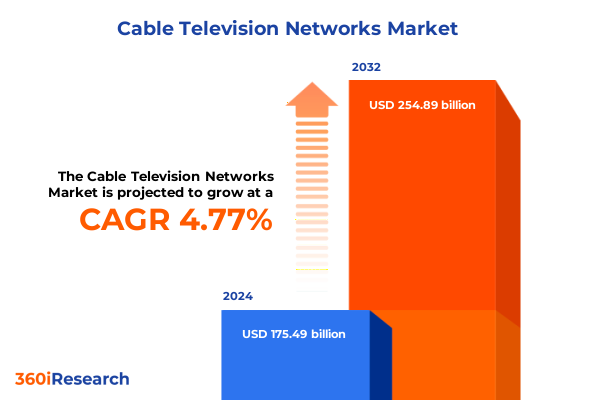

The Cable Television Networks Market size was estimated at USD 183.56 billion in 2025 and expected to reach USD 192.08 billion in 2026, at a CAGR of 4.80% to reach USD 254.89 billion by 2032.

Unveiling the Rapidly Evolving Cable Television Environment Fueled by Technology Integration and Shifting Consumer Expectations

Over the past decade, the cable television industry has undergone a profound evolution as consumer expectations for on-demand content and personalized experiences have risen. Where once linear channel lineups and appointment-based viewing reigned supreme, the proliferation of streaming platforms and smart devices has blurred the boundaries between traditional cabling infrastructures and internet-driven delivery models. This shift has compelled established providers to reimagine their value proposition, placing greater emphasis on seamless content curation, integrated service bundles, and next-generation network capabilities.

In parallel, technology advancement has accelerated the pace of change across every facet of cable operations. High-definition and Ultra High Definition formats have become standard expectations, while advanced compression techniques and content management systems are enabling unprecedented flexibility in how programming is packaged, marketed, and monetized. At the same time, mobile broadband convergence and the rise of fixed wireless alternative offerings have tested legacy revenue models, forcing operators to seek innovative approaches to customer acquisition, retention, and service differentiation.

This executive summary delves into the pivotal trends, regulatory headwinds, and competitive strategies shaping the cable television networks market today. By examining transformative landscape shifts, the cumulative impact of recent tariff measures, segmentation nuances, regional patterns, and the strategic moves of major players, readers will gain a comprehensive perspective on how to navigate a market that is both fiercely competitive and ripe with new growth opportunities.

Drawing upon primary interviews with industry executives, secondary data including regulatory filings, and a synthesis of market commentary, the analysis that follows offers a distilled yet comprehensive viewpoint to inform strategic decision-making. Each section highlights actionable insights and recommendations designed to help stakeholders align their investments, product roadmaps, and partnership strategies with the realities of a fast-moving environment. As the journey ahead promises both challenges and opportunities, clarity will be essential to forging resilient and forward-looking business models.

Exploring Critical Industry Disruptions Redefining Cable Networks Through Convergence of Streaming, Broadband, and Mobile Innovations

Major cable operators have responded to shifting viewing habits by embracing hybrid service models that blend traditional channel packages with on-demand streaming libraries. One recent innovation exemplifies this shift: a unified digital storefront embedded within set-top devices that enables subscribers to browse, manage, and bill multiple third-party streaming subscriptions alongside core cable offerings through a single interface. This kind of platform represents a strategic pivot toward content neutrality, positioning providers as aggregators rather than mere signal distributors. Concurrently, cable giants have begun to entwine mobile connectivity with broadband services to stem subscriber churn, leveraging their existing infrastructure to offer bundled wireless plans that can lock in households across fixed and mobile networks.

In the network operations arena, the drive toward next-generation cable standards has encountered new sources of complexity. Deliberations over future proofing capital budgets have led some operators to defer planned DOCSIS 4.0 rollouts as tariff uncertainties loom over key equipment manufacturers. Anticipated duties on amplifiers and outside plant components have prompted suppliers to reevaluate production locations, which in turn has tempered the pace of upgrade deployments across the industry. At the same time, the ongoing convergence of broadband, video, and IP services continues to reshape vendor–operator relationships, elevating the importance of scalable, software-defined network architectures.

