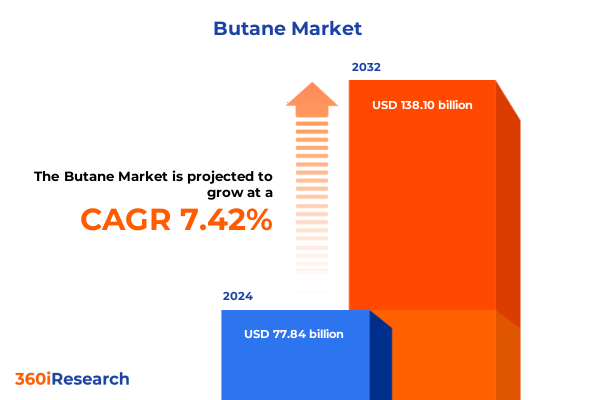

The Butane Market size was estimated at USD 83.54 billion in 2025 and expected to reach USD 89.66 billion in 2026, at a CAGR of 7.44% to reach USD 138.10 billion by 2032.

Exploring the Pivotal Role of Butane in Modern Energy and Industrial Applications Amid Rapid Global Economic and Environmental Shifts

Butane has emerged as a strategic hydrocarbon that bridges traditional energy paradigms and evolving industrial requirements. Across both mature and emerging economies, demand for butane spans from fueling household appliances and industrial burners to serving as a critical feedstock for petrochemical synthesis and refrigeration cycles. As global economies adapt to evolving environmental objectives, the role of butane has grown in prominence given its cleaner-burning properties relative to heavier hydrocarbons. Consequently, stakeholders in the fuel, chemical and manufacturing sectors are intensifying efforts to understand the nuances of supply chain dynamics, regulatory frameworks, and end-use demand drivers that define this vital segment of the energy landscape.

Given its dual identity as both an energy source and a chemical input, butane’s trajectory is influenced by macroeconomic variables, geopolitical considerations and technological innovations. Tightening emissions standards and advancing refrigeration technologies have propelled investments in high-purity grades, while infrastructure modernization efforts have shaped the adoption of compressed and liquefied variants. This introduction lays the groundwork for exploring the key structural shifts, policy impacts, segmentation intricacies, regional variances, and competitive maneuvers that collectively outline the current and future contours of the global butane market.

Mapping the Transformative Shifts Redefining Supply Chains and Demand Dynamics in the Global Butane Market Landscape

Recent years have witnessed profound transformations that are recalibrating the balance between supply chains and demand for butane. Technological advancements in extraction and purification have enabled producers to deliver higher throughput at lower per-unit costs, reshaping supplier-buyer relationships. At the same time, digitalization of logistics and the rollout of real-time tracking solutions have reduced downtime and loss in transit, enabling just-in-time restocking models to take root. Moreover, the proliferation of alternative fuels and aggressive decarbonization targets have compelled market participants to reevaluate feedstock strategies, integrating renewable LPG blends and bio-butane derivatives into their offerings.

Simultaneously, evolving geopolitical tensions and trade realignments have introduced new complexities into sourcing strategies. With a greater emphasis on energy security, many importing nations are diversifying supply origins and negotiating long-term off-take agreements that provide both price stability and assurance of volume. Meanwhile, downstream industries such as aerosol propellants and refrigeration are adapting formulation requirements in response to updated environmental protocols, driving demand toward ultra-high-purity grades. These intersecting shifts underscore the market’s fluidity and signal opportunities for early-mover advantage among agile participants.

Analyzing the Cumulative Effects of New United States Tariff Measures on Butane Trade Flows Manufacturing Costs and Pricing Structures

In 2025, a suite of new tariff measures introduced by the United States government has generated notable ripples across butane trade routes and cost structures. These duties, imposed under broader trade policy initiatives, have incrementally raised the landed cost of imported butane from several key producer regions. As a result, importers have been compelled to pivot to alternative sources or to enhance domestic production capabilities to mitigate elevated procurement expenses. In parallel, refinery operators have reoptimized feedstock blends to offset incremental duty burdens, passing portions of these costs to downstream distributors and end users.

Furthermore, these tariff adjustments have catalyzed a reconfiguration of regional trade flows. Traditional low-cost exporters have seen their butane shipments redirected toward markets unaffected by the duties, while suppliers targeting the U.S. market have pursued new bilateral agreements that include cost-sharing mechanisms to preserve competitiveness. On the domestic front, this policy environment has spurred incremental capital investments in midstream infrastructure-particularly in butane extraction and storage facilities-to fortify self-reliance and reduce exposure to import volatility. Cumulatively, these dynamics have reinforced the strategic imperative for market players to incorporate tariff risk assessments into both procurement strategies and price modelling exercises.

