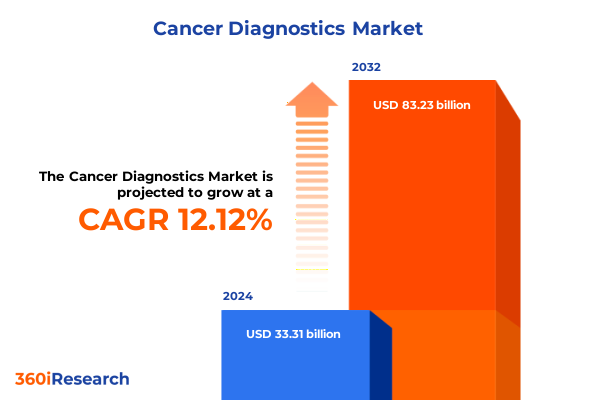

The Cancer Diagnostics Market size was estimated at USD 37.02 billion in 2025 and expected to reach USD 41.15 billion in 2026, at a CAGR of 12.26% to reach USD 83.23 billion by 2032.

Unveiling the Crucial Role of Advanced Diagnostics in Transforming Cancer Care Pathways and Elevating Patient Outcomes Across Global Healthcare Systems

Advancements in cancer diagnostics have transcended traditional boundaries, ushering in a new era where early detection, precision profiling, and personalized treatment pathways converge to redefine patient care. Over the past decade, breakthroughs in molecular assays, imaging modalities, and digital pathology have enabled clinicians to diagnose malignancies at earlier stages with unprecedented accuracy. This evolution reflects a broader shift toward proactive disease management, empowering physicians to tailor therapeutic strategies according to individual tumor biology and patient-specific risk factors.

Against this backdrop of rapid innovation, the competitive landscape in diagnostic oncology has intensified, driven by robust investment in research and development and strategic collaborations between technology providers, academic institutions, and healthcare systems. Novel liquid biopsy platforms are complementing conventional tissue-based analyses, while integration of artificial intelligence in image interpretation accelerates diagnostic workflows and enhances reproducibility. These transformative capabilities are not only improving clinical outcomes but also reshaping payer and regulatory frameworks, as stakeholders balance the need for cost containment with the promise of value-based care.

This executive summary distills critical insights into the current state of cancer diagnostics, examining key market drivers, technological shifts, and strategic imperatives. By articulating emerging trends and identifying areas of growth potential, our analysis seeks to guide decision-makers through a complex and rapidly evolving landscape, equipping them with the knowledge required to capitalize on innovation and optimize patient-centric solutions.

Exploring the Revolutionary Technological and Clinical Innovations Redefining the Cancer Diagnostics Landscape in the Modern Era

The cancer diagnostics landscape is undergoing a fundamental metamorphosis, driven by the convergence of cutting-edge technologies and evolving clinical paradigms. Digital pathology platforms now enable high-resolution whole-slide imaging with integrated AI algorithms that can detect nuanced morphological patterns, accelerating result turnaround and reducing diagnostic variability. Concurrently, liquid biopsy techniques leveraging circulating tumor DNA and exosomes offer noninvasive windows into tumor genomics, facilitating longitudinal monitoring of treatment response and early relapse detection without the need for repeat tissue biopsies.

Complementing these innovations, imaging modalities have advanced beyond anatomical assessment to incorporate functional and metabolic insights through hybrid PET/MRI systems and multiparameter MRI sequences. These enhancements provide richer diagnostic context, improving tumor characterization and guiding biopsy targeting. Simultaneously, immunohistochemistry and in situ hybridization assays have become increasingly multiplexed, allowing simultaneous visualization of multiple biomarkers and yielding deeper insights into tumor microenvironment dynamics.

Together, these transformative shifts not only bolster diagnostic precision but also enable seamless integration of companion diagnostics into therapeutic decision-making. As regulatory pathways evolve to accommodate these novel approaches, stakeholders must anticipate changes in reimbursement frameworks, laboratory accreditation standards, and data governance policies. This dynamic environment demands agility from manufacturers, laboratories, and healthcare providers, as they adapt to an era where diagnostics are inextricably linked to personalized oncology care.

Analyzing the Far-Reaching Implications of Newly Instituted US Tariffs on Cancer Diagnostic Imports and Domestic Market Dynamics

In 2025, the United States implemented revised import tariffs on certain categories of diagnostic reagents, instruments, and components classified under the harmonized system codes applicable to oncology testing. These measures, introduced as part of broader trade policy adjustments, have elevated duties on a range of laboratory devices and consumables, particularly those originating from key manufacturing hubs. The immediate effect has been an uptick in landed costs for diagnostic centers and research institutes, prompting procurement teams to reevaluate supplier contracts and inventory strategies.

