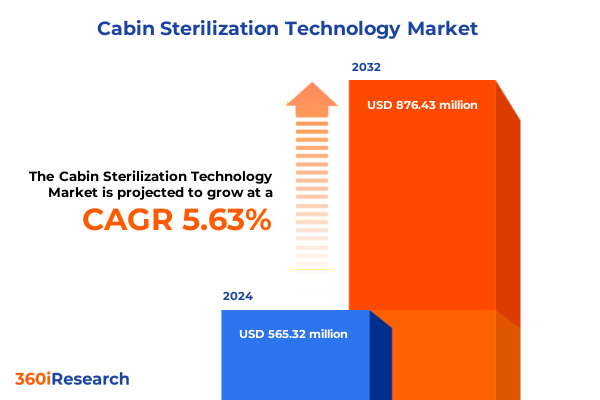

The Cabin Sterilization Technology Market size was estimated at USD 588.32 million in 2025 and expected to reach USD 618.06 million in 2026, at a CAGR of 5.85% to reach USD 876.43 million by 2032.

Unveiling the critical role of advanced cabin sterilization technologies in shaping health security and operational efficiency across transportation sectors

In an era marked by heightened health concerns and evolving regulatory landscapes, cabin sterilization technology has emerged as a vital component of safety protocols across transportation sectors. Passenger expectations for hygienic environments have reached unprecedented levels, compelling stakeholders to reevaluate traditional cleaning methods and embrace advanced sterilization solutions. This shift underscores the significance of integrating cutting-edge technologies that deliver rapid, effective, and verifiable disinfection outcomes without compromising operational efficiency.

Against this backdrop, industry leaders are confronted with a complex ecosystem of technology types, cabin configurations, end users, and distribution channels, each presenting unique requirements and challenges. The breadth of options-from chemical fumigation systems leveraging chlorine dioxide or formaldehyde to non-chemical approaches such as UV-C, ozone, and plasma sterilization-demands a strategic framework that aligns technology selection with specific use cases and compliance standards. Simultaneously, global health crises and evolving trade policies have introduced new variables that shape cost structures and supply chain resilience.

This executive summary provides a comprehensive yet concise overview of the transformative trends reshaping cabin sterilization, the cumulative impact of recent tariff adjustments, detailed segmentation insights, and region-focused market dynamics. By distilling key company profiles and actionable recommendations, this document equips decision-makers with the insights needed to navigate the dynamic landscape, optimize investments, and secure competitive advantage in an increasingly safety-driven market environment.

Examining the seismic shifts redefining cabin sterilization frameworks driven by technological breakthroughs regulatory pressures and evolving hygiene expectations

Over the past several years, transformative shifts in the cabin sterilization landscape have been propelled by technological breakthroughs that reconcile efficacy with environmental responsibility. Innovations in UV-C systems have introduced portable units capable of delivering high-intensity germicidal irradiation within minutes, complementing fixed installations designed for seamless integration into HVAC configurations. Parallel advancements in ozone sterilization now harness corona discharge and UV photolysis to generate high‐purity ozone on demand, reducing reliance on chemical agents and enabling automated treatment cycles.

In concert with these technology drivers, regulatory pressures have intensified as authorities worldwide raise the bar for disinfection standards. Post-pandemic guidelines now emphasize continuous air and surface sterilization, mandating periodic validation through biological indicators and real-time monitoring. Industry stakeholders are therefore investing in systems equipped with integrated sensors and IoT connectivity to demonstrate compliance, log sterilization events, and facilitate predictive maintenance protocols that minimize downtime.

Changing passenger expectations have further catalyzed market evolution. Travelers now view cabin hygiene as a core component of service quality, influencing purchasing decisions and brand loyalty. This paradigm shift has prompted end-users-from commercial airlines to third party service providers-to adopt multi-modal sterilization strategies that combine outbreak response solutions with preventive maintenance routines. Ultimately, the convergence of cutting-edge technology, stricter regulations, and consumer-driven demands is charting a new course for cabin sterilization, one defined by continuous improvement and data-driven validation workflows.

