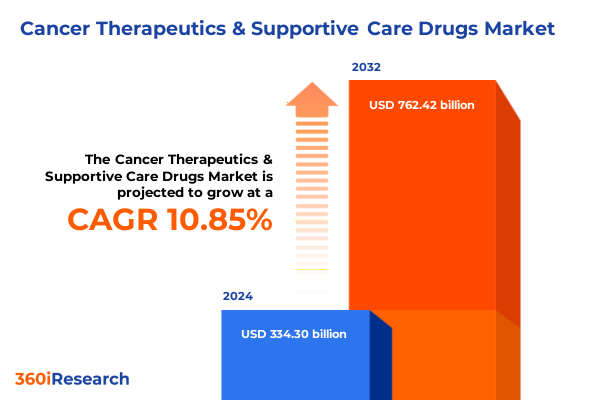

The Cancer Therapeutics & Supportive Care Drugs Market size was estimated at USD 371.38 billion in 2025 and expected to reach USD 408.20 billion in 2026, at a CAGR of 10.82% to reach USD 762.42 billion by 2032.

Setting the Stage for Groundbreaking Developments in Cancer Therapeutics and Comprehensive Supportive Care through an Informed Executive Overview

The dynamic interplay between innovative therapeutic modalities and comprehensive supportive care solutions underscores a transformative era in oncology, as groundbreaking science converges with patient-centric approaches to improve outcomes. Rising incidence across diverse geographies, coupled with an increasing emphasis on quality of life during treatment, has propelled oncology into a realm where therapeutic efficacy and supportive interventions are evaluated in tandem. This convergence demands a holistic understanding of both the mechanisms that target malignancies and the interventions that mitigate treatment-related adverse effects.

Against this backdrop, this executive summary presents a synthesized overview designed to equip industry stakeholders, healthcare decision-makers, and investment professionals with critical insights. By illuminating recent paradigm shifts, examining policy implications, and dissecting granular segmentation and regional dynamics, the following analysis offers a strategic compass for navigating the complex oncology landscape. Readers will gain clarity on regulatory drivers, supply chain considerations, and competitive positioning, thereby enabling informed decisions that align with both patient needs and market realities.

Unveiling the Transformative Shifts Revolutionizing the Cancer Therapeutics and Supportive Care Landscape in the Modern Era

In recent years, cancer research has witnessed profound transformative shifts fueled by advances in molecular biology, bioengineering, and digital health. Immunotherapies have emerged from experimental phases to become front-line interventions, with checkpoint inhibitors and cell-based therapies redefining response expectations. Concurrently, novel antibody drug conjugates and small molecule inhibitors have expanded the therapeutic arsenal, targeting tumor biology with increasing precision. At the same time, supportive care has evolved beyond reactive symptom management to proactive maintenance of patient wellbeing, leveraging antiemetics, hematopoietic growth factors, and personalized pain management strategies to sustain treatment adherence and improve quality of life.

Moreover, the integration of precision medicine platforms, real-world evidence analytics, and telehealth initiatives has enabled more seamless coordination between oncologists, pharmacists, and care support teams. Consequently, treatment pathways can be tailored not only to tumor genomics but also to patient-specific risk profiles, comorbidities, and psychosocial factors. As a result, the oncology ecosystem is transitioning into a patient-centric model that balances aggressive disease targeting with nuanced supportive protocols, thus forging a new paradigm in which therapeutic success and comprehensive care are equally prioritized.

Assessing the Cumulative Impact of 2025 United States Tariff Regulations on Cancer Drug Production, Distribution, and Access Dynamics

Assessing the impact of the United States tariff regulations enacted in 2025 reveals a multifaceted influence on cancer drug production, distribution, and affordability. Elevated duties on imported active pharmaceutical ingredients have incentivized manufacturers to reevaluate supply chain architectures, prompting shifts toward domestic synthesis and strategic partnerships with local API producers. These adjustments aim to mitigate cost pressures and buffer against cross-border logistical complexities, yet they also introduce transitional expenses associated with facility expansion and raw material qualification.

Furthermore, distributors and specialty pharmacies are recalibrating procurement strategies, opting for diversified supplier networks to ensure consistent availability of both therapeutics and supportive care products. Payers and providers, in turn, face mounting pressure to reconcile premium pricing with reimbursement frameworks, thereby influencing formulary decisions and patient access programs. In this context, industry players must navigate an evolving policy landscape where tariff-induced cost fluctuations can significantly sway competitive positioning and long-term investment priorities.

