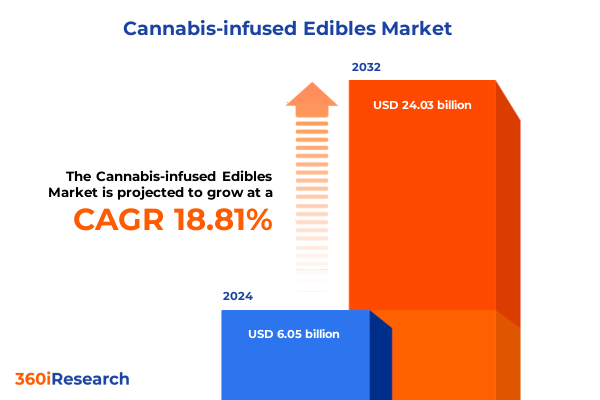

The Cannabis-infused Edibles Market size was estimated at USD 7.17 billion in 2025 and expected to reach USD 8.51 billion in 2026, at a CAGR of 18.84% to reach USD 24.03 billion by 2032.

Exploring the Rising Wave of Cannabis-Infused Edibles and Their Rapid Evolution in Consumer Preferences and Market Dynamics

The cannabis-infused edibles sector has emerged as one of the most dynamic and rapidly evolving segments within the broader cannabis industry, propelled by shifts in consumer preferences, regulatory frameworks, and technological advancements. What was once a niche offering confined to underground markets has transformed into a mainstream category embraced by a diverse demographic of consumers seeking alternative consumption methods. Edibles appeal to individuals seeking discretion, convenience, and precise dosing, marking a distinct evolution from traditional smoking or vaping of cannabis flower. As legalization gains ground across multiple jurisdictions, consumers are increasingly experimenting with products that blend familiar formats-such as baked goods, chocolates, and beverages-with carefully calibrated cannabinoid profiles.

Looking ahead, the trajectory of cannabis-infused edibles will be shaped by ongoing research into cannabinoid science, the rise of wellness-focused formulations, and the integration of gourmet culinary techniques. Manufacturers are innovating to meet demand for microdosing, fast-acting delivery systems, and clean-label formulations that align with health-conscious lifestyles. Moreover, advances in extraction and encapsulation technologies are enabling more consistent dosing, faster onset, and longer shelf life, further expanding the appeal of edibles. In this context, stakeholders-from product developers and investors to distributors and policymakers-must grasp the underlying trends and drivers that will define the next wave of growth in this vibrant market.

Uncovering Transformative Shifts Redefining Cannabis Edibles Industry Through Regulatory Changes Technological Advancements and Consumer Behavior Trends

Over the past five years, the cannabis-infused edibles landscape has undergone transformative shifts, driven by a confluence of regulatory liberalization, technological breakthroughs, and evolving consumer behaviors. On the regulatory front, an increasing number of states and countries have established clear frameworks for edible production, labeling, and testing, reducing barriers to entry and fostering a more robust marketplace. This regulatory maturation has been complemented by the advent of sophisticated extraction techniques-such as supercritical CO₂ and solventless methods-which yield purer cannabinoid isolates and terpene-rich profiles, enhancing both safety and sensory experience.

Simultaneously, consumer expectations have evolved beyond mere potency toward nuanced preferences for taste, functionality, and convenience. Edibles no longer serve only recreational consumers; medical users are opting for precisely dosed formulations to manage chronic pain, anxiety, and sleep disorders. Product developers are responding with innovations such as rapid-onset delivery systems employing nanoemulsion or liposomal encapsulation, enabling consumers to tailor their experience with unprecedented control. In parallel, packaging innovation-featuring tamper-evident seals, child-resistant mechanisms, and clear dosing information-has elevated consumer confidence and accelerated adoption. Collectively, these paradigm shifts underscore a market that is not static but continuously being redefined by new entrants, cross-industry partnerships, and a deepening understanding of the end-user experience.

