guidelines. Primary engagements comprised structured deep-dive discussions and open-ended surveys designed to capture firsthand perspectives on procedural challenges, technology adoption barriers and future innovation priorities.

Secondary data sources were meticulously curated to include clinical trial registries, patent databases and global tariff notifications, ensuring robust triangulation of findings. Quantitative validation involved cross-referencing shipment statistics, device approval timelines and reimbursement coding data, thereby fortifying the reliability of thematic conclusions. Additionally, case studies from leading healthcare centers provided real-world context regarding integration pathways and user feedback.

Throughout the methodology, rigorous data cleaning and quality assurance protocols were applied to maintain accuracy and mitigate bias. Analytical techniques spanned both thematic content analysis for qualitative inputs and statistical trend validation for quantitative datasets. Collectively, this multi-layered approach underpins the actionable insights presented, offering stakeholders a transparent, reproducible foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Breast Biopsy Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Breast Biopsy Device Market, by Product

- Breast Biopsy Device Market, by Procedure Type

- Breast Biopsy Device Market, by Technique

- Breast Biopsy Device Market, by Category

- Breast Biopsy Device Market, by Application

- Breast Biopsy Device Market, by End User

- Breast Biopsy Device Market, by Distribution Channel

- Breast Biopsy Device Market, by Region

- Breast Biopsy Device Market, by Group

- Breast Biopsy Device Market, by Country

- United States Breast Biopsy Device Market

- China Breast Biopsy Device Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesizing Core Insights to Illuminate Future Opportunities and Guide Stakeholders Toward Enhanced Diagnostic Precision and Patient Centricity in Breast Biopsy Devices

The journey through cutting-edge innovations, shifting trade policies and diverse regional landscapes underscores the dynamic nature of the breast biopsy device industry. By examining the interplay of product technologies, procedural modalities and end-user requirements, stakeholders gain a holistic perspective that informs targeted investment decisions and product roadmaps. Meanwhile, the cumulative effects of tariff adjustments in 2025 highlight the critical importance of adaptive supply chain strategies and proactive policy engagement.

Segmentation analysis illuminates the nuanced demands across device categories-from high-precision assay kits to ergonomic biopsy tables-and procedural pathways that span core needle sampling to vacuum-assisted techniques. Regional insights further reveal how reimbursement frameworks, healthcare infrastructure and demographic factors converge to shape adoption patterns. In parallel, company profiles illustrate the competitive imperatives driving R&D collaboration, digital transformation and strategic partnerships.

Ultimately, the synthesis of these insights points toward a future in which patient-centered design, integrated digital ecosystems and resilient operational frameworks will define market leadership. As diagnostic precision continues to advance, stakeholders equipped with these core insights will be poised to deliver superior clinical outcomes, drive sustainable growth and propel the next wave of innovation in breast biopsy device development.

Engaging with Ketan Rohom to Leverage Expert Insights and Secure Comprehensive Breast Biopsy Device Market Intelligence to Drive Informed Strategic Decisions

Engaging with Ketan Rohom offers an unparalleled opportunity to deepen strategic insights and secure the comprehensive intelligence needed to outpace competitors in the evolving breast biopsy device arena. As Associate Director of Sales & Marketing at 360iResearch, Ketan brings a wealth of experience in translating complex diagnostic trends into actionable guidance that empowers decision makers across healthcare, technology and regulatory landscapes. By connecting directly with him, stakeholders gain privileged access to tailored consultations, in-depth briefings and bespoke data visualizations designed to illuminate critical inflection points and optimize resource allocation.

Through a collaborative dialogue driven by rigorous analysis and industry foresight, Ketan ensures that every inquiry is met with precision, contextual relevance and pragmatic recommendations. Whether exploring new product development, diversifying distribution channels or navigating tariff-driven supply chain challenges, his expertise serves as a catalyst for informed, confident decision-making. Reach out today to unlock the full potential of the market research report and chart a definitive path toward sustainable growth in breast biopsy device development and commercialization.

- How big is the Breast Biopsy Device Market?

- What is the Breast Biopsy Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?