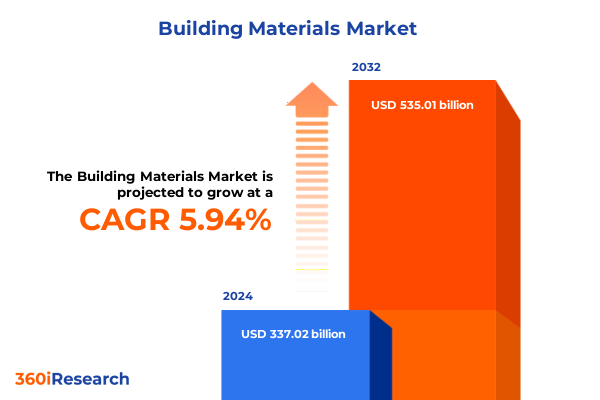

The Building Materials Market size was estimated at USD 357.11 billion in 2025 and expected to reach USD 376.72 billion in 2026, at a CAGR of 5.94% to reach USD 535.01 billion by 2032.

Unveiling the dynamic footprint of the global building materials market amid evolving technologies, regulations, and sustainability imperatives

The global building materials sector stands at a pivotal juncture, shaped by accelerating technological advances, shifting regulatory landscapes, and heightened sustainability imperatives. In recent years, stakeholders across the value chain have grappled with the need to balance cost containment and performance enhancement alongside emerging demands for carbon reduction and circular economy practices. Against this backdrop, understanding the multifaceted drivers of demand-from raw material availability to end-user preferences-has never been more critical.

This executive summary synthesizes the most salient trends redefining today’s building materials market. It provides decision-makers with a strategic lens through which to evaluate competitive positioning, supply chain resilience, and innovation pipelines. By mapping these dynamics across material types, construction modalities, regional markets, and leading corporate strategies, this overview sets the stage for actionable insights that support data-driven planning.

As the industry navigates geopolitical headwinds, evolving trade policies, and the imperative for digital transformation, this introduction frames the report’s deeper exploration of transformative shifts, tariff impacts, and segmentation nuances. The content that follows equips executives, investors, and technical leaders with a comprehensive understanding of market forces, ensuring they can anticipate disruptions and capitalize on new opportunities in an increasingly complex global environment.

Identifying pivotal transformative shifts reshaping demand, production, and innovation trajectories within the global building materials ecosystem

Over the past decade, the building materials landscape has undergone transformative shifts driven by a convergence of technological innovation, environmental mandates, and digitalization. Advanced manufacturing processes, such as 3D printing for concrete components and modular prefabrication, have significantly accelerated project timelines and reduced on-site waste. Simultaneously, the proliferation of smart materials-incorporating sensors and adaptive properties-has begun to reshape product development, enabling structures that respond to environmental stressors in real time.

Regulatory changes targeting embodied carbon and energy efficiency have propelled manufacturers to explore low-carbon cement alternatives, recycled aggregates, and bio-based insulation solutions. These policy frameworks have, in turn, spurred collaborative R&D initiatives across the value chain, uniting material scientists, equipment providers, and construction firms. Digital platforms for supply chain traceability and Building Information Modeling (BIM) integration have enhanced transparency and reduced cost overruns, while predictive analytics tools now optimize maintenance cycles for infrastructure assets.

Taken together, these shifts are driving a paradigm in which the building materials industry must concurrently address performance, sustainability, and agility. Enterprises that prioritize cross-functional innovation and embrace digital ecosystems will be best positioned to lead market evolution and meet the rigorous demands of modern construction projects.

Evaluating the cumulative effects of 2025 United States tariffs on supply chains, pricing dynamics, and competitive positioning in the building materials sector

The implementation of new United States tariffs in early 2025 has introduced a complex set of challenges for building materials producers, distributors, and end-users. Tariffs imposed on select steel, aluminum, and composite imports have elevated input costs for domestic manufacturers reliant on global supply chains. These cost increases have rippled downstream, affecting pricing structures for structural components, metal-based sealants, and specialized coatings.

In response, many firms have accelerated nearshoring strategies, investing in regional processing facilities to insulate against trade volatility and reduce logistical lead times. However, the shift toward localized production has been tempered by capacity constraints and the need to maintain quality standards consistent with established global benchmarks. Concurrently, purchasers in the commercial and residential markets have begun reallocating budgets toward alternative materials-such as engineered wood and advanced polymers-to mitigate exposure to tariff-driven price inflation.

Looking ahead, competitive positioning will hinge on a company’s ability to leverage backward integration, secure stable raw material agreements, and deploy advanced cost-management analytics. Those that can streamline operations while maintaining supply chain agility will convert the tariff landscape into an opportunity for strengthening domestic capabilities and fostering resilient growth.