Assessing the multifaceted repercussions of United States tariff adjustments in 2025 on import costs supply chains and competitive dynamics within cabin sterilization technology

The introduction of new United States tariffs in 2025 has created a ripple effect across the cabin sterilization technology market, influencing both equipment manufacturers and end-users. These tariffs, targeting key components and finished systems imported from major manufacturing hubs, have incrementally raised the landed cost of chemical generators, UV-C chambers, and plasma units. For technology providers, this has necessitated a reassessment of global production footprints, with many companies exploring near-shoring and strategic partnerships to mitigate duty exposure and reduce lead times.

For procurement teams within airlines, automotive OEMs, and rail operators, the tariff-induced cost escalation has underscored the importance of total cost of ownership analyses. Rather than defaulting to the lowest upfront purchase price, organizations are now evaluating lifecycle expenses-encompassing maintenance, consumables, energy usage, and downtime. In turn, technology vendors have responded by enhancing service agreements, bundling remote monitoring capabilities, and offering leasing models that convert capital expenditures into manageable operating costs.

Furthermore, supply chain resilience has become a strategic imperative in light of tariff volatility. Companies that once relied heavily on a limited set of overseas suppliers have diversified their sourcing networks to include domestic fabrication and regional distribution centers. This shift has been supported by investments in additive manufacturing for critical spare parts and digital twin simulations to optimize inventory levels. As a result, stakeholders are better equipped to navigate future trade policy fluctuations without compromising sterilization efficacy or operational continuity.

Decoding the intricate segmentation landscape for cabin sterilization technologies encompassing technology variations cabin types end users applications and distribution routes

The cabin sterilization market’s segmentation landscape reveals a tapestry of interdependent variables, each influencing technology adoption and customization. Based on Technology Type, solutions span Chemical Fumigation Systems-further delineated by chlorine dioxide and formaldehyde options-Ozone Sterilization Systems incorporating corona discharge and UV photolysis, Plasma Sterilization Systems differentiated by atmospheric pressure and cold plasma modalities, and UV-C Systems available in fixed installations as well as portable units. Each of these technological variants is tailored to distinct disinfection scenarios, balancing factors such as treatment duration, residue elimination, and compatibility with diverse cabin materials.

Meanwhile, segmentation by Cabin Type underscores the nuanced requirements of aircraft, automotive, marine, and rail environments. Within the aircraft segment, narrow body, regional jets, and wide body cabins demand varying throughput capacities and integration footprints. In the automotive context, commercial vehicle fleets and passenger cars present divergent sterilization workflows, while marine applications distinguish between the scale and sanitation cycles of commercial ships versus cruise liners. Rail cabins, including locomotive operator spaces and passenger coaches, prioritize rapid turnaround and minimized passenger disruption.

End User segmentation further illuminates the decision-making matrix, encompassing automotive manufacturers, commercial aviation operators, marine service providers, rail operators, and specialized third party service organizations. The Application dimension differentiates between outbreak response, preventive maintenance, and routine disinfection, guiding procurement strategies and deployment cadence. Finally, distribution channels-from aftermarket sales and direct sales channels to system integrators, value added resellers, and online platforms-dictate go-to-market tactics and service models. Understanding this multi-layered segmentation framework enables stakeholders to align product development roadmaps with end-user expectations and channel dynamics.

This comprehensive research report categorizes the Cabin Sterilization Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Cabin Type

- End User

- Application

- Distribution Channel

Mapping regional nuances and growth drivers for cabin sterilization solutions across the Americas Europe Middle East Africa and Asia Pacific markets

Regional dynamics play a pivotal role in shaping demand patterns, regulatory requirements, and competitive intensity. In the Americas, market momentum is propelled by stringent federal and state-level sanitation mandates complemented by significant investments in domestic manufacturing. The presence of major aerospace hubs and automotive production facilities drives early adoption, and a strong network of third party service providers enhances after-sales support and maintenance coverage. However, variability in municipal public health guidelines across U.S. states and Latin American countries introduces complexity for manufacturers seeking standardized solutions.