As laboratories grapple with higher input expenses, a growing emphasis on supply chain diversification has emerged. Many institutions are pivoting towards domestic manufacturers to mitigate exposure to tariff-induced price volatility. At the same time, global diagnostics companies are assessing potential relocation of assembly operations to U.S. territories or exploring tariff engineering approaches to reclassify components and minimize duty burdens. This recalibration extends to reagent suppliers, which are negotiating volume-based agreements and exploring direct-to-lab distribution models to streamline logistics and contain costs.

These tariff-driven dynamics also influence innovation pipelines, as research and development budgets are reprioritized to favor diagnostic modalities with lower import dependency and greater scalability. Stakeholders must remain vigilant to evolving trade policies and potential future tariff adjustments, continuously optimizing procurement frameworks and strategic partnerships to safeguard diagnostic service continuity and ensure timely access to critical cancer detection technologies.

Deciphering Key Market Segmentation Insights to Illuminate Distinct Drivers Across Technologies, Cancer Types, and End Users

A nuanced exploration of market segmentation reveals distinct patterns across technology platforms, cancer types, and end users. Within technology, the landscape encompasses flow cytometry, including specialized modalities such as cell sorting and multiparameter analyses; imaging techniques spanning computed tomography, magnetic resonance imaging, positron emission tomography, and ultrasound; immunohistochemistry approaches in both chromogenic and fluorescent formats; in situ hybridization assays; and molecular diagnostics platforms, from microarrays and polymerase chain reaction assays to next-generation sequencing workflows. Each segment exhibits unique adoption drivers, regulatory considerations, and integration challenges.

Cancer type segmentation further delineates the market into hematological malignancies, such as leukemia, lymphoma, and multiple myeloma, and solid tumors including breast, colorectal, lung, and prostate cancers. Diagnostic requirements differ significantly between these categories, with liquid biopsies and flow cytometry playing pivotal roles in hematology, while imaging, histopathology, and molecular panels dominate solid tumor workflows.

End user segmentation highlights the varying needs of ambulatory care centers, diagnostic laboratories, hospitals, and research institutes, the latter encompassing both academic institutions and private research centers. Diagnostic laboratories seek high-throughput automation to manage large sample volumes, whereas hospitals prioritize integrated point-of-care systems to expedite clinical decision-making. In the research domain, flexibility and multiplexing capabilities are paramount to support exploratory studies and biomarker discovery initiatives. Understanding these nuanced segmentation insights is critical for stakeholders aiming to align product development and commercialization strategies with distinct market requirements.

This comprehensive research report categorizes the Cancer Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Cancer Type

- End User

Mapping Regional Dynamics to Highlight Unique Growth Drivers and Challenges Across the Americas, EMEA, and Asia-Pacific Markets

Regional analysis underscores the heterogeneity of the global cancer diagnostics market, shaped by varied healthcare infrastructures, regulatory landscapes, and reimbursement models. In the Americas, particularly the United States and Canada, established reimbursement pathways and high healthcare expenditure drive widespread adoption of advanced diagnostics. The mature environment fosters rapid integration of molecular assays and digital pathology solutions, supported by robust clinical guideline frameworks and payer incentives for value-based diagnostics.

Across Europe, the Middle East, and Africa, market dynamics diverge considerably. Western European nations benefit from standardized regulatory processes and government-backed screening programs, accelerating uptake of early detection technologies, while emerging markets in Eastern Europe and the Gulf region exhibit growing demand constrained by budgetary limitations and logistical challenges. In Africa, access gaps persist, with reliance on external funding and partnerships to introduce basic histopathology and immunohistochemistry services.

In Asia-Pacific, rapid economic growth and expanding healthcare access fuel significant investment in diagnostic infrastructure. Markets such as Japan and Australia demonstrate strong uptake of next-generation sequencing and AI-enabled imaging, whereas China and India invest heavily in local manufacturing to meet burgeoning domestic demand. Collaborative public–private initiatives are driving expansion of screening networks and decentralized testing models, positioning Asia-Pacific as a dynamic growth frontier in cancer diagnostics.

This comprehensive research report examines key regions that drive the evolution of the Cancer Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategic Moves and Innovations of Leading Industry Players Shaping the Future of Cancer Diagnostics Ecosystem

Leading industry players continue to shape the market through strategic mergers and acquisitions, portfolio expansions, and collaborative partnerships. Major diagnostics manufacturers are strengthening their molecular diagnostics and digital pathology offerings through targeted acquisitions of innovative biotech firms and software providers. Collaborative alliances between instrument makers and reagent suppliers enhance co-development of integrated diagnostic workflows, ensuring seamless interoperability and improved assay performance.

Some companies are channeling significant investment into artificial intelligence and machine learning applications, embedding advanced algorithms directly into scanner and software platforms to deliver real-time analytical insights. Others focus on geographic expansion, entering underserved markets via distribution agreements and local partnerships, while investing in manufacturing capacity to reduce lead times and improve supply reliability.

