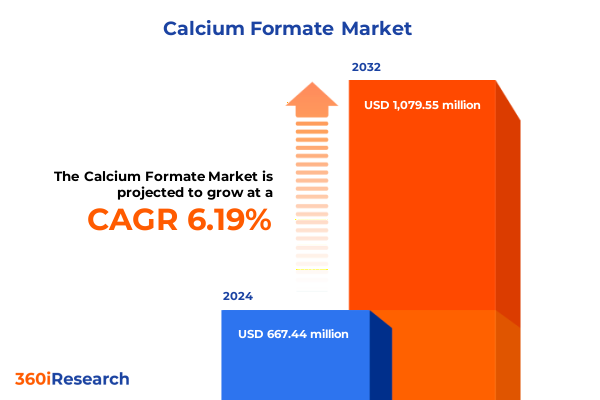

The Calcium Formate Market size was estimated at USD 707.22 million in 2025 and expected to reach USD 753.70 million in 2026, at a CAGR of 6.22% to reach USD 1,079.55 million by 2032.

Calcium formate at the crossroads of construction, feed, and specialty chemicals in a reshaping global industrial ecosystem

Calcium formate has emerged as a critical multi-functional additive at the intersection of construction materials, animal nutrition, leather processing, and environmental technologies. Chemically, it is the calcium salt of formic acid, and this simple structure underpins a wide spectrum of performance benefits, ranging from accelerated cement hydration and improved early strength in concrete and mortars to pH control and microbial growth inhibition in animal feeds. In leather tanning, it improves chrome penetration and process efficiency, while in industrial settings it contributes to flue gas desulfurization and can act as a component in deicing systems that are less aggressive to steel and concrete compared with traditional chloride-based salts.

In parallel, calcium formate is increasingly recognized as an enabling material for cleaner industrial processes. Its use as an additive in wet flue gas desulfurization can increase sulfur dioxide capture efficiency and reduce limestone consumption, lowering both emissions and operating cost in coal and oil-fired power plants. As a co-product of trimethylolpropane production or as a product synthesized from calcium hydroxide and carbon monoxide, it also connects directly to larger discussions on carbon management and industrial symbiosis. Recent advances in process technology even show that calcium formate can be produced by converting carbon monoxide-rich off-gases from steel and yellow phosphorus operations into a stable, tradable product, effectively locking in carbon that would otherwise be oxidized to carbon dioxide.

Against this technical backdrop, end-use industries are facing rising pressure to improve sustainability performance, reduce corrosion and infrastructure damage from winter maintenance, and comply with stricter veterinary and food safety regulations. Calcium formate’s low-chloride profile makes it an attractive alternative to calcium chloride as a cement accelerator where reinforcement corrosion is a concern, and its authorization as a preservative for feeds in major jurisdictions offers producers a way to stabilize feed quality while supporting animal performance. As a result, the compound has transitioned from a relatively niche derivative of formic acid into a strategically important additive whose supply security, regulatory status, and performance differentiation all carry growing weight in procurement and R&D discussions.

At the same time, the trading environment in which calcium formate circulates has become significantly more complex. Global chemical supply chains are still recalibrating after multiple shocks in logistics and energy prices, while new tariff regimes are altering the economics of long-established producer–consumer corridors. These shifts mean that an understanding of calcium formate now requires not only an appreciation of chemistry and applications but also a firm grasp of policy, regional cost structures, and evolving customer expectations across the construction, feed, leather, and industrial sectors.

Evolving environmental standards, circular carbon processes, and digital supply chains are transforming the calcium formate market landscape

The landscape for calcium formate is being reshaped by a series of transformative forces that extend from the laboratory to the macro-policy level. One of the most notable shifts is the push toward low-chloride, corrosion-mitigating admixtures in cement and concrete. Traditional accelerators such as calcium chloride are increasingly constrained by standards and asset owners concerned about rebar corrosion and premature deterioration. In this context, calcium formate has gained prominence as a non-chloride accelerator that can deliver faster setting and higher early strength without compromising the long-term durability of reinforced structures, especially in cold-weather applications. This shift is not merely incremental; it changes how admixture portfolios are designed, how specifications are written, and how construction projects in harsh climates are scheduled.

