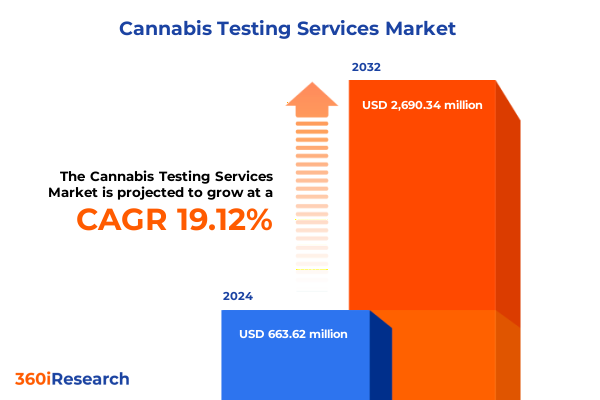

The Cannabis Testing Services Market size was estimated at USD 784.35 million in 2025 and expected to reach USD 932.79 million in 2026, at a CAGR of 19.25% to reach USD 2,690.34 million by 2032.

Navigating the Complexities of Modern Cannabis Testing to Ensure Unwavering Quality, Safety, and Regulatory Adherence in a Dynamic Market

The cannabis testing landscape has evolved into a multifaceted ecosystem where safety, quality assurance, and regulatory compliance intersect at every stage of the supply chain. Laboratories today are tasked not only with validating potency and detecting contaminants but also with upholding stringent standards that vary across jurisdictions. Consequently, laboratories must integrate rigorous analytical protocols with robust quality management systems to address an expanding array of risks-from microbial pathogens and heavy metals to pesticide residues and solvent carryover. With regulatory bodies continuously updating requirements to reflect emerging scientific evidence and public health priorities, laboratories face the dual challenge of maintaining operational agility while rigorously adhering to evolving mandates.

Moreover, the convergence of diverse stakeholders, including cultivators, manufacturers, distributors, and regulators, has created an environment in which data integrity and turnaround times can significantly influence market access and brand reputation. In response, industry participants are investing in advanced instrumentation, adopting digital workflows, and pursuing accreditation under internationally recognized standards. These efforts not only streamline sample throughput but also support traceability and transparency from seed-to-sale. This introduction sets the stage for a detailed examination of the transformative shifts, tariff-driven pressures, segmentation dynamics, regional variations, and competitive strategies that define the cannabis testing sector in 2025.

Examining the Unprecedented Technological, Regulatory, and Consumer-Driven Transformations Reshaping the Cannabis Testing Ecosystem Worldwide

In recent years, the cannabis testing sector has undergone unprecedented technological advances, regulatory overhauls, and shifting consumer expectations that have collectively redefined its operational contours. Technological breakthroughs in chromatography and mass spectrometry have enabled laboratories to detect trace-level compounds with unparalleled precision, which, in turn, has elevated the benchmark for analytical rigor. At the same time, digital transformation initiatives-ranging from laboratory information management systems to blockchain-based traceability solutions-are enhancing data integrity and accelerating decision-making across the supply chain.

Simultaneously, regulatory agencies are harmonizing and, in some cases, tightening testing requirements to address emerging public health concerns related to contaminants and novel consumption formats. This tightening of standards has prompted laboratories to expand their testing portfolios and validate new analytical methods. Additionally, consumer-driven trends toward product differentiation-such as terpene profiling for distinctive flavor experiences and comprehensive potency labeling for minor cannabinoids-have spurred laboratories to diversify service offerings. As a result, industry leaders are collaborating with technology providers to co-develop bespoke assays and turnkey solutions that integrate sample preparation automation, high-throughput instrumentation, and advanced data analytics, thereby unlocking new efficiency gains and competitive advantages.

