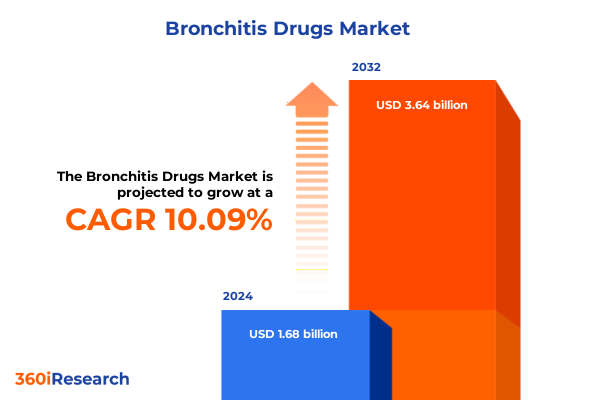

The Bronchitis Drugs Market size was estimated at USD 1.86 billion in 2025 and expected to reach USD 2.01 billion in 2026, at a CAGR of 10.09% to reach USD 3.64 billion by 2032.

Exploring the critical importance of innovative bronchitis therapies in improving patient outcomes and addressing evolving treatment challenges across healthcare settings

Bronchitis remains a pervasive respiratory condition characterized by inflammation of the bronchial tubes, leading to persistent cough, wheezing, and significant morbidity across diverse patient populations. In recent years, therapeutic innovations have aimed at not only alleviating acute symptoms but also reducing recurrence and preventing progression to chronic obstructive pulmonary disease. As public health systems strive to improve patient outcomes and contain healthcare expenditures, the introduction of novel drug classes has become critical. These advancements extend beyond traditional antibiotic regimens to encompass targeted bronchodilators, precision corticosteroid therapies, and enhanced expectorants, all of which underscore the field’s rapid evolution.

Understanding this dynamic landscape is essential for stakeholders seeking to optimize treatment protocols and align with regulatory expectations. This executive summary sets the stage for a holistic examination of bronchitis drug markets by exploring transformative shifts in research and development, evaluating policy impacts, and uncovering segmentation-driven opportunities. By contextualizing recent industry breakthroughs alongside emerging clinical strategies, this introduction aims to furnish decision-makers with a clear framework for navigating the complexities of modern bronchitis therapeutics.

Assessing the transformative shifts reshaping bronchitis drug development driven by technological breakthroughs patient-centric models and changing clinical protocols

The bronchitis drug sector is undergoing a profound transformation driven by technological breakthroughs and evolving clinical paradigms. Precision medicine approaches now leverage genetic and biomarker insights to tailor corticosteroid and antibiotic use, reducing unnecessary exposure and mitigating resistance. In parallel, digital health platforms enable real-time monitoring of lung function and symptom progression, empowering clinicians to adjust bronchodilator regimens dynamically. Moreover, the integration of telemedicine solutions has broadened patient access, ensuring timely interventions for exacerbations irrespective of geographic barriers.

In addition to technological advances, industry stakeholders are embracing patient-centric models that emphasize adherence support and outcome measurement. Smart inhalers equipped with dose-tracking sensors provide actionable data, enabling physicians to reinforce compliance and refine dosage strategies. Furthermore, collaborative research consortia are accelerating the translation of novel small molecules and biologics from bench to bedside, fostering a more agile development cycle. Together, these shifts are redefining the bronchitis treatment paradigm, emphasizing personalized care pathways and seamless, data-driven management.

Understanding the cumulative impact of new United States tariffs on bronchitis drug supply chains, pricing dynamics, and stakeholder strategies in 2025

In 2025, the imposition of new United States tariffs on key pharmaceutical ingredients and finished dosage forms has introduced significant complexities for bronchitis drug supply chains. Tariffs on imported active pharmaceutical ingredients (APIs) have elevated manufacturing costs for antibiotics such as macrolides and penicillins, as well as advanced inhalation devices. Consequently, many manufacturers face compressed margins and are exploring alternative sourcing and nearshoring strategies to mitigate cost pressures. These adjustments have also prompted strategic stockpiling and long-term procurement contracts to buffer against future rate fluctuations.