A second structural change is the integration of calcium formate into decarbonization and circular-economy strategies. Process innovations now enable the production of calcium formate by reacting calcium hydroxide with carbon monoxide present in industrial off-gases from steel and phosphorus plants, converting a previously flared waste stream into a value-added product. Life-cycle assessments of these routes indicate lower global warming potential compared with traditional neutralization processes using formic acid and calcium carbonate, since they avoid the associated carbon dioxide emissions and “lock” carbon monoxide into the solid product. For stakeholders seeking to meet emissions targets or monetize carbon credits, such process routes can turn calcium formate production capacity into a lever for measurable carbon reductions.

In the animal nutrition arena, regulatory and technical developments are likewise changing the role of calcium formate. Scientific opinions and regulations from European authorities have clarified safety thresholds and efficacy for its use as a preservative and acidifier in feed across a wide range of species, providing a stronger framework for feed formulators to incorporate the additive in a compliant and performance-oriented way. This has encouraged not only the use of pure calcium formate but also its inclusion in composite eubiotic solutions and zootechnical additives that combine organic acids to improve gut health and feed efficiency in poultry and other species. The emphasis is shifting from simple preservation toward integrated performance enhancement, favoring suppliers who can deliver consistent feed-grade quality and robust technical support.

At the same time, adoption of calcium formate in environmental applications such as flue gas desulfurization and low-corrosion deicing blends is broadening its industrial relevance. Studies on wet flue gas desulfurization systems show that adding calcium formate can enhance the dissolution of limestone, promote gypsum crystal growth, and ultimately raise sulfur dioxide removal efficiency while reducing reagent consumption and energy use. On winter maintenance networks, formulations combining calcium formate with urea or other salts offer deicing performance with reduced corrosivity relative to traditional sodium chloride, helping municipalities and infrastructure operators meet both performance and asset-protection objectives.

Overlaying these technological and regulatory dynamics is the digital transformation of chemical procurement and supply-chain management. Buyers of calcium formate, particularly in mid-sized construction and feed companies, are increasingly leveraging digital platforms for price discovery, supplier qualification, and shipment tracking. This is changing the balance of power along the value chain, as transparency on origin, specification, and logistics performance becomes more widely available. Producers that can pair differentiated products with high-quality digital customer interfaces and real-time supply-chain visibility are better positioned to win share, especially as buyers seek to diversify away from single-region dependence in response to tariff and logistics risks.

Cascading effects of 2025 United States tariffs on calcium formate trade flows, sourcing strategies, and downstream application economics

Trade policy developments in 2025 have introduced a new layer of complexity for participants in the calcium formate value chain, particularly those with exposure to United States import and export flows. Beginning in February, the United States implemented additional tariffs on imports from China under emergency economic powers, applying an across-the-board surcharge on goods that included a wide range of specialty and inorganic chemicals. Subsequent escalations and reciprocal actions pushed effective tariff rates on many Chinese-origin products, including numerous chemical categories, to unusually high levels. While tariff schedules for individual HS codes associated with calcium formate can vary and are subject to exemptions, the overall direction has been clear: importing chemical intermediates and additives from China into the United States has become materially more expensive and administratively burdensome.

These measures come at a time when trade statistics show that the United States is a leading importer of calcium formate globally, drawing significant volumes from China as well as from suppliers in South Korea and Belgium. As tariffs raise the landed cost of Chinese material, United States buyers are under pressure to re-balance their sourcing portfolios. In practice, this is driving greater interest in alternative Asian suppliers, European producers, and any available domestic capacity. However, shifting volumes is not frictionless: alternative origins often come with higher base prices, longer transit times, or constraints in feed-grade and high-purity specifications, all of which can affect downstream users in construction admixtures, animal feed, leather processing, and industrial flue gas treatment.

The tariff environment is not limited to United States–China relations. An agreement announced in mid-2025 introduced a new framework of duties on European Union exports to the United States, with an expected 15% tariff covering a broad portion of EU outbound trade. Although some chemicals are anticipated to be exempt or partially shielded, the absence of a finalized legal text has created substantial uncertainty for European specialty chemical exporters. For calcium formate, this uncertainty complicates long-term supply contracts between European producers and United States distributors or OEMs, as pricing formulas must now account for potential tariff contingencies and the risk of retroactive changes.

Cumulatively, these trade measures are compressing margins and altering the calculus for inventory and logistics. Chemical industry analyses suggest that broad-based tariff regimes on key trading partners can raise input costs by high single to low double-digit percentages and lengthen lead times through additional customs clearance steps. For calcium formate importers, this has encouraged greater use of bonded warehouses, multi-port delivery strategies, and more frequent partial shipments to avoid stockouts. It has also elevated the importance of accurate HS classification and origin documentation, as small differences in coding can translate into significant duty exposure.