Examining the Cumulative Impact of Newly Implemented United States Tariffs in 2025 on the Production Cost Structure and Supply Chain Dynamics

In 2025, the United States introduced a series of tariffs affecting the importation of specialized ingredients and packaging components critical to cannabis-infused edible manufacturers. Prior to these measures, many producers relied on imported hemp-derived concentrates, terpene blends, and advanced packaging materials sourced from international markets. The newly implemented tariffs have incrementally increased the landed cost of these inputs, necessitating a reevaluation of cost structures across the value chain. As a result, manufacturers are facing pressure to optimize sourcing strategies, either by onshoring production or identifying alternative domestic suppliers that can meet stringent quality and safety standards.

Moreover, the tariffs have prompted supply chain realignment, with many operators consolidating suppliers and negotiating long-term agreements to mitigate price volatility. Some forward-looking companies have started investing in vertical integration-establishing in-house extraction facilities and packaging operations-to insulate themselves from external cost shocks. In addition to direct cost implications, higher tariffs have affected lead times and logistical complexity, spurring a recalibration of inventory management practices. The cumulative impact of these trade measures highlights the critical interplay between policy decisions and industry resilience, underscoring the necessity for agile operational models and proactive supply chain risk assessments.

Deriving Key Insights from Multi-Dimensional Segmentation of Cannabis-Infused Edibles Across Product Type Flavor Ingredient Gender and Distribution Channel

In analyzing the cannabis-infused edibles market through a multi-dimensional segmentation lens, a detailed understanding emerges of how product types, flavor profiles, ingredient composition, gender demographics, and distribution channels each inform consumer choice and competitive strategy. Within the realm of product types, baked goods such as brownies, cookies, and pastries continue to command a significant share, prized for their familiarity and ease of dosing, while beverages spanning infused water, sodas, and teas are gaining traction among health-conscious users seeking lower-calorie alternatives. Chocolates in dark, milk, and white formats offer a premium sensory experience, and gummies-often molded into fruit-inspired shapes-maintain robust popularity. Savory items including dressings, sauces, and spreads cater to culinary experimentation, and snack foods such as chips, nuts, and popcorn extend reach into on-the-go consumption occasions.

Flavor segmentation further refines this picture, as fruity options-delivered through berry, citrus, or tropical infusions-resonate with those desiring a refreshing taste, whereas savory nuances such as cheese, herbaceous, and spicy formulations appeal to consumers seeking a more gourmet or novel palate. Sweet flavors featuring caramel, chocolate, and vanilla remain perennial favorites. Ingredient-based distinctions between artificial and natural components delineate brands prioritizing clean-label transparency from those focused on cost efficiencies. Gender segmentation reveals nuanced consumption patterns, with female consumers often gravitating toward microdosed, wellness-oriented formulations and male consumers exhibiting stronger demand for higher-potency products. Distribution channels split between offline dispensaries and retail outlets, where experiential purchasing drives customer education, and online platforms offering discreet delivery and subscription models. Lastly, consumer type segmentation differentiates medical users-valuing consistency and therapeutic efficacy-from recreational users-driven by flavor innovation and experiential variety. Together, these segments form a cohesive framework for tailoring product development, marketing approaches, and sales strategies that resonate with distinct consumer cohorts.

This comprehensive research report categorizes the Cannabis-infused Edibles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Types

- Flavor

- Ingredients

- Gender

- Distribution Channel

- Consumer Type

Analyzing Regional Variations in Consumer Adoption Production Capacities and Regulatory Frameworks for Cannabis-Infused Edibles Across Major Global Markets

Geographic analysis of the cannabis-infused edibles market reveals pronounced differences in consumer adoption rates, production capacities, and regulatory environments across major global regions. In the Americas, where a growing number of U.S. states and several Latin American countries have embraced legislation, the market is characterized by robust infrastructure investment and competitive consolidation. Leading producers benefit from established distribution networks in dispensaries and a maturing e-commerce ecosystem, while regulatory agencies continue refining standards for potency, packaging, and safety, fostering incremental innovation.

In contrast, Europe, the Middle East, and Africa present a patchwork of regulatory stances, with Western European markets gradually liberalizing and Middle Eastern and African regions generally maintaining stringent prohibitions. Nonetheless, pioneering companies in certain European Union countries are launching pilot programs for medical edibles, leveraging advanced manufacturing capabilities and a strong emphasis on quality assurance. Finally, the Asia-Pacific region offers both opportunity and challenge: select markets such as Australia and parts of Southeast Asia have initiated medical frameworks, while major economies continue to restrict non-medical use. Within this context, regional producers and international entrants are prioritizing partnerships with local stakeholders, navigating import-export controls, and aligning product portfolios with stringent compliance requirements. These regional distinctions underscore the importance of a tailored market entry and expansion strategy that accounts for divergent regulatory timelines, consumer tastes, and distribution landscapes.

