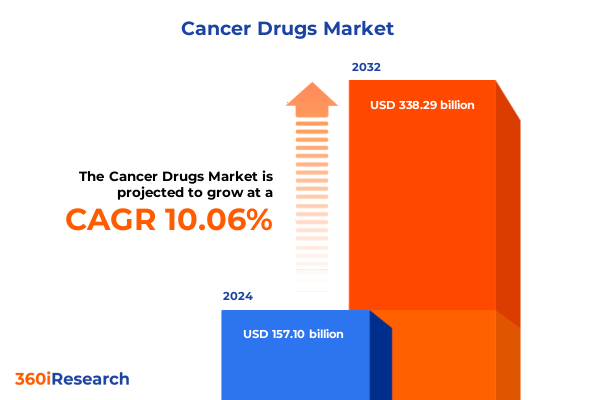

The Cancer Drugs Market size was estimated at USD 172.06 billion in 2025 and expected to reach USD 188.72 billion in 2026, at a CAGR of 10.13% to reach USD 338.29 billion by 2032.

Unveiling the Dynamic Evolution of Cancer Therapeutics Amidst Rapid Technological Advances and Shifting Patient-Centric Care Paradigms

Over the past decade, the oncology drug landscape has undergone a profound transformation driven by advances in molecular biology, genomics, and bioengineering. Researchers and pharmaceutical companies have leveraged high-throughput screening, next-generation sequencing, and computational modelling to identify novel targets and accelerate preclinical validation. Moreover, the maturation of immuno-oncology platforms has ushered in a new era of therapies that harness the body’s immune system, challenging traditional cytotoxic approaches. These scientific breakthroughs have been complemented by an increasingly collaborative ecosystem in which academia, biotech startups, and large biopharma entities share data and co-develop early-stage assets.

Simultaneously, the regulatory environment has evolved to accommodate innovative therapeutic classes while ensuring patient safety. Expedited approval pathways, adaptive trial designs, and real-world evidence have become integral to the development lifecycle, enabling faster access for patients with high unmet needs. In parallel, payers and health authorities are implementing outcome-based agreements to align pricing with clinical benefit, reshaping value assessment frameworks across major markets. These dynamics have introduced both unprecedented opportunities and complex challenges for stakeholders striving to bring the next generation of oncology treatments to market.

As treatment paradigms continue to shift toward precision and personalization, a patient-centric ethos has taken center stage. Patient advocacy groups and digital health platforms are increasingly influencing trial design, endpoint selection, and post-marketing surveillance. Meanwhile, healthcare providers are adapting care pathways to integrate oral therapies, combination regimens, and home-based administration models. In this context, strategic agility, data-driven decision-making, and stakeholder engagement emerge as critical success factors.

In recent years, global consortia and open innovation platforms have also emerged as vital enablers, promoting data sharing across academic institutions, startups, and industry stakeholders. By consolidating insights from preclinical models and real-world treatment outcomes, collaborative networks are accelerating the translation of early-stage discoveries into clinically viable oncology therapies.

Transformative Shifts Revolutionizing Oncology Drug Development Through Precision Medicine Innovations and Revolutionary Immunotherapeutic Breakthroughs

Precision medicine has emerged as a cornerstone of contemporary oncology drug development, fundamentally altering the way novel treatments are designed and delivered. Through detailed genomic profiling and biomarker-driven stratification, therapies that were once conceived for broad patient populations can now be tailored to molecularly defined subgroups. Tyrosine kinase inhibitors and monoclonal antibodies that selectively inhibit oncogenic drivers exemplify this paradigm, delivering improved efficacy and safety profiles relative to traditional cytotoxic regimens. Furthermore, the integration of companion diagnostics into the development framework has become a strategic imperative, facilitating patient selection and optimizing clinical outcomes.

Concurrently, immunotherapeutic approaches are redefining the treatment landscape by mobilizing the host immune response against malignant cells. Checkpoint inhibitors targeting PD-1, PD-L1, and CTLA-4 pathways have achieved durable remissions in several tumor types, while cell-based therapies such as CAR T-cells continue to expand their footprint beyond hematologic malignancies. Recent innovations include bispecific antibodies and oncolytic viruses, which are engineered to recruit immune effector mechanisms with increased precision. These modalities are frequently evaluated in combination regimens to overcome resistance and potentiate synergistic effects, underscoring the shift toward multifaceted therapeutic strategies.

In addition, the digital revolution is accelerating translational research and clinical development. Artificial intelligence algorithms and machine learning models are being applied to preclinical compound screening, safety assessment, and predictive modeling of patient response. Real-world evidence derived from electronic health records and patient-generated data is informing regulatory submissions and value-based contracting. Meanwhile, decentralized trial designs leveraging telemedicine, wearable sensors, and remote monitoring are streamlining patient participation and reducing operational complexity.