Downstream, the impact of these tariff-induced cost increases is playing out differently across application segments. Construction chemical formulators, operating in intensely competitive markets, are exploring partial substitution with other accelerators or reformulating to use lower dosages of calcium formate while maintaining performance, sometimes in combination with other admixture technologies. Feed manufacturers, facing sensitivity to input cost volatility, are re-examining the balance between different organic acids and salts in their acidification and preservation strategies to optimize efficacy per unit cost. In sectors such as flue gas desulfurization and deicing, where procurement often occurs through public tenders, tariff-related price shifts are shaping bid structures and, in some cases, accelerating interest in local production or joint ventures to mitigate import exposure.

Looking ahead, trade policy remains fluid, and industry participants must treat the 2025 United States tariff landscape as a moving parameter rather than a fixed constraint. Scenario planning that considers partial rollbacks, broader multilateral disputes, or further escalation will be essential for producers and buyers of calcium formate alike. Organizations that build flexible sourcing architectures, maintain diversified supplier bases, and incorporate tariff clauses into contracts will be better placed to navigate both near-term volatility and longer-term shifts in global chemical trade patterns.

Unpacking application, form, product grade, and sales channel segmentation to reveal high-value pockets in calcium formate demand

Viewing the calcium formate market through the lens of application reveals several important patterns that shape demand behavior and supplier strategy. Animal feed uses are driven primarily by regulatory approvals and the search for reliable acidifiers and preservatives that support gut health and feed hygiene without compromising safety. The ability of calcium formate to reduce feed pH and inhibit microbial growth, combined with its contribution to dietary calcium, makes it particularly attractive in pig and poultry diets. At the same time, cement retarder and accelerator applications respond closely to construction activity, climate considerations, and evolving building codes, with calcium formate being specified both to speed early strength development and to help control setting at low temperatures. Deicing applications emphasize reduced corrosivity and environmental impact relative to traditional rock salt, while leather tanning and mineral processing employ calcium formate as a process aid that enhances penetration of tanning agents and improves flotation or separation efficiency.

Form factors play a crucial role in matching calcium formate to these application environments. Granular material tends to be favored where dust control and flowability are important, such as in some feed and construction applications that rely on volumetric dosing or pneumatic transfer. Liquid preparations, although less common, can offer advantages in automated dosing systems or when calcium formate is co-formulated with other soluble additives in feed or environmental technologies. Fine powders, by contrast, are often preferred in high-performance construction chemicals and specialty blends, where rapid dissolution, homogeneous mixing, and tight particle-size control are required. The choice between granular, liquid, and powder forms is thus not merely a logistics decision; it affects formulation behavior, process efficiency, and sometimes worker safety, particularly when dust exposure must be minimized.

Overlaying form and application is the question of product grade, which fundamentally determines the regulatory and quality framework under which calcium formate can be used. Feed grade material must meet stringent impurity limits and demonstrate safety and efficacy under animal nutrition regulations, whereas food grade products are produced under even tighter controls where they are authorized. Industrial grade can tolerate a broader impurity profile, making it suitable for construction admixtures, deicing, flue gas desulfurization, and other technical uses where performance and cost competitiveness take precedence over nutritional considerations. Suppliers increasingly differentiate their portfolios by offering specialized grades tailored to particular segments, such as low-dust feed granules, ultra-low heavy-metal content products for sensitive applications, or high-purity grades optimized for use in emissions control systems.

The sales channel architecture adds another dimension to this segmentation. Direct sales from manufacturers to end users or OEMs remain critical where large volumes, customized specifications, and tight technical collaboration are involved, for example in relationships with multinational construction chemical formulators or integrated feed conglomerates. Within direct sales, transactions may be structured either around long-term supply contracts with manufacturers or via OEM arrangements where calcium formate is embedded in branded formulations. Distributors, both national and regional, play a pivotal role in serving fragmented customer bases in construction, agriculture, and smaller industrial niches. National distributors can combine scale and warehousing to provide reliable coverage across large territories, while regional distributors offer responsiveness and local market knowledge in markets where demand is geographically concentrated or seasonal.

