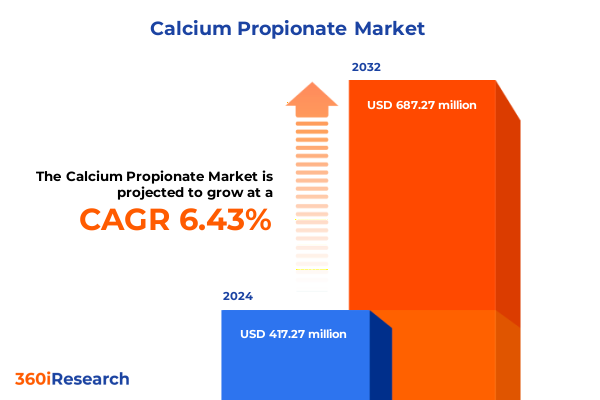

The Calcium Propionate Market size was estimated at USD 443.47 million in 2025 and expected to reach USD 472.39 million in 2026, at a CAGR of 6.45% to reach USD 687.27 million by 2032.

Unveiling the Critical Importance of Calcium Propionate in Enhancing Shelf Life and Safety Across Food Feed and Pharmaceutical Industries

Calcium propionate serves as a cornerstone preservative across food, feed, and pharmaceutical industries owing to its ability to inhibit mold and bacterial growth without compromising product integrity. Known chemically as the calcium salt of propionic acid, it is widely recognized under the E number E282 in food applications, particularly in baked goods, dairy products, and processed meats, where it extends shelf life by disrupting microbial metabolism and reproduction. This regulatory approval is underscored by its classification as “generally recognized as safe” (GRAS) by the U.S. Food and Drug Administration, as well as endorsement from the World Health Organization and European Food Safety Authority.

In recent years, calcium propionate has evolved from a simple mold inhibitor to a multifunctional additive that also addresses food safety, production efficiency, and waste reduction goals. Bakery operators, for instance, leverage its compatibility with yeast fermentation and pH stability to maintain product quality over extended distribution channels. Meanwhile, feed manufacturers deploy it to combat mold-related diseases in poultry and ruminants, enhancing livestock health and feed shelf life. Transitioning into pharmaceutical formulations, it finds application as a stabilizing agent in topical and oral dosage forms, illustrating its cross-sector versatility.

Exploring the Transformative Shifts Redefining the Calcium Propionate Landscape from Clean Label Trends to Global Supply Chain Innovations

Over the past five years, a confluence of consumer and industrial priorities has reshaped the calcium propionate landscape. Foremost among these is the rapid rise of clean-label and natural-positioned products, driving manufacturers to optimize preservative profiles and justify the inclusion of propionates in perceived healthier formulations. This shift has prompted ingredient producers to refine production methods, emphasizing traceability, reduced chemical footprints, and transparent sourcing practices.

Concurrently, the global chemicals sector has grappled with supply chain disruptions that accelerated digital transformation and supplier diversification initiatives. Event-driven logistic constraints, such as port congestion in Savannah and New York/New Jersey during early 2025, heightened operational risk for calcium propionate supply chains, compelling stakeholders to invest in advanced inventory management and real-time shipment tracking systems. As a result, collaborative platforms and agile procurement strategies have gained prominence, fostering greater resilience against future shocks.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Calcium Propionate Supply Chains Costs and Competitive Dynamics

The enactment of sweeping U.S. tariffs in early 2025 has introduced new cost pressures and strategic recalibrations in the calcium propionate market. A universal 10% tariff on all imported goods took effect on April 5, followed by targeted duties on major trading partners and a 30% levy on Chinese imports implemented mid-May. These measures have led to an average increase of 8–15% in landed costs for specialty chemicals, including calcium propionate, as tariffs are passed through alongside rising freight and insurance premiums.

Beyond direct financial impact, companies have been forced to adjust sourcing strategies by front-loading shipments, qualifying alternative suppliers in tariff-exempt jurisdictions, and reconfiguring supply networks to mitigate compliance burdens. Furthermore, export competitiveness of domestically produced calcium propionate is expected to face headwinds in Asia-Pacific markets due to reciprocal duties and evolving origin rules. Collectively, these dynamics are reshaping global flow patterns and redefining the balance between cost optimization and supply security.