This comprehensive research report examines key regions that drive the evolution of the Cannabis-infused Edibles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Shaping the Competitive Cannabis-Infused Edibles Ecosystem Through Innovation Partnerships and Strategic Market Positioning

Within the competitive cannabis-infused edibles ecosystem, leading companies are distinguished by their commitment to product innovation, strategic alliances, and nimble market positioning. Some operators have carved out a distinct niche by developing proprietary nanoemulsion technologies that accelerate cannabinoid absorption, while others have formed joint ventures with established food and beverage manufacturers to leverage co-packing and distribution expertise. Investment in high-throughput extraction facilities and automated encapsulation lines has enabled these front-runners to maintain consistent quality while scaling to meet rising demand.

Furthermore, several prominent players have prioritized sustainability and social responsibility, integrating locally sourced ingredients and eco-friendly packaging into their value propositions. Collaborative partnerships between cannabis producers and research institutions have catalyzed the development of next-generation formulations, such as balanced THC-CBD ratios targeted at specific therapeutic outcomes. In the marketing domain, innovative loyalty programs and immersive retail experiences-ranging from branded cafés to curated tasting events-have reinforced brand equity and deepened consumer engagement. By combining technological prowess with strategic collaborations and customer-centric initiatives, these companies set the bar for excellence and drive the competitive benchmarks within the edibles segment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cannabis-infused Edibles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlas Growers Ltd.

- Auntie Dolores

- Aurora Cannabis Inc.

- Baked Bros

- Balanced Health Botanicals by Village Farms International

- Cannabinoid Creations

- Canopy Growth Corporation

- Charlotte's Web Holdings Inc

- Cheeba Chews

- Chef Rubber

- Coast Cannabis Co.

- Cresco Labs, LLC

- Cronos Group Inc.

- Curaleaf Holdings Inc.

- CV Sciences, Inc.

- Dixie Group, Inc.

- Elixinol LLC

- Evergreen herbal limited

- Green Organic Dutchman Holdings Ltd.

- Green Thumb Industries Inc.

- HEAVENLY SWEET CALIFORNIA

- HeavenlyRx, Ltd.

- Heineken International B.V.

- Isodiol International Inc.

- Joy Organics LLC

- Kats Botanicals

- Kaya Holdings, Inc.

- Kazmira LLC

- Kiva Products, LLC

- Koios Beverage Corp

- Medical Marijuana Inc.

- Medically Correct LLC

- Medix CBD

- Melodiol Global Health Limited

- Mentor Cannabis, Inc.

- Mirth Provisions

- Organigram Holdings Inc.

- Plus Products Inc. By Glass House Brands

- Resonate Blends, Inc.

- Tilray Inc.

- White Rabbit

Delivering Actionable Recommendations to Industry Leaders for Navigating Regulatory Complexities Boosting Consumer Engagement and Ensuring Sustainable Growth

Industry leaders seeking to navigate the complex cannabis-infused edibles landscape must adopt a multifaceted approach that addresses regulatory compliance, consumer engagement, and supply chain resilience. First, proactive engagement with policymakers and participation in industry coalitions can help shape favorable regulations and ensure that emerging standards are both practical and conducive to innovation. By fostering transparent dialogues on dosage guidelines, labeling requirements, and safety testing protocols, companies can mitigate compliance risks and build trust with regulators and end users alike.

Second, investment in product differentiation-through novel delivery mechanisms, unique flavor combinations, and targeted functional formulations-will be essential to capture consumer attention in an increasingly crowded marketplace. Embracing digital marketing tools and data analytics can further refine audience segmentation and personalize engagement across both offline and online channels. Third, strengthening supply chain resilience through diversified sourcing, strategic inventory management, and vertical integration will guard against external cost pressures such as tariff changes or ingredient shortages. This includes forging long-term partnerships with domestic suppliers and exploring sustainable cultivation and extraction practices. Finally, building robust educational initiatives-such as transparent dosage guidelines, interactive digital content, and in-store dispensary training-will empower consumers to make informed choices, thereby reducing barriers to adoption and fostering long-term brand loyalty.