Online channels are steadily expanding their influence across the calcium formate value chain. Company websites now commonly support direct inquiries, technical documentation access, and in some cases transactional ordering for standard pack sizes. Third-party platforms enable smaller buyers to source from multiple suppliers with improved price transparency and logistics options, lowering the barriers to switching vendors and encouraging competition. As digital procurement matures, producers that present clear, comparable information on product grade, form, and application suitability through these online channels are likely to capture incremental share, especially among mid-sized and smaller customers that historically relied solely on distributor relationships.

This comprehensive research report categorizes the Calcium Formate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Product Grade

- Application

- Sales Channel

Regional dynamics across the Americas, Europe–Middle East–Africa, and Asia-Pacific redefine calcium formate sourcing, usage, and innovation

Regional dynamics in the calcium formate market are shaped by differing industrial structures, regulatory regimes, and trade exposures. In the Americas, demand is anchored by robust construction activity, extensive winter road networks, and a sizeable feed and livestock sector. The United States, in particular, stands out as both a major importer and a key consumer, sourcing significant volumes of calcium formate from Asia and Europe to support its concrete admixture industry, feed manufacturers, and specialty chemical applications. Tariff policies implemented in 2025 have heightened the strategic importance of supply diversification and have begun to nudge buyers toward a mix of traditional Asian sources, European suppliers, and any available regional production. In Latin America, construction growth and agricultural expansion are supporting increasing interest in both industrial and feed-grade calcium formate, though local availability and currency volatility often influence the pace and nature of adoption.

Across Europe, the Middle East, and Africa, the calcium formate landscape is closely linked to the region’s strong regulatory orientation and energy-cost challenges. Europe hosts several established producers, including companies that manufacture calcium formate as a co-product of polyol production or as part of integrated formic acid chains. Stringent construction standards that limit the use of chloride-based accelerators, along with advanced animal welfare and feed safety regulations, provide a supportive environment for higher value-added grades and formulations. At the same time, elevated energy prices and environmental compliance costs are prompting some specialty chemical manufacturers to rationalize capacity or shift production to regions with more favorable cost structures, even as they maintain technical leadership in product development. In the Middle East and Africa, adoption is more uneven, with pockets of strong demand where large infrastructure projects, mining activities, or intensive poultry and livestock production create clear use cases for calcium formate in construction, mineral processing, and feed.

Asia-Pacific represents both the heart of global production and a rapidly evolving demand center. China is a leading producer of formic acid and its derivatives, including calcium formate, benefiting from integrated value chains and cost-efficient production infrastructure. Several Chinese and regional manufacturers have built substantial capacity to serve both domestic needs and export markets, supplying construction chemicals, feed additives, leather processors, and industrial users across the region. At the same time, Asia-Pacific is seeing rising internal demand driven by urbanization, infrastructure investment, and growth in commercial livestock production. Emerging regulatory frameworks on feed additives and environmental emissions are gradually converging toward international norms, which is likely to favor higher-quality feed and industrial grades over time. Countries such as India, Vietnam, and Indonesia are becoming increasingly important as both importers and, in some cases, as hubs for downstream formulation rather than basic production.

Taken together, these regional patterns create a complex mosaic in which calcium formate flows from production clusters in Asia and parts of Europe toward diversified demand centers in the Americas, Europe, Middle East, Africa, and the broader Asia-Pacific region. Trade policies, logistics constraints, and local standards all influence which suppliers can competitively serve which markets. Industry participants that align their production footprint, grade portfolio, and sales-channel strategies with the specific needs of each of these regions will be best placed to capture growth while managing regulatory and tariff-related risks.

This comprehensive research report examines key regions that drive the evolution of the Calcium Formate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive strategies of leading calcium formate producers highlight specialization, integration, and customer-centric technical support

The competitive landscape for calcium formate is characterized by a mix of global specialty chemical producers, integrated formic acid manufacturers, and regional firms that focus on cost-efficient supply. Among the global players, European-based producers such as Perstorp have invested in calcium formate as a strategic extension of their polyol and formic acid chains, acquiring additional businesses and expanding capacity to serve both construction and feed markets. Their offerings typically emphasize consistent high purity, well-documented performance in tile adhesives and concrete accelerators, and specialized feed-grade products marketed under proprietary brands, supported by extensive technical service.

