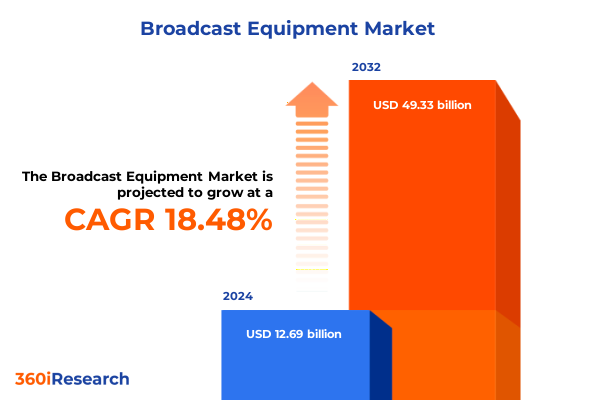

The Broadcast Equipment Market size was estimated at USD 15.01 billion in 2025 and expected to reach USD 17.75 billion in 2026, at a CAGR of 18.52% to reach USD 49.33 billion by 2032.

How Emerging Technologies And Changing Consumption Habits Are Redefining The Broadcast Equipment Landscape For Modern Content Delivery And Operational Efficiency Enabling Next Generation Experiences

The broadcast equipment industry is undergoing an unprecedented period of transformation shaped by rapid innovation and evolving consumption behaviors. As audiences increasingly demand high-quality, on-demand content across diverse platforms, suppliers and operators must adapt to maintain relevance and drive engagement. Traditional broadcast models rooted in hardware-centric workflows are giving way to flexible, software-driven solutions that emphasize agility, cost efficiency, and scalability. In this context, the market is characterized by a convergence of legacy systems and emerging technologies that collectively redefine how content is created, managed, and distributed.

Against this backdrop, technological advancements such as Internet Protocol (IP) workflows, cloud computing architectures, and next-generation connectivity protocols are reshaping the competitive landscape. Ultra High Definition (UHD) formats are rapidly transitioning from niche broadcast applications to mainstream deployment, while remote production and virtualized environments enable global collaboration without the need for physical studios. These developments not only improve operational efficiency but also foster creative experimentation and new revenue streams.

This executive summary provides a concise yet comprehensive overview of the key forces driving the broadcast equipment market. Through an exploration of transformative shifts, regulatory impacts, segmentation insights, regional dynamics, and leading vendor strategies, we offer decision-makers an informed foundation to navigate current challenges and capitalize on emerging opportunities.

Uncover The Transformative Shifts In Broadcast Infrastructure And Workflow Models Driving Unprecedented Flexibility And Scalability Across The Industry And Cost Optimization

The broadcast equipment sector is witnessing transformative shifts driven by an imperative to optimize every stage of the content lifecycle. Legacy analog and SDI infrastructures are progressively yielding to IP-based networks that provide unprecedented flexibility in routing, control, and monitoring. This migration has been accelerated by the industry’s embrace of virtualization, whereby software-defined functions alleviate the constraints of proprietary hardware platforms and enable cloud-native deployments.

Simultaneously, the integration of artificial intelligence and machine learning is revolutionizing asset management, metadata tagging, and automated quality control. Intelligent algorithms can detect anomalies in real time, optimize encoding parameters, and even assist in creative editing workflows. Moreover, the proliferation of 5G and edge computing is expanding the boundaries of live production, enabling broadcasters to capture and transmit ultra-low-latency feeds from remote locations without the logistical burdens of traditional OB vans.

These shifts collectively enhance scalability and cost optimization, allowing operators to reallocate capital expenditures toward innovation rather than maintenance. Interoperability standards such as SMPTE ST 2110 and AMWA’s NMOS framework play a pivotal role in ensuring that diverse hardware and software components interconnect seamlessly. As a result, broadcasters can orchestrate dynamic workflows that adapt to real-time audience demands and deliver premium experiences across linear, OTT, and interactive channels.