Unlocking critical segmentation insights that illuminate market nuances across material types, construction stages, application areas, and end-user categories

A nuanced understanding of market segmentation is essential for identifying pockets of strategic advantage. When examining based on material type, the sector spans aggregates through wood and timber, each segment exhibiting distinct performance and sustainability profiles that influence application-specific uptake. Aggregates serve as fundamental load-bearing substrates, while bitumen and asphalt underpin critical infrastructure investments. Cement and concrete remain core to structural integrity, yet ceramics, tiles, and drywall contribute to aesthetic and functional finishes. Glass and insulation materials drive energy efficiency goals, and metals, paints, sealants, and adhesives support long-term durability in challenging environments. Plastics and composites are increasingly favored for their lightweight and corrosion-resistant properties, while wood and timber offer renewable alternatives aligned with green building certification standards.

Shifting to the lens of construction type reveals differentiated demand streams across maintenance and repairs, new construction, and renovation and retrofitting projects. Maintenance requirements sustain aftermarket volumes for coatings, sealants, and specialized repair mortars. New construction, fueled by urban development, commercial real estate expansions, and industrial capacity growth, underpins bulk material consumption cycles. Renovation and retrofitting, driven by sustainability upgrades and code compliance, present opportunities for insulated cladding systems, low-VOC paints, and high-performance glazing solutions.

Exploring application-based segmentation uncovers a spectrum ranging from exterior finishes to interior finishes, structural components to landscaping installations. Exterior finishes, such as advanced protective coatings and facade panels, address weather resilience. Insulation and waterproofing solutions enhance building envelopes to meet stringent thermal requirements. Interior finishes contribute to occupant wellbeing through acoustic, aesthetic, and hygienic innovations. Landscaping and outdoor structures integrate material science with environmental design, while plumbing, HVAC, windows, and doors leverage precision-engineered components for seamless integration. Structural components ensure load distribution, seismic resistance, and safety compliance.

Finally, the end-user lens highlights demand differentiation across commercial construction, industrial construction, infrastructure, and residential construction projects. Commercial segments-spanning hotels and hospitality venues, office developments, and retail centers-prioritize design flexibility, durability, and amenity-driven material choices. Industrial zones, including factories, logistics hubs, and warehouses, demand robust structural solutions and specialized coatings for chemical and temperature resistance. Infrastructure projects encompassing airports, railways, bridges, public utilities, and highways call for materials that combine longevity with maintenance efficiency. Residential construction remains a cornerstone for market growth, with evolving consumer preferences guiding the adoption of sustainable cladding, modular systems, and smart home–compatible building components.

This comprehensive research report categorizes the Building Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Construction Type

- Application

- End-User

Highlighting key regional trajectories that drive demand dynamics and growth potential across the Americas, Europe Middle East and Africa, and Asia-Pacific

Regional dynamics continue to exert a defining influence on building materials supply and demand patterns. In the Americas, North American investment in infrastructure renewal and affordable housing initiatives has boosted demand for high-performance composites, energy-efficient insulation, and low-carbon cement alternatives. Latin American markets are diversifying beyond traditional concrete and clay brick to incorporate more lightweight and prefabricated systems, driven by rapid urbanization and budgetary pressures.

Across Europe, the Middle East, and Africa, stringent EU emissions regulations and Middle Eastern megaprojects are shaping material preferences toward advanced concretes, glass solutions with enhanced thermal insulation, and specialized coatings that withstand extreme temperature fluctuations. African nations, spurred by infrastructure funding from international development agencies, are integrating modern building techniques, although logistical challenges in remote regions continue to favor local aggregate use and modular timber systems.

The Asia-Pacific region remains the largest growth engine, with urbanization in China and India accelerating demand for cement, steel-reinforced composites, and ceramic tiles. Southeast Asian markets are embracing green building certifications, driving uptake of recycled aggregates and bio-based insulation materials. Australia and Japan sustain steady volumes in renovation and retrofitting markets, bolstered by seismic and energy-efficient building code updates. Together, these regional trajectories underscore the importance of tailored go-to-market strategies that align material portfolios with diverse regulatory regimes, climatic conditions, and project financing landscapes.

This comprehensive research report examines key regions that drive the evolution of the Building Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting leading industry players shaping innovation, sustainability, and competitive strategies within the global building materials marketplace

Leading companies in the building materials arena are pursuing a blend of organic innovation, strategic acquisitions, and sustainability commitments to maintain competitive advantage. Major cement producers have intensified low-carbon R&D efforts, while specialty chemicals manufacturers are developing resin and sealant formulations that meet evolving environmental standards. Integrated conglomerates leverage vertical integration to streamline logistics, from raw material extraction to finished product distribution, ensuring consistent quality control and cost efficiencies.

Regional players are also gaining traction by addressing localized building codes and end-user preferences. In North America, firms specializing in high-performance insulation and advanced glazing have carved out niche positions by aligning product certifications with federally backed energy retrofit programs. In Europe, a subset of manufacturers has cultivated expertise in facade integration systems that blend photovoltaic modules with traditional cladding, capitalizing on renewable energy mandates. Asia-Pacific conglomerates are investing heavily in automated production lines and digital ordering platforms to meet the high-volume requirements of rapid urban expansion.