Other major contributors include companies that integrate calcium formate within broader portfolios of formates and organic salts. Chinese groups, such as Feicheng Acid Chemicals and Chongqing Chuandong Chemical, leverage large-scale formic acid production and long-standing export capabilities to supply industrial-grade calcium formate globally. Their competitive advantages center on scale, cost-efficiency, and the ability to tailor packaging and logistics to a wide variety of customer requirements. These producers often act as key suppliers to international trading houses and distributors that, in turn, serve construction chemical formulators, feed manufacturers, and industrial users in multiple regions.

In North America and Europe, specialty chemical companies and distributors play a pivotal role in bridging global supply with local demand. Firms such as GEO Specialty Chemicals and various regional distributors offer calcium formate alongside complementary products, including dispersants, plasticizers, and other construction admixtures, allowing them to address a broad spectrum of customer needs with integrated solutions. These organizations emphasize application know-how, customized blends, and reliable local warehousing, catering especially to mid-sized customers who value technical support and shorter lead times over purely lowest-cost sourcing.

A notable trend among leading companies is the move toward differentiation through sustainability and innovation. Some producers are developing calcium formate grades optimized for low-dust handling or enhanced stability in humid environments, responding to both occupational safety requirements and process reliability concerns in feed mills and dry-mix mortar plants. Others are investing in process technologies that use industrial off-gases as feedstock for calcium formate production, positioning themselves as providers of carbon-reducing solutions for steel and phosphorus industries. Additionally, several companies are extending their technical documentation and digital support tools, offering formulation guidance, dosage recommendations, and regulatory updates through online platforms to strengthen customer loyalty and reduce switching costs.

As competitive intensity increases, partnerships and joint ventures are becoming more prominent as mechanisms to enter new regions or access specific end-use segments. Integrated chemical producers are teaming up with feed additive specialists to develop co-branded zootechnical products that combine calcium formate with other functional ingredients, while construction-chemical firms are collaborating with admixture suppliers to embed calcium formate into broader performance packages tailored to regional cement types and climate conditions. These collaborative strategies, supported by consistent quality and robust service, are likely to define the next phase of competition in the calcium formate market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Calcium Formate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Calform GmbH

- GuRong Petrochemical Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- LANXESS AG

- Lucen Technologies Limited

- Perstorp Holding AB

- Qingdao Sunrise Biotechnology Co., Ltd.

- Shandong Baisheng Biological Technology Co., Ltd.

- Sidley Chemical Co., Ltd.

- TCI Chemicals India Pvt. Ltd.

Strategic priorities and practical actions for industry leaders to navigate risk, capture value, and accelerate innovation in calcium formate

In light of the forces reshaping calcium formate markets, industry leaders should prioritize a set of concrete, interlocking actions to protect margins and capture emerging opportunities. The first priority is to harden supply resilience in the face of tariff volatility and logistics disruption. This involves diversifying sourcing across multiple producing regions, structuring contracts with flexible origin clauses, and building relationships with both large integrated producers and nimble regional suppliers. Where volumes justify it, companies should also evaluate the feasibility of regional safety stocks or consignment inventories close to critical customers, especially in construction and feed applications where continuity of supply is paramount.

A second action area is portfolio and specification strategy. Producers and formulators alike should reassess how their calcium formate offerings map to the evolving needs of application segments and grades. In construction, there is a clear opportunity to develop and promote non-chloride admixture systems where calcium formate plays a central role in achieving early strength and cold-weather performance, supported by robust testing and compliance with local standards. In feed, the focus should be on demonstrating the performance benefits of calcium formate in acidification and preservation, and on integrating it effectively into multi-acid and eubiotic concepts that align with current thinking on gut health and antibiotic stewardship. Industrial customers in deicing, mineral processing, and flue gas desulfurization will respond positively to grades and particle-size distributions that enhance process stability and reduce handling issues.

Digital transformation should be treated not as an optional enhancement but as a core element of competitive strategy. Companies can strengthen their position by making product documentation, safety data, and performance guidance readily available through well-designed web portals, and by enabling straightforward online inquiries and, where appropriate, transactional ordering. For distributors and mid-sized producers, investing in digital tools that provide customers with shipment tracking, inventory visibility, and dynamic pricing can differentiate service levels in crowded markets. These capabilities will also make it easier to manage the increased complexity introduced by tariffs, as real-time data on stock positions and lead times becomes essential for maintaining customer service while controlling working capital.

