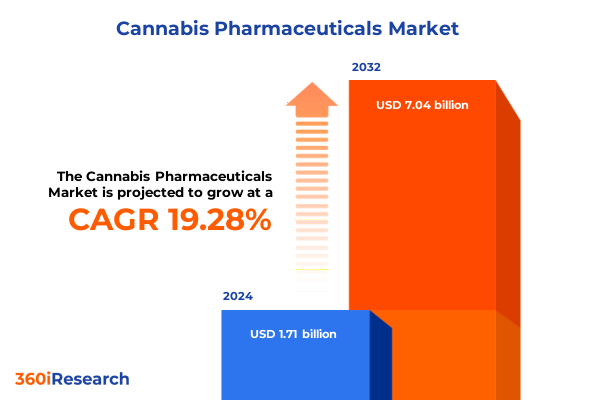

The Cannabis Pharmaceuticals Market size was estimated at USD 2.04 billion in 2025 and expected to reach USD 2.44 billion in 2026, at a CAGR of 19.30% to reach USD 7.04 billion by 2032.

Navigating the Shifting Foundations of Cannabis Pharmaceuticals Through Regulatory Milestones Clinical Breakthroughs and Evolving Therapeutic Acceptance

The cannabis pharmaceuticals domain has emerged from its historical stigma to become a focal point of innovation and therapeutic promise. Over the past decade, landmark regulatory decisions have redefined the boundaries of cannabinoid-based medicine, catalyzing unprecedented research initiatives and clinical trials. In late 2024 the United States Drug Enforcement Administration proposed reclassifying cannabis, a move that would facilitate broader clinical research and potentially reshape the federal oversight of cannabinoid-derived therapies. Concurrently, the acquisition of GW Pharmaceuticals by Jazz Pharmaceuticals and the FDA approval of Epidiolex for rare seizure disorders underscore the maturation of cannabis-derived treatments into mainstream pharmacology, signaling a new era of legitimacy and acceptance.

This transformative backdrop sets the stage for a market defined by rigorous quality standards, complex regulatory frameworks, and the intertwining of traditional pharmaceutical rigor with plant-based innovation. As clinical evidence accrues around cannabinoids’ efficacy in areas ranging from epilepsy to chronic pain and oncology support, industry stakeholders must navigate evolving legislative landscapes, emerging tariff regimes, and shifting patient expectations. In this context, understanding the foundational forces at play is critical for any organization seeking to participate meaningfully in the cannabis pharmaceuticals arena.

Witnessing Revolutionary Scientific Discoveries Regulatory Harmonization Efforts and Investment Dynamics Reshaping the Global Cannabis Pharmaceuticals Ecosystem

Scientific breakthroughs have accelerated the refinement of cannabinoid compounds, driving a wave of formulation innovations across a spectrum of delivery mechanisms. From hard-shell and soft-gel capsules engineered for precise dosing to broad-spectrum, full-spectrum, and isolate oils optimized for specialized indications, product pipelines are rapidly diversifying. Alongside these advancements, topical creams, lotions, and salves have demonstrated targeted efficacy in dermatological applications, reflecting a growing demand for localized treatment options.

Deciphering the Strategic Consequences of U.S. 2025 Tariff Policies on Sourcing Production and Supply Chains for High-Purity Cannabis-Derived Pharmaceutical Products

In early 2025, the United States administration initiated a Section 232 investigation into pharmaceutical imports, encompassing finished drug products, active pharmaceutical ingredients (APIs), and derivative components critical to drug manufacturing. Concurrently, announcements of potential tariffs of up to 200% on imported pharmaceuticals-coupled with a baseline 10% global tariff on goods including medical devices and APIs-have unsettled supply chains and raised costs across the sector. Although medical cannabis and hemp-derived cannabinoid products remain largely exempt from these levies, ancillary goods such as extraction machinery, packaging materials, and lab equipment are subject to higher duties, increasing operational expenses for producers and contract manufacturers.

These trade measures have prompted a strategic reassessment of sourcing strategies, with companies exploring domestic and nearshore manufacturing alternatives to mitigate tariff exposure. However, limitations in local economies of scale and technical specialization mean that reshoring often results in higher costs and production delays. At the same time, investor sentiment has shown caution, with some capital raises deferred as market participants await greater clarity on tariff enforcement and regulatory timelines. In aggregate, the trajectory of U.S. tariff policy in 2025 underscores the need for agile supply chain management and proactive risk mitigation in cannabinoid-based pharmaceutical development.