Uncovering Vital Segment-Level Dynamics Across Product Types Purity Grades Applications End Users and Distribution Channels in the Butane Market

Market segmentation in the butane landscape reveals nuanced performance drivers across multiple dimensions, each shaping competitive positioning and growth trajectories. When assessing segment performance by product type, the dynamic between compressed and liquefied variants emerges as a critical determinant of distribution efficiency and end-use suitability, with compressed butane gaining traction in regions with robust cylinder infrastructure and liquefied butane favored for bulk storage in industrial applications. Simultaneously, purity grade distinctions-spanning commercial, medical, and technical categories-reflect the market’s responsiveness to regulatory mandates and end-use quality requirements, as medical-grade butane commands premium handling protocols to support pharmaceutical aerosol delivery systems.

Additionally, the application spectrum underscores different demand rhythms: aerosol propellants benefit from consistent consumption patterns tied to personal care and household products, while cooking and heating usages exhibit pronounced seasonality that necessitates agile supply chain adjustments. Motor fuel adoption trends are increasingly influenced by flexible fuel vehicle programs and biofuel integration incentives, whereas refrigerant applications are shaped by evolving environmental protocols that favor lower global warming potential alternatives. From an end user perspective, the commercial sector leverages butane for controlled heating processes, the industrial domain spans automotive paint shops, manufacturing boilers and petrochemical cracking units, and residential consumption hinges on reliable cylinder-based energy solutions. Finally, channel dynamics reveal an interplay between direct sales agreements with large-scale consumers, established distributor networks that provide regional reach, and emerging online retail platforms that cater to small batch buyers, each modality tailoring its value proposition to distinct buyer preferences.

This comprehensive research report categorizes the Butane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- Distribution Channel

- Application

- End User

Highlighting Distinct Regional Variations in Demand Supply Regulatory Trends and Growth Drivers for Butane Across the Americas EMEA and Asia-Pacific

Regional heterogeneity in the butane market underscores how localized conditions mediate global trends and competitive parameters. Within the Americas, the interplay between abundant feedstock availability in key producing areas and stringent environmental permitting in developed economies has created a dualistic landscape: some jurisdictions capitalize on low-cost extraction, while others focus on high-value applications and export-oriented infrastructure. Cross-border pipelines and marine terminals facilitate trade among Canada, the United States and Latin America, yet regulatory divergence on emissions and safety protocols demands adaptive compliance strategies.

Across Europe, the Middle East and Africa, a tapestry of regulatory frameworks and resource endowments defines distinct sub-regional dynamics. European markets prioritize ultra-high-purity grades to support advanced refrigeration systems and aerosol standards, whereas Middle Eastern producers leverage structural advantages in feedstock costs to serve both regional demand and global export channels. Meanwhile, African markets-characterized by nascent distribution infrastructure-are experiencing incremental growth spurred by rural energy access initiatives and emerging petrochemical investments.

In the Asia-Pacific sphere, rapidly urbanizing populations and expanding industrial bases fuel sustained butane demand, particularly in Southeast Asia and parts of Oceania. Policymakers in key markets are integrating butane into national energy diversification plans, balancing domestic refining capacities against volumes procured via maritime import routes. Moreover, partnerships between local stakeholders and multinational energy firms are accelerating the build-out of storage terminals and cylinder filling plants, establishing resilient networks to accommodate both seasonal surges and long-term growth aspirations.

This comprehensive research report examines key regions that drive the evolution of the Butane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing the Strategic Moves Partnerships Innovations and Market Positioning of Leading Global Butane Producers and Suppliers Impacting Competitive Dynamics

Leading players in the butane market are executing a spectrum of strategic initiatives to reinforce their competitive footholds. Integrated energy majors have been expanding capacity through targeted investments in extraction and midstream assets, while independent chemical producers are differentiating via specialized high-purity offerings and dedicated logistics solutions. Partnerships and joint ventures are increasingly common, with several global suppliers aligning with regional distributors to deepen market penetration and localize service capabilities.

Innovation remains a focal point, as companies develop advanced purification techniques that reduce sulfur content and improve consistency in critical applications such as medical aerosol propellants. Meanwhile, digitalization efforts - including predictive maintenance systems and blockchain-based traceability - are enhancing operational transparency and customer engagement. On the corporate development front, mergers and acquisitions continue to reshape market structure, with larger entities absorbing niche providers to expand into adjacent product lines or to secure footholds in emerging markets. Through these multifaceted strategies, incumbent and challenger firms alike seek to balance cost leadership with value-added service portfolios, positioning themselves for sustained success as market complexities deepen.

This comprehensive research report delivers an in-depth overview of the principal market players in the Butane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BP p.l.c.

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ConocoPhillips

- Exxon Mobil Corporation

- Gazprom PJSC

- Marathon Petroleum Corporation

- PetroChina Company Limited

- Petroliam Nasional Berhad

- Phillips 66 Company

- Saudi Arabian Oil Company

- Shell plc

- TotalEnergies SE

- Valero Energy Corporation

- Vitol SA

Delivering Actionable Strategic Roadmaps for Industry Leaders to Enhance Supply Resilience Optimize Operations and Capitalize on Butane Market Opportunities

Industry leaders looking to thrive amid ongoing volatility must adopt holistic strategies that fortify both upstream and downstream resilience. Strengthening supply chain visibility through the integration of real-time analytics platforms enables more accurate demand forecasting and proactive risk management, reducing exposure to sudden disruptions in feedstock deliveries or duty adjustments. Concurrently, diversifying procurement sources and forging long-term offtake partnerships with multiple suppliers can create redundancy that safeguards operations against geopolitical or regulatory shifts.

On the operational front, investing in scalable purification and fractionation infrastructure allows refiners and distributors to switch rapidly between grades, aligning output with evolving quality requirements. Embracing digital twin models and advanced process control systems can optimize energy consumption in midstream processes, thereby enhancing cost competitiveness while meeting tightening environmental standards. Furthermore, cultivating collaborative innovation ecosystems-via partnerships with technology providers and research institutions-can accelerate the development of lower-carbon LPG blends and circular economy solutions that resonate with customer sustainability mandates. By implementing these targeted recommendations, market participants can reinforce their positions and capture emerging value pools as the butane landscape continues to evolve.

Detailing Rigorous Multimodal Research Methodologies Data Collection Protocols and Analytical Frameworks Underpinning the In-Depth Butane Market Study Insights

This analysis is underpinned by an integrated research framework that blends qualitative and quantitative approaches to ensure comprehensive coverage of the butane ecosystem. Primary data was gathered through in-depth interviews with senior executives across the supply chain, including refinery operators, major distributors and regulatory bodies. These conversations were complemented by structured surveys that elicited detailed perspectives on policy impacts, pricing dynamics and infrastructure constraints. Secondary research involved the review of official trade databases, environmental regulatory filings and academic publications to triangulate findings and validate emerging trends.

Proprietary modeling tools were employed to analyze historical trade flows, import-export balances, and distribution channel efficiencies, with rigorous cross-verification against publicly available customs and port authority records. The use of multi-stage sampling techniques guaranteed representation of diverse geographies, end users and company profiles, while systematic coding of qualitative inputs facilitated thematic analysis of strategic priorities and risk perceptions. Throughout the process, standard quality assurance protocols were applied to maintain data integrity, including consistency checks, outlier detection and peer review by subject matter experts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Butane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Butane Market, by Product Type

- Butane Market, by Purity Grade

- Butane Market, by Distribution Channel

- Butane Market, by Application

- Butane Market, by End User

- Butane Market, by Region

- Butane Market, by Group

- Butane Market, by Country

- United States Butane Market

- China Butane Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings Strategic Implications and Future Outlook to Guide Decision-Makers in Navigating the Evolving Butane Market Landscape

Bringing together these insights yields a nuanced portrait of a market at the intersection of supply chain modernization, regulatory realignment and evolving end-use requirements. Key thematic threads include the growing premium on higher-purity grades, the strategic imperative to navigate tariff-driven cost pressures, and the critical importance of adaptable infrastructure to absorb demand volatility. Furthermore, segmentation patterns highlight how product type, application and distribution channels interact to create differentiated value pools suited to distinct customer cohorts.

Regional analyses underscore that while global trends set the broad contours, local policy frameworks and resource endowments ultimately dictate market behavior. Competitive dynamics are increasingly influenced by digital capabilities and alliance networks, as leading firms seek to enlarge their service offerings beyond traditional commodity deliveries. Collectively, these findings affirm that success in the butane market will hinge on an organization’s ability to integrate strategic foresight, operational agility and stakeholder collaboration into a unified growth plan.

Engage with Ketan Rohom to Secure Comprehensive Butane Market Analysis Solutions Customized to Your Strategic Objectives and Drive Business Growth

To discuss tailored insights and secure direct access to the full market intelligence package, reach out to Ketan Rohom at his role as Associate Director, Sales & Marketing. He is available to guide you through specialized modules, address specific strategic objectives, and demonstrate how these findings can be applied to optimize your supply chain, refine your product portfolio, and unlock new avenues for growth in the evolving butane market landscape

- How big is the Butane Market?

- What is the Butane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?