Assessing the Broad Economic and Operational Consequences of 2025 United States Tariffs on the Cannabis Testing Supply Chain and Industry Dynamics

Since early 2025, laboratories conducting cannabis testing have faced escalating costs and supply chain disruptions driven by a series of tariff measures imposed by the United States government. A Reuters briefing highlighted that hardware components-such as chromatography columns, mass spectrometry systems, specialized glassware, and consumer-facing vape hardware-are subject to new duties that compel firms to renegotiate supply agreements or absorb added expenses, often passing costs downstream to consumers. These tariffs have compounded existing trade tensions, generating procurement bottlenecks that extend analytical turnaround times and compress laboratory margins.

Complementing these sector-specific impacts, an April 2025 analysis reported that U.S. laboratories now contend with a universal 10% tariff on imported goods, alongside elevated country-specific rates that escalate tariffs on Chinese lab instruments to as much as 145%. This convergence of universal and targeted duties has driven laboratories to re-evaluate sourcing strategies, prioritize domestic or USMCA-compliant suppliers, and adapt inventory management practices to mitigate cost spikes. Consequently, many laboratories are accelerating partnerships with local distributors and exploring secondary markets for pre-owned equipment to maintain service continuity and uphold compliance in an increasingly volatile trade environment.

Unveiling Critical Segmentation Perspectives Spanning Test Types, Product Varieties, End Users, Analytical Technologies, and Laboratory Frameworks

Understanding the full spectrum of cannabis testing services requires a nuanced appreciation of multiple analytical dimensions. When laboratories evaluate offerings by test type, they must account for foundational assessments such as heavy metal analysis and moisture content determinations alongside specialized modalities, including microbial examinations that span endotoxin detection, pathogenic bacteria screening, total aerobic counts, and yeast and mold assays; pesticide evaluations that encompass carbamate, organochlorine, organophosphate, and pyrethroid analyses; as well as comprehensive potency assessments that differentiate among CBD quantification, minor cannabinoid profiling, and THC concentration. Further depth is achieved through residual solvent scrutiny and terpene fingerprinting, which collectively inform product safety and sensory characteristics.

This complexity is mirrored in the range of product formats laboratories service, from infused beverages and concentrated extracts to edibles, dried flower, oils, tinctures, and topical preparations. Each matrix presents unique extraction and detection challenges that influence method validation protocols and throughput considerations. Additionally, end users such as dispensaries seek rapid compliance testing to facilitate time-sensitive releases, whereas growers and manufacturers rely on iterative quality audits to optimize cultivation and production workflows. Regulatory authorities and research institutions, on the other hand, emphasize method rigor and reproducibility to guide public policy and scientific advancement.

The analytical backbone underpinning these services spans established platforms like gas chromatography-mass spectrometry, high-performance liquid chromatography, inductively coupled plasma-mass spectrometry, and liquid chromatography-tandem mass spectrometry, as well as emerging techniques such as near-infrared spectroscopy and polymerase chain reaction. Laboratories must weigh instrument performance, operational costs, and data management capabilities when selecting technology suites. Finally, organizational structures differ between contract laboratories that offer broad third-party testing portfolios and in-house setups embedded within vertically integrated operators, each model carrying distinct operational and strategic implications.

This comprehensive research report categorizes the Cannabis Testing Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Product Type

- Technology

- Lab Type

- End User

Highlighting Regional Nuances Driving Demand and Innovation Across the Americas, Europe Middle East & Africa, and Asia-Pacific Testing Markets

Regional dynamics exert a profound influence on the strategic priorities and operational capacity of cannabis testing facilities. In the Americas, a mature regulatory environment-anchored in comprehensive state-level mandates and federal clarification efforts-has incentivized significant consolidation among service providers and fostered advanced method standardization. Laboratories in North America benefit from extensive reference laboratories, robust accreditation frameworks, and a high degree of cross-border collaboration between adjacent legal jurisdictions. Meanwhile, in Latin America, emerging markets are beginning to adopt integrated testing regimes that emphasize affordability and scalability, catalyzing investment in modular laboratory infrastructure.

Transitioning to Europe, the Middle East, and Africa, stakeholders face a heterogeneous regulatory mosaic. European Union members are progressively aligning testing requirements under centralized directives, which is driving the adoption of pan-European quality benchmarks and encouraging the pooling of analytical resources. Conversely, markets in the Middle East and Africa are characterized by nascent legalization efforts and cautious regulatory approaches that prioritize import controls and public health surveillance, thereby creating opportunities for mobile and satellite laboratory models.

