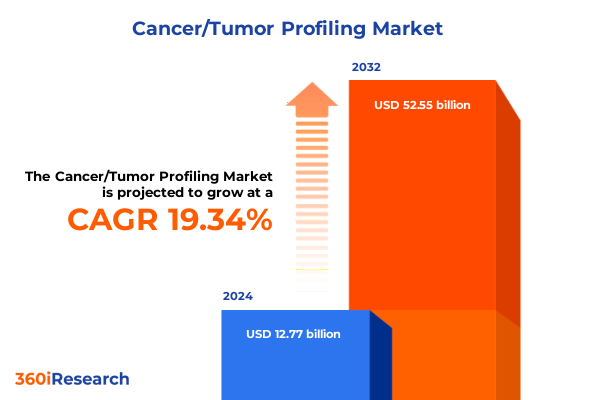

The Cancer/Tumor Profiling Market size was estimated at USD 15.29 billion in 2025 and expected to reach USD 18.31 billion in 2026, at a CAGR of 19.92% to reach USD 54.55 billion by 2032.

Comprehensive exploration of the evolving landscape of tumor profiling research clinical practices and technological innovations shaping future strategies

Tumor profiling has emerged as a critical pillar in personalized medicine, enabling clinicians and researchers to dissect the molecular architecture of malignancies with unprecedented granularity. Advances in genomic, proteomic, and epigenomic technologies now provide the framework for tailoring diagnostic and therapeutic strategies to individual patient profiles. As the confluence of high-throughput sequencing platforms, digital pathology, and bioinformatics solutions continues to accelerate, stakeholders across clinical, research, and industrial settings are increasingly leveraging integrated data streams to inform decision making and optimize patient outcomes.

Furthermore, a nuanced understanding of tumor heterogeneity and the dynamic interplay between genetic mutations and the tumor microenvironment has catalyzed the development of novel biomarkers and companion diagnostics. This foundational overview is designed to establish the context for subsequent discussion by highlighting how technological innovation intersects with evolving clinical paradigms. By mapping the current state of research methodologies and application areas, this introduction sets the stage for a deeper exploration of transformative shifts throughout the tumor profiling landscape.

Evolving diagnostic paradigms breakthroughs in throughput sequencing molecular imaging and integrative multiomic approaches redefining tumor profiling standards

Over the past decade, the tumor profiling landscape has undergone a series of transformative shifts driven by methodological advancements and interdisciplinary collaboration. The integration of next generation sequencing with minimal residual disease monitoring has revolutionized longitudinal patient tracking, while digital PCR and advanced fluorescence in situ hybridization techniques have enhanced sensitivity for low-abundance targets. Concurrently, immunohistochemistry platforms have evolved to incorporate tissue microarrays, enabling higher throughput and multiplexed analyses that were previously unattainable with traditional direct or indirect staining approaches.

In addition, the advent of real time PCR assays using both dye-based and probe-based chemistries has streamlined target validation workflows, complementing microarray applications such as comparative genomic hybridization and SNP genotyping for broader genomic insights. These breakthroughs have been further amplified by the application of transcriptome and whole exome sequencing, as well as the incorporation of hybrid capture–based targeted panels. By bridging the gap between data generation and clinical utility through robust bioinformatics pipelines and cloud-based platforms, these paradigm shifts are establishing new benchmarks for diagnostic accuracy and therapeutic precision.

Detailed examination of how the 2025 United States import tariffs have influenced supply chains procurement strategies and research investments in tumor profiling

In 2025, the introduction of new United States import tariffs targeting laboratory reagents and instrumentation has introduced significant implications for the tumor profiling ecosystem. The imposed duties on key consumables, including sequencing reagents and specialized antibodies, have compelled procurement teams to reassess supplier portfolios and explore domestic manufacturing collaborations. As a result, many organizations have prioritized contingency planning to mitigate supply disruptions and cost pressures, reinforcing the imperative for diversified sourcing strategies in an increasingly protectionist environment.

Moreover, tariffs on high-performance sequencers, fluorescence microscopes, and mass spectrometers have influenced capital acquisition timelines and total cost of ownership analyses. Research laboratories and diagnostic centers are adapting by extending equipment service contracts, leveraging instrument sharing consortia, and negotiating volume-based agreements with original equipment manufacturers. These strategic responses illustrate how tariff-driven market forces can reshape both short-term operational decision making and long-term investment roadmaps within the tumor profiling domain.