Examining The Comprehensive Impact Of 2025 United States Tariffs On Broadcaster Procurement Strategies Supply Chains And Competitive Dynamics And Long Term Resilience

In early 2025, the United States implemented a series of tariffs targeting specific categories of broadcast equipment imports. These measures, designed to protect domestic manufacturers, have had far-reaching implications across the value chain. Component costs for cameras, switchers, and servers have risen notably, prompting equipment vendors to reevaluate sourcing strategies and renegotiate contracts with suppliers. Moreover, end users have reported extended lead times as manufacturers balance inventory constraints against escalating raw material expenses.

To mitigate budgetary pressures, several broadcasters and professional studios are diversifying their procurement channels. Rather than solely relying on traditional suppliers, some have forged partnerships with component fabricators in Korea, Japan, and Southeast Asia. These alliances facilitate alternative supply routes that bypass the most heavily taxed Chinese imports, although they may entail additional logistical complexity. At the same time, equipment manufacturers have accelerated efforts to localize assembly operations within North America, leveraging free trade agreements to preserve competitive price points.

Long-term resilience is increasingly viewed as paramount. Forward-looking organizations are building strategic inventory buffers and exploring modular design philosophies that allow critical subsystems to be upgraded independently of the entire platform. By fostering closer collaboration between procurement, engineering, and finance teams, stakeholders can better anticipate tariff adjustments and align procurement timelines with anticipated policy changes, thereby minimizing cost volatility and safeguarding operational continuity.

Insightful Analysis Of Broadcast Equipment Market Segmentation Revealing Critical Differentiators Across Technology Types User Applications And Distribution Channels And Emerging Trends Insight

A nuanced understanding of market segmentation is essential for anticipating demand patterns and tailoring product portfolios. Within the realm of equipment type, demand for audio solutions such as microphones and mixers continues to expand alongside the rise of live streaming and podcasting, while broadcast monitors-both color grading and standard preview displays-remain critical for post-production workflows. Servers and storage platforms, divided between graphics and playout servers, reflect the dual imperatives of real-time rendering and reliable content delivery. Similarly, switchers and routers are bifurcated into audio routing systems and video switching matrices, each playing a vital role in signal management, as video cameras spanning ENG, PTZ, and studio configurations underpin both remote and studio productions.

When evaluating the adoption of enabling technologies, cloud-based private and public deployments have emerged as foundational to modern broadcast infrastructures, while high-definition formats such as 1080p and 720p maintain strongholds in legacy environments. File-based streaming and live IP broadcasting extend the reach of content creators, even as standard-definition formats-480i and 576i-persist in markets with bandwidth constraints. The push toward Ultra High Definition at 4K and 8K resolutions is gaining traction among premium content providers seeking to differentiate through superior visual fidelity.

End users-ranging from educational institutions covering both schools and universities to government entities in defense and public safety-demand specialized feature sets, while professional studios for film and news production prioritize reliability and latency performance. Broadcasters, including both AM and FM radio operators and private and public television networks, require integrated solutions that support hybrid delivery models. Across distribution channels, aftermarket upgrades for spare parts coexist with OEM sales from audio and camera manufacturers, complemented by online transactions via direct manufacturer portals and e-commerce platforms as well as traditional retail outlets. Applications such as advertising insertion, entertainment production, field and studio news gathering, sports highlights and live coverage, and weather forecasting and storm tracking drive differentiated requirements that inform product roadmaps and sales strategies.

This comprehensive research report categorizes the Broadcast Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Technology

- End User

- Distribution Channel

- Application

In Depth Exploration Of Regional Variations Highlighting How Americas Europe Middle East Africa And Asia Pacific Markets Are Uniquely Shaped By Local Drivers And Regulatory Variances

Regional dynamics reveal stark contrasts in investment priorities and regulatory frameworks. In the Americas, the United States remains a dominant force, with significant capital flowing into IP-centric solutions and cloud migration initiatives that support seamless content distribution across terrestrial and OTT platforms. Canada’s government incentives for media digitization, coupled with a strong public broadcasting tradition, encourage the adoption of next-generation production facilities. Meanwhile, Latin American markets are accelerating the replacement of aging analog infrastructures driven by consumer demand for high-definition and interactive services.

