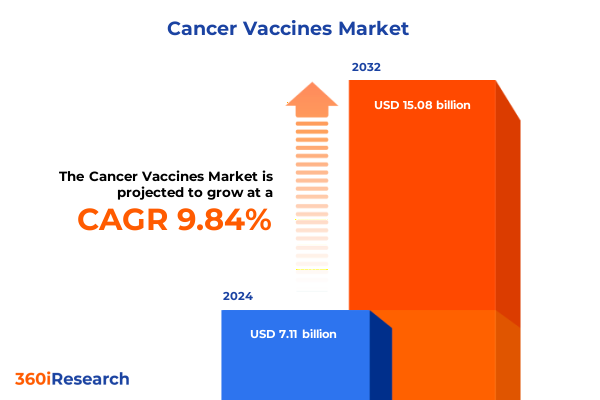

The Cancer Vaccines Market size was estimated at USD 7.78 billion in 2025 and expected to reach USD 8.53 billion in 2026, at a CAGR of 9.90% to reach USD 15.08 billion by 2032.

Pioneering the Dawn of Cancer Vaccines: Unveiling the Foundations, Opportunities, and Imperative Need for Innovative Immunization Strategies

Cancer vaccines represent a transformative frontier in oncology, harnessing the body’s own immune system to recognize and destroy malignant cells with unprecedented precision. Unlike traditional treatments that often rely on cytotoxic agents or radiation, these immunotherapeutic platforms aim to train immune surveillance mechanisms, reducing off-target effects and promoting lasting antitumor responses. Since the initial explorations of prophylactic vaccines against virus-associated cancers, researchers have steadily expanded the scope of both preventive and therapeutic approaches, paving the way for a new era of cancer prevention and treatment.

Over the past decade, advancements in molecular biology, genomics, and bioinformatics have accelerated the discovery of tumor-specific antigens, enabling the design of personalized vaccines that target unique neoantigens in individual patients. Concurrently, lessons learned from the rapid development of mRNA vaccines during global health emergencies have invigorated cancer vaccine research, demonstrating that platform technologies can be adapted swiftly for oncological indications. Regulatory bodies are increasingly embracing innovative trial designs and expedited pathways, reflecting a growing recognition of immunization strategies as vital components of comprehensive cancer care.

This executive summary distills the critical trends, structural shifts, and actionable insights shaping the cancer vaccine landscape. It offers an analytical foundation for decision makers, illustrating how scientific breakthroughs, market forces, and policy developments intersect to reshape research priorities, partnership strategies, and commercialization roadmaps. By exploring the context and implications of these dynamics, stakeholders can chart informed pathways to accelerate development, navigate emerging challenges, and ultimately deliver transformative therapies to patients worldwide.

Revolutionary Breakthroughs and Strategic Alliances Rapidly Reshaping the Cancer Vaccine Landscape with Unprecedented Momentum and Global Collaboration

Breakthrough discoveries in antigen identification, adjuvant engineering, and delivery mechanisms have rapidly redefined the scope of cancer vaccine research. Advanced sequencing technologies now permit high-resolution mapping of tumor mutational landscapes, while synthetic biology approaches enable the creation of multi-epitope vaccines capable of eliciting robust cytotoxic T-cell responses. Consequently, the field has shifted from one-size-fits-all prophylactic models toward bespoke formulations that address tumor heterogeneity and microenvironmental complexity.

Moreover, strategic alliances between biopharmaceutical companies, academic institutions, and specialized contract research organizations have become integral to translational success. Collaborative consortia accelerate proof-of-concept validation and streamline manufacturing scale-up, leveraging shared expertise in process development, clinical trial execution, and regulatory navigation. In tandem, alliances with technology firms specializing in data analytics and artificial intelligence are optimizing candidate selection and predictive modeling, ensuring that vaccine candidates advance with higher probability of clinical benefit.