Amid these transformations, providers are also investing in AI-driven analytics to glean real-time insights into consumption patterns, enabling dynamic bandwidth allocation and personalized content recommendations. Such capabilities are rapidly becoming cornerstones of subscriber engagement strategies as the battle for audience attention intensifies.

Assessing the Multi-Faceted Consequences of 2025 United States Import Tariffs on Cable Television Infrastructure and Service Economics

The implementation of new U.S. import duties in early 2025 has introduced a significant cost variable for cable infrastructure and service economics. Under adjustments to Section 301 provisions, the tariff rate for key semiconductor components classified under HTS headings 8541 and 8542 doubled from 25% to 50% effective January 1, 2025, directly impacting the cost structure of set-top box production, headend servers, and network control systems. Moreover, telecommunications equipment originating from high-impact regions such as China has faced a further 10% uptick in duty rates, bringing certain network amplifiers and outside plant passives under a 35% tariff regime as of February 2025. These measures have expanded the expense profile for critical hardware components, compelling operators and suppliers alike to revisit sourcing strategies and pricing models.

In response to these elevated import levies, several leading cable vendors have indicated intentions to delay the deployment of advanced DOCSIS 4.0 architectures until tariff clarity improves or alternative manufacturing pathways are established. Such postponements risk slowing the delivery of symmetric multi-gigabit services and could widen the competitive gap with fiber and fixed wireless providers. On the consumer-facing side, global television brands are preparing to pass a portion of the increased input costs onto end users, with retailers projecting retail price adjustments on new TV sets and related equipment in the latter half of 2025. This incremental price pressure may suppress discretionary spending on premium hardware, shifting further value toward digital service bundles and content-centric offerings.

Deriving Actionable Insights from Comprehensive Market Segmentation Analysis Spanning Service Types, Content Portfolios, Technological Tiers, Subscription Models and End User Profiles to Illuminate Growth Opportunities

An in-depth examination of service type segmentation reveals three distinct categories shaping end-user engagement: pay-per-view offerings capitalize on live event exclusivity, premium subscription tiers cater to audiences seeking curated channel lineups, and video-on-demand solutions have become the cornerstone of personalized viewing experiences. Each service type demands different bandwidth commitments, content acquisition strategies, and customer support infrastructures, underscoring the importance of flexible network architectures.

Content type segmentation further elucidates the market’s breadth, spanning entertainment programming designed to capture wide audience demographics, movie channels that rely on licensed or original cinematic releases, specialized news services offering real-time reporting and analysis, and sports networks that drive peak viewership during marquee events. Success within each content vertical hinges on balancing rights costs against advertising and subscription revenues.

Technology segmentation highlights the critical role of signal fidelity in consumer perception, with standard definition delivering baseline accessibility, high definition setting the minimum expectation for modern screens, and ultra high definition pushing the boundaries of visual immersion. The emergence of 4K and nascent 8K formats within the ultra high definition domain is fueling demand for network capacity enhancements and advanced compression codecs.

Subscription type segmentation outlines a spectrum of commitment models: annual contracts provide predictable revenue streams yet entail higher customer acquisition costs, monthly plans offer flexibility but can exert subscriber churn, and prepaid arrangements open pathways to underserved or budget-conscious segments. Finally, end-user segmentation differentiates the commercial ecosystems-where multi-site deployments and service-level agreements drive B2B revenue-from residential markets focused on individual or family subscriptions, each with its own service quality benchmarks and marketing imperatives.

This comprehensive research report categorizes the Cable Television Networks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Content Type

- Technology

- Transmission Type

- Signal Quality

- End User

- Distribution Channel

Identifying Distinct Regional Dynamics Influencing Cable Television Adoption and Content Strategies Across the Americas, Europe, Middle East & Africa, and Asia-Pacific

Across the Americas, cable television operators continue to leverage mature infrastructure investments while exploring hybrid delivery models to recapture cord-cutter demographics. The United States remains at the forefront of bundling strategies, with providers integrating streaming services and fixed wireless offerings into unified packages to enhance value and reduce churn. In Latin America, growth opportunities are emerging through expanded pay-per-view sports programming and localized content partnerships, offsetting slower broadband penetration in some regions.

