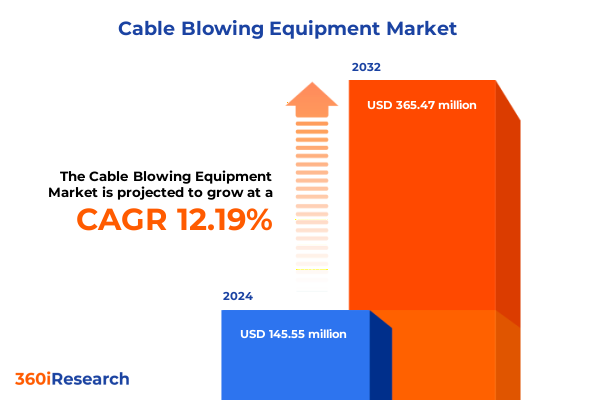

The Cable Blowing Equipment Market size was estimated at USD 161.76 million in 2025 and expected to reach USD 180.99 million in 2026, at a CAGR of 12.34% to reach USD 365.47 million by 2032.

An authoritative orientation to the cable blowing equipment ecosystem highlighting operational drivers, innovation trajectories, supply-chain vulnerabilities, regulatory headwinds, and buyer expectations across industries

The cable blowing equipment ecosystem is a technical and commercially nuanced domain that sits at the intersection of civil infrastructure, telecom deployment, and industrial automation. Equipment designers and operators are navigating more complex project requirements as fiber densification, subterranean conduit work, and urban redeployment accelerate. Buyers now require machines that combine higher precision control with portability and reduced setup time to accommodate dense urban fiber-to-the-premises programs as well as long-haul power and submarine-style cable installations.

From a stakeholder perspective, procurement teams are balancing capital intensity against lifecycle reliability, while field operations prioritize uptime, ease of maintenance, and interoperability with complementary tools such as winches, jetting systems, and micro-trenching rigs. This introduction frames the rest of the executive summary by clarifying how engineering priorities, installation economics, and service-level expectations are shaping vendor selection and product road maps across industrial, telecom, and utility segments.

How rapid automation, modular design, and supply-chain resilience are converging to redefine equipment design, procurement priorities, and field deployment practices

The landscape for cable blowing equipment is undergoing a series of transformative shifts driven by technological advances, tighter supply-chain controls, and the increasing convergence of civil works with digital infrastructure rollouts. Innovations in automation and sensorization are enabling semi automatic and fully automatic machines to perform tasks that once required extensive manual oversight, yielding consistent blow pressures, real-time diagnostics, and reduced operator training cycles. As a result, lifecycle operating costs and field safety outcomes are changing the calculus for both incumbents and new entrants.

Simultaneously, macro-level trade and policy changes have amplified the importance of localized sourcing and resilient inventory strategies, prompting OEMs and contractors to re-evaluate supplier footprints and component substitution options. This environment is accelerating adoption of modular designs that allow for interchangeable hydraulic, mechanical, or pneumatic subsystems, and it is pushing product development toward easier field serviceability and remote monitoring capabilities. The net effect is a sector that is both more technically capable and more sensitive to geopolitical and logistical risk drivers than in previous deployment cycles.

Assessing the aggregated effects of recent United States tariff actions in 2025 and how layered trade measures are reshaping sourcing, procurement, and supplier strategies

The cumulative policy environment in 2025 has introduced heightened trade friction and layered duties that materially influence capital procurement decisions for cable blowing equipment and their subsystems. A suite of new and expanded tariffs, export controls, and reciprocal measures implemented across early-to-mid 2025 increased the cost and complexity of sourcing certain imported components and finished units, creating incentives for manufacturers to reconfigure supply chains and reclassify inputs to mitigate stacking of duties. These changes affect not only direct imports of machinery but also critical inputs such as precision metal components, electronic controls, and specialty polymers. Legal advisories and trade law analyses have documented the breadth and timing of these measures and their immediate impact on cross-border procurement flows.

Complementing ad hoc executive orders and unilateral duties, targeted tariff adjustments announced by trade authorities in late 2024 and implemented in 2025 affected select upstream technologies and raw materials important to high-precision manufacturing and semiconductor-dependent controls that appear in higher-end cable blowing systems. Policymakers signaled that certain tariff increases would remain for the foreseeable future, prompting many vendors to accelerate domestic qualification of suppliers and to reconsider finished-goods inventory strategies to shield customers from near-term cost volatility. The combination of broad-based duties and targeted increases has produced a practical shift toward supplier localization, dual-sourcing, and nearshoring for mission-critical components.

Importantly, the policy cycle in 2025 also included episodic diplomatic engagement and negotiated pauses that created short windows of reduced uncertainty, which some multinational contractors used to execute previously delayed orders or to renegotiate contractual terms. These pauses demonstrated that trade measures and resulting market responses remain subject to rapid political developments and that procurement teams must retain agility to capture transactional opportunities when duty exposure is temporarily eased. This pattern has reinforced the strategic value of flexible contracting and staged inventory draw-downs to manage exposure to sudden tariff changes.