In-depth analysis of tumor profiling market segmentation by technology product type application and end user revealing nuanced insights into evolving niche demands

An analysis of market segmentation by technology reveals a mosaic of platforms that cater to distinct research and clinical needs. Beginning with amplification-based methods, conventional PCR remains a staple for routine target detection while digital PCR offers enhanced quantitative precision. Fluorescence in situ hybridization encompasses chromosome enumeration probes, copy number variation assays, and fusion gene detection, enabling spatial resolution of chromosomal alterations. In parallel, immunohistochemistry techniques-including direct IHC, indirect IHC, and tissue microarray-provide insights into protein expression within histological contexts. Microarray technologies support comparative genomic hybridization, expression profiling, and SNP genotyping, whereas next generation sequencing methodologies span targeted amplicon-based panels, hybrid capture workflows, transcriptome sequencing, whole exome sequencing, and whole genome sequencing. Complementing this spectrum, real time PCR with both dye-based and probe-based formats continues to facilitate rapid, high-sensitivity assays.

When viewed through the lens of product type, consumable reagents such as antibodies, PCR reagents, probes, and sequencing reagents serve as recurring revenue drivers that underpin assay development. Instrument platforms-including fluorescence microscopes, mass spectrometers, microarray scanners, PCR instruments, and sequencers-represent critical capital investments, and their operational efficiency is increasingly enhanced by software and services offerings, from bioinformatics suites to cloud deployment architectures, consultation services, and centralized data management systems. Application segmentation further refines focus areas by disease indication, with breast cancer profiling extending into gene expression analysis, mutation detection, proteomic assessments, and receptor characterization. Colorectal cancer workflows emphasize epigenetic profiling, MSI testing, and mutation analysis, while lung cancer initiatives concentrate on minimal residual disease monitoring, molecular susceptibility testing, and therapy selection. Prostate cancer investigations leverage copy number variation analysis, fusion detection, and gene expression evaluations. Finally, end users span diagnostic laboratories in both clinical and reference settings, hospital oncology and pathology departments, pharmaceutical and biopharmaceutical entities engaged in clinical trial and companion diagnostic services as well as drug development, and research and academic institutes across government, university, and biotech research centers.

This comprehensive research report categorizes the Cancer/Tumor Profiling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Application

- End User

Strategic regional perspectives highlighting distinct market drivers regulatory environments and infrastructure capabilities across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a pivotal role in shaping the adoption and evolution of tumor profiling solutions. In the Americas, robust research infrastructure and streamlined regulatory pathways have fostered the deployment of next generation sequencing platforms and advanced molecular assays. Numerous centers of excellence collaborate across academic, clinical, and industry sectors, driving early adoption of integrative diagnostics. Furthermore, government funding initiatives and reimbursement frameworks have underpinned efforts to standardize testing protocols and facilitate broader clinical implementation.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts are influencing market entry strategies for novel diagnostics. Countries such as Germany and the United Kingdom have established precision medicine centers that serve as regional hubs for technology validation and real-world evidence generation. Meanwhile, in the Asia-Pacific region, emerging economies are rapidly expanding laboratory capacities and forging public–private partnerships to support local reagent production and instrumentation manufacturing. This diverse landscape underscores the importance of adaptive go-to-market approaches that align with regional reimbursement policies, localized innovation ecosystems, and varying levels of clinical infrastructure readiness.

This comprehensive research report examines key regions that drive the evolution of the Cancer/Tumor Profiling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insightful overview of leading industry players technological partnerships pipeline advancements and competitive differentiators shaping the tumor profiling sector

Leading organizations within the tumor profiling arena are distinguished by their integrated technology portfolios and strategic collaborations. Key players have prioritized platform interoperability, forging alliances with software vendors to streamline data analytics workflows and enhance user experience. Investment in research and development continues to drive incremental enhancements in sequencing accuracy, assay sensitivity, and throughput, enabling differentiation in a competitive landscape.

Additionally, mergers and acquisitions have served as catalysts for expanding geographic reach and augmenting service offerings. Partnerships between instrumentation manufacturers and specialty reagent providers have facilitated bundled solutions that reduce time to result and improve operational efficiency. Moreover, engagement with academic consortia and participation in large-scale clinical trials have bolstered evidence generation, further solidifying the leadership positions of companies that demonstrate both technological prowess and a commitment to collaborative innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cancer/Tumor Profiling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Caris Life Sciences, Inc.

- F. Hoffmann-La Roche Ltd

- Guardant Health, Inc.