Across Europe, Middle East & Africa, broadcasters navigate a complex tapestry of regulatory environments and cultural preferences. Western European countries emphasize IP-based standardization and collaborative production hubs, whereas the Middle East invests heavily in greenfield studio builds to support premium sports and entertainment franchises. Africa’s broadcast sector, while still developing, is witnessing rapid uptake of cloud-delivered playout services to reach geographically dispersed audiences, bypassing the high costs of terrestrial network expansion.

Asia-Pacific stands out as the fastest-growing region, where rapid digitalization in China and India fuels demand for scalable server infrastructures and UHD camera deployments. Japan’s pioneering work in 8K transmission and display technologies sets a global benchmark, while Australia’s stable market showcases gradual upgrades to IP and cloud workflows. Regulatory frameworks and spectrum allocation policies across these markets continue to influence deployment timelines and technology roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Broadcast Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Discover Leading Broadcast Equipment Manufacturers Strategic Moves Partnerships And Innovations Shaping The Competitive Landscape For Market Leadership And Market Positioning

The competitive landscape is defined by established incumbents and agile challengers each pursuing differentiated strategies. Grass Valley maintains a strong position in playout servers and multiviewer platforms, leveraging its deep integration with live sports and news production workflows. Imagine Communications has doubled down on software-defined networking and cloud orchestration, forging strategic alliances with major public cloud providers to deliver end-to-end IP workflows as a service. Sony’s expertise in camera sensor development and its end-to-end studio ecosystem ensures broad appeal among tier-one broadcasters seeking turnkey solutions.

Meanwhile, Evertz continues to innovate in routing and signal processing, emphasizing scalability for large-scale operations and remote production models. Blackmagic Design’s disruptive pricing and fully integrated switcher and camera lineups have democratized access to professional-grade equipment for independent producers and educational institutions. Ross Video is carving out a niche in robotic camera automation and virtual set technologies, catering to news desks and sports studios looking for advanced graphics and remote operation.

New entrants and specialized vendors are also influencing market dynamics. AJA Video Systems focuses on high-performance I/O solutions that bridge legacy and IP environments, while Telestream’s software-centric approach addresses the burgeoning OTT encoding and monitoring segment. Together, these companies drive continuous innovation, raising the bar for interoperability, feature richness, and total cost of ownership considerations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Broadcast Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acorde Technologies S.A.

- Amphenol Corporation

- AVL Technologies

- Belden Inc.

- Cisco Systems, Inc.

- Clyde Broadcast Technology Limited

- CommScope, Inc.

- Datum Systems

- Eletec Sarl

- ETL Systems Ltd.

- Evertz Microsystems Ltd.

- EVS Broadcast Equipment SA

- Global Invacom Group

- Grass Valley Group

- Hangzhou HAOXUN Technologies Co., Ltd.

- Harmonic Inc.

- Micro Communications by Microwave Techniques, LLC

- Molex LLC

- NEC Corporation

- OMB Sistemas Electrónicos S.A.

- Rohde & Schwarz GmbH & Co KG

- Sencore by Wellav Technologies Ltd.

- TE Connectivity Ltd.

- Telefonaktiebolaget LM Ericsson

- TVC Communications by WESCO International, Inc.

Strategic Action Plans For Industry Leaders To Navigate Evolving Regulations Technological Disruption And Competitive Pressures Effectively And Profitably Achieving Operational Excellence

Industry leaders must embrace modular, software-driven architectures to future-proof investments and accelerate time to market. By transitioning from monolithic hardware designs to containerized services and microservices frameworks, organizations can deploy new features rapidly and scale resources dynamically. At the same time, cultivating partnerships with cloud providers and network operators enables seamless hybrid workflows that blend on-premises performance with cloud elasticity. To support these shifts, cross-functional teams should develop competency centers focused on IP standards, automation scripting, and cybersecurity protocols.

In parallel, diversifying supply chains remains critical to managing tariff volatility and geopolitical risks. Leaders should map component origins, qualify alternative suppliers, and negotiate framework agreements that allow for agile sourcing. Concurrently, incorporating sustainability metrics into procurement decisions not only addresses environmental concerns but can also yield cost savings through reduced power consumption and lower lifecycle maintenance. Pilot programs for recyclable and modular hardware architectures will demonstrate both corporate responsibility and operational efficiency.