Unveiling the Multifaceted Segmentation of Cannabis Pharmaceuticals Product Variety Compound Spectrum Administration Pathways Distribution Channels and End-User Roles

Product type nuances significantly influence formulation strategies in cannabis pharmaceuticals, where hard-shell and soft-gel capsules offer discreet, consistent dosing, appealing especially to patients requiring regimen compliance. Oil-based formats-available in broad-spectrum, full-spectrum, and isolate varieties-cater to distinct pharmacokinetic profiles, enabling personalized therapeutic approaches. Patches and tinctures further diversify delivery options, balancing onset speed with duration of action, while creams, lotions, and salves provide targeted relief in topical applications.

Diverse cannabinoid profiles play a pivotal role in clinical differentiation: non-psychoactive cannabidiol (CBD) leads in anti-inflammatory and anxiolytic indications, cannabigerol (CBG) is under investigation for neuroprotective and antibacterial properties, cannabinol (CBN) is explored for its potential sedative benefits, and delta-9-tetrahydrocannabinol (THC) remains central in appetite stimulation and spasticity management. These compound-specific attributes align with application areas spanning dermatology, neurological disorders, oncology support, and pain management, where the selection of active ingredients is calibrated to therapeutic objectives.

Route of administration further refines patient experience and pharmacodynamics: inhalation offers rapid onset for acute symptom relief, oral ingestion and sublingual delivery provide controlled, sustained release, and topical applications limit systemic exposure while targeting localized tissue. Distribution pathways-from direct-to-patient sales to hospital and retail pharmacy networks, including online platforms-ensure accessibility across care settings. End users ranging from specialized clinics and hospitals to homecare services and dedicated treatment centers tailor product selection to patient demographics and clinical requirements, driving segmentation-informed development and commercialization strategies.

This comprehensive research report categorizes the Cannabis Pharmaceuticals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Compound Type

- Route Of Administration

- Application

- End User

- Distribution Channel

Examining Divergent Regional Dynamics Shaping Cannabis Pharmaceuticals Across the Americas Europe Middle East & Africa and Asia-Pacific Markets

In the Americas, the United States navigates federal scheduling constraints even as individual states expand medical and adult-use programs. Canada’s federally regulated framework continues to mature, supporting clinical research collaborations and GMP-certified production. Curaleaf, Green Thumb Industries, and other North American leaders exemplify the convergence of pharmaceutical-grade manufacturing with patient-centric distribution models.

Across Europe, Middle East & Africa, Germany’s decriminalization and planned regulatory reforms promise broader patient access and clinical trial opportunities. Australia’s stringent quality protocols position local producers as global suppliers of pharmaceutical-grade cannabis biomass, while Israel’s evolving export pilot programs underscore its role as an innovation hub and import market, balancing domestic supply with international trade ambitions.

In Asia-Pacific, jurisdictions such as Japan and South Korea are cautiously advancing clinical research, often under strict licensing regimes, while New Zealand explores expanded medical use pathways. Australia’s progressive GMP standards and growing export partnerships further cement the region’s importance in the upstream cultivation and downstream formulation stages of cannabis pharmaceuticals.

This comprehensive research report examines key regions that drive the evolution of the Cannabis Pharmaceuticals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders from Jazz Pharmaceuticals to Panaxia Highlighting Strategic Portfolios Partnerships Clinical Leadership and Global Distribution Strategies

Jazz Pharmaceuticals stands at the forefront with its FDA-approved Epidiolex, which generated over $972 million in 2024 through global launches and robust prescriber uptake, marking it as the first cannabinoid-based therapy to achieve blockbuster status. Following the GW Pharmaceuticals acquisition, Jazz has expanded its neuroscience and oncology portfolios, leveraging cannabinoid science to enhance its therapeutic pipeline.

Tilray Brands has transitioned from cultivation-centric operations to a strategic focus on R&D, forming partnerships to develop novel cannabinoid APIs and exploring clinical trials aligned with neurological and oncological indications. Canopy Growth has refocused on pharmaceutical-grade formulations, emphasizing standardized spectrum products and licensure in key European markets.

Curaleaf and Green Thumb Industries lead vertically integrated models in North America, combining cultivation scale with branded pharmaceutical and wellness offerings distributed through a network of dispensaries and pharmacies. In Israel, Panaxia and BOL Pharma harness EU-GMP partnerships to supply oils and tablets abroad, navigating export certification frameworks and driving cross-border collaboration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cannabis Pharmaceuticals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Aphria, Inc.

- Aurora Cannabis, Inc.

- Bausch Health Companies, Inc.

- Botanix Pharmaceuticals

- Breath of Life Pharma, Ltd.

- Cannabis Science, Inc.

- Cannamedical Pharma GmbH

- Canopy Growth Corporation

- Cara Therapeutics Inc.

- CB Therapeutics Inc.

- Celadon Pharmaceuticals PLC

- Corbus Pharmaceuticals Holdings, Inc.