Illuminating Key Segmentation Insights across Drug Type Variations, Administration Routes, Mechanisms of Action, Indications, and Distribution Channels

A comprehensive segmentation analysis reveals the nuanced contours of the oncology therapeutics and supportive care market. Based on drug type, the market study distinguishes between supportive care agents and therapeutic modalities, with the former encompassing analgesics, antiemetics, erythropoiesis stimulating agents, and hematopoietic growth factors, and the latter comprising antibody drug conjugates, cytotoxic chemotherapies, hormonal agents, monoclonal antibodies, and small molecule inhibitors. This dual framework underscores the interdependence of symptom management and direct anticancer interventions in holistic treatment strategies.

In addition, route of administration segmentation evaluates the clinical and logistical implications of intramuscular, intravenous, oral, and subcutaneous delivery methods, illuminating preferences that balance patient convenience, pharmacokinetics, and administration costs. Mechanism of action insights further refine this picture by examining checkpoint inhibitors, immunomodulators, monoclonal antibodies, proteasome inhibitors, and tyrosine kinase inhibitors, each representing distinct molecular pathways and therapeutic paradigms. Reflecting disease heterogeneity, the study also segments by indication across breast cancer, colorectal cancer, leukemia, lung cancer, and lymphoma, highlighting where clinical need and research focus converge. Finally, distribution channel analysis considers hospital pharmacies, online pharmacies, retail pharmacies, and specialty pharmacies, capturing the evolving dynamics of drug dispensing, patient engagement, and channel optimization.

This comprehensive research report categorizes the Cancer Therapeutics & Supportive Care Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Type

- Route Of Administration

- Mechanism Of Action

- Indication

- Distribution Channel

Examining Critical Regional Dynamics Shaping Cancer Therapeutics and Supportive Care Markets across the Americas, Europe Middle East and Africa, and Asia-Pacific Territories

Regional dynamics play a pivotal role in shaping oncology markets, with the Americas leading in mature infrastructure, robust R&D investment, and comprehensive reimbursement ecosystems. The United States, in particular, drives the adoption of advanced biologics and precision therapies, supported by well-established patient support programs and integrated healthcare networks. In contrast, Latin American countries are gradually expanding access through public-private partnerships and localized manufacturing initiatives, reflecting a strategic emphasis on cost containment and wider treatment availability.

Europe, the Middle East, and Africa exhibit divergent regulatory pathways and market maturities, where the European Union’s centralized approval processes contrast with the fragmented landscapes of several emerging markets. Reimbursement frameworks in Western Europe frequently encourage early adoption of breakthrough therapies, while certain Middle Eastern and North African markets prioritize affordability through tender-based procurement. Over in Asia-Pacific, rapid growth is driven by expanding healthcare infrastructure, rising cancer incidence, and increasing payer collaboration. Countries such as Japan and South Korea spearhead innovation through strong government support, whereas Southeast Asian markets focus on scaling manufacturing capacity and forging strategic alliances with global players.

This comprehensive research report examines key regions that drive the evolution of the Cancer Therapeutics & Supportive Care Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategies and Portfolios of Leading Industry Players Driving Innovation in Cancer Therapeutics and Supportive Care Solutions Worldwide

Leading pharmaceutical and biotech firms are actively leveraging R&D pipelines, strategic collaborations, and targeted acquisitions to cement their positions in oncology. Key players have diversified portfolios that integrate next-generation immunotherapies alongside established cytotoxic and supportive care offerings. By pursuing alliances with academic research centers and biotechnology innovator companies, these industry leaders expedite clinical development and broaden indication scopes.

In parallel, several companies are enhancing patient support ecosystems through digital platforms that streamline therapy adherence, symptom monitoring, and financial assistance. This dual focus on innovation and support services fosters deeper engagement across stakeholder groups, from payers and providers to patients and caregivers. Moreover, competitive differentiation is increasingly driven by capabilities in real-world data generation and predictive analytics, enabling companies to demonstrate value, optimize trial designs, and secure favorable pricing and reimbursement terms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cancer Therapeutics & Supportive Care Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amgen Inc.

- AstraZeneca PLC

- Bayer AG

- Bristol-Myers Squibb Company

- Cipla Limited

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Gilead Sciences, Inc.

- GlaxoSmithKline plc

- Helsinn Healthcare SA

- Johnson & Johnson Services, Inc.