Another critical recommendation is to integrate sustainability into product and marketing strategies in a substantive way. For producers, this may include evaluating low-carbon process routes for calcium formate, quantifying the emissions benefits of specific technologies, and communicating these metrics credibly to customers in construction, power generation, and heavy industry who are under pressure to demonstrate emissions reductions. For downstream formulators and distributors, it means understanding and articulating how calcium formate-based solutions can reduce corrosion, improve asset longevity, or enable more efficient flue gas cleaning and feed preservation, thereby supporting broader environmental and animal welfare goals.

Finally, industry leaders should institutionalize structured market intelligence and scenario planning. The pace of change in tariffs, regulations, and industrial energy prices requires a disciplined approach to monitoring external developments and translating them into actionable implications for sourcing, pricing, product development, and capital allocation. Regularly updated assessments that integrate trade data, regulatory trends, and competitive moves will allow organizations to pivot more quickly than rivals when new risks or opportunities emerge. By combining these strategic and operational actions, companies involved in calcium formate-whether as producers, distributors, or intensive users-can move from reactive adaptation to proactive shaping of their market environment.

Robust research methodology integrating primary intelligence, secondary validation, and expert review for a holistic view of calcium formate

The analysis underpinning this executive summary is grounded in a research methodology designed to combine breadth of coverage with depth of technical and commercial insight. At its core, the approach integrates multiple data streams into a coherent narrative that reflects both current market realities and plausible near-term developments. Primary intelligence from industry participants, including producers, distributors, and downstream users in construction, animal nutrition, leather processing, and industrial applications, provides context on purchasing behavior, specification preferences, and perceived pain points in areas such as tariffs, logistics, and regulatory compliance.

To validate and enrich these perspectives, the research draws on secondary sources from authoritative technical and regulatory bodies, as well as from company disclosures and specialized industry publications. Regulatory and scientific documents from European institutions and related agencies are used to characterize the safety and efficacy of calcium formate in animal feed, defining acceptable use levels, target species coverage, and environmental considerations. Technical literature and application notes are consulted to understand how calcium formate functions in cement and mortar systems, deicing formulations, flue gas desulfurization, and other industrial processes, providing a factual basis for statements about performance benefits and process integration.

Trade and shipment data, where available from customs-based analytics and commercial databases, are used to map flows of calcium formate between producing and consuming regions. These sources help identify key importer and exporter countries, the relative importance of particular corridors such as Asia-to-Americas and intra-Asian trade, and the degree of concentration among supplying nations. Parallel analysis of company-level information, including product portfolios, facility locations, and strategic announcements, informs the characterization of the competitive landscape and the identification of leading participants in both feed-grade and industrial-grade segments.

The tariff and trade-policy dimension is addressed through a combination of official announcements, policy analyses, and sector-specific commentary focused on chemicals. These sources are used to trace the timing, scope, and effective rates of tariffs affecting major trade relationships relevant to calcium formate, notably between the United States, China, and the European Union. Where possible, the analysis emphasizes structural effects-such as shifts in sourcing patterns, cost pass-through, and supply-chain redesign-rather than attempting to forecast exact pricing outcomes, in keeping with the qualitative nature of this summary.

Throughout the research process, cross-validation is a central principle. Insights derived from one class of sources are checked against others wherever possible, and apparent discrepancies are investigated to distinguish between genuine uncertainty and simple differences in scope or timing. The result is an evidence-based, triangulated view of the calcium formate market that aims to be both technically sound and commercially relevant, while avoiding unsupported speculation on market size, share, or long-term quantitative forecasts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Calcium Formate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Calcium Formate Market, by Form

- Calcium Formate Market, by Product Grade

- Calcium Formate Market, by Application

- Calcium Formate Market, by Sales Channel

- Calcium Formate Market, by Region

- Calcium Formate Market, by Group

- Calcium Formate Market, by Country

- United States Calcium Formate Market

- China Calcium Formate Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesis of emerging themes in calcium formate markets, from decarbonization to tariff resilience and end-use diversification

Taken together, the developments described in this executive summary point to a calcium formate market that is more strategically important, more technologically sophisticated, and more geopolitically exposed than in the past. On the demand side, the compound’s versatility across construction, feed, leather, deicing, and environmental applications ensures that it remains embedded in multiple value chains, each with its own drivers and sensitivities. The move away from chloride-based accelerators in reinforced concrete, the need for effective and safe feed preservatives and acidifiers, and the search for lower-impact deicing and flue gas treatment solutions all reinforce the relevance of calcium formate as a multifunctional additive.