Emerging efforts in personalized cancer vaccines targeting patient-specific neoantigens are under investigation, representing a novel frontier in immuno-oncology. Although challenges persist related to manufacturing complexity and off-target immune responses, early clinical data highlight the potential for bespoke vaccines to complement existing checkpoint inhibitor regimens, further expanding the therapeutic arsenal.

Assessing the Comprehensive Consequences of Newly Implemented United States Tariffs on Oncology Drug Supply Chains and Global Pricing Dynamics

Recent adjustments to United States tariff policy have introduced significant headwinds for oncology drug manufacturers that rely on complex international supply chains. The imposition of higher duties on key pharmaceutical raw materials and intermediates has increased input costs, particularly for active pharmaceutical ingredients sourced from established manufacturing hubs in Asia and Europe. These changes have prompted companies to reassess procurement strategies, renegotiate supplier agreements, and explore nearshoring options to mitigate exposure to fluctuating duties.

Consequently, the elevated tariff burden has exerted upward pressure on production expenses, necessitating strategic inventory management and cost optimization across the value chain. Manufacturers are increasingly considering vertical integration or strategic alliances with contract development and manufacturing organizations that maintain domestic or tariff-exempt facilities. At the same time, some firms have accelerated investments in localized bioprocessing capabilities to preserve supply continuity and reduce vulnerability to trade policy shifts. Such adjustments have required capital deployment into facility upgrades and workforce training, reflecting a broader trend toward manufacturing resilience.

Looking ahead, the cumulative impact of the 2025 tariff framework is likely to influence pricing negotiations with payers, as sponsors seek to balance margin protection with patient access mandates. In response, companies are exploring innovative contracting models, including performance-based arrangements, to align reimbursements with therapeutic value. Additionally, multinational firms may leverage dual sourcing strategies and digital supply chain monitoring to optimize inventory flows and dynamically respond to policy changes. These adaptive measures underscore the strategic importance of supply chain agility in the evolving oncology drug market.

Illuminating Critical Segmentation Dimensions That Illuminate Diverse Oncology Therapeutic Modalities and Patient Care Pathways

Segmentation by drug type reveals the nuanced therapeutic preferences and development priorities within the oncology market. Traditional cytotoxic regimens encompass alkylating agents that disrupt DNA replication, antimetabolites that inhibit key enzymatic pathways, and antitumor antibiotics that interfere with cellular division. Hormone therapies continue to play an essential role for hormone-sensitive malignancies, while immunotherapy modalities engage the host immune system to target malignant cells with greater specificity. The advent of targeted therapy has ushered in a new class of apoptosis-inducing drugs and monoclonal antibodies designed to bind precisely to tumor-associated antigens, alongside small-molecule tyrosine kinase inhibitors that intercept aberrant signaling cascades.

When analyzed by administration route and therapy type, the market exhibits diverse delivery models and regimen complexities that influence patient adherence and healthcare resource utilization. Intravenous infusions remain a mainstay for high-potency injectables, whereas oral formulations empower patients with self-administration options and the potential for outpatient care. Subcutaneous and intramuscular injections offer alternative delivery mechanisms that can reduce infusion center burden and streamline dosing schedules. In addition, combination therapy regimens that pair two or more agents are evaluated against monotherapy options to enhance efficacy, overcome resistance, and target multiple pathways, thereby introducing additional considerations for trial design and safety monitoring.

Further segmentation analysis by cancer type, end user, and distribution channel highlights divergent market dynamics and adoption patterns. Breast, colorectal, liver, lung, pancreatic, and prostate cancers each present unique clinical profiles, biomarker landscapes, and treatment guidelines that inform pipeline prioritization and commercialization strategies. The end user environment extends from hospitals and clinics, where inpatient infusion capacity and oncology specialists concentrate, to ambulatory care centers that facilitate outpatient procedures and home healthcare settings that support oral and self-injectable therapies. Distribution channels divide between hospital pharmacies, which supply high-cost biologics and specialty medications, and retail pharmacies that dispense oral regimens, necessitating tailored distribution logistics and patient support services.

Cross-segmentation analyses reveal that certain therapeutic modalities align more closely with specific administration routes and care settings, informing portfolio prioritization. For instance, targeted oral TKIs may exhibit stronger uptake in home healthcare environments, whereas complex combination regimens rely on hospital infrastructure, highlighting the strategic value of integrated segmentation frameworks.

