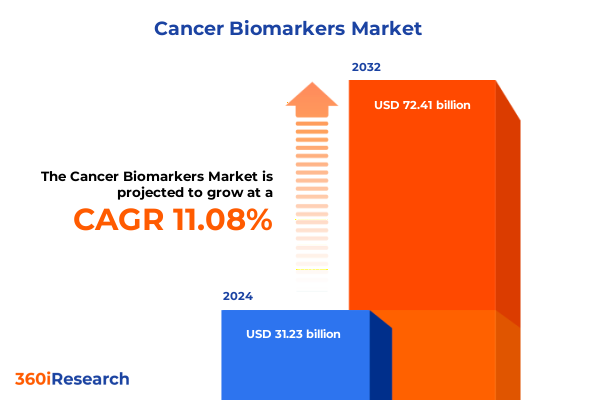

The Cancer Biomarkers Market size was estimated at USD 34.66 billion in 2025 and expected to reach USD 38.13 billion in 2026, at a CAGR of 11.09% to reach USD 72.41 billion by 2032.

Understanding the Critical Role of Cancer Biomarker Innovations in Advancing Precision Oncology and Supporting Targeted Therapeutic Strategies

Cancer biomarkers have emerged as pivotal tools in the era of precision oncology, enabling clinicians and researchers to detect, classify, and monitor malignancies with unprecedented accuracy. By illuminating the molecular and cellular underpinnings of tumor biology, biomarkers guide targeted therapeutic interventions, optimize patient stratification, and inform prognostic assessments. The convergence of expanding molecular insights and technological breakthroughs has redefined conventional diagnostic paradigms, replacing one-size-fits-all approaches with individualized treatment regimens that can significantly improve patient outcomes.

Amid intensifying global efforts to accelerate innovation, stakeholders across pharmaceutical, diagnostic, and academic sectors are channeling investments into next-generation biomarker platforms. The drive to harness genetic, proteomic, metabolic, and cellular indicators reflects a broader commitment to reduce time-to-diagnosis, enhance therapeutic precision, and lower overall healthcare costs. As the portfolio of clinically validated biomarkers grows, the integration of these tools into routine practice underscores a fundamental shift toward evidence-based, patient-centric care models that promise to transform cancer management at every stage.

Exploring Breakthrough Technological and Scientific Shifts Driving the Rapid Evolution and Adoption of Next Generation Cancer Biomarker Platforms

The landscape of cancer biomarker research has undergone a profound metamorphosis, fueled by breakthroughs in high-throughput sequencing and molecular profiling technologies. The advent of next-generation sequencing platforms has enabled comprehensive analyses of genomic alterations, leading to the identification of novel genetic biomarkers that inform targeted therapies. In parallel, advances in mass spectrometry and proteomic workflows have enabled the quantitative assessment of protein biomarkers, enriching our understanding of tumor heterogeneity and therapeutic resistance mechanisms.

Concurrently, the rise of liquid biopsy has redefined noninvasive monitoring paradigms, leveraging circulating tumor DNA, RNA fragments, and exosomes to provide real-time insights into tumor evolution. The recent FDA clearance of high-throughput liquid biopsy platforms underscores this shift, as these assays deliver rapid, actionable data that complement traditional tissue-based diagnostics. Moreover, the integration of artificial intelligence and machine learning algorithms into multi-omic data interpretation has accelerated biomarker discovery, uncovering subtle molecular patterns that eluded manual analysis. Taken together, these technological and scientific shifts have laid the groundwork for a new era of personalized oncology, where biomarker-driven decision making becomes the linchpin of therapeutic success.

Assessing the Broad Economic and Operational Consequences of Newly Enacted United States Tariff Measures on Cancer Biomarker Technology and Reagents

The cumulative impact of U.S. tariff measures enacted in 2025 has introduced significant economic and operational challenges for stakeholders in the cancer biomarker ecosystem. Following the conclusion of the four-year statutory review, Section 301 tariffs on a wide array of Chinese imports, including reagents, sequencer components, and laboratory consumables, have remained at rates ranging from 7.5% to 25%. In March 2025, the imposition of an additional 20% tariff under emergency powers expanded the scope of affected goods, encompassing certain high-throughput sequencing instruments and advanced mass spectrometry equipment. This layered tariff structure has elevated procurement costs, disrupted established supply chains, and compelled organizations to reassess sourcing strategies.