Complementing scientific and partnership advances, regulatory authorities in key markets have introduced adaptive trial designs and conditional approval pathways tailored to immunotherapeutic modalities. These progressive frameworks foster iterative learning, permitting early efficacy signals to inform trial expansion and dosing regimens. Together, these shifts underscore a dynamic landscape where innovation, collaboration, and policy reform converge to accelerate the translation of promising vaccine candidates into clinical reality.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Cancer Vaccine Supply Chains, Costs, and Global Market Dynamics

In 2025, the United States implemented tariffs on select biologics manufacturing equipment and raw materials, intending to bolster domestic production but inadvertently affecting global vaccine supply chains. Essential reagents, specialized cold-chain packaging solutions, and single-use bioreactor components now face increased import duties, raising the landed costs for vaccine developers and contract manufacturing organizations. Of particular note, tariffs on lipid nanoparticles and nucleic acid reagents used in mRNA and DNA vaccines have heightened cost pressures for next-generation therapeutic platforms.

As a result, organizations are reassessing their supply chain architectures to mitigate tariff-induced cost escalations. Some large manufacturers are expanding domestic sourcing partnerships, while smaller biotechnology firms explore strategic alliances with regional producers in low-tariff jurisdictions. These adjustments are reshaping procurement strategies; companies are balancing the imperative to maintain cost efficiencies with the necessity of ensuring uninterrupted access to high-quality materials essential for vaccine research and production.

Furthermore, the tariff landscape has prompted a broader reexamination of end-to-end manufacturing footprints. In addition to nearshoring critical processes, firms are investing in modular and flexible production facilities that can be rapidly reconfigured to accommodate multiple vaccine platforms. Consequently, the cumulative impact of these tariffs extends beyond immediate cost increases, driving long-term structural realignments in the global cancer vaccine ecosystem.

Delving into Critical Segmentation Dimensions That Illuminate Diverse Therapeutic and Preventive Vaccine Pathways for Precision Targeting

When examining the market through the lens of product type, it becomes evident that preventive vaccines, historically centered on virus-associated neoplasms, are now expanding to include prophylactic immunization against oncodriver antigens. Simultaneously, therapeutic vaccines have matured beyond generic peptide formulations, advancing toward personalized neoantigen constructs designed for individual patient profiles. This evolution underscores a clear demarcation between segments prioritizing population-level prevention and those focusing on targeted tumor eradication in established disease.

Based on formulations, the proliferation of diverse technological platforms is striking. Cell-based vaccines harness dendritic cells or engineered tumor cells to present antigens directly, whereas nucleic acid-based modalities leverage DNA and RNA constructs to instruct host cells to synthesize specific antigens. In parallel, peptide- and protein-based vaccines offer defined immunogenic epitopes, synthetic vaccines employ novel chemical scaffolds to enhance immune activation, and viral vector-based approaches utilize modified viruses to deliver antigenic payloads. Each formulation comes with unique manufacturing complexities, stability considerations, and immune activation profiles, dictating strategic choices for developers based on intended clinical application.

The route of administration further differentiates offerings, with intramuscular injections remaining the most prevalent due to well-established delivery protocols and patient familiarity. However, intravenous formulations are gaining traction for cell-based and nucleic acid-based constructs requiring precise systemic distribution. These pathways influence not only clinical trial design but also cold chain logistics and site-of-care readiness, factors that weigh heavily in commercialization planning.

Developmental stage segmentation reveals a dynamic pipeline, with early-phase clinical trials testing novel antigens and adjuvant combinations in Phase I and Phase II cohorts, and more advanced candidates entering confirmatory Phase III studies. Meanwhile, indication-specific segmentation highlights intense activity in breast, colorectal, lung, melanoma, and prostate cancers, reflecting both prevalence and unmet therapeutic needs. Finally, the end-user landscape spans cancer research institutes pioneering early research, hospitals and clinics delivering frontline care, and specialized treatment centers equipped for complex immunization regimens, each bringing distinct procurement cycles, regulatory oversight, and clinical expertise into play.

This comprehensive research report categorizes the Cancer Vaccines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Formulations

- Administration Pathway

- Development Phase

- Indication

- End-User

Uncovering Regional Nuances and Growth Catalysts Across the Americas, Europe Middle East Africa, and Asia Pacific Markets for Strategic Insights

Across the Americas, innovation hubs in North America continue to lead clinical development and regulatory approvals for novel cancer vaccines. The presence of world-class research institutions, coupled with robust venture capital investment, underpins a thriving ecosystem of early-stage startups and established biopharmaceutical companies. Meanwhile, Latin America is emerging as a cost-effective manufacturing partner, with several nations offering favorable incentives for biologics production, thereby creating a complementary value chain that supports clinical supply for global trials.