Within Europe, the Middle East & Africa, regulatory harmonization across the European Union contrasts with more fragmented protocols in the Middle East and Africa, where differing levels of infrastructure development and public health priorities influence adoption rates. Europe’s emphasis on environmental sustainability incentivizes low-chemical and energy-efficient sterilization systems, whereas emerging markets in EMEA often favor cost-effective solutions that balance efficacy with resource constraints. Cross-regional partnerships and EU-level procurement initiatives have begun to streamline certification processes, easing market entry for advanced technology vendors.

The Asia Pacific region represents a mosaic of high-growth opportunities underpinned by rapid fleet expansions in air travel, automotive mobility solutions, and high-speed rail networks. Regulatory bodies in Japan, South Korea, and Australia have introduced progressive guidelines mandating automated sterilization validation, propelling demand for connected systems with data analytics capabilities. Meanwhile, burgeoning markets in Southeast Asia and India exhibit a strong appetite for modular sterilization units that can retrofit existing fleets, bridging the gap between foundational disinfection needs and advanced continuous sterilization strategies.

This comprehensive research report examines key regions that drive the evolution of the Cabin Sterilization Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading industry players their strategic initiatives innovation portfolios and competitive positioning within the cabin sterilization technology sphere

Leading industry players have adopted diverse strategies to gain competitive advantage in the cabin sterilization technology arena. Established equipment manufacturers continue to deepen their portfolios through incremental innovations, enhancing system efficacy, energy efficiency, and automation capabilities. These incumbents leverage their extensive service networks to offer turnkey sterilization packages and long-term maintenance contracts, ensuring recurring revenue streams and high customer retention.

Simultaneously, a wave of specialized technology providers is entering the market, propelled by breakthroughs in cold plasma and advanced UV-C dosing methodologies. These agile entrants often partner with research institutions and clinical laboratories to validate their platforms, then target niche segments such as regional jet operators and luxury cruise lines. Strategic alliances with HVAC integrators and IoT solution vendors enable rapid scaling and differentiated value propositions centered on data-driven performance insights.

In parallel, several companies are pursuing vertical integration strategies, combining component manufacturing with end-to-end system assembly and service delivery. This approach streamlines quality control and accelerates time to market but requires substantial capital investment. Others focus on licensing core sterilization technologies to regional OEMs under white-label agreements, expanding geographic reach while limiting direct operational overhead. Across the board, mergers and acquisitions remain prevalent as firms seek to augment their technology stacks, broaden their customer bases, and capture emerging revenue opportunities in adjacent market segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cabin Sterilization Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroClean Technologies, Inc.

- American Ultraviolet, LLC

- Cantel Medical Corporation

- Daikin Industries, Ltd.

- DENSO Corporation

- Ecolab Inc.

- Honeywell International Inc.

- Johnson Controls International plc

- Signify N.V.

- Valeo SA

- Xenex Disinfection Services, LLC

- Xylem Inc.

Delivering strategic imperatives for industry leaders focused on capitalizing emerging trends optimizing operations and sustaining competitive advantage in cabin sterilization

Industry stakeholders seeking to secure a leadership position in cabin sterilization must adopt a multi-pronged strategy that aligns technological excellence with operational resilience. First, investing in modular system architectures will enable rapid customization across cabin types and applications, accelerating deployment timelines and reducing total integration costs. Second, forging strategic partnerships with compliance and certification bodies will streamline market approvals, enhance credibility, and build trust among risk-averse end-users.

Third, manufacturers should embrace service-based revenue models that bundle equipment with remote monitoring and predictive maintenance services, transforming capital expenditures into recurring income streams. Such models not only improve cash flow visibility but also foster deeper customer engagement through continuous performance feedback loops. Fourth, organizations must prioritize R&D initiatives that focus on energy efficiency and sustainable consumables, catering to evolving environmental regulations and end-user demands for green solutions.

Finally, to mitigate geopolitical uncertainties and tariff risks, industry leaders should diversify manufacturing footprints and cultivate a network of digital supply chain partners. Leveraging additive manufacturing for critical components can further insulate operations from disruptions. By integrating these strategic imperatives into their corporate roadmaps, stakeholders can navigate market complexities, capture new growth vectors, and deliver unparalleled safety and sanitation outcomes.