Beyond direct cost implications, tariffs have influenced pricing dynamics and stakeholder strategies across the value chain. Payers are increasingly scrutinizing formularies and negotiating more aggressively, while providers are examining changes in prescription behavior to manage overall treatment expenditure. In response, some pharmaceutical companies are redistributing manufacturing footprints, adopting dual-sourcing models for critical inputs, and engaging in targeted lobbying to secure tariff exemptions for life-saving therapies. Recognizing these evolving dynamics is crucial for industry participants aiming to maintain supply reliability and balance affordability with innovation.

Uncovering key insights from segmentation by drug type administration route distribution channel and end user to inform targeted strategies

A nuanced segmentation of bronchitis therapies reveals distinct growth drivers and therapeutic priorities across multiple dimensions. When analyzed by drug type, antibiotics remain central to managing bacterial bronchitis, with fluoroquinolones, macrolides, and penicillins each fulfilling specific efficacy and safety profiles. Bronchodilators, including anticholinergics, beta agonists, and methylxanthines, continue to play a pivotal role in relieving airflow obstruction. Corticosteroids have diversified into inhaled formulations for targeted pulmonary delivery and systemic options for severe inflammation. Meanwhile, expectorants such as guaifenesin enhance mucus clearance and support adjunctive care in mucus-laden patients.

Examining the route of administration underscores the importance of delivery optimization. Inhalation modalities-spanning dry powder inhalers, metered dose inhalers, and nebulizers-offer rapid symptomatic relief directly at the bronchial level. Injectable therapies administered intramuscularly or intravenously remain critical in acute care settings, particularly when oral administration is contraindicated. Oral formulations, delivered via syrup or tablet, serve as the backbone for outpatient management. Distribution channels further differentiate market reach, with hospital pharmacies, online pharmacies (direct to consumer and third party), and retail pharmacies (chain and independent) each serving distinct patient segments. End-user analysis highlights clinics (both primary care and specialty), home care environments (including home health agencies and self-care scenarios), and hospitals, each demanding tailored therapeutic strategies to align with care delivery infrastructure.

This comprehensive research report categorizes the Bronchitis Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Type

- Route Of Administration

- Distribution Channel

- End User

Highlighting the distinct regional dynamics influencing bronchitis drug adoption across Americas, Europe Middle East & Africa, and Asia-Pacific landscapes

Regional dynamics exert a profound influence on the adoption and penetration of bronchitis drugs, shaping both innovation priorities and market access strategies. In the Americas, healthcare systems emphasize cost-effectiveness and broad formulary coverage, with payers collaborating on value-based agreements for advanced inhalers and biologic adjuncts. North American regulatory frameworks support expedited approval pathways, driving early launches of differentiated therapies, while Latin American markets exhibit growing demand for generics and biosimilars as budget constraints intensify.

Across Europe, the Middle East, and Africa, heterogeneous regulatory environments and reimbursement models necessitate adaptive market entry tactics. Western European nations often prioritize clinical outcomes and patient quality of life, fostering investment in digital adherence tools and combination products. In contrast, emerging EMEA markets focus on foundational access, favoring generics and cost-efficient injectables. The Asia-Pacific region presents a dual landscape: mature markets in Japan and Australia are advancing precision inhalation technologies, whereas high-growth territories in Southeast Asia emphasize local manufacturing partnerships and volume-driven distribution to improve affordability and reach.

This comprehensive research report examines key regions that drive the evolution of the Bronchitis Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading pharmaceutical innovators shaping the bronchitis treatment landscape through strategic partnerships and targeted research initiatives

Leading pharmaceutical companies are actively investing in bronchitis drug portfolios through strategic alliances, targeted research, and manufacturing scalability. Global giants have established collaborations with biotechnology firms to advance novel inhaled formulations and biologic candidates that modulate inflammatory pathways. These partnerships often include shared development costs and co-marketing agreements, enabling rapid access to emerging innovations. Simultaneously, specialty generics producers are expanding capacity for off-patent antibiotics and inhalation device components, ensuring continuity of supply and competitive pricing.

Mid-sized biopharma firms are differentiating through niche pipelines, focusing on next-generation bronchodilators with prolonged duration of action or enhanced receptor selectivity. Many of these players are leveraging in-licensing deals to secure rights to patented molecules, accelerating time to market. Additionally, contract manufacturing organizations have bolstered their capabilities to provide end-to-end services, from API synthesis to device assembly, thereby supporting both established brands and emerging entrants. Collectively, these company-level initiatives underscore a shared commitment to reinforcing the bronchitis treatment armamentarium.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bronchitis Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- AstraZeneca PLC

- Bayer AG

- Boehringer Ingelheim International GmbH

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Ltd.