In response, the Office of the U.S. Trade Representative granted a three-month extension of select product exclusions through August 31, 2025, alleviating some short-term pressures on solar manufacturing and specialized laboratory tools. However, these limited reprieves fall short of offsetting broader cost inflation, underscoring the need for ongoing advocacy and strategic planning. Moreover, a landmark ruling by the U.S. Court of International Trade in May 2025 invalidated certain emergency tariffs imposed under the International Emergency Economic Powers Act, injecting uncertainty into tariff administration and heightening the potential for further legal challenges.

Consequently, biotechnology firms, diagnostic laboratories, and research institutions face a dual imperative: mitigate the financial burdens of imposed duties while maintaining continuity in assay development and clinical trials. This has prompted increased investment in domestic manufacturing, regional supply diversification, and long-term contracts with alternative vendors. Although these adaptations contribute to supply chain resilience, they also necessitate capital expenditures and extended lead times, reshaping operational priorities and influencing the pace of biomarker innovation.

Uncovering Key Insights from Comprehensive Market Segmentation Across Biomarker Types Technologies Applications End Users Cancer Types and Test Modalities

A granular examination of market segmentation reveals distinct growth trajectories and innovation imperatives across multiple dimensions. Biomarker type analysis highlights an accelerating shift toward genetic biomarkers, with DNA, RNA, and epigenetic indicators capturing the imagination of researchers pursuing tumor-specific signatures. Within this genetic subset, detailed studies of messenger RNA, microRNA, and long non-coding RNA are unlocking novel diagnostic and prognostic applications. Protein and metabolic biomarkers continue to play critical roles in mechanistic insights and therapeutic monitoring, while cellular markers enrich our understanding of tumor microenvironment interactions.

From a technological standpoint, established platforms like PCR and ELISA maintain their foundational status, yet next-generation sequencing and mass spectrometry have ascended as indispensable tools for comprehensive profiling. The emergence of hybrid approaches combining flow cytometry with multi-omic analytics further underscores the sector’s penchant for innovation. In parallel, application-driven segmentation delineates clear distinctions between companion diagnostics, prognostic assays, and predictive testing solutions, each addressing unique clinical needs. End users span academic research institutes, diagnostic laboratories, and contract research organizations, while hospitals and pharmaceutical entities leverage biomarker data to optimize clinical trial design and patient management. Finally, cancer type delineation-encompassing breast, lung, colorectal, ovarian, and prostate malignancies-and test modality classification between liquid and tissue biopsy frames the competitive landscape and underscores the tailored nature of biomarker deployment.

This comprehensive research report categorizes the Cancer Biomarkers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Biomarker Type

- Technology

- Cancer Type

- Test Type

- Application

- End User

Highlighting Regional Dynamics and Growth Opportunities in the Americas Europe Middle East Africa and Asia Pacific Cancer Biomarker Markets

Regional dynamics in the Americas underscore a robust innovation ecosystem anchored by leading clinical research hubs and favorable regulatory frameworks. The United States continues to drive product approvals and commercial rollouts, supported by a growing network of biotech incubators and federal grant programs. In Latin America, evolving healthcare infrastructure and rising cancer incidence are fueling demand for cost-effective diagnostics, stimulating partnerships that bring affordable biomarker testing to underserved populations.

Across Europe, Middle East, and Africa, diverse regulatory landscapes and healthcare funding models shape market adoption patterns. Western Europe’s established reimbursement pathways facilitate rapid uptake of novel companion diagnostics, while Middle East initiatives are prioritizing precision oncology centers to elevate regional care standards. In Africa, nascent diagnostic capabilities are driving collaborative efforts between global technology providers and local laboratories to create scalable testing solutions tailored to resource-limited settings.

