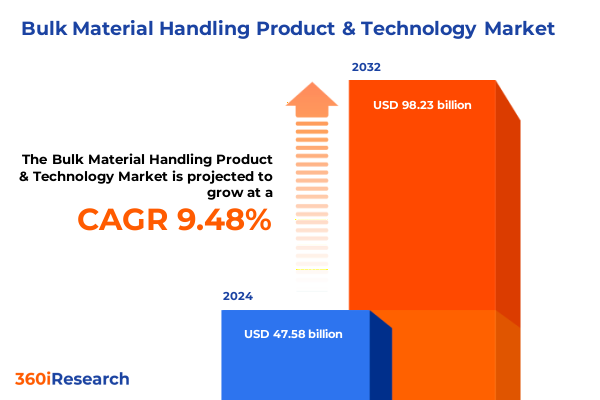

The Bulk Material Handling Product & Technology Market size was estimated at USD 51.32 billion in 2025 and expected to reach USD 55.36 billion in 2026, at a CAGR of 9.71% to reach USD 98.23 billion by 2032.

Establishing the Strategic Imperatives and Core Drivers Shaping Modern Bulk Material Handling Operations

In an era defined by escalating global trade complexities and relentless performance demands, the bulk material handling sector stands at a pivotal crossroads. Innovations in equipment design, digitization of operational processes, and heightened sustainability requirements are intersecting to reshape traditional paradigms. Industry stakeholders, ranging from system integrators to end users in critical segments like mining and power generation, must contend with a rapidly evolving landscape that demands both agility and foresight. Understanding the confluence of technological breakthroughs, regulatory dynamics, and evolving customer expectations is the cornerstone of strategic decision making.

This executive summary offers a concise yet comprehensive orientation to the current bulk material handling environment, spotlighting the most influential forces driving market behavior. It distills complex trends and regulatory shifts into actionable insights, equipping senior leadership with the clarity required to steer investment priorities. By establishing a cohesive narrative around key market catalysts and emerging best practices, this introduction lays the groundwork for in-depth analysis. Transitioning from foundational drivers to nuanced implications, the report empowers organizations to anticipate disruptions, seize opportunities for innovation, and maintain resilience in the face of ongoing industry transformation.

Revolution in Bulk Material Handling via Automation, Modular Design, AI Optimization, and Sustainability Innovations

Over the past few years, the integration of automation technologies and digital platforms has fundamentally altered the operational dynamics of bulk material handling systems. Advanced sensor networks embedded within conveyors and elevators now feed real-time data streams into centralized control systems, enabling predictive maintenance strategies that significantly minimize unplanned downtime. Concurrently, the adoption of artificial intelligence algorithms for process optimization has led to measurable enhancements in throughput and energy consumption, underscoring a shift toward performance-driven architectures.

Alongside digital acceleration, there is a pronounced movement toward modular and scalable equipment configurations that allow rapid adjustments to changing production requirements. This versatility is critical in industries such as chemicals and food and beverage, where product portfolios frequently expand. Additionally, environmental imperatives have spurred the development of low-emission pneumatic conveying solutions and recycled-material components in belt conveyors, reflecting an industry-wide commitment to sustainability. Taken together, these transformative shifts underscore how converging technological and operational trends are redefining efficiency benchmarks and setting new standards for safety and reliability in bulk material handling.

Evaluating the Strategic Consequences of 2025 United States Tariff Adjustments on Bulk Handling Ecosystem Costs and Supply Stability

The introduction of revised tariff structures by the United States in 2025 has exerted considerable influence on the bulk material handling supply chain, driving a reevaluation of sourcing and manufacturing strategies. Import duties on key components such as specialized conveyor belts and precision-engineered screw sections have increased landed costs for operators reliant on global suppliers. In response, many original equipment manufacturers have accelerated plans for nearshoring production facilities and forging partnerships with domestic specialists to mitigate exposure to external tariff volatility.

This regulatory recalibration has also prompted buyers to reexamine total lifecycle expenses, prioritizing equipment designs that offer simplified maintenance and extended wear cycles. As a consequence, demand is rising for domestically produced alternatives that balance cost-effectiveness with high performance. From the vantage point of procurement leaders, aligning capital expenditure with tariff-driven cost variability remains a central challenge. Strategically, those organizations that have swiftly realigned their supplier networks and optimized import volumes are finding themselves better positioned to stabilize operational budgets and sustain long-term competitiveness.

Deriving Strategic Perspectives from Equipment, Technology, Material, Industry, and Distribution Channel Segmentations

A nuanced understanding of the bulk material handling market emerges when dissecting performance and demand across multiple dimensions. Equipment type segmentation reveals that conventional belt conveyors, whether outfitted as cleated, flat, or troughed belts, continue to account for a significant share of throughput in industries where granular materials dominate. Simultaneously, bucket elevators-available in centrifugal or continuous configurations-remain indispensable in vertical lifting applications, particularly within the power generation and cement sectors. In scenarios requiring controlled pneumatic movement, dense phase and dilute phase conveying systems offer tailored solutions that excel in abrasion resistance and prevention of material degradation. For specialized applications where gentle transport or precise dosing is vital, screw conveyors and both trough and tube vibratory conveyors demonstrate unique advantages in handling powders, pellets, and slurries.