Finally, investing in talent development and change management is essential. As workflows evolve, personnel must acquire new skill sets in software configuration, cloud orchestration, and data analytics. Organizations should implement continuous learning programs, certification tracks, and knowledge-sharing forums to bridge the gap between traditional broadcast engineering and IT-centric operations. By fostering a culture that values experimentation and cross-disciplinary collaboration, companies can accelerate innovation and maintain a clear competitive advantage.

Rigorous Research Methodology Synthesizing Primary Interviews And Secondary Data To Ensure Robust Insights Into The Broadcast Equipment Market Dynamics With Transparent Data Validation Processes

Our research methodology integrates both qualitative and quantitative techniques to ensure a robust and unbiased market analysis. Primary research involved in-depth interviews with senior executives at leading broadcasters, technology vendors, and service providers, allowing us to capture firsthand perspectives on emerging challenges and strategic priorities. These insights were contextualized through a comprehensive review of industry white papers, regulatory filings, and publicly available financial statements. By triangulating multiple data sources, we validated key trends and identified areas of convergence and divergence among stakeholder views.

Quantitative analysis encompassed the examination of historical product shipment data, technology adoption rates, and end-user investment patterns across different geographic regions. We employed statistical modeling to discern adoption curves for new technologies such as UHD, IP broadcasting, and cloud-native production, adjusting for macroeconomic variables and tariff impacts. Scenario planning techniques were used to simulate potential policy shifts, cost fluctuations, and service level requirements, providing a spectrum of outcomes that inform risk mitigation strategies.

To maintain transparency and reproducibility, our approach included rigorous data validation processes. Secondary data points were cross-checked against multiple independent sources, while primary interview findings were coded and anonymized to eliminate respondent bias. The resulting dataset underpins the actionable insights presented in this summary and offers a high degree of confidence for decision-makers planning capital investments and strategic initiatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Broadcast Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Broadcast Equipment Market, by Equipment Type

- Broadcast Equipment Market, by Technology

- Broadcast Equipment Market, by End User

- Broadcast Equipment Market, by Distribution Channel

- Broadcast Equipment Market, by Application

- Broadcast Equipment Market, by Region

- Broadcast Equipment Market, by Group

- Broadcast Equipment Market, by Country

- United States Broadcast Equipment Market

- China Broadcast Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4770 ]

Clear Takeaways Summarizing Key Insights From Market Trends Technological Advancements Regulatory Impacts And Strategic Imperatives For Stakeholders Empowering Decision Makers

In reviewing the broadcast equipment market today, several pivotal themes emerge. The transition to IP-based infrastructures and cloud architectures is no longer optional but fundamental for delivering high-quality, on-demand content across multiple platforms. At the same time, tariff-induced cost pressures underscore the necessity for diversified supply chains and modular design philosophies that foster resilience and cost predictability. These forces are amplified by regional disparities, where regulatory frameworks and investment climates shape distinct growth trajectories in the Americas, EMEA, and Asia-Pacific.

Leading manufacturers continue to advance interoperability and software-centric solutions, blurring the lines between traditional hardware providers and IT vendors. In response, industry leaders must adopt agile procurement models, invest in talent development for software fluency, and forge strategic alliances that extend beyond conventional OEM relationships. By embracing these imperatives, organizations can not only navigate current challenges but also capitalize on emerging opportunities in areas such as remote production, immersive experiences, and next-generation connectivity. Empowering Decision Makers

Secure Exclusive Access Today By Engaging Ketan Rohom To Transform Your Broadcast Equipment Strategy With Comprehensive Market Intelligence And Future Proof Operations

For decision-makers seeking to gain a competitive edge, engaging with Ketan Rohom will unlock the comprehensive intelligence required to refine strategies and accelerate growth. His deep expertise in broadcast equipment market dynamics and customer needs ensures that your organization receives tailored guidance designed to maximize ROI and operational resilience. Forward-thinking leaders who collaborate with him benefit from early access to in-depth analyses, scenario planning, and market entry tactics that drive sustainable performance. Begin the process today to transform insights into actions and solidify your position in an evolving industry landscape.

- How big is the Broadcast Equipment Market?

- What is the Broadcast Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?