In the Asia-Pacific region, the interplay between evolving medical cannabis frameworks and stringent public health policies underscores a dual focus on analytical innovation and regulatory oversight. Countries such as Australia and Japan are investing heavily in polymerase chain reaction-based pathogen screening and near-infrared spectroscopy for rapid in-field assessments, while Southeast Asian nations are piloting harmonized testing protocols to support both local therapeutic markets and research initiatives. Collectively, these regional distinctions shape demand for specialized instrumentation, expertise, and service delivery models across global testing ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Cannabis Testing Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Approaches, Collaborations, and Technological Leadership Among Key Players Shaping the Cannabis Testing Industry

Industry leadership in cannabis testing is increasingly defined by strategic collaborations, technological differentiation, and scalable service models. Major international analytical service providers leverage expansive networks of accredited laboratories and standardized methods to ensure consistency across multiple jurisdictions, while regional specialists differentiate through niche expertise in local regulatory requirements and matrix-specific protocols. Collaborative alliances between instrument vendors and laboratories have given rise to co-developed assay kits and turnkey workflows, which reduce method transfer times and enhance data comparability.

Innovation is also propelled by continuous investment in high-throughput automation and advanced data analytics. Leading laboratories are integrating laboratory information management systems with advanced analytics platforms to enable predictive quality control and real-time performance monitoring. This integration facilitates dynamic scheduling, proactive maintenance of instrumentation, and sophisticated trend analysis that benefits both routine compliance testing and research-driven quality improvement programs.

Moreover, selective mergers and acquisitions among contract laboratories and vertically integrated operators are expanding service footprints and diversifying client portfolios. By combining complementary capabilities-such as molecular pathogen testing, mycotoxin analysis, and bespoke method development-these entities can offer end-to-end solutions from sample intake through final reporting. This consolidation trend underscores a broader strategic imperative: to balance specialized scientific expertise with operational scale and geographic reach.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cannabis Testing Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Anresco Laboratories

- Autoscribe Informatics by Xybion Digital Inc.

- Bia Diagnostics, LLC

- CATLAB, LLC

- Danaher Corporation

- Digipath Inc.

- Eurofins Scientific SE

- EVIO Inc.

- Hamilton Company

- MCR Labs

- PerkinElmer, Inc.

- ProVerde Laboratories, Inc.

- ProVerde Laboratories, Inc.

- Restek Corporation

- Saskatchewan Research Council

- SC Laboratories, Inc.

- SGS SA

- Shimadzu Corporation

- Steep Hill Inc. by Canbud Distribution Corporation

- The Smithers Group Inc.

- Thermo Fisher Scientific, Inc.

- Trichome Analytical LLC

- Waters Corporation

Strategic Imperatives for Industry Leaders to Enhance Compliance, Innovation, and Operational Efficiency in Cannabis Testing Practices

Leaders in the cannabis testing sector must adopt a multifaceted strategy that aligns scientific innovation with operational excellence. To begin, laboratories should prioritize investments in state-of-the-art analytical platforms that deliver both sensitivity and throughput; this focus will enable rapid response to regulatory changes and evolving consumer demands. Moreover, establishing strategic partnerships with instrument manufacturers and consumables suppliers can secure favorable service agreements, reduce procurement risk, and foster collaborative method optimization.

In addition, organizations should implement robust quality management systems that exceed baseline accreditation standards, incorporating continuous training programs and proficiency testing to reinforce analytical accuracy and data integrity. Cross-functional teams should be empowered to conduct root cause analyses of critical deviations and implement corrective actions swiftly, thereby minimizing rework and maintaining customer confidence.

