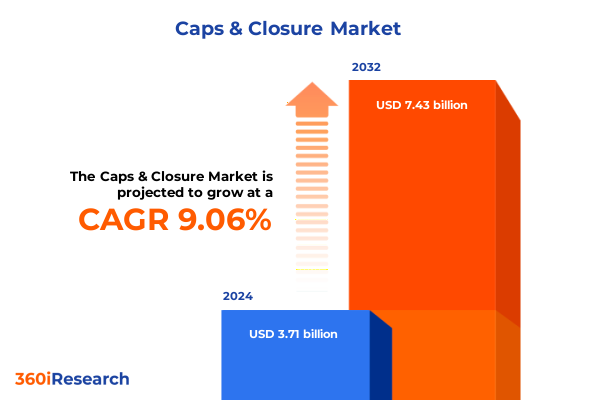

The Caps & Closure Market size was estimated at USD 4.00 billion in 2025 and expected to reach USD 4.33 billion in 2026, at a CAGR of 9.21% to reach USD 7.43 billion by 2032.

Exploring the Dynamic World of Caps and Closures and Unveiling Critical Drivers That Are Reshaping Industry Trajectories Globally

In an era defined by rapid change and growing complexities across global supply chains, the caps and closures sector stands at a pivotal inflection point. The intersection of shifting consumer expectations, heightened regulatory scrutiny, and escalating sustainability imperatives has propelled manufacturers and brand owners to rethink every element of product presentation and protection. As a result, decision-makers must gain a holistic understanding of the technological innovations, material evolutions, and logistical considerations that now shape strategic planning and operational excellence.

This introduction lays the groundwork for a thorough exploration of the forces and factors that drive market behavior in the caps and closures industry. From the transformative impact of advanced polymers and lightweight metal alloys to the ripple effects of tariff measures, each dynamic is dissected to illuminate its significance. Beyond mere description, the ensuing analysis unpacks how these elements coalesce to redefine competitive benchmarks, inform investment priorities, and signal new pathways for sustainable growth. Readers will emerge equipped with a clear frame of reference, empowering them to navigate complexity and harness emerging possibilities with confidence.

Identifying Transformative Shifts in Caps and Closures That Are Driving Innovation Sustainability and Operational Efficiency Across the Value Chain

Over recent years, the caps and closures landscape has been transformed by several profound shifts that extend from material science breakthroughs to digital integration at the point of production. Innovations in high-performance polymers, for instance, have enabled the design of closures that not only ensure hermetic sealing but also enhance end-user convenience through ergonomic features and child-resistant mechanisms. Simultaneously, the adoption of artificial intelligence and machine vision in extrusion and injection molding processes has elevated quality assurance standards, enabling real-time defect detection and reducing waste.

Equally significant has been the drive toward circularity, compelling market participants to integrate recycled content and design for disassembly. As brand owners respond to consumer demand for transparency and sustainability claims, they partner with suppliers to implement closed-loop systems, wherein post-consumer resin is reintegrated into new cap and closure production. These endeavors, reinforced by policy incentives and ecological certifications, underscore how environmental considerations now intersect with cost efficiency and brand reputation. Collectively, these trends mark a paradigm shift-where material evolution, digitalization, and sustainability converge to redefine industry norms and competitive advantage.

Examining How Recent United States Tariff Measures Have Cumulatively Impacted the Caps and Closures Industry Ecosystem and Supply Chains

Since the introduction of broadened tariff measures on key packaging inputs in 2025, the caps and closures industry has encountered complex cost and supply chain implications. While the policy intent aimed to fortify domestic manufacturing of aluminum and select engineered plastics, the cumulative effect has reverberated across international trade corridors. As import duties on metal closures rose, downstream producers faced elevated raw material expenditures, compelling a recalibration of supplier contracts and procurement models.

Consequently, many stakeholders diversified their sourcing mix by forging partnerships with regional material providers to mitigate exposure to import levies. Yet this pivot introduced secondary challenges, including variable material grades and lead-time unpredictability. In parallel, enhancements to customs classification guidelines resulted in more rigorous inspections at ports, translating to extended lead times for certain closure types. Ultimately, these tariff-driven dynamics have underscored the strategic importance of supply chain resilience, prompting industry actors to strengthen collaborative planning mechanisms, invest in inventory safeguards, and explore alternative material blends.

Revealing Key Segmentation Patterns Based on Material Type and Application That Inform Targeted Strategies in the Caps and Closures Market

The caps and closures market exhibits a rich tapestry of segmentation, each dimension revealing distinct implications for product design, cost structure, and end-market suitability. By material, the sector divides into composite, metal, and plastic substrates. Composite constructions marry lightweight polymers with reinforcing agents to balance durability and aesthetic appeal. Metal closures concentrate on aluminum and tinplate, where aluminum’s corrosion resistance and tinplate’s printability fulfill diverse packaging demands. Within the plastic realm, high-density polyethylene offers exceptional toughness for heavy-duty applications, polyethylene terephthalate delivers transparency and chemical stability for beverages, and polypropylene combines heat resistance with formability for hot-fill products.