In Europe, Middle East, and Africa, regulatory harmonization efforts are gaining momentum, streamlining clinical trial approvals across multiple jurisdictions. The European Union’s centralized evaluation processes, alongside regional hubs in the Middle East investing in cutting-edge facility infrastructure, are fostering increased collaboration. In Africa, partnerships between international organizations and local research institutions are driving capacity building for vaccine manufacturing and distribution, aligning public health goals with commercial development strategies.

The Asia-Pacific region has emerged as a critical driver of cost-efficient research, development, and production. Leading markets such as China, Japan, and South Korea are investing heavily in next-generation vaccine platforms, supported by government grants and favorable reimbursement frameworks. Simultaneously, biotechnology clusters in Southeast Asia are expanding GMP-certified facility footprints, positioning the region as a central node for clinical trial enrollment and mass production. Together, these regional nuances highlight the importance of tailored market entry strategies that reflect local strengths, regulatory landscapes, and infrastructure capabilities.

This comprehensive research report examines key regions that drive the evolution of the Cancer Vaccines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Biopharmaceutical Innovators Driving Advancements in Cancer Vaccines Through Collaborations, Clinical Prowess, and Technological Excellence

Major biopharmaceutical players are amplifying their presence in the cancer vaccine space through diversified portfolios and strategic collaborations. Leading innovators have launched platform partnerships to co-develop personalized neoantigen vaccines, while simultaneously investing in advanced manufacturing technologies such as continuous bioprocessing to reduce production timelines and costs. These companies are also forging alliances with academic research centers to access cutting-edge discovery pipelines and validate early-stage candidates in translational studies.

Mid-size biotechnology firms are differentiating by specializing in proprietary adjuvant systems and delivery vehicles that enhance immune activation and antigen presentation. By focusing on niche technological advantages-such as lipid nanoparticle optimization or novel viral vectors-these companies are securing strategic investments from global partners seeking to augment internal pipelines. Additionally, these firms are increasingly engaging in out-licensing agreements that allow for broader geographic reach while retaining core intellectual property rights.

Contract development and manufacturing organizations play a pivotal role in enabling scalability for both emerging and established developers. By expanding modular production capabilities and offering integrated clinical trial supply services, these CDMOs help streamline the path from bench to bedside. As demand for flexibility and rapid scale-up intensifies, the leading service providers are investing in digital tracking systems, automated quality control platforms, and advanced cold chain solutions to meet stringent regulatory requirements and evolving client expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cancer Vaccines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advaxis Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bayer AG

- BioNTech SE

- Bristol Myers Squibb Company

- Celldex Therapeutics, Inc.

- CureVac SE

- Dynavax Technologies Corporation

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- GSK PLC

- Helsinn Healthcare SA

- Inovio Pharmaceuticals, Inc.

- Johnson & Johnson Services, Inc

- JW CreaGene

- Merck & Co., Inc.

- Moderna, Inc.

- Pfizer Inc.

- Sanofi SA

- Sanpower Group Co., Ltd.

- Scorpius Holdings, Inc.

- Serum Institute of India Pvt. Ltd.

- Sun Pharmaceutical Industries Ltd.

- Vaxine Pty Ltd

Actionable Strategies for Industry Leadership to Capitalize on Cancer Vaccine Innovations While Mitigating Risks and Navigating Regulatory Complexities

Industry leaders should prioritize investments in platform technologies that support both preventive and therapeutic applications, thereby maximizing R&D efficiency and enabling rapid pivoting among vaccine modalities. By establishing cross-functional innovation hubs that integrate discovery, translational research, and process development, organizations can accelerate candidate progression while mitigating the risk of development bottlenecks. Additionally, expanding partnerships with technology firms specializing in artificial intelligence can enhance antigen selection processes, improving trial success rates.

Supply chain resilience must be a strategic cornerstone moving forward. Companies are advised to diversify sourcing channels for critical raw materials, balancing domestic production with partnerships in low-tariff regions to manage cost volatility. Investing in flexible, modular manufacturing facilities will allow for seamless scale-up across multiple vaccine platforms and adapt to evolving regulatory standards. Furthermore, incorporating digital traceability solutions will enhance transparency and compliance while reducing time to market.