In Europe, Middle East & Africa regions, diverse regulatory regimes and varying levels of connectivity present a complex landscape. Western Europe benefits from high-definition saturation and competitive content licensing markets, driving innovation in ad-supported and premium subscription formats. In contrast, Middle Eastern markets are characterized by significant demand for sports broadcast rights and satellite–cable convergence, while African territories reveal strong growth potential in prepaid access and low-bandwidth optimized content solutions. Tailored strategies that consider local language preferences, regulatory constraints, and payment infrastructures are critical for success.

The Asia-Pacific region stands out for its rapid deployment of ultra high definition broadcasting standards and dynamic competition between cable and broadband service providers. Markets such as Japan and South Korea have established early leadership in 8K experimental deployments, while Southeast Asian economies are witnessing the commercial rollout of 4K linear and on-demand platforms. Strategic alliances between regional content producers and global licensors are accelerating the availability of premium localized programming, creating new monetization streams and underscoring the importance of network scalability to accommodate evolving consumption patterns.

This comprehensive research report examines key regions that drive the evolution of the Cable Television Networks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Maneuvers of Leading Cable Networks Consolidating Their Positions Amid Industry Transformation

Comcast has repositioned its core cable business by rolling out an integrated digital storefront within its Xfinity X1 and Xumo Stream Box platforms, enabling subscribers to navigate hundreds of third-party streaming channels and manage billing through a streamlined interface. This move reflects a broader strategic shift toward becoming a content aggregator while reinforcing the value of proprietary cable infrastructure. Concurrently, Comcast’s announcement of a media spinoff, known as Versant Media Group, will carve its NBCUniversal cable assets-encompassing networks such as USA Network, CNBC, and MSNBC-into an independent company led by seasoned industry executives. The spinoff, slated to finalize later this year, is expected to unlock shareholder value by granting increased strategic focus to both the parent and the new entity.

Similarly, Warner Bros. Discovery has embarked on a high-stakes restructuring designed to bifurcate its linear network operations from its streaming and studio businesses. The creation of a Global Linear Networks company, hosting channels like TNT, TBS, and CNN, alongside a standalone Streaming & Studios division, underscores a commitment to sharpen operational priorities and optimize capital allocation across diverging content modalities.

Meanwhile, niche operators and content producers are exploring direct-to-consumer channels to supplement traditional distribution. These firms, supported by agile content libraries and digital-first marketing, are pressuring incumbents to refine their value propositions and invest in user experience enhancements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cable Television Networks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A&E Television Networks

- Altice USA, Inc.

- AMC Networks Inc.

- Bell Canada Enterprises Inc.

- British Broadcasting Corporation (BBC)

- Comcast Corporation

- Cox Communications, Inc.

- Dish Network Corporation

- Fox Corporation

- Grupo Televisa S.A.B

- Mediacom Communications Corporation by WPP plc

- Paramount Global

- ProSiebenSatMedia SE

- Rogers Communications Inc.

- Seven West Media Ltd.

- Sony Group Corporation

- T-Mobile US, Inc.

- The Walt Disney Company

- Verizon Communications Inc.

- Warner Bros. Discovery

- Yomiuri Telecasting Corporation

- Zee Entertainment Enterprises Ltd.

Formulating Pragmatic Recommendations to Empower Industry Leaders in Navigating Technological Convergence, Market Disruptions, and Service Diversification

In the face of accelerating technological convergence and evolving consumer expectations, providers should prioritize investments in unified content platforms that seamlessly integrate live linear programming with on-demand and streaming apps. By adopting APIs and open-standard frameworks, operators can reduce time-to-market for third-party integrations and deliver frictionless user interfaces that reinforce subscriber loyalty. In parallel, a renewed focus on scalable software-defined network architectures will be critical to efficiently support the transition to Ultra High Definition and emerging 8K formats without compromising service quality.

As hardware input costs rise under shifting tariff conditions, industry leaders must cultivate flexible sourcing strategies that leverage diversified manufacturing footprints and engage in proactive supplier negotiations. Establishing collaborative partnerships with key vendors can facilitate joint risk-sharing arrangements, enabling cost predictability and mitigating the impact of duty fluctuations. Additionally, accelerating the deployment of edge compute and AI-driven analytics will empower operators to optimize network utilization, predict maintenance needs, and personalize content recommendations, collectively enhancing operational agility and subscriber satisfaction.