Actionable segmentation insights showing how equipment type, application requirements, operation modes, and end-user profiles uniquely influence product strategy and service models

Segmentation dynamics create actionable implications for product development, customer engagement, and after-sales service models. When equipment selection is evaluated across equipment type differences such as hydraulic, mechanical, and pneumatic variants, buyer decisions are primarily influenced by application profiles, maintenance ecosystems, and the availability of field service expertise. Hydraulic solutions continue to appeal where high force and control are needed for larger-diameter or power cable installations, while mechanical and pneumatic systems retain advantages for portability and environments where hydraulic fluids or complex hoses introduce contamination or maintenance risks.

Application-driven segmentation-spanning copper cable, fiber optic cable, micro cable, and power cable, with fiber optic work further divided into multi mode and single mode use cases-creates distinct technical and contractual expectations. Fiber optic deployments, particularly single mode backbone projects, demand higher insertion precision, gentler handling of fragile fibers, and integrated diagnostics to protect optical integrity during blowing operations. Conversely, copper and power cable projects place greater emphasis on tensile capacity and robust mechanical guidance to manage heavier, stiffer conductors.

Operational mode distinctions among fully automatic, manual, and semi automatic systems determine the nature of training, warranty frameworks, and software-service relationships. Fully automatic platforms drive recurring revenue models through software updates and remote monitoring services, while manual systems continue to offer cost-effective entry points for contractors who prioritize simplicity and low capital outlay. End-user segmentation across construction, data centers, oil & gas, telecommunications, and utilities, where telecommunications itself differentiates between wireless and wireline needs, dictates project timelines, service-level requirements, and procurement cadences. Each end-user vertical imposes its own acceptance testing, certification, and deployment cadence, which manufacturers must address through configurable product options, tailored support packages, and credible field references.

This comprehensive research report categorizes the Cable Blowing Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Operation Mode

- Application

- End User

Comparative regional intelligence explaining how the Americas, Europe Middle East & Africa, and Asia-Pacific each prioritize deployment speed, compliance, and service readiness

Regional dynamics are shaping vendor go-to-market approaches and post-sale support models in differentiated ways across the major global trading blocs. Within the Americas, the emphasis is on rapid deployment for urban broadband programs and utility upgrades, combined with a strong focus on equipment availability, local spare parts inventories, and contractors’ ability to mobilize crews for congested right-of-way projects. This has increased demand for machines that can be quickly reconfigured for short, frequent jobs and that require minimal calibration between shifts.

In Europe, Middle East & Africa, regulatory complexity, standards heterogeneity, and a mix of densely populated urban cores and remote rural networks steer procurement toward modular systems that can be adapted across varied terrains and compliance regimes. Regional energy transitions and telecom modernization programs in this region also amplify demand for ruggedized equipment with extended maintenance intervals. In the Asia-Pacific, extremely rapid fiber densification campaigns, large-scale data center construction, and high-volume manufacturing capabilities in-country incentivize scale-oriented solutions, local OEM partnerships, and, increasingly, price-competitive configurations that do not compromise on diagnostic and automation features. Across each region, service networks, spare-parts logistics, and training programs remain decisive differentiators for vendors seeking sustainable growth.

This comprehensive research report examines key regions that drive the evolution of the Cable Blowing Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key competitive and partnership dynamics that differentiate market leaders from niche specialists through engineering, aftermarket services, and regional agility

Competitive dynamics among incumbent OEMs, specialist niche suppliers, and new entrants reflect a mix of engineering differentiation, commercial agility, and aftermarket economics. Leading equipment providers are extending their value propositions beyond hardware by embedding remote diagnostics, predictive maintenance capabilities, and modular upgrade paths that reduce total installed downtime and simplify integration with fleet management systems. Meanwhile, specialist vendors focused on certain application niches-such as micro cable insertion or long-distance power cable blowing-are leveraging deep domain expertise to secure long-term framework agreements with utilities and system integrators.

Partnership strategies are increasingly important: alliances with control-system suppliers, automation software firms, and regional service partners allow manufacturers to deliver turnkey solutions that reduce the time from procurement to first deployment. In parallel, nimble regional players are capitalizing on the need for localized production and fast spare-parts delivery, often offering attractive service-level agreements that larger global vendors struggle to match. The resulting competitive landscape favours companies that can combine proven engineering, dependable after-sales support, and flexible commercial models that absorb short-term regulatory and freight volatility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cable Blowing Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allame Makina Sanayi ve Ticaret A.Ş.

- Anfkom Telecom Co., Ltd.

- Bagela Baumaschinen GmbH & Co. KG

- Blue Dragon Jet AB

- CBS Products Ltd.

- CommScope Holding Company, Inc.

- Corning Incorporated

- DVP Group S.r.l.

- FOK Maschinenbau GmbH

- Furukawa Electric Co., Ltd.

- Gabriel’s Construction, Inc.

