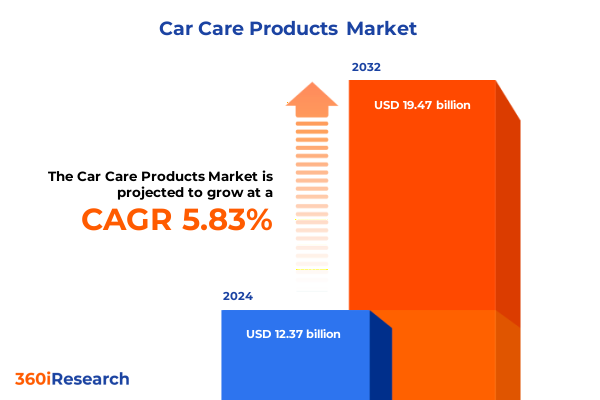

The Car Care Products Market size was estimated at USD 13.04 billion in 2025 and expected to reach USD 13.76 billion in 2026, at a CAGR of 5.88% to reach USD 19.47 billion by 2032.

Setting the Stage with an Engaging Overview of the Car Care Products Sector and Its Contemporary Market Dynamics and Drivers

The car care products sector has undergone a profound transformation in recent years, driven by a combination of shifting consumer behaviors, technological innovation, and evolving regulatory requirements. As vehicle ownership patterns change and cars remain on the road for longer, demand for maintenance and detailing products has surged, prompting suppliers to expand their portfolios and rethink their value propositions. Moreover, heightened environmental scrutiny has spurred the development of low-VOC and biodegradable formulas, reflecting a broader sustainability imperative that is reshaping R&D priorities within the industry.

In parallel, the proliferation of digital channels has revolutionized how end users discover, evaluate, and purchase car care solutions. E-commerce platforms and social media influencers now play pivotal roles in guiding purchase decisions, compelling incumbent manufacturers and emerging brands alike to invest in online engagement strategies. As a result, traditional distribution models are being complemented-and in some cases supplanted-by direct-to-consumer approaches. Consequently, industry stakeholders must navigate a complex ecosystem that spans product innovation, channel optimization, and regulatory compliance to capture the value presented by this dynamic market environment.

Examining Pivotal Technological Breakthroughs and Consumer Behavior Shifts That Are Reshaping the Car Care Product Landscape

Technological advancements have become a key catalyst for change within the car care products landscape, yielding formulations that offer superior performance while addressing growing environmental concerns. Nano-engineered coatings and polymer-based sealants now deliver longer-lasting protection against UV radiation, water spotting, and chemical contaminants. Concurrently, enzyme-based cleaners and waterless wash technologies have emerged to cater to eco-conscious consumers seeking efficient, resource-saving alternatives. These transformative innovations are redefining customer expectations and elevating quality benchmarks across the market.

Consumer behavior has similarly undergone a notable shift, with an increasing segment of end users embracing do-it-yourself maintenance routines rather than relying solely on professional detailers. This trend is underpinned by rising awareness of product efficacy, the influence of online tutorials, and greater access to specialized tools and accessories. At the same time, professional service providers are differentiating themselves through premium, bespoke offerings, leveraging advanced chemicals and specialized equipment. Consequently, both manufacturers and distributors are recalibrating their product portfolios and go-to-market tactics, focusing on performance claims, sustainability credentials, and digital engagement to resonate with diverse customer cohorts.

Analyzing the Cascading Economic Consequences of Recent United States Tariff Implementations on Car Care Product Supply Chains in 2025

The introduction of new tariff measures in early 2025 has introduced a fresh dimension of complexity for car care product stakeholders, particularly those reliant on imported raw materials and specialized equipment. Under these policies, a range of surfactants, polymers, and aerosol components have been subjected to elevated duties, resulting in an uptick in input costs for both multinational and domestic manufacturers. This realignment of cost structures has necessitated rapid supply chain adjustments, with many firms sourcing alternative chemical suppliers or renegotiating logistics contracts to alleviate margin pressure.

Moreover, the tariff landscape has influenced the competitive dynamics of branded versus private-label offerings. As input expenses escalate, white-label producers have sought to maintain price points by leveraging scale advantages and streamlined production processes, prompting established brands to emphasize differentiation through premium claims and certification standards. In response, several manufacturers have accelerated their innovation pipelines to introduce value-added formulations that justify higher retail pricing. Ultimately, industry participants that have proactively diversified sourcing geographies and optimized their procurement strategies are better positioned to weather the ripple effects of tariff-related disruptions.