- Cronos Group Inc. By Altria Group

- Green Thumb Industries

- Jazz Pharmaceuticals PLC

- Medical Marijuana Inc.

- MGC Pharmaceuticals Limited

- Panaxia Pharmaceutical Industries

- Pascal Biosciences Inc.

- PharmaCyte Biotech, Inc.

- Renew Biopharma, Inc.

- Teva Pharmaceutical Industries Ltd.

- Tilray Brands, Inc.

- Zynerba Pharmaceuticals, Inc. by Harmony Biosciences

Actionable Strategic Imperatives for Industry Leaders Including Regulatory Engagement Formulation Innovation and Omnichannel Distribution for Sustainable Growth

Industry leaders should prioritize proactive engagement with regulatory agencies to influence policy frameworks and anticipate classification shifts that impact research and commercialization. Establishing strategic alliances for API sourcing and localized manufacturing can mitigate the cost burdens of tariff uncertainties. Investing in advanced formulation technologies-such as nanoemulsions, transdermal patches, and precision-dosing capsules-will differentiate offerings and address evolving patient preferences.

To capture emerging therapeutic niches, companies must align compound selection with targeted applications, leveraging robust pharmacological data on CBD, CBG, CBN, and THC to inform product design. Integrating digital health platforms for patient monitoring and outcome tracking can enhance real-world evidence generation, supporting reimbursement pathways and clinician adoption. Finally, expanding distribution through omnichannel strategies-combining direct-to-patient, hospital pharmacies, and licensed online outlets-will optimize market reach and patient accessibility.

Robust Research Approach Integrating Expert Interviews Literature Review Government Filings and Proprietary Analytical Frameworks for Comprehensive Cannabis Pharma Insights

This report synthesizes insights from primary interviews with industry executives, regulatory officials, and clinical experts, complemented by extensive secondary research across peer-reviewed journals, trade databases, and public company filings. Proprietary analyses of Section 232 investigations and tariff implications draw on government notices and trade press, ensuring accuracy in assessing supply chain risks. Clinical segmentation and administration route profiling are informed by pharmacokinetic studies and provider surveys, offering a robust understanding of patient and clinician preferences.

Data triangulation is achieved through cross-referencing market intelligence platforms, patent filings, and conference proceedings. Each segment’s insights are validated through expert panel reviews to enhance credibility and mitigate bias. Quantitative and qualitative findings are integrated within a proprietary analytical framework, providing a comprehensive view of the cannabis pharmaceuticals landscape from regulatory evolution to competitive dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cannabis Pharmaceuticals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cannabis Pharmaceuticals Market, by Product Type

- Cannabis Pharmaceuticals Market, by Compound Type

- Cannabis Pharmaceuticals Market, by Route Of Administration

- Cannabis Pharmaceuticals Market, by Application

- Cannabis Pharmaceuticals Market, by End User

- Cannabis Pharmaceuticals Market, by Distribution Channel

- Cannabis Pharmaceuticals Market, by Region

- Cannabis Pharmaceuticals Market, by Group

- Cannabis Pharmaceuticals Market, by Country

- United States Cannabis Pharmaceuticals Market

- China Cannabis Pharmaceuticals Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings on Regulatory Evolution Tariff Impacts Segmentation Trends and Strategic Pathways in Cannabis Pharmaceuticals

The cannabis pharmaceuticals sector stands at a critical juncture, with regulatory shifts, tariff dynamics, and scientific advances converging to redefine opportunity landscapes. While U.S. tariff policies introduce cost pressures, strategic supply chain realignments and localized manufacturing can buffer impacts. Simultaneously, evolving compound science and multi-modal delivery systems are expanding therapeutic potential across dermatology, neurology, oncology support, and pain management.

Regional variations-from North America’s state-driven frameworks to Europe’s regulatory harmonization efforts and Asia-Pacific’s cautious clinical expansions-underscore the importance of adaptive market strategies. Leading organizations are leveraging partnerships, R&D investments, and advanced formulation technologies to differentiate offerings and capture value.

As the industry continues to mature, stakeholders must align regulatory foresight, segmentation-driven product development, and omnichannel distribution approaches to navigate complexity and sustain growth in the dynamic cannabis pharmaceuticals domain.

Partnering with Ketan Rohom Unlocks Exclusive Cannabis Pharmaceuticals Market Insights for Strategic Competitive Advantage

Interested in accessing a detailed and expertly crafted report on cannabis pharmaceuticals? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to unlock proprietary insights, strategic analyses, and comprehensive competitive intelligence tailored to inform your organization’s next strategic move. Secure your copy today and empower your decision-making with industry-leading expertise.

- How big is the Cannabis Pharmaceuticals Market?

- What is the Cannabis Pharmaceuticals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?