Detailing a Rigorous Research Methodology Incorporating Data Sourcing Analytical Frameworks and Expert Validation to Ensure Comprehensive Insights

The research methodology underpinning this analysis combines both primary and secondary approaches to deliver comprehensive, reliable insights into the cannabis-infused edibles market. Primary data was collected through structured interviews with key stakeholders, including product innovators, regulatory experts, supply chain leaders, and consumer focus groups. These one-on-one discussions afforded deep qualitative perspectives on emerging trends, pain points, and strategic priorities across the value chain.

Concurrent with primary research, extensive secondary analysis was conducted using publicly available databases, regulatory filings, industry publications, and selected proprietary data sources. A rigorous data triangulation process was applied, wherein findings from disparate sources were cross-validated to ensure consistency and accuracy. Analytical frameworks-such as SWOT, PESTLE, and Porter’s Five Forces-were utilized to assess market dynamics, competitive intensity, and external influences. In addition, statistical techniques were employed to interpret trend data and identify significant correlations between regulatory developments, consumer preferences, and product adoption patterns. All insights were subjected to expert validation panels, ensuring that conclusions resonate with real-world experiences and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cannabis-infused Edibles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cannabis-infused Edibles Market, by Product Types

- Cannabis-infused Edibles Market, by Flavor

- Cannabis-infused Edibles Market, by Ingredients

- Cannabis-infused Edibles Market, by Gender

- Cannabis-infused Edibles Market, by Distribution Channel

- Cannabis-infused Edibles Market, by Consumer Type

- Cannabis-infused Edibles Market, by Region

- Cannabis-infused Edibles Market, by Group

- Cannabis-infused Edibles Market, by Country

- United States Cannabis-infused Edibles Market

- China Cannabis-infused Edibles Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Comprehensive Findings on Market Trends Regulatory Developments and Consumer Dynamics to Conclude the Landscape of Cannabis-Infused Edibles

The cannabis-infused edibles market stands at an inflection point defined by rapid innovation, evolving regulatory landscapes, and shifting consumer expectations. Through an examination of transformative technological breakthroughs-such as enhanced extraction methods and precision dosing systems-and an understanding of the 2025 tariff landscape’s impact on supply chain structures, this analysis illuminates both challenges and opportunities moving forward. Segmentation insights reveal the importance of tailoring product portfolios to distinct consumer cohorts, whether by product format, flavor preference, ingredient integrity, or distribution channel. Regional analysis underscores diverse adoption curves and regulatory timelines, calling for adaptive market entry and growth strategies.

Profiling leading companies highlights the competitive advantages gained through partnerships, vertical integration, and sustainability commitments, while actionable recommendations offer a roadmap for navigating compliance demands, differentiating offerings, and building resilient operations. Ultimately, the findings coalesce around a central theme: success in the cannabis-infused edibles sector will hinge on the ability to harmonize innovation with regulatory adherence and consumer-centricity. By leveraging robust data insights and adopting a strategic, agile mindset, market participants can position themselves to thrive amid ongoing industry evolution.

Engaging Directly with Ketan Rohom Associate Director of Sales and Marketing to Secure the Definitive Market Research Report on Cannabis-Infused Edibles

To obtain the most comprehensive and forward-looking insights into the cannabis-infused edibles market, reach out to Ketan Rohom, Associate Director of Sales and Marketing, who can provide you with full access to the detailed research findings. Ketan Rohom brings deep industry expertise and can guide you through the scope of the report, ensuring that you secure the exact data sets and analyses that align with your strategic objectives. By connecting with Ketan, you will be empowered to leverage the full breadth of this study-ranging from segmentation nuances to regional dynamics and competitive benchmarks-so that you can make data-driven decisions with confidence. Act now to engage directly with Ketan Rohom and secure your copy of the definitive market research report on cannabis-infused edibles, designed to equip your organization with the actionable intelligence needed to stay ahead in this rapidly evolving landscape.

- How big is the Cannabis-infused Edibles Market?

- What is the Cannabis-infused Edibles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?