Unveiling Nuanced Insights from a Multidimensional Segmentation Framework That Illuminates Consumer Preferences and Distribution Patterns

A multifaceted segmentation framework reveals nuanced dynamics across product categories, distribution channels, end users, applications, and car types. Based on product type, market analysis spans cleaners & degreasers, interior care, polishes & waxes, protectants, and tire & wheel care, with detailed sub-segments such as brake cleaner, engine degreaser, multi-purpose cleaner, carnauba wax, spray polish, and synthetic wax. In examining distribution channels, insights emerge from the performance of automotive dealerships, hypermarkets & supermarkets, online retail with manufacturer websites and third-party platforms, and specialty stores. When dissecting end user preferences, the contrast between DIY enthusiasts and professional detailers underscores divergent purchasing motivations, usage frequencies, and premiumization tendencies.

Applications further refine strategic opportunities by distinguishing between exterior and interior use cases, highlighting how surface protection and cleaning demands vary across touchpoints. Lastly, car type segmentation differentiates commercial vehicles from passenger cars, illuminating fleet maintenance requirements versus consumer-driven detailing rituals. Together, these segmentation dimensions provide a comprehensive lens through which manufacturers, distributors, and retailers can tailor product development, promotional efforts, and inventory management to align with the specific needs of each target audience.

This comprehensive research report categorizes the Car Care Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Car Type

- End User

- Application

- Distribution Channel

Highlighting Distinct Regional Market Characteristics and Growth Catalysts across the Americas, EMEA, and Asia-Pacific Car Care Sectors

Regional distinctions play a pivotal role in shaping the competitive contours and growth trajectories of the car care products market. In the Americas, a mature automotive ecosystem coexists with strong DIY tendencies, underpinned by established retail networks and a robust aftermarket services sector. Consumption patterns here are influenced by factors such as vehicle age distributions, climate extremes, and cultural preferences for hands-on maintenance approaches, driving sustained demand for both foundational and premium formulations.

In Europe, Middle East & Africa, regulatory stringency on chemical emissions and packaging sustainability has elevated the adoption of eco-friendly and recyclable car care solutions. Furthermore, the proliferation of urban detailing services and subscription-based maintenance models in advanced European markets is redefining how consumers perceive and access car care products. Turning to Asia-Pacific, rapid motorization across emerging economies, coupled with escalating per-capita incomes, has catalyzed growth in both DIY and professional channels. Urbanization trends and increasing vehicle parc sizes in metropolitan hubs are creating fertile ground for innovative spray-and-wipe systems and mobile detailing services, which align with busy consumer lifestyles.

This comprehensive research report examines key regions that drive the evolution of the Car Care Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives That Are Steering Innovation and Competitive Positioning in Car Care Products

Leading companies in the car care products arena have distinguished themselves through varied approaches to innovation, branding, and channel expansion. Some legacy manufacturers have doubled down on R&D investments to introduce advanced polymer coatings and eco-smart formulations, thereby reinforcing their premium market positioning and fortifying intellectual property portfolios. Others have pursued strategic partnerships and co-branding agreements to extend their reach into emerging e-commerce ecosystems, capturing digitally native consumers who prioritize convenience and authenticity.

Meanwhile, nimble regional players have capitalized on local market knowledge to develop formulations specifically tailored to climate and road conditions, earning loyalty through targeted product claims and competitive pricing. Mergers and acquisitions remain a prominent tactic, as global conglomerates seek to augment their portfolios with niche specialty brands that boast strong grassroots followings. Across the competitive landscape, successful companies are those that harmonize sustainability initiatives, brand storytelling, and channel diversification to sustain growth in a highly fragmented yet opportunity-rich marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Car Care Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Adolf Würth GmbH & Co KG

- Armor All

- Autoglym The Altro Group plc

- Bilt-Hamber Laboratories

- BULLSONE Co Ltd

- CarPro

- Chemical Guys

- Griot's Garage

- Illinois Tool Works Inc

- Jopasu India Pvt Ltd

- Liqui Moly GmbH

- Meguiar's Inc

- Menzerna Polishing Compounds GmbH & Co KG

- Mothers Polishes Waxes Cleaners

- P&S Sales