- Illumina, Inc.

- Natera, Inc.

- NeoGenomics, Inc.

- PerkinElmer, Inc.

- QIAGEN N.V.

- Sysmex Corporation

- Tempus Labs, Inc.

- Thermo Fisher Scientific Inc.

Pragmatic recommendations guiding industry stakeholders on strategic collaborations technology adoption and investment priorities to navigate the evolving tumor profiling arena

To thrive in an environment characterized by rapid technological progression and evolving regulatory landscapes, industry leaders should pursue strategic vendor diversification to safeguard against supply chain vulnerabilities exacerbated by tariff pressures. Embracing modular automation platforms can enhance laboratory throughput and reduce manual error, while establishing formal partnerships with contract research organizations and academic centers can accelerate validation studies and drive real-world data generation.

Moreover, companies should prioritize end-to-end data integration by investing in interoperable informatics infrastructures that support seamless data flow from sample preparation through bioinformatics analysis. Proactive engagement with regulatory bodies to shape guidelines and reimbursement frameworks will ensure market readiness for novel assays. By aligning innovation roadmaps with unmet clinical needs and fostering cross-sector alliances, stakeholders can unlock new value propositions and sustain competitive advantage.

Rigorous research methodology combining systematic literature review expert interviews data triangulation and quality assurance protocols to ensure analytical robustness

This report’s findings are grounded in a rigorous blend of secondary and primary research methodologies designed to ensure analytical integrity. The secondary research component comprised an exhaustive review of peer-reviewed literature, white papers, patent filings, and technical manuals to map current technological capabilities and regulatory developments. Publicly available data sources, industry conference proceedings, and financial disclosures were also synthesized to contextualize market dynamics and regional variations.

Primary research was conducted through structured interviews with senior industry executives, laboratory directors, and key opinion leaders across clinical, academic, and industrial settings. Follow-up surveys and expert validation sessions were employed to corroborate qualitative insights and refine thematic analyses. Data triangulation techniques were applied to reconcile conflicting inputs and establish confidence intervals around core observations. Quality assurance protocols, including cross-referencing multiple information streams and peer review of all analytical outputs, have been implemented to uphold the highest standards of research rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cancer/Tumor Profiling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cancer/Tumor Profiling Market, by Technology

- Cancer/Tumor Profiling Market, by Product Type

- Cancer/Tumor Profiling Market, by Application

- Cancer/Tumor Profiling Market, by End User

- Cancer/Tumor Profiling Market, by Region

- Cancer/Tumor Profiling Market, by Group

- Cancer/Tumor Profiling Market, by Country

- United States Cancer/Tumor Profiling Market

- China Cancer/Tumor Profiling Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3498 ]

Summarizing critical insights and future directions underscoring the imperative for innovation collaboration and adaptive strategies in tumor profiling research

Throughout this executive summary, we have dissected the multifaceted evolution of tumor profiling, from foundational technologies to emerging best practices and external market forces. The convergence of sequencing innovations, high-sensitivity assays, and integrated informatics has unlocked new possibilities for precision oncology, while economic and regulatory considerations continue to influence strategic decision making across stakeholder groups.

Looking ahead, the imperative for cross-disciplinary collaboration and adaptive strategies will only intensify as clinical demands evolve and competitive landscapes shift. By leveraging the insights outlined in this report-across segmentation, regional dynamics, company positioning, and actionable recommendations-industry participants can chart pathways toward sustainable growth and enhanced patient impact.

Engaging call to action inviting stakeholders to connect with Ketan Rohom Associate Director Sales Marketing to secure the complete tumor profiling market research insights

To gain an in-depth perspective on the tumor profiling market and its emerging opportunities, it is essential to engage with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expert guidance will help you identify the segments most aligned with your strategic objectives, from advanced sequencing technologies to targeted diagnostic applications. By connecting directly with Ketan, you can access tailored insights and additional complimentary data supplements that extend beyond the scope of summary reports, ensuring you make evidence-based decisions with confidence.

Schedule a personalized consultation to explore interactive dashboards, methodology nuances, and unique value-added analyses that underpin the comprehensive tumor profiling report. Reach out today to secure your copy of the full research deliverable and stay at the forefront of technological advancements and market dynamics. Empower your organization with data-driven intelligence by partnering with a recognized authority who can facilitate access to specialized advisory services and ongoing market surveillance updates.

- How big is the Cancer/Tumor Profiling Market?

- What is the Cancer/Tumor Profiling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?