A technology-based perspective underscores the rising prominence of automated solutions over manual systems, as organizations seek integrated controls, remote monitoring, and reduced labor dependency. Material type considerations further refine market opportunities: granular substances, powders, pellets, and slurries each impose specific design and wear requirements that influence equipment selection and maintenance protocols. Parallel examination of end-use verticals-spanning cement, chemicals, food and beverage, mining, pharmaceuticals, and power generation-illuminates how sector-specific regulations, throughput demands, and contamination risks drive differentiated product development.

Finally, distribution channel dynamics play a pivotal role in market accessibility and customer engagement. Dealers and distributors leverage OEM partnerships and third-party networks to extend regional reach, while direct sales operations cater to large-scale projects with bespoke configuration needs. Online channels, including e-marketplaces and manufacturer websites, are increasingly pivotal for aftermarket parts, rapid quotes, and servicing requests, reflecting a digital shift in how buyers research, compare, and procure bulk handling solutions.

This comprehensive research report categorizes the Bulk Material Handling Product & Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Technology

- Material Type

- End Use Industry

- Distribution Channel

Unveiling Regional Market Dynamics across Americas, Europe Middle East Africa, and Asia Pacific Driving Bulk Handling Advancements

Geographic dynamics in the Americas illustrate a market characterized by mature infrastructure and a high adoption of state-of-the-art automation, particularly in North America’s mining and power sectors. Capital investment cycles are closely tied to regional economic indicators, with the United States and Canada leading in greenfield projects that integrate advanced predictive maintenance and digital twins. Latin American operations, while more cost-sensitive, are increasingly open to modular equipment designs that offer low initial outlays and faster deployment timelines.

Within Europe, Middle East, and Africa, regulatory frameworks in the European Union have placed stringent emissions and safety standards on material handling installations, stimulating demand for low-emission pneumatic systems and enclosed conveyors. The Middle East’s energy-driven economies continue to invest in large-scale, high-capacity materials throughput projects, with an emphasis on corrosion-resistant equipment suited to harsh environmental conditions. In sub-Saharan Africa, a surge in mining exploration has elevated interest in ruggedized equipment and mobile conveying units that can operate effectively in remote locations.

The Asia-Pacific region remains a growth epicenter, fueled by rapid industrialization, urbanization, and expansions in downstream processing industries. Countries like China and India are investing heavily in domestically manufactured systems to support their extensive cement, chemical, and power generation sectors. Southeast Asian markets are increasingly integrating Industry 4.0 principles into bulk material handling solutions, seeking to balance cost constraints with performance-driven automation.

This comprehensive research report examines key regions that drive the evolution of the Bulk Material Handling Product & Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping Competitive Positions and Strategic Alliances Among Leading Bulk Material Handling Manufacturers and Technology Innovators

The competitive landscape is marked by a diverse mix of legacy equipment manufacturers and emerging technology innovators. Established global players have reinforced their positions through strategic mergers and acquisitions, bolstering product portfolios with complementary conveyor technologies and enhanced digital offerings. Concurrently, niche providers specializing in advanced materials or precision conveying have carved out valuable positions by catering to high-purity industries such as pharmaceuticals and food processing.

Strategic partnerships between OEMs and software firms have become increasingly prevalent, as integrated solutions providers deliver turnkey systems with embedded analytics and remote support capabilities. This trend is particularly pronounced in the United States and Europe, where service contracts tied to uptime guarantees are redefining customer expectations. New market entrants with agile development cycles are also making inroads by focusing on modular components and rapid prototyping, enabling faster customization.

Competitive differentiation often hinges on the ability to offer end-to-end services, from conceptual engineering through aftermarket support. As a result, organizations that excel in lifecycle management and spare parts availability command stronger customer loyalty. Innovation in materials science, such as wear-resistant alloys and polymer composites, further distinguishes market leaders by enhancing equipment longevity and reducing maintenance overhead.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bulk Material Handling Product & Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BEUMER Group GmbH & Co. KG

- Caterpillar Inc.

- Daifuku Co., Ltd.

- Flexicon Corporation

- FLSmidth & Co. A/S

- KION Group AG

- Komatsu Ltd.

- Liebherr-International AG

- Metso Outotec Corporation

- Sandvik AB

- Schenck Process Holding GmbH

- Siemens AG

- Techint Group S.p.A.

- ThyssenKrupp AG

- Vanderlande Industries B.V.

Strategic Guidance for Implementing Smart Equipment, Sustainability Programs, and Service-Driven Models to Enhance Market Leadership

To thrive in an increasingly complex environment, industry leaders should prioritize the deployment of smart equipment capable of generating process data that can be harnessed for continuous improvement. Investing in scalable architectures that support phased automation upgrades will help balance capital allocation with rapid performance gains. In parallel, organizations must develop robust supplier ecosystems to mitigate tariff-induced risks, including dual-sourcing strategies and localized manufacturing partnerships.