Deriving Actionable Insights from Form Function Application and Sales Channel Segmentations to Optimize Calcium Propionate Strategies

A detailed segmentation of the calcium propionate market reveals nuanced performance across product forms, functions, applications, and sales channels. In terms of physical form, granular offerings-both coated and standard-continue to dominate applications requiring precise dosing, while concentrated and ready-to-use liquids gain traction in high-throughput industrial and feed operations. Powder variants, particularly fine powders, are favored for formulations where rapid dissolution and uniform dispersion are critical, such as in advanced pharmaceutical and functional food systems.

Functionally, feed preservative segments tailored for poultry and ruminants account for sustained demand in animal health, whereas food-grade propionates act as bacteriostatic agents and mold inhibitors that extend bakery and dairy product shelf life. Pharmaceutical-grade variants, designed for oral and topical formulations, are witnessing incremental uptake in nutraceutical and personal care segments due to stringent regulatory stewardship around preservative efficacy and safety.

When viewed through the lens of application, bakery ingredients-especially breads, cakes, and pastries-constitute the primary end-use, followed by confectionery and desserts with a focus on candies, chocolates, and frozen treats. Dairy applications such as cheese and cultured products leverage propionate’s moisture-stabilizing properties, while pet food manufacturers balance dry and wet formulations to prevent spoilage. Processed meats, ranging from hams and poultry products to sausages, continue to rely on calcium propionate to inhibit microbial growth without altering sensory attributes.

Finally, sales channels underscore the dual trajectories of direct manufacturer-to-feed and food producers seeking full specification support, contrasted with indirect pathways through distributors and retailers that provide broad market reach and inventory accessibility. This segmentation framework illuminates where targeted innovation and value-added services can unlock competitive advantage.

This comprehensive research report categorizes the Calcium Propionate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Function

- Application

- Sales Channel

Decoding Key Regional Dynamics in the Calcium Propionate Market across the Americas Europe Middle East Africa and Asia Pacific Regions

Regional market behavior for calcium propionate underscores varied growth drivers and regulatory landscapes. In the Americas, sustained consumption in North American bakery and feed sectors is driven by robust demand for shelf-stable products and stringent feed safety standards. This region has also absorbed recent price surges due to supply constraints and port congestion, resulting in operational strategies emphasizing localized warehousing and blended supply agreements.

In Europe, Middle East, and Africa, evolving clean-label mandates and food safety regulations have prompted manufacturers to examine propionate usage thresholds and labeling conventions. While European importers have navigated higher raw material costs, particularly in Germany, they continue to invest in process optimizations and ingredient consolidation to preserve margin structure and meet consumer transparency expectations.

Asia-Pacific remains the fastest-evolving region, with dynamic shifts in China’s production landscape influenced by seasonal weather events and currency valuations. These factors have periodically tightened local supply, compelling multinational players to establish regional blending and repackaging facilities to ensure continuity. Emerging markets across Southeast Asia are also amplifying demand through bakery, dairy, and pharmaceutical channels as food processing and healthcare infrastructure modernize.

This comprehensive research report examines key regions that drive the evolution of the Calcium Propionate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Moves and Competitive Differentiators Among Leading Calcium Propionate Producers and Suppliers Globally

The competitive landscape is marked by strategic initiatives among global and regional leaders. Kerry Group plc (Niacet Corporation) has invested in clean-label R&D to differentiate its propionate portfolio for premium bakery and dairy applications. Perstorp and Macco Organiques have expanded capacity through joint ventures and backward integration to secure high-purity feedstock supplies, reinforcing supply chain resilience in volatile markets.

Eastman Chemical Company and BASF SE are leveraging digital platforms to offer predictive supply analytics and batch-traceability solutions to key account customers, while A.M. Food Chemical Co. Ltd. and Calpro Specialities have emphasized local manufacturing footprints in India and China to cater to rapid-growth segments. Strategic partnerships between distributors such as Brenntag AG and ingredient specialists like Fine Organic Industries underscore the value of tailored distribution agreements and technical service support in unlocking new application segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Calcium Propionate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.M FOOD CHEMICAL CO., LIMITED