Furthermore, embracing digital transformation through end-to-end sample tracking, electronic recordkeeping, and automated data analytics will streamline workflows and enhance transparency for clients. By leveraging digital dashboards and predictive analytics, laboratories can anticipate maintenance needs, optimize resource allocation, and deliver value-added insights alongside routine test results. Finally, cultivating a client-centric culture that emphasizes open communication, tailored reporting formats, and ongoing education programs will differentiate service offerings and foster long-term partnerships with cultivators, manufacturers, and regulatory stakeholders.

Detailing the Rigorous Research Framework, Data Collection Techniques, and Analytical Processes Underpinning the Cannabis Testing Market Study

The research underpinning this market study adheres to a rigorous, multi-phase framework designed to ensure data integrity, methodological transparency, and actionable insights. Primary data was collected through in-depth interviews with laboratory directors, quality assurance managers, regulatory experts, and equipment manufacturers, providing firsthand perspectives on technology adoption, regulatory compliance, and market dynamics. These interviews were complemented by structured surveys distributed across a representative sample of contract laboratories and in-house facilities to quantify service portfolios, instrumentation footprints, and operational challenges.

Secondary research involved a comprehensive review of regulatory guidelines, industry white papers, peer-reviewed journals, and trade association publications to contextualize market trends and identify emerging analytical methods. Publicly available patent filings, conference proceedings, and technical application notes were analyzed to map the innovation landscape and forecast potential technology trajectories. Data triangulation techniques were employed to reconcile discrepancies between primary findings and secondary sources, ensuring a balanced synthesis of qualitative and quantitative evidence.

Analytical outputs were validated through peer review by external subject-matter experts who assessed the robustness of conclusions, the relevance of case studies, and the applicability of recommendations. This iterative validation process fostered methodological rigor and reinforced the credibility of the final report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cannabis Testing Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cannabis Testing Services Market, by Test Type

- Cannabis Testing Services Market, by Product Type

- Cannabis Testing Services Market, by Technology

- Cannabis Testing Services Market, by Lab Type

- Cannabis Testing Services Market, by End User

- Cannabis Testing Services Market, by Region

- Cannabis Testing Services Market, by Group

- Cannabis Testing Services Market, by Country

- United States Cannabis Testing Services Market

- China Cannabis Testing Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Consolidating Core Insights and Implications to Illuminate the Path Forward for Stakeholders Across the Evolving Cannabis Testing Landscape

The convergence of regulatory evolution, technological innovation, and shifting market demands has established a new paradigm for cannabis testing services. Laboratories that invest in advanced analytical platforms, adopt harmonized quality standards, and harness digital tools for data management stand to achieve both operational efficiency and market differentiation. Tariff-induced pressures have underscored the importance of resilient supply chains and strategic sourcing, while segmentation analysis has revealed diverse needs across test types, product formats, end-user segments, and technology preferences. Regional insights highlight that success hinges on navigating unique regulatory landscapes and leveraging localized expertise.

Industry consolidation and strategic collaborations among key players are reshaping the competitive terrain, creating opportunities for service expansion and method standardization. For stakeholders ranging from cultivators and manufacturers to regulators and research institutions, the path forward involves embracing a proactive mindset toward compliance, continuous innovation, and client-centric service delivery. By aligning scientific rigor with operational agility, laboratories can not only meet current regulatory requirements but also anticipate future developments, ensuring sustained growth and leadership in this rapidly evolving sector.

Engage with Ketan Rohom to Secure In-Depth Insights and Access Comprehensive Cannabis Testing Research Tailored to Your Strategic Objectives

To explore the detailed findings and unlock competitive advantages through comprehensive cannabis testing insights, connect directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) who can guide you through the report’s rich analysis and bespoke recommendations. He can provide deeper perspectives on evolving regulations, technological innovations, and market dynamics specific to your strategic needs. By engaging with Ketan, you’ll gain direct access to proprietary data, expert commentary, and tailored consulting opportunities that empower you to make informed decisions and achieve operational excellence. Don’t miss the opportunity to leverage this essential research for your organization’s growth and compliance goals; reach out to Ketan Rohom today to request a sample chapter, discuss pricing, or schedule a personalized briefing that aligns with your objectives.

- How big is the Cannabis Testing Services Market?

- What is the Cannabis Testing Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?