A focus on sustainability can serve as both a compliance measure and a value driver; adopting energy-efficient conveying systems and recyclable component materials will resonate with both regulatory bodies and environmentally conscious customers. Furthermore, embracing service-driven business models-such as outcome-based contracts and remote monitoring subscriptions-can diversify revenue streams and deepen customer engagement.

Finally, cultivating cross-functional teams that blend mechanical engineering expertise with data analytics and supply chain management will be instrumental in translating technological potential into operational reality. By fostering an organizational culture that rewards innovation and agility, companies can position themselves to capitalize on emergent trends and safeguard long-term competitiveness.

Comprehensive Primary Consultations and Robust Secondary Research Techniques Applied to Generate Reliable Bulk Handling Market Insights

The research methodology underpinning this report combines rigorous primary and secondary processes to ensure comprehensive and unbiased insights. Primary efforts included in-depth interviews with senior executives, procurement specialists, and engineering managers across major end-use industries, providing first-hand perspectives on pain points, technology adoption, and future investment plans. These engagements were supplemented by targeted surveys to capture quantitative data on maintenance cycles, performance metrics, and supplier preferences.

On the secondary side, credible industry publications, regulatory filings, and corporate filings were meticulously reviewed to verify historical trends and recent developments. Technical white papers and patent filings offered perspectives on emerging technology trajectories, while trade association reports shed light on sector-specific safety and environmental regulations. A robust triangulation process was employed to cross-validate findings and resolve any discrepancies, thereby reinforcing the reliability of the synthesized insights.

Throughout the research, strict protocols were observed to avoid potential biases, including standardized data collection templates, anonymization of sensitive responses, and review panels comprised of domain experts. This structured approach ensures that the conclusions and recommendations articulated in the report rest on a solid evidentiary foundation and reflect the multifaceted realities of the bulk material handling industry.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bulk Material Handling Product & Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bulk Material Handling Product & Technology Market, by Equipment Type

- Bulk Material Handling Product & Technology Market, by Technology

- Bulk Material Handling Product & Technology Market, by Material Type

- Bulk Material Handling Product & Technology Market, by End Use Industry

- Bulk Material Handling Product & Technology Market, by Distribution Channel

- Bulk Material Handling Product & Technology Market, by Region

- Bulk Material Handling Product & Technology Market, by Group

- Bulk Material Handling Product & Technology Market, by Country

- United States Bulk Material Handling Product & Technology Market

- China Bulk Material Handling Product & Technology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Distilling Transformational Trends, Segmentation Insights, and Competitive Imperatives to Navigate Bulk Material Handling’s Future

The analysis underscores a pivotal inflection point for the bulk material handling sector, where technological innovation, regulatory shifts, and geopolitical influences converge to redefine strategic imperatives. Stakeholders who embrace digital transformation, from predictive maintenance frameworks to integrated control ecosystems, will be best positioned to unlock new levels of operational efficiency and cost predictability. At the same time, tariff-driven supply chain reforms necessitate agile sourcing strategies that balance domestic and international procurement to stabilize input costs.

Segmentation insights reveal that while conventional belt and bucket elevator systems remain foundational, growth opportunities lie in advanced pneumatic and vibratory solutions tailored to specialized materials and stringent cleanliness requirements. Regional dynamics highlight that mature markets are pushing the envelope in automation and sustainability, whereas high-growth economies demand robust, cost-effective equipment adapted to local conditions.

Competitive analyses point to an intensifying battle for differentiation through aftersales service models, digital offerings, and materials innovation. Companies that align their organizational structures and talent strategies to embrace cross-disciplinary collaboration will lead the charge in developing holistic solutions that meet evolving customer needs. In sum, the collective findings chart a roadmap for navigating the complexities of the modern bulk material handling landscape, equipping readers with the critical knowledge required to make informed strategic choices.

Invitation to Collaborate with Ketan Rohom for Bespoke Market Intelligence and Strategic Advisory in Bulk Material Handling

This exclusive collaboration opportunity invites decision makers to engage with Ketan Rohom, a seasoned associate director specializing in sales and marketing, whose expertise can be instrumental in navigating the complexities of bulk material handling markets. By partnering directly with Ketan, stakeholders will gain privileged access to proprietary analyses, tailored strategic workshops, and consultative sessions designed to align market intelligence with specific organizational objectives. This personalized approach ensures that insights derived from the market research report are not only comprehensively understood but also immediately applicable to operational challenges and growth initiatives. Engaging with Ketan leads to a bespoke buying experience, where report findings are contextualized to unique supply chain considerations, capital investment plans, and technological roadmaps. Secure your organization’s competitive advantage by reaching out to explore custom licensing agreements, group access options, or extended advisory support. The invitation extends to senior executives, procurement leaders, and technology decision makers seeking in-depth guidance to drive actionable outcomes. Begin a transformative partnership that elevates strategic planning and operational execution in bulk material handling-contact Ketan Rohom today and take the decisive step toward unlocking the full potential of your market intelligence assets.

- How big is the Bulk Material Handling Product & Technology Market?

- What is the Bulk Material Handling Product & Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?