- Lupin Limited

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Limited

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

Presenting Actionable Recommendations for Industry Leaders to Navigate Evolving Oncology Market Forces and Strengthen Competitive Positions

To navigate evolving market forces and sustain competitive advantage, industry leaders should prioritize strategic investments in localized manufacturing hubs, thereby reducing tariff-induced vulnerabilities while ensuring supply continuity. Additionally, forging collaborative alliances with regional distributors and payer networks can facilitate streamlined access pathways and more favorable formulary placements. Embracing digital health technologies offers further opportunity to enhance patient engagement through remote monitoring, adherence support, and predictive risk assessment tools that anticipate adverse events before they emerge.

Furthermore, organizations need to cultivate flexible pricing models and value-based contracting arrangements that align payer incentives with treatment outcomes, particularly in high-cost therapeutic segments. Continued investment in real-world evidence generation will underpin these models, bolstering negotiation leverage and demonstrating product differentiated value. By integrating these measures into corporate strategy, companies can build resilient operations that adapt to policy shifts, market volatility, and evolving patient expectations.

Detailing a Robust and Transparent Research Methodology Underpinning Comprehensive Analysis of Cancer Therapeutics and Supportive Care Market Trends

This analysis is grounded in a rigorous, multi-layered research methodology that combines extensive secondary data review with targeted primary research. The secondary phase encompassed a systematic examination of peer-reviewed literature, regulatory filings, clinical trial registries, and corporate disclosures to build a foundational data repository. Building upon this base, primary research included in-depth interviews with a cross-section of industry experts, including oncology clinicians, pharmacoeconomic specialists, supply chain executives, and patient advocacy leaders.

Quantitative data points were validated through triangulation, cross-referencing multiple information sources to ensure consistency and reliability. Advanced analytical frameworks and proprietary models were employed to dissect segmentation patterns, tariff implications, and regional variances. All findings underwent stringent quality assurance reviews, involving methodological audits and expert panel consultations to safeguard against bias and confirm the robustness of insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cancer Therapeutics & Supportive Care Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cancer Therapeutics & Supportive Care Drugs Market, by Drug Type

- Cancer Therapeutics & Supportive Care Drugs Market, by Route Of Administration

- Cancer Therapeutics & Supportive Care Drugs Market, by Mechanism Of Action

- Cancer Therapeutics & Supportive Care Drugs Market, by Indication

- Cancer Therapeutics & Supportive Care Drugs Market, by Distribution Channel

- Cancer Therapeutics & Supportive Care Drugs Market, by Region

- Cancer Therapeutics & Supportive Care Drugs Market, by Group

- Cancer Therapeutics & Supportive Care Drugs Market, by Country

- United States Cancer Therapeutics & Supportive Care Drugs Market

- China Cancer Therapeutics & Supportive Care Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Strategic Takeaways Emphasizing Collaboration, Innovation, and Agility for Future Success in Cancer Drug Development and Patient Support Evolution

In conclusion, the intersection of cutting-edge therapeutics and comprehensive supportive care heralds a new chapter in oncology, one defined by precision, personalization, and patient empowerment. The evolving regulatory environment, particularly in the context of the 2025 tariff regime, underscores the imperative for agile manufacturing strategies and adaptive supply chain models. Segmentation analyses reveal that success hinges on a nuanced understanding of drug type synergies, delivery modalities, mechanism-driven innovation, disease-specific demands, and dynamic distribution networks.

As regional landscapes continue to diverge, organizations must balance global ambitions with local execution, leveraging strategic partnerships and digital capabilities to optimize market entry and patient reach. Ultimately, stakeholders who embrace data-driven decision making, foster cross-sector collaboration, and maintain an unwavering commitment to patient outcomes will be best positioned to navigate uncertainty and propel the next wave of advancements in cancer care.

Seize the Opportunity to Acquire the Comprehensive Cancer Therapeutics and Supportive Care Market Report by Engaging with Ketan Rohom Associate Director Sales & Marketing

Engaging with Ketan Rohom, Associate Director of Sales and Marketing, offers a personalized pathway to obtain this comprehensive market research report and unlock tailored insights for strategic decision making. Through a one-on-one consultation, stakeholders can explore customized data packages aligned with unique organizational objectives, ensuring that critical business imperatives are supported by the depth and breadth of our analysis. Prospective purchasers will receive guidance on the optimal report format, additional data add-ons, and potential custom research modules. To initiate this strategic engagement, interested parties are encouraged to connect directly with Ketan Rohom to discuss pricing options, exclusive bundles, and potential enterprise licensing solutions that will empower their teams to stay ahead in the dynamic cancer therapeutics and supportive care arena.

- How big is the Cancer Therapeutics & Supportive Care Drugs Market?

- What is the Cancer Therapeutics & Supportive Care Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?