To maintain competitive advantage, these organizations prioritize regulatory excellence, securing timely approvals through adaptive clinical trial designs and real-world evidence generation. They also engage with key opinion leaders and professional societies to validate clinical utility and drive guideline inclusion. Collectively, these strategic initiatives underscore the paramount importance of agility and collaboration in navigating an increasingly complex and opportunity-rich cancer diagnostics ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cancer Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Canon Medical Systems Corporation

- Danaher Corporation

- Danaher Corporation

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd

- Fujifilm Corporation

- GE HealthCare Technologies Inc.

- Hologic, Inc.

- Illumina, Inc.

- Myriad Genetics, Inc.

- NeoGenomics Laboratories, Inc.

- PerkinElmer, Inc.

- QIAGEN N.V.

- Quest Diagnostics Incorporated

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Strategic Imperatives and Actionable Recommendations to Empower Industry Leaders in Navigating the Evolving Cancer Diagnostics Arena

Industry leaders should prioritize a proactive innovation agenda that integrates emerging technologies such as liquid biopsy and AI-driven image analytics into holistic diagnostic solutions. Collaboration with academic centers and oncology consortia will accelerate clinical validation and bolster payer confidence in novel assays. To navigate evolving tariff frameworks, organizations must develop robust supply chain contingency plans, including dual sourcing strategies and near-shoring of critical components, safeguarding continuity of diagnostics services.

Expanding access in emerging markets demands tailored commercial models that consider local regulatory pathways, reimbursement landscapes, and infrastructure constraints. Partnering with regional distributors and leveraging public–private initiatives can drive market penetration while addressing affordability and training needs. Internally, investing in digital platforms for data management and remote support services will streamline laboratory operations and enhance customer engagement.

Finally, embedding sustainability principles in manufacturing and packaging processes can bolster corporate responsibility credentials, aligning with global environmental and social governance expectations. By embracing these strategic imperatives, industry leaders will be well-positioned to capture new growth opportunities and deliver impactful diagnostic solutions that advance patient care.

Outlining a Rigorous Research Methodology Ensuring Comprehensive Market Insights Through Multi-Source Data Collection and Expert Validation

This report synthesizes insights drawn from a rigorous multi-phase research methodology. Primary research involved in-depth interviews with oncology thought leaders, laboratory directors, regulatory experts, and procurement specialists across key regions. These qualitative discussions provided firsthand perspectives on technology adoption barriers, clinical utility considerations, and market access strategies.

Secondary research leveraged authoritative sources, including peer-reviewed journals, clinical trial registries, regulatory filings, and industry white papers, to compile data on diagnostic platforms, biomarker validations, and competitive landscapes. Patent analysis and clinical pipeline tracking were conducted to identify emerging assay innovations and long-term development trends.

Data triangulation and validation processes were applied throughout, ensuring consistency across multiple information streams. Quantitative data were cross-verified against public market disclosures and financial reports to ensure accuracy. The final findings underwent internal expert review and were benchmarked against external advisory inputs to maintain methodological rigor and objectivity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cancer Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cancer Diagnostics Market, by Technology

- Cancer Diagnostics Market, by Cancer Type

- Cancer Diagnostics Market, by End User

- Cancer Diagnostics Market, by Region

- Cancer Diagnostics Market, by Group

- Cancer Diagnostics Market, by Country

- United States Cancer Diagnostics Market

- China Cancer Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Concluding Insights Emphasizing the Critical Role of Innovative Diagnostics in Advancing Cancer Care and Market Evolution

As the global healthcare community strives to improve cancer outcomes, diagnostics stand at the forefront of this mission. The convergence of advanced technologies, shifting trade policies, and evolving clinical practices creates a rich tapestry of opportunities and challenges. Precision assays, AI-enabled platforms, and decentralized testing models promise to elevate the standard of care, enhancing early detection rates and personalizing therapeutic interventions.

Yet, navigating this complex environment requires strategic foresight, operational agility, and deep market understanding. Stakeholders must continuously adapt to dynamic tariff landscapes, regional market nuances, and the accelerating pace of innovation. By aligning organizational objectives with technological advancements and adopting targeted market entry strategies, industry participants can drive meaningful impact and sustainable growth.

Ultimately, the future of cancer diagnostics will be defined by collaboration-across borders, disciplines, and sectors-to ensure timely, equitable access to life-saving diagnostic tools. Armed with the insights and recommendations outlined herein, decision-makers are equipped to steer their organizations toward a more precise, efficient, and patient-centered diagnostic ecosystem.

Connect with Ketan Rohom to Acquire the Detailed Market Research Report and Gain a Competitive Edge in Cancer Diagnostics

To unlock a deeper understanding of prevailing market trends, key competitive dynamics, and emerging opportunities in cancer diagnostics, we invite you to reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive expertise in guiding healthcare stakeholders through complex strategic decisions, ensuring access to precise, data-driven insights. Engaging with him will provide you with detailed methodologies, segmentation analyses, and actionable recommendations tailored to your organizational needs. Secure your comprehensive market research report today and equip your leadership with the intelligence required to navigate an ever-evolving cancer diagnostics landscape with confidence and clarity

- How big is the Cancer Diagnostics Market?

- What is the Cancer Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?