This comprehensive research report categorizes the Cancer Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Type

- Administration Route

- Therapy Type

- Cancer Type

- End User

- Distribution Channel

Exploring Regional Variations and Growth Drivers Shaping Oncology Therapeutics Across the Americas, Europe Middle East Africa, and Asia-Pacific Landscapes

Within the Americas region, the United States maintains a dominant position driven by a robust biotechnology ecosystem, well-established regulatory pathways, and significant R&D investment. Access to cutting-edge therapies is facilitated by accelerated approval mechanisms and proactive payer engagement models, although pricing pressures and reimbursement negotiations remain ongoing challenges. Meanwhile, Canada’s centralized healthcare system prioritizes cost-effectiveness evaluations and formulary management, often resulting in extended assessment timelines. In Latin America, market expansion is constrained by heterogeneous regulatory environments, limited infrastructure, and variable patient access, yet the growing prevalence of cancer and expanding public-private partnerships are gradually creating new opportunities for market entry.

Across Europe, the Middle East, and Africa, the oncology segment is characterized by market fragmentation and diverse reimbursement policies. Western European markets benefit from established health technology assessment frameworks and collaborative clinical networks, fostering rapid uptake of novel agents. In contrast, Eastern European countries may experience longer approval cycles and budgetary constraints that delay patient access. Within the Middle East and Africa, regulatory modernization initiatives and strategic partnerships are accelerating the introduction of advanced therapies, albeit against a backdrop of resource limitations and infrastructure development requirements. These regional disparities necessitate customized market entry and commercialization strategies to address localized hurdles.

The Asia-Pacific landscape encompasses mature markets such as Japan, where strong regulatory alignment with global standards expedites drug launches, alongside high-growth emerging economies including China, India, and Southeast Asia. Regulatory reforms in China have significantly reduced approval timelines and expanded domestic manufacturing capacity. Japan’s nationwide cancer control plans and reimbursement policies support the adoption of next-generation treatments, while emerging markets in the region exhibit growing demand for cost-effective generics and biosimilars. As healthcare systems in Asia-Pacific invest in oncology infrastructure and digital health solutions, the region is poised to contribute substantially to global oncology innovation.

Digital health solutions and telemedicine platforms are gaining traction across all regions, enabling remote monitoring and virtual consultations that address access barriers. By facilitating patient engagement and data capture, these technologies are enhancing clinical fidelity and paving the way for decentralized care models that adapt to local healthcare landscapes.

This comprehensive research report examines key regions that drive the evolution of the Cancer Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Pharmaceutical Innovators and Emerging Biotech Entrants Driving Competitive Dynamics in the Oncology Drug Sector

Innovator pharmaceutical companies continue to define the competitive contours of the oncology landscape through robust R&D investments and expansive product portfolios. Established players have leveraged decades of expertise to bring a diverse array of therapies to market, ranging from small-molecule kinase inhibitors to complex biologics targeting the immune system. These incumbents maintain ongoing phase II and III programs across multiple indications, positioning themselves to sustain leadership as key patents expire. At the same time, they are enhancing commercial capabilities and leveraging global footprint advantages to optimize launch performance across major markets.

Emerging biotechnology firms and specialty developers have injected fresh momentum into the sector by advancing novel mechanisms of action and innovative delivery technologies. These smaller entities often partner with large pharmaceutical companies to access development expertise, regulatory guidance, and commercial infrastructure. Strategic alliances have become a critical pathway for translating early-stage science into late-stage development, with landmark licensing agreements and co-development collaborations underscoring the value of shared risk and complementary strengths. Such partnerships enable rapid portfolio expansion and facilitate access to previously untapped modalities.

Mergers and acquisitions remain a pivotal growth lever, as companies seek to bolster their pipeline, diversify risk, and gain entry into adjacent markets. Recent transactions have focused on acquiring rights to promising clinical assets in immuno-oncology, targeted therapies, and next-generation antibody platforms. Concurrently, leading firms are forging data-sharing initiatives and technology alliances to harness real-world evidence, artificial intelligence, and digital biomarkers. By integrating these capabilities, industry participants aim to accelerate drug discovery, optimize clinical trial design, and deliver differentiated value propositions to patients and payers alike.

Collaborative initiatives between regulatory agencies and industry consortia are streamlining approval processes, leveraging harmonized guidelines and expedited review pathways. Incentives for orphan drug designations and breakthrough therapy classifications continue to encourage investment in niche indications, underscoring the evolving policy environment’s role in shaping competitive dynamics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cancer Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- Astellas Pharma Inc

- AstraZeneca PLC

- Bayer AG

- BeiGene, Ltd.

- Bristol‑Myers Squibb Company

- Daiichi Sankyo Company, Limited

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Fresenius Kabi AG

- Getwell Oncology Pvt Ltd

- GlaxoSmithKline plc

- Incyte Corporation

- Kite Pharma, Inc by Gilead Company

- Medivir AB

- Merck & Co., Inc.

- Nammi Therapeutics, Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Taiho Pharmaceutical Co., Ltd. by Otsuka Holdings Co., Ltd.