- Genius Engineers Pvt. Ltd.

- Inno Instrument Oy

- Jakob Thaler GmbH

- Katimex Cielker GmbH

- KOSMAK Makine Sanayi ve Ticaret A.Ş.

- Ningbo Huaxiang Dongfang Machinery & Tools Co., Ltd.

- OFS Fitel, LLC

- Prysmian S.p.A.

- Schleuniger AG

- SkyFiberTech AB

- Sumitomo Electric Industries, Ltd.

- TE Connectivity Ltd.

- Upcom Telekomünikasyon Bilisim Teknolojileri Sanayi ve Ticaret Ltd. Şti.

Practical, revenue-protecting recommendations for manufacturers and contractors to manage tariff exposure, accelerate modularization, and monetize service capabilities

Industry leaders should pursue several clear actions to protect margins, preserve customer value, and convert regulatory turbulence into competitive advantage. First, accelerate qualification of alternative suppliers and expand dual-sourcing arrangements for precision components and electronics to reduce exposure to episodic tariff stacking and export controls. Second, re-architect product portfolios toward modular subsystems so that hydraulic, mechanical, or pneumatic elements can be swapped without a full machine redesign, thereby shortening field retrofit cycles and lowering obsolescence risk.

Third, invest in remote diagnostic and predictive-maintenance capabilities that can be monetized as recurring service offerings; these capabilities not only enhance uptime but also create ongoing revenue streams that smooth capital cycle variability. Fourth, strengthen regional service footprints by placing critical spares closer to major deployment corridors and by training a network of certified service providers who can perform first-line repairs under standardized protocols. Finally, embed trade compliance expertise into commercial contracts to allow for dynamic pricing or duty-adjustment clauses that protect both suppliers and buyers when tariff regimes change, thereby reducing negotiation frictions and accelerating procurement decisions.

Transparent research methodology describing how primary interviews, technical validation, and regulatory triangulation underpin the executive insights and recommendations

Research methods combined multiple qualitative and quantitative sources to assemble a comprehensive view of the cable blowing equipment domain, with emphasis on engineering attributes, procurement behavior, and regulatory impacts. Primary inputs included structured interviews with field engineers, procurement leads, equipment fleet managers, and regional service partners to capture operational pain points, asset reliability metrics, and expectations for automation and diagnostics. Secondary inputs encompassed manufacturer technical literature, publicly available regulatory announcements, trade-law analysis, and regional deployment program materials to validate observed trends and to contextualize strategic responses.

Analytical approaches involved cross-referencing equipment capability profiles with application requirements, mapping supplier footprints against freight and duty exposure, and stress-testing service-model permutations under different regulatory scenarios. The methodology explicitly avoided reliance on single-source proprietary market models and prioritized corroboration of trade-policy facts and technical specifications through official government releases, legal advisories, and direct operator testimony to ensure actionable reliability of the conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cable Blowing Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cable Blowing Equipment Market, by Equipment Type

- Cable Blowing Equipment Market, by Operation Mode

- Cable Blowing Equipment Market, by Application

- Cable Blowing Equipment Market, by End User

- Cable Blowing Equipment Market, by Region

- Cable Blowing Equipment Market, by Group

- Cable Blowing Equipment Market, by Country

- United States Cable Blowing Equipment Market

- China Cable Blowing Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Conclusive perspective on how resilience, modular innovation, and service-centric strategies determine future winners in the cable blowing equipment ecosystem

In conclusion, the cable blowing equipment sector is at an inflection point where technological maturation, evolving end-user expectations, and trade-policy volatility intersect. Vendors that move quickly to modularize designs, deepen regional service capabilities, and offer software-enabled uptime assurances will find it easier to win long-term contracts and to command premium aftermarket terms. Contractors and utilities that prioritize flexible procurement frameworks, dual-sourcing strategies, and contractual protections against duty shocks will be better positioned to maintain project schedules and capital efficiency.

The interplay of automation, supply-chain localization, and policy dynamics does not diminish the value of proven engineering; rather, it augments the premium that the market places on reliability, field serviceability, and predictable total cost of ownership. In this environment, strategic clarity, operational resilience, and a commitment to continuous product and service innovation become the most reliable differentiators for vendors and buyers alike.

Immediate procurement pathway and personalized briefing offer to obtain the comprehensive cable blowing equipment market research report with tailored commercial support

For research buyers and commercial leaders seeking immediate access to the full, authoritative market research report on the cable blowing equipment sector, please connect with Ketan Rohom, Associate Director, Sales & Marketing. Ketan can facilitate a tailored briefing that aligns the report’s findings to your strategic priorities, arrange a licensing review, and coordinate custom data extracts or bespoke consultancy add-ons to accelerate decision making. Engage directly to schedule a demo of the report deliverables, request executive summaries for investor presentations, or discuss bespoke forecasting scenarios and procurement intelligence adapted to your procurement or go-to-market timelines.

- How big is the Cable Blowing Equipment Market?

- What is the Cable Blowing Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?