- AB Mauri (UK) Limited

- ADDCON GmbH

- Archer-Daniels-Midland Company

- Barentz

- BASF SE

- Cargill Incorporated

- Dow Chemical Company

- Dr. Paul Lohmann GmbH & Co. KGaA

- Eastman Chemical Company

- Evonik Industries AG

- Fine Organic Industries Limited

- Impextraco NV

- Kemin Industries, Inc

- Kemira Oyj

- Kerry Group plc

- Lallemand Inc

- Macco Organiques Inc

- Niacet BV

- Perstorp Holding AB

- Spectrum Chemical Manufacturing Corp

- Titan Biotech Ltd

- Univar Solutions Inc

Formulating Actionable Recommendations for Industry Leaders to Navigate Challenges and Leverage Opportunities in Calcium Propionate Markets

Industry leaders should prioritize end-to-end visibility across supply networks by integrating real-time tracking systems and advanced analytics to anticipate disruptions and optimize safety stocks. Leveraging tariff-exemption strategies, such as sourcing from USMCA-compliant providers and tariff-excluded chemical categories, can mitigate cost impacts and preserve margin integrity.

Manufacturers are also advised to deepen collaborations with key accounts on co-development projects that tailor formulations-such as ready-to-use liquid concentrates and fine powders-to specific process requirements. Investing in clean-label certification and transparent documentation will address evolving consumer preferences and regulatory expectations. Finally, diversifying sales channels by strengthening direct engagement with strategic feed and food producers, while maintaining robust indirect distributor partnerships, can broaden market access and reinforce supply reliability.

Detailing the Rigorous Research Methodology Employed to Ensure Data Integrity and Comprehensive Analysis in This Calcium Propionate Study

This analysis is grounded in a rigorous research methodology combining secondary data from regulatory bodies, trade associations, and industry reports with primary insights gathered from executive interviews across manufacturing, supply chain, and procurement functions. Quantitative data was validated through triangulation, cross-referencing import/export records, tariff schedules, and logistic performance metrics to ensure comprehensive coverage of market dynamics.

Qualitative perspectives were obtained through structured discussions with subject-matter experts, enabling the identification of emerging trends, competitive strategies, and regional variances. A systematic framework guided the synthesis of segmentation insights, tariff impact assessments, and regional analyses, ensuring that recommendations align with real-world operational constraints and growth objectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Calcium Propionate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Calcium Propionate Market, by Form

- Calcium Propionate Market, by Function

- Calcium Propionate Market, by Application

- Calcium Propionate Market, by Sales Channel

- Calcium Propionate Market, by Region

- Calcium Propionate Market, by Group

- Calcium Propionate Market, by Country

- United States Calcium Propionate Market

- China Calcium Propionate Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Concluding Insights on Market Evolution and Strategic Imperatives Highlighting Future Prospects for Calcium Propionate Applications

In conclusion, calcium propionate continues to command a pivotal role as a versatile preservative across diverse industry applications. The interplay between clean-label demands, supply chain resilience, and evolving trade policies underscores the importance of agile sourcing and strategic segmentation. Regional nuances in consumption patterns and regulatory frameworks highlight the need for tailored approaches in the Americas, Europe, Middle East, Africa, and Asia-Pacific.

Looking forward, success in the calcium propionate market will hinge on the ability of industry players to harmonize cost management, product innovation, and customer-centric service offerings. Companies that proactively adapt to tariff environments, co-develop specialized formulations, and leverage direct and indirect channels stand poised to capture incremental value and foster sustainable growth.

Take the Next Step in Securing Your Competitive Advantage by Engaging with Ketan Rohom to Acquire the Comprehensive Calcium Propionate Market Report Today

I invite you to partner directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure the in-depth calcium propionate report that will equip your organization with actionable intelligence and a competitive edge. This comprehensive study distills market dynamics, segmentation insights, tariff impacts, and regional analyses into a structured framework designed for executive decision-making. Engaging Ketan will ensure you receive customized support in interpreting the findings, exploring collaboration opportunities, and tailoring deployment strategies to your specific needs. With his guidance, you can rapidly integrate the report’s recommendations into your strategic planning and operational initiatives, positioning your company to thrive in an evolving market environment. Contact Ketan Rohom today to transform insight into impact and drive sustained growth in the calcium propionate sector.

- How big is the Calcium Propionate Market?

- What is the Calcium Propionate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?