On the supply and production side, advances in process technology and growing attention to decarbonization are reshaping how calcium formate is made and marketed. Routes that convert carbon monoxide-rich industrial off-gases into calcium formate, thereby reducing net carbon emissions and generating tradable carbon benefits, illustrate how this product can contribute to broader industrial sustainability agendas. At the same time, the integration of calcium formate production into wider formic acid and polyol value chains allows some producers to capture economies of scale and scope, supporting reliable supply of both industrial and feed-grade material to global customers.

The trading and policy environment has become a defining feature of the market’s outlook. The tariff measures introduced by the United States in 2025, and the associated responses and negotiations with key partners, have already altered sourcing decisions, contract structures, and inventory strategies for calcium formate buyers and sellers. These pressures are likely to persist, even if specific tariff levels change, given the underlying trend toward more politicized trade in chemicals and other strategic goods. In parallel, evolving regulations on feed additives, construction materials, and emissions control continue to raise the bar on product quality, documentation, and regulatory compliance.

From a strategic perspective, the key implication is that success in calcium formate markets will depend less on commodity-style cost competition and more on an integrated capability set that spans technical performance, regulatory fluency, supply-chain resilience, and customer-centric innovation. Producers, distributors, and major users that invest in this capability set-while continuously monitoring regional developments across the Americas, Europe, Middle East, Africa, and Asia-Pacific-will be best positioned to weather volatility and capitalize on growth pockets.

In conclusion, calcium formate can no longer be viewed as a simple derivative of formic acid or an interchangeable additive among many. It is a strategically important component in multiple industrial and agricultural systems that are themselves undergoing profound transformation. Organizations that recognize this and align their sourcing, R&D, and market strategies accordingly will not only safeguard current business but also open pathways to new products, services, and sustainability-driven value propositions in the years ahead.

Engage with Ketan Rohom to access actionable calcium formate intelligence and support data-driven purchasing and strategy decisions

Decision-makers evaluating strategic options in the calcium formate space are operating at a moment of unusual complexity and opportunity. Trade realignments, sustainability pledges, and shifting end-use technologies are all reshaping how this versatile additive is specified, sourced, and priced. In such an environment, having access to a structured, evidence-based view of the market is no longer a luxury; it is an operational necessity.

To translate this complexity into clear, actionable insight, it is essential to work with a partner who combines deep subject-matter expertise with a practical understanding of commercial realities. Ketan Rohom, Associate Director, Sales & Marketing, is uniquely positioned to bridge technical analysis with the decisions that govern procurement, product portfolio, and regional expansion. By engaging directly with him, stakeholders can move beyond generic commentary toward tailored intelligence that speaks to their specific supply chains, contract structures, and growth targets.

The full market research report on calcium formate provides a level of granularity that goes far beyond an executive summary. It dissects demand patterns by application, form, product grade, sales channel, and region, and it contextualizes those patterns within the current tariff environment and evolving environmental regulations. This enables procurement teams to renegotiate supply contracts with confidence, commercial leaders to prioritize the most resilient and profitable customer segments, and technical teams to benchmark their own formulations against best practices in construction, feed, leather, deicing, and industrial processes.

Prospective buyers can also expect structured scenario analysis around 2025 tariff trajectories, including sensitivity to different trade-policy outcomes and their implications for landed cost and margin stability. In parallel, the report highlights how regulatory developments in animal nutrition, construction standards, and emissions control are shaping the product specifications that will be accepted in key regional markets. Together, these elements form a practical roadmap for de-risking existing business while systematically identifying where incremental growth is most attainable.

To unlock this level of insight, the next step is straightforward. Initiate a discussion with Ketan Rohom to explore licensing options for the calcium formate market research report and to define any custom analytical add-ons that would best support your organization’s decision-making. Whether the priority is a focused cut on feed-grade adoption in Asia-Pacific, a deep dive on deicing formulations in the Americas, or a comparative assessment of regional sourcing strategies under various tariff scenarios, Ketan can help you structure a solution that aligns with both your budget and your strategic agenda.

By acting now, industry leaders can secure a decision advantage at a time when every contract renewal, plant investment, and product launch is influenced by fast-moving policy and technology shifts. The calcium formate report, combined with direct engagement with Ketan Rohom, offers a clear path to move from reactive adjustments to proactive, data-driven strategy in this critical specialty chemical segment.

- How big is the Calcium Formate Market?

- What is the Calcium Formate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?