Asia-Pacific presents a tapestry of opportunities driven by expansive populations, government-backed biotech funding, and surging R&D investments. China’s ambitious genomic medicine initiatives and Japan’s streamlined approval processes for in vitro diagnostics have positioned the region as a hotbed for cutting-edge biomarker research. Meanwhile, Southeast Asia’s growing private healthcare sector is forging alliances to introduce advanced liquid biopsy and NGS-based assays, fostering a dynamic environment where localized innovation meets global expertise.

This comprehensive research report examines key regions that drive the evolution of the Cancer Biomarkers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Key Competitive Landscapes and Strategic Movements by Leading Companies Shaping the Future of Cancer Biomarker Innovation

Leading companies are deploying a multifaceted strategy to consolidate their positions in the cancer biomarker market. Sequencing giants have accelerated partnerships with assay developers to co-create integrated NGS solutions, while diagnostic incumbents are enhancing their portfolios through targeted acquisitions. Partnerships between large-scale instrument manufacturers and specialty reagent suppliers have streamlined the delivery of end-to-end workflows, enabling customers to adopt robust biomarker platforms with greater confidence.

At the same time, biotechnology companies specializing in liquid biopsy and circulating tumor cell analysis are securing long-term collaborations with pharmaceutical firms, embedding their assays into clinical trials for novel therapeutics. The resulting co-development model not only expedites drug approval timelines but also anchors biomarker tests within emerging treatment paradigms. Strategic alliances between AI-driven analytics providers and established diagnostics players are reshaping data interpretation, empowering laboratories to extract deeper insights from complex multi-omic datasets.

Moreover, a wave of investment from private equity and venture capital funds is energizing early-stage innovators, particularly those advancing non-coding RNA biomarkers and metabolomic panels. By fostering ecosystem partnerships and securing milestone-based funding, these nimble entrants are poised to challenge incumbents, driving continuous improvement in assay sensitivity, specificity, and clinical utility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cancer Biomarkers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Caris Life Sciences

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd

- Foundation Medicine, Inc.

- Guardant Health, Inc.

- Hologic, Inc.

- Illumina, Inc.

- Myriad Genetics, Inc.

- Natera, Inc.

- NeoGenomics Laboratories, Inc.

- PerkinElmer, Inc.

- QIAGEN N.V.

- Quest Diagnostics Incorporated

- Siemens Healthineers AG

- SomaLogic, Inc.

- Thermo Fisher Scientific Inc.

Providing Actionable Strategies and Forward Looking Recommendations for Industry Leaders Seeking to Accelerate Growth and Resilience in Cancer Biomarker Markets

Industry leaders must prioritize supply chain resilience to navigate the uncertainties introduced by evolving tariff policies and geopolitical tensions. Establishing dual sourcing arrangements and strategic inventory reserves can buffer against sudden cost escalations, ensuring uninterrupted access to critical reagents and instruments. Simultaneously, forging partnerships with domestic manufacturers will not only mitigate import duties but also strengthen local capacity for high-precision assay production.

Moreover, aligning R&D roadmaps with emerging regulatory priorities will accelerate product approval pathways. Early engagement with regulatory agencies, participation in draft guidance consultations, and active involvement in standard-setting consortia can streamline submission processes for companion diagnostics and multi-omic assays. Investing in robust clinical validation studies that demonstrate real-world performance metrics will enhance payer receptivity and secure favorable reimbursement decisions.

To capitalize on the AI revolution, stakeholders should integrate advanced analytics platforms into biomarker discovery pipelines. Leveraging machine learning to mine large-scale genomic and proteomic datasets will uncover novel signatures and predictive models that traditional techniques may overlook. Collaborative data sharing networks, underpinned by strong governance frameworks, can amplify these efforts by broadening access to diverse patient cohorts and accelerating biomarker qualification.

Finally, cultivating cross-sector alliances among academia, biotech innovators, and pharmaceutical sponsors will foster translational research and expedite clinical implementation. By orchestrating multidisciplinary consortia and co-funded initiatives, organizations can catalyze the development of next-generation biomarker solutions that address unmet clinical needs and reinforce precision oncology’s promise.