Finally, operators should deepen their regional market segmentation efforts by tailoring service bundles and content acquisition strategies to the unique dynamics of the Americas, Europe, Middle East & Africa, and Asia-Pacific territories. Customizing subscription models-ranging from prepaid offerings in emerging economies to hybrid bundles in mature markets-will unlock new revenue streams and solidify competitive positioning in an increasingly fragmented media ecosystem.

Detailing a Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Multi-Stage Validation Protocols for Market Insights

This study employs a hybrid research framework combining both primary and secondary methodologies to ensure a robust and balanced analysis. Primary insights were garnered through structured interviews and in-depth consultations with senior executives across major cable operators, technology vendors, and content rights holders. These conversations provided firsthand perspectives on strategic priorities, operational constraints, and investment roadmaps.

Secondary research drew upon publicly available regulatory filings, industry white papers, and credible technology news outlets to aggregate data on tariff schedules, infrastructure rollouts, and corporate reorganizations. By cross-referencing multiple sources, the analysis mitigates bias and validates key findings through data triangulation. In addition, trade association reports and standards bodies provided technical parameters for network evolution, including DOCSIS and UHD specifications.

A multi-stage validation process was implemented to refine the analysis, incorporating iterative feedback loops with subject matter experts and peer reviews. This approach ensured accuracy in interpreting market dynamics, technological trends, and regional variances. Quantitative inputs were complemented by qualitative assessments of competitive strategies, enabling a comprehensive synthesis of both numerical and narrative insights. The research period spans the first half of 2025, capturing the latest regulatory updates and technology milestones that are reshaping the industry landscape. Overall, the methodology underscores transparency, rigor, and replicability, supporting the credibility of the report’s conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cable Television Networks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cable Television Networks Market, by Service Type

- Cable Television Networks Market, by Content Type

- Cable Television Networks Market, by Technology

- Cable Television Networks Market, by Transmission Type

- Cable Television Networks Market, by Signal Quality

- Cable Television Networks Market, by End User

- Cable Television Networks Market, by Distribution Channel

- Cable Television Networks Market, by Region

- Cable Television Networks Market, by Group

- Cable Television Networks Market, by Country

- United States Cable Television Networks Market

- China Cable Television Networks Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Synthesizing Key Takeaways to Illuminate Future-Proof Strategies and the Imperative of Adaptation in a Rapidly Evolving Cable Television Landscape

In conclusion, the cable television networks industry finds itself at an inflection point characterized by converging technologies, shifting consumer preferences, and evolving regulatory influences. The transformations outlined in this summary-from the integration of streaming storefronts and mobile bundling to the ramifications of U.S. tariff policies and the strategic segmentation of services-highlight a market in flux. Yet within this dynamic environment lie clear pathways for differentiation and growth.

Operators capable of harmonizing traditional linear offerings with modular on-demand and streaming ecosystems will be best positioned to retain subscribers while capturing new audiences. Simultaneously, proactive management of hardware cost pressures through diversified sourcing and supplier collaboration will safeguard profit margins as networks scale to accommodate higher-resolution video formats. Regional market nuances further underscore the need for tailored go-to-market approaches that reflect local consumption behaviors, regulatory frameworks, and infrastructure maturity.

Ultimately, success will hinge on a willingness to embrace innovation-leveraging software-defined platforms, edge compute capabilities, and data-driven personalization to deliver compelling user experiences. As major companies realign their portfolios through spin-offs and corporate restructurings, the competitive landscape will continue to evolve. Maintaining adaptability and a clear strategic vision will thus be essential for long-term resilience and value creation.

Engage Directly with Ketan Rohom to Secure In-Depth Cable Television Market Intelligence and Propel Strategic Decision-Making with a Tailored Research Report

To explore these insights in greater depth and to access the full market research report complete with detailed data, appendices, and proprietary analysis, please connect with Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this intelligence can support your strategic objectives. Ketan can provide personalized guidance on leveraging market segmentation findings, regional trends, and tariff impact assessments to inform your investment and operational plans. Engage today to secure your copy of the comprehensive cable television networks market report and empower your organization with the foresight needed to thrive in a rapidly changing media ecosystem

- How big is the Cable Television Networks Market?

- What is the Cable Television Networks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?