Turning to closure types, corks impart a premium touch, particularly in wine and spirit segments, while flip-top variants cater to personal care lines with their ease of access. Screw closures, ubiquitous across bottled water and edible oil, provide reliable sealing, and snap-on designs find favor in quick-service food packaging for their convenience. Application segmentation further refines the landscape: the cosmetics and personal care sphere leverages hair care and skin care formulations that demand compatibility with active ingredients, whereas food and beverage closures must navigate subcategories such as alcoholic beverages, carbonated drinks, and water, each presenting distinct viscosity and gas-retention requirements. Pharmaceutical closures bifurcate into injectable and oral solid, with the latter subdividing into capsules and tablets, where tamper-evidence and moisture-barrier properties are paramount.

Finally, end-use verticals crystallize market opportunities by spotlighting bottled water, where lightweight screw caps remain a core element; edible oils, which lean toward larger diameter closures with child-resistant features; soft drinks, emphasizing pressures and carbonation integrity; and wine and spirits, which prioritize both tradition through corks and convenience via synthetic alternatives. By deciphering these segmentation layers, stakeholders can align product roadmaps with end-user preferences, optimize material sourcing, and tailor innovation pipelines to address nuanced performance criteria.

This comprehensive research report categorizes the Caps & Closure market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Type

- Application

- End Use

Uncovering Regional Nuances in the Caps and Closures Landscape with a Strategic Focus on Americas EMEA and Asia Pacific Market Dynamics

Regional landscapes shape caps and closures strategies in profoundly different ways, influenced by regulatory frameworks, consumer behavior, and raw material availability. In the Americas, a strong emphasis on convenience packaging and eco-friendly designs prevails, driven by both consumer demand for on-the-go consumption and legislative momentum toward recyclability. North American producers have responded with closures incorporating post-consumer resin and refill-friendly mechanisms, while South American markets leverage locally abundant metal resources for tinplate and aluminum variants.

Across Europe, Middle East & Africa, stringent environmental directives and extended producer responsibility schemes have spurred advanced trials of biodegradable polymers and material-light closures. Western European brand owners often pilot novel multilayer systems, whereas MENA players prioritize cost-effective adaptations of existing designs to accommodate emerging economies. Meanwhile, in Asia-Pacific, rapid urbanization and a burgeoning middle class elevate demand for premium packaging. Regional specialists in high-density polyethylene and polypropylene are optimizing plant footprints to serve local beverage and personal care giants, while cross-border collaborations facilitate technology transfers and capacity expansions to meet accelerating consumption patterns.

These regional distinctions underscore the importance of tailoring go-to-market approaches. By understanding how regulatory, cultural, and resource considerations inform closure design and material selection, manufacturers and brand owners can unlock growth pockets and mitigate localized risks more effectively.

This comprehensive research report examines key regions that drive the evolution of the Caps & Closure market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Companies and Competitive Strategies That Are Shaping the Competitive Landscape of the Caps and Closures Sector

Leading companies in the caps and closures space demonstrate a blend of scale, innovation prowess, and supply chain dexterity. Global packaging conglomerates have reinforced their market positions by integrating forward into value-add services such as design thinking workshops and regulatory advisory, ensuring that their closure offerings align with evolving consumer needs and compliance standards. Their investments in advanced tooling and in-house polymer compounding provide end-to-end control over quality and customization, addressing demanding applications from pharmaceuticals to premium spirits.

Mid-tier specialists, by contrast, leverage agility to seize niche segments-such as high-barrier closures for beverage carbonation or child-resistant systems for edible oils. Partnerships between these players and emerging consumer packaged goods companies have facilitated rapid prototyping and short-run production models, enabling brand owners to test innovative closure concepts with limited risk. Simultaneously, vertically integrated metal producers capitalize on integrated smelter operations to guarantee raw material security and cost predictability, setting competitive benchmarks in aluminum and tinplate closures.

Competitive differentiation often hinges on sustainability credentials, with frontrunners achieving significant milestones in recycled content, carbon footprint reduction, and material-light design. These accomplishments not only resonate with regulatory requirements but also strengthen brand storytelling, reinforcing customer loyalty. Altogether, the competitive landscape is characterized by a dynamic interplay among global scale, specialized expertise, and sustainability leadership, driving continuous evolution in cap and closure solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Caps & Closure market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albea SA.

- Alpla Holdings GmbH

- Amcor Ltd.

- AptarGroup Inc.

- BERICAP Holding GmbH

- Berlin Packaging UK

- Berry Global, Inc.