Detailing the Rigorous Research Methodology Utilized to Ensure Comprehensive Data Integrity Validation and Analytical Rigor for Cancer Biomarker Insights

This research employed a rigorous mixed-methodology framework to capture comprehensive insights into the cancer biomarker domain. Primary research included in-depth interviews with leading oncologists, laboratory directors, and regulatory experts across North America, Europe, and Asia. These discussions elucidated unmet clinical needs, emerging technology adoption barriers, and evolving payer expectations.

Secondary research drew on a wide array of reputable sources, including scientific publications, clinical trial registries, regulatory filings, and patent databases. Data extraction and synthesis leveraged automated text mining tools, ensuring full coverage of the latest developments in biomarker discovery, validation studies, and market launches. Quantitative data were triangulated against historical benchmarks and comparable markets to validate emerging trends and estimate relative growth trajectories.

Analytical rigor was reinforced through a multi-stage validation process. Internal workshops brought together cross-functional teams to review preliminary findings and challenge underlying assumptions. Statistical sensitivity analyses assessed the robustness of key insights under varying scenarios, while peer reviews by independent experts provided critical feedback on methodological soundness and interpretive accuracy. Together, these measures guarantee the reliability and actionable nature of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cancer Biomarkers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cancer Biomarkers Market, by Biomarker Type

- Cancer Biomarkers Market, by Technology

- Cancer Biomarkers Market, by Cancer Type

- Cancer Biomarkers Market, by Test Type

- Cancer Biomarkers Market, by Application

- Cancer Biomarkers Market, by End User

- Cancer Biomarkers Market, by Region

- Cancer Biomarkers Market, by Group

- Cancer Biomarkers Market, by Country

- United States Cancer Biomarkers Market

- China Cancer Biomarkers Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Critical Conclusions on Market Dynamics Trends and Strategic Imperatives Shaping the Future Landscape of Cancer Biomarker Development

Bringing together multifaceted developments in technology, regulation, and market dynamics underscores the convergence of forces reshaping cancer biomarker innovation. The rapid ascent of next-generation sequencing and liquid biopsy platforms reflects a maturation of molecular diagnostics, while AI-driven analytics promises to unlock deeper layers of biological complexity. Simultaneously, the reverberations of U.S. tariff policies and evolving trade regulations have galvanized stakeholders to reimagine supply chains and domestic manufacturing strategies.

Segmentation analysis reveals that genetic biomarkers, particularly at the DNA and RNA levels, are driving the most significant advancements, with protein and metabolic indicators complementing these insights through functional assessment. The geographic lens highlights the Americas as a hub of groundbreaking research, EMEA as a leader in regulatory harmonization, and Asia-Pacific as a burgeoning center of biotech investment. Competitive dynamics are characterized by strategic alliances, M&A activity, and targeted funding mechanisms that fuel continuous innovation across both established and emerging players.

Collectively, these findings articulate a clear imperative for industry participants: invest in resilient supply chains, engage proactively with regulatory bodies, harness advanced analytics for discovery, and foster cross-sector collaborations. By embracing these strategic imperatives, organizations can navigate the complexities of the marketplace, accelerate the translation of biomarker research into clinical impact, and ultimately, improve patient outcomes across the cancer care continuum.

Initiating Your Journey Towards Accelerated Growth and Strategic Edge with an Expert Market Research Report from an Associate Director of Sales and Marketing

The transformative insights captured in this report represent only a glimpse of the strategic intelligence available to industry decision-makers poised to capitalize on the rapidly shifting dynamics of cancer biomarker innovation. Ketan Rohom, Associate Director of Sales & Marketing, is primed to guide you through a personalized exploration of the full research dossier, detailing in-depth analyses tailored to your unique priorities. Engaging with him will empower your organization to refine product pipelines, optimize partnerships, and align commercial strategies with emerging scientific horizons.

Reach out to Ketan Rohom to coordinate a confidential consultation that will equip your leadership teams with actionable intelligence, empowering you to anticipate market shifts, mitigate risk, and unlock new growth pathways. Seize this opportunity to invest in research that not only illuminates current trends but also charts a clear course toward sustained competitive advantage in the dynamic cancer biomarker landscape.

- How big is the Cancer Biomarkers Market?

- What is the Cancer Biomarkers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?