Engaging proactively with regulatory agencies and policymakers is imperative to shape adaptive frameworks that accommodate novel clinical trial designs and conditional approvals. Early dialogue through scientific advice procedures and pilot programs for accelerated pathways can clarify requirements and align expectations. Finally, maintaining patient-centric approaches-such as integrating real-world evidence and patient-reported outcomes into development plans-will not only support differentiated value propositions but also foster payer and provider confidence in long-term clinical benefits.

Comprehensive Methodological Framework Integrating Primary and Secondary Research to Ensure Robust Analysis of Cancer Vaccine Market Dynamics

The research methodology integrates rigorous primary and secondary approaches to ensure a comprehensive understanding of the cancer vaccine landscape. Primary research involved in-depth interviews with leading immuno-oncology experts, clinical investigators, regulatory officials, and supply chain executives. These qualitative insights were complemented by client workshops with cross-functional stakeholders to validate emerging trends and pain points throughout the development and commercialization continuum.

Secondary research encompassed an exhaustive review of peer-reviewed journals, patent filings, regulatory agency announcements, and technical white papers. Publicly available clinical trial registries and corporate pipelines were systematically analyzed to chart candidate progress across development phases. In addition, proprietary databases tracking manufacturing capacity, strategic partnerships, and funding rounds provided quantitative context to emerging technological and market dynamics.

To uphold analytical rigor, data triangulation techniques were applied, cross-checking findings from multiple sources for consistency. Key performance indicators-such as historical approval timelines, patient enrollment rates, and manufacturing lead times-were normalized to account for platform differences. A peer review process involving subject matter experts was employed to remove potential biases and ensure that conclusions accurately reflect the current state of innovation and commercialization in cancer vaccines.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cancer Vaccines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cancer Vaccines Market, by Product Type

- Cancer Vaccines Market, by Formulations

- Cancer Vaccines Market, by Administration Pathway

- Cancer Vaccines Market, by Development Phase

- Cancer Vaccines Market, by Indication

- Cancer Vaccines Market, by End-User

- Cancer Vaccines Market, by Region

- Cancer Vaccines Market, by Group

- Cancer Vaccines Market, by Country

- United States Cancer Vaccines Market

- China Cancer Vaccines Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Critical Insights and Imperatives to Guide Stakeholders Through the Evolving Challenges of the Cancer Vaccine Ecosystem

The cancer vaccine sector stands at a critical inflection point, characterized by rapid scientific progress, evolving regulatory frameworks, and shifting supply chain paradigms. Preventive and therapeutic vaccines have transitioned from conceptual models to tangible clinical assets, driven by advanced antigen discovery methods and novel delivery platforms. Meanwhile, geopolitical and economic policies-such as the United States’ 2025 tariff measures-are reshaping supply chain strategies, underscoring the need for agility and strategic foresight.

Collectively, these developments underscore the vast potential and inherent complexities inherent in bringing next-generation cancer vaccines to market. Stakeholders must navigate a multifaceted landscape that spans intricate scientific challenges, dynamic policy environments, and diverse regional ecosystems. By leveraging the strategic insights contained in this report-ranging from segmentation analyses to regional nuances and company profiles-organizations can chart informed pathways to accelerate development, enhance collaboration, and ultimately deliver transformative immunotherapies that redefine cancer care.

Engage with Ketan Rohom to Secure In-Depth Cancer Vaccine Market Insights and Empower Your Strategic Decision Making Today

To take full advantage of these insights and elevate your strategic positioning in the evolving cancer vaccine arena, connect with Ketan Rohom, Associate Director of Sales & Marketing. His deep understanding of both market dynamics and client priorities ensures you receive a tailored briefing on the report’s comprehensive findings, timelines for implementation, and customized support for your organization’s unique needs. Engaging with Ketan opens the door to exclusive executive summaries, interactive workshops, and personalized consultation sessions designed to translate data-driven insights into actionable roadmaps. Don’t miss the opportunity to secure your competitive edge-reach out today to explore how this market research can shape and empower your strategic decision making.

- How big is the Cancer Vaccines Market?

- What is the Cancer Vaccines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?