- Blue Ocean Closures

- Borealis AG

- Caps and Closures Pty Ltd

- Chemco Group

- Closure Systems International Inc.

- Crown Holdings, Inc.

- Duravant LLC

- Hoffer Plastics Corporation

- Jokey Group

- MOCAP, LLC

- MRP Solutions

- O.Berk Company, LLC

- Pact Group Holdings Ltd.

- Phoenix Closures, Inc. by Sonoco Products Company

- Silgan Holdings Inc.

- Tetra Laval International S.A.

- TotalEnergies SE

- United Caps Luxembourg S.A.

Providing Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in the Caps and Closures Arena

To navigate this multifaceted market environment, companies should prioritize a dual-track approach that balances sustainability innovation with agile supply chain design. First, embedding circularity into product development-from selecting compatible recycling grades to optimizing geometry for material reduction-will yield long-term cost efficiencies and bolster brand equity. In parallel, establishing strategic partnerships with regional resin and metal suppliers can mitigate tariff risks and stabilize input costs, while cross-functional teams align procurement, R&D, and marketing for faster decision cycles.

Moreover, adopting advanced digital tools such as predictive maintenance platforms and AI-driven quality analytics can streamline operations and minimize waste. Firms should also explore modular manufacturing footprints that enable flexible shifts between plastic and metal lines in response to market signals. Equally important is a relentless focus on consumer insights and regulatory horizon scanning; monitoring evolving bottle closure requirements will open avenues for first-mover advantage. Collectively, these recommendations equip industry leaders to anticipate disruptions, enhance operational resilience, and unlock sustainable growth across diverse caps and closures segments.

Detailing Rigorous Research Methods and Data Collection Approaches Underpinning the Comprehensive Analysis of the Caps and Closures Market

The research underpinning this analysis integrates a blend of primary and secondary methodologies to ensure comprehensiveness and rigor. Primary investigations include structured interviews with supply chain executives, material scientists, and brand managers, providing firsthand perspectives on technology adoption, regulatory impacts, and customer preferences. These qualitative insights are complemented by surveys targeting plant operations teams to quantify process efficiencies, defect rates, and sustainability initiatives across diverse closure production lines.

Secondary research draws upon industry publications, patent filings, and regulatory agency data to map historical trends and forecast regulatory trajectories. In addition, trade association reports and technical papers inform the material science narrative, shedding light on emerging polymer formulations and metal alloy treatments. Data triangulation techniques ensure the validity of findings, while cross-referencing multiple sources enhances the robustness of market segmentation and competitive analysis. This methodological framework delivers a balanced, evidence-based view of the caps and closures domain, supporting reliable strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Caps & Closure market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Caps & Closure Market, by Material

- Caps & Closure Market, by Type

- Caps & Closure Market, by Application

- Caps & Closure Market, by End Use

- Caps & Closure Market, by Region

- Caps & Closure Market, by Group

- Caps & Closure Market, by Country

- United States Caps & Closure Market

- China Caps & Closure Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Drawing Conclusive Insights That Synthesize Industry Trends Strategic Implications and Future Pathways for the Caps and Closures Domain

Across the caps and closures spectrum, the synthesis of market trends and strategic imperatives reveals a sector in dynamic transformation. Innovations in material science are converging with digital manufacturing, while evolving consumer values and policy environments elevate sustainability to a core competitive pillar. Tariff developments have further underscored the necessity for supply chain diversification and operational adaptability, reinforcing the strategic value of resilient procurement models.

Segmentation insights demonstrate that nuanced material and closure type combinations serve distinct end-use requirements, from child-resistant edible oil caps to high-barrier pharmaceutical closures. Regional analyses highlight the divergent priorities of Americas, EMEA, and Asia-Pacific markets, emphasizing the need for localized strategies. Leading players distinguish themselves through integrated value-add services, rapid prototyping capabilities, and sustainability leadership. Together, these insights form a coherent narrative: success will depend on the ability to integrate circularity, leverage digital tools, and cultivate agile supply chain architectures. This conclusion provides a clear strategic compass for stakeholders seeking to thrive amidst evolving industry dynamics.

Engaging with Associate Director Ketan Rohom to Unlock Exclusive Caps and Closures Market Insights Through Premier Research Subscriptions

To explore the full breadth of market insights and gain a competitive edge with the most comprehensive analysis available today, reach out to the Associate Director, Sales & Marketing, Ketan Rohom. Guided by deep industry expertise and a commitment to delivering actionable intelligence, he will facilitate access to the in-depth report that empowers your organization to anticipate shifts in market dynamics, align strategic priorities, and capitalize on emerging cap and closure opportunities. Engage directly to secure tailored insights and enjoy priority support in leveraging these findings for sustainable growth and innovation.

- How big is the Caps & Closure Market?

- What is the Caps & Closure Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?