- Takeda Pharmaceutical Company Limited

Strategic Imperatives and Tactical Recommendations for Industry Leaders to Navigate Oncology Market Disruptions and Capitalize on Emerging Opportunities

Industry leaders should prioritize the development of precision oncology platforms by deepening engagements with genomic profiling services and companion diagnostic developers. By integrating molecular insights early in the pipeline, organizations can improve clinical trial success rates and deliver therapies with stronger benefit-risk profiles. Focused investment in biomarker-driven research and adaptive trial methodologies will also enable more efficient resource allocation across high-potential indications.

In parallel, companies must bolster supply chain resilience to navigate evolving trade policies and mitigate tariff-related cost pressures. Implementing dual sourcing strategies, pursuing nearshoring opportunities, and fostering strategic alliances with contract manufacturing partners are essential steps to ensure continuity of supply. Incorporating digital supply chain monitoring tools will provide real-time visibility and analytics, empowering proactive decision-making in response to policy shifts or logistical disruptions.

Furthermore, forging cross-sector collaborations with technology providers and patient advocacy groups can enhance market access and patient engagement. Adopting decentralized clinical trial designs and telehealth integrations will expand trial reach, reduce patient burden, and accelerate data collection. Embracing outcome-based contracting models and value-based pricing agreements will align stakeholder incentives, fostering sustainable reimbursement frameworks that support continued innovation in cancer therapeutics.

Comprehensive Research Approach Employing Rigorous Data Triangulation, Expert Consultations, and Systematic Analytical Frameworks in Oncology Market Analysis

The research methodology underpinning this analysis combines extensive primary and secondary research to deliver a holistic view of the oncology drug sector. Secondary research encompassed a thorough review of scientific literature, regulatory filings, and corporate disclosures to establish a foundational understanding of therapeutic modalities, clinical guidelines, and market structure. These insights informed the development of segmentation frameworks and guided the selection of key value chain participants for further investigation.

Primary research involved in-depth interviews with oncology specialists, biopharmaceutical executives, regulatory affairs experts, and supply chain managers. These discussions provided qualitative perspectives on emerging trends, unmet needs, and strategic priorities across different stakeholder groups. Insights gleaned from subject matter experts enriched the analysis by validating assumptions, identifying best practices, and uncovering nuanced factors influencing pipeline prioritization and commercialization strategies.

To ensure analytical rigor, data triangulation techniques were employed, correlating findings from multiple sources to derive robust conclusions. Quantitative data from clinical trial registries, patent databases, and public financial reports were cross-referenced with qualitative inputs to assess therapeutic performance, competitive positioning, and supply chain resilience. Systematic frameworks and structured validation processes were applied throughout to uphold the integrity and reliability of the research findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cancer Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cancer Drugs Market, by Drug Type

- Cancer Drugs Market, by Administration Route

- Cancer Drugs Market, by Therapy Type

- Cancer Drugs Market, by Cancer Type

- Cancer Drugs Market, by End User

- Cancer Drugs Market, by Distribution Channel

- Cancer Drugs Market, by Region

- Cancer Drugs Market, by Group

- Cancer Drugs Market, by Country

- United States Cancer Drugs Market

- China Cancer Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Core Insights to Outline Future Directions and Strategic Imperatives within the Rapidly Evolving Oncology Therapeutics Landscape

This executive summary has synthesized the most salient developments shaping the oncology drug market, from transformative advances in precision medicine and immunotherapy to the nuanced effects of newly imposed trade policies. By examining segmentation dimensions across therapeutic classes, delivery models, and patient care settings, the analysis has illuminated the diverse factors driving innovation and adoption. Regional insights reveal the interplay between regulatory frameworks, healthcare infrastructure, and reimbursement dynamics, underscoring the importance of tailored strategies for each geography.

Looking forward, industry participants must remain agile in responding to an increasingly complex ecosystem characterized by rapid scientific progress, evolving policy landscapes, and heightened stakeholder expectations. Leveraging data-driven decision-making, forging strategic partnerships, and investing in supply chain resilience will be critical to sustaining competitive advantage. Ultimately, the ability to align technological potential with patient-centric value propositions will determine success in the dynamic field of cancer therapeutics.

Unlock In-Depth Oncology Market Intelligence and Propel Your Strategic Growth with Tailored Insights from Associate Director Sales & Marketing

To access the comprehensive oncology market research report and unlock in-depth analysis of therapeutic trends, regulatory impacts, segmentation insights, and strategic imperatives, reach out to Ketan Rohom, Associate Director of Sales & Marketing. This exclusive report empowers decision-makers with the intelligence necessary to navigate evolving trade policies, optimize product portfolios, and capitalize on emerging opportunities across global regions. Secure your copy today to inform R&D prioritization, refine commercialization strategies, and drive sustainable growth in the rapidly transforming cancer drugs market.

- How big is the Cancer Drugs Market?

- What is the Cancer Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?