Across all geographies, collaboration between material suppliers, construction technology providers, and digital services firms is driving ecosystem-level innovation. Those that balance scale with specialization, and sustainability with performance, will be the companies setting the strategic agenda for the next phase of market development.

This comprehensive research report delivers an in-depth overview of the principal market players in the Building Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armstrong World Industries, Inc.

- Boral Limited

- Buzzi Unicem S.p.A.

- CEMEX, S.A.B. de C.V.

- China National Building Material Company Limited

- Compagnie de Saint-Gobain S.A.

- CRH plc

- GAF Materials Corporation

- Georgia-Pacific LLC

- Heidelberg Materials AG

- Holcim Ltd.

- James Hardie Industries plc

- Kingspan Group plc

- Knauf Gips KG

- Owens Corning Corporation

- RPM International Inc.

- Sika AG

- Taiheiyo Cement Corporation

- The Sherwin-Williams Company

- UltraTech Cement Limited

Presenting actionable recommendations that empower industry leaders to leverage emerging trends, optimize operations, and secure competitive advantage

Industry leaders must adopt a multi-dimensional approach to turn emerging trends into tangible business outcomes. First, integrating circular economy principles into product design and end-of-life recovery will position companies to meet tightening sustainability regulations and customer requirements for greener materials. By establishing closed-loop partnerships with demolition and recycling firms, materials providers can secure feedstock streams for next-generation composites.

Second, embracing digital transformation across supply chain planning and customer engagement platforms will enhance operational agility. Predictive maintenance analytics for manufacturing equipment can reduce unplanned downtime, while B2B e-commerce portals streamline order fulfillment and improve order accuracy. Additionally, leveraging digital twins at the project level enables real-time collaboration between architects, engineers, and suppliers, reducing costly change orders.

Third, forging strategic alliances with technology startups and research institutes can accelerate breakthroughs in smart materials and advanced coatings. Co-development agreements and joint ventures in additive manufacturing for custom architectural components will help diversify revenue streams. Finally, companies should prioritize talent development in data science, sustainability, and materials engineering to ensure they have the internal expertise required to execute these initiatives and remain at the forefront of market innovation.

Detailing research methodologies that blend primary interviews, secondary data sources, and rigorous analysis protocols to ensure robust market intelligence

This research employs a robust, multi-stage methodology to deliver comprehensive market intelligence. Secondary research formed the foundation, leveraging publicly available regulatory filings, material patents, company annual reports, and leading academic publications focused on construction materials innovation. These sources provided initial market structure, competitive landscapes, and material technology roadmaps.

Primary research was conducted through in-depth interviews with C-level executives, technical directors, procurement managers, and supply chain specialists across material suppliers, distributors, and end-user segments. These qualitative insights were validated through quantitative surveys capturing purchase drivers, adoption timelines, and pricing sensitivities. In total, data was gathered from a balanced mix of stakeholders representing commercial, residential, industrial, and infrastructure projects worldwide.

A rigorous analysis framework ensured data integrity and consistency. Triangulation techniques reconciled insights from primary and secondary sources, while cross-segment benchmarking identified leading performance indicators. The integration of scenario analysis provided a forward-looking perspective on tariff developments and regional growth projections. All data points underwent multiple rounds of validation by subject-matter experts to guarantee accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Building Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Building Materials Market, by Material Type

- Building Materials Market, by Construction Type

- Building Materials Market, by Application

- Building Materials Market, by End-User

- Building Materials Market, by Region

- Building Materials Market, by Group

- Building Materials Market, by Country

- United States Building Materials Market

- China Building Materials Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing critical insights and strategic imperatives that encapsulate the evolving opportunities and challenges within the global building materials ecosystem

The building materials industry is experiencing a confluence of innovation, sustainability pressures, and geopolitical influences that together create both challenges and opportunities. As tariff regimes reshape supply chain economics, manufacturers must pivot toward agile production models and localized sourcing strategies. Material innovations-ranging from low-carbon cement alternatives to smart glazing-are poised to redefine project specifications and performance benchmarks.

Segmentation analyses reveal that opportunities abound in every material category and application sector, provided stakeholders tailor their offerings to meet the stringent demands of maintenance, new construction, and retrofit markets. Regional insights underscore the necessity of customized go-to-market frameworks that align with local regulatory drivers and infrastructure investment patterns. Moreover, collaborative ecosystems-spanning technology providers, recyclers, and research institutions-are emerging as critical enablers of long-term competitive differentiation.

In an environment where sustainability credentials and digital capabilities are as pivotal as cost and performance, industry participants must forge ahead with an integrated strategic vision. By leveraging the insights and recommendations presented in this report, market leaders can position themselves to capture value, mitigate risks, and drive the next wave of transformative growth.

Engage with Ketan Rohom to discover how in-depth market intelligence can drive strategic decision-making and unlock growth in building materials ventures

Engage with Ketan Rohom today to explore how comprehensive market intelligence can be the catalyst for transformative growth and strategic differentiation in your building materials ventures.

- How big is the Building Materials Market?

- What is the Building Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?