- GSK plc

- Hikma Pharmaceuticals PLC

- Johnson & Johnson

- Merck & Co., Inc.

- Mylan N.V.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

Delivering actionable recommendations for industry leaders to navigate market complexities and optimize bronchitis treatment portfolios effectively

Industry leaders seeking to capitalize on bronchitis therapeutic opportunities should prioritize integrated ecosystem partnerships and patient-centric service models. Engaging early with technology providers to co-develop smart inhalers can enhance adherence monitoring and generate real-world evidence for payer negotiations. Additionally, diversifying sourcing strategies by establishing regional manufacturing hubs ensures supply resilience and cost control amid shifting trade policies.

Investments in precision diagnostics and biomarker research can propel tailored corticosteroid and antibiotic usage, minimizing adverse events and resistance development. Aligning with academic centers and leveraging outcome-based contracting will further solidify the value proposition for novel therapies. Moreover, deepening relationships with home healthcare networks and telemedicine platforms extends market reach, while providing seamless support for self-managing patients. By holistically addressing clinical, logistical, and economic dimensions, industry participants can optimize their bronchitis treatment portfolios and secure sustainable growth.

Detailing a rigorous research methodology incorporating primary stakeholder interviews secondary data analysis and expert validation to ensure report credibility

This analysis is founded on a multi-tiered research methodology designed to reinforce accuracy and strategic relevance. Primary research involved in-depth interviews with pulmonologists, pharmacists, payers, and patient advocacy representatives to capture firsthand insights into therapy utilization, unmet needs, and adoption hurdles. Concurrently, secondary data were aggregated from peer-reviewed journals, regulatory filings, and proprietary licensing databases to map competitive landscapes and regulatory trajectories.

All collected data underwent rigorous triangulation to validate consistency and uncover latent patterns. Quantitative findings were complemented by qualitative assessments, enabling a comprehensive understanding of driver interdependencies. Finally, an expert advisory panel comprising clinical researchers and industry executives reviewed preliminary conclusions, ensuring methodological soundness and contextual alignment. This robust approach underpins the strategic intelligence presented throughout the executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bronchitis Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bronchitis Drugs Market, by Drug Type

- Bronchitis Drugs Market, by Route Of Administration

- Bronchitis Drugs Market, by Distribution Channel

- Bronchitis Drugs Market, by End User

- Bronchitis Drugs Market, by Region

- Bronchitis Drugs Market, by Group

- Bronchitis Drugs Market, by Country

- United States Bronchitis Drugs Market

- China Bronchitis Drugs Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding with strategic imperatives and forward-looking perspectives to drive innovation and sustain growth in the bronchitis therapeutics domain

In conclusion, the bronchitis drug sector stands at a pivotal juncture where advanced therapeutics, shifting policy environments, and regional market nuances converge to redefine treatment paradigms. Stakeholders who embrace patient-centric innovation, fortify supply chain resilience, and harness data-driven decision-making will be best positioned to meet evolving clinical demands. The cumulative impact of tariffs in 2025 underscores the need for agile sourcing and dynamic pricing strategies, while segmentation insights reveal targeted pathways for portfolio differentiation and value creation.

Looking ahead, continued collaboration across pharmaceutical developers, healthcare providers, and technology enablers will be essential to deliver holistic bronchitis management solutions. By integrating strategic foresight with methodological rigor and adaptive execution, organizations can navigate the complexities of this therapeutic landscape and drive meaningful improvements in patient care and market performance.

Engaging directly with Ketan Rohom to secure comprehensive insights and advanced market intelligence in bronchitis drug research solutions

To gain an in-depth, data-driven view of bronchitis drug landscapes and unlock actionable intelligence for your organization, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan’s expertise ensures you obtain tailored insights on therapeutic innovations, competitive positioning, and emerging opportunities. Engage with him to explore customized research packages, secure proprietary analysis, and accelerate strategic decision-making. Harness the full potential of advanced bronchitis therapeutics intelligence by partnering with Ketan to acquire the comprehensive report and drive your next phase of growth.

- How big is the Bronchitis Drugs Market?

- What is the Bronchitis Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?