Outlining a rigorous research framework integrating primary expert interviews secondary data analysis and robust validation protocols for market insights

This research employs a rigorous framework combining both primary and secondary methodologies to ensure the credibility and relevance of insights. Primary data collection involved structured interviews with technical experts at leading equipment manufacturers, hygiene protocol specialists in transportation operators, and regulatory authority representatives. These conversations provided firsthand perspectives on technology adoption drivers, compliance challenges, and operational trade-offs.

Secondary research encompassed a comprehensive review of peer-reviewed journals, regulatory agency publications, industry conference proceedings, and publicly available service provider case studies. Detailed company profiles, patent filings, and trade association reports were analyzed to map competitive landscapes and identify innovation trajectories. Each data point was validated through cross-referencing multiple sources, ensuring consistency and accuracy.

Quantitative triangulation techniques were applied to reconcile any discrepancies between reported adoption rates and supplier shipment data, while qualitative validation workshops were conducted with an external panel of transportation and health safety experts. This layered approach ensures that the findings presented herein reflect real-world conditions and robustly support strategic decision-making for stakeholders across the cabin sterilization ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cabin Sterilization Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cabin Sterilization Technology Market, by Technology Type

- Cabin Sterilization Technology Market, by Cabin Type

- Cabin Sterilization Technology Market, by End User

- Cabin Sterilization Technology Market, by Application

- Cabin Sterilization Technology Market, by Distribution Channel

- Cabin Sterilization Technology Market, by Region

- Cabin Sterilization Technology Market, by Group

- Cabin Sterilization Technology Market, by Country

- United States Cabin Sterilization Technology Market

- China Cabin Sterilization Technology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing core conclusions on transformative trends market challenges and strategic priorities that will define the next era of cabin sterilization solutions

The evolving cabin sterilization landscape is characterized by rapid technological innovation, stringent regulatory mandates, and heightened stakeholder expectations. Advanced methods such as plasma sterilization and intelligent UV-C systems are redefining hygiene standards, while persistent supply chain challenges and tariff fluctuations underscore the need for operational agility. Segmentation analyses reveal that tailored solutions-optimized for specific cabin configurations, end-user workflows, and application scenarios-are instrumental in driving adoption and long-term value.

Regional insights highlight diverse market dynamics, from the Americas’ emphasis on domestic manufacturing and federal sanitation guidelines to Europe’s regulatory cohesion and EMEA’s cost-sensitive adoption patterns, and the Asia Pacific’s tech-savvy fleets and high-speed rail expansions. Leading companies are charting varied strategic paths-ranging from vertical integration and service bundling to technology licensing and M&A-each addressing unique competitive imperatives.

Looking ahead, industry leaders that embrace modular architectures, sustainable consumables, service-oriented business models, and diversified manufacturing strategies will be best positioned to capture emerging opportunities. By synthesizing these transformative trends, the insights herein provide a clear roadmap for stakeholders to navigate uncertainties and drive resilient growth in the cabin sterilization market.

Encouraging decisive engagement with Ketan Rohom to leverage comprehensive cabin sterilization market insights and drive informed strategic decision making

To explore how comprehensive insights into cabin sterilization technologies can empower your strategic initiatives and operational excellence, we invite you to engage directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). By partnering with Ketan, you gain privileged access to proprietary analyses, granular data breakdowns, and personalized consultations tailored to your organization’s unique challenges and objectives. This collaboration will enable you to benchmark your technology roadmap against industry best practices, prioritize investment decisions with confidence, and identify untapped market opportunities before your competitors.

Seize the opportunity to transform your understanding of the cabin sterilization landscape into actionable strategies that drive growth, resilience, and customer satisfaction. Contact Ketan today to secure your copy of the full cabin sterilization market research report, complete with in-depth regional assessments, competitive intelligence, and forward-looking trend projections. Your next strategic breakthrough in health security and operational efficiency starts here

- How big is the Cabin Sterilization Technology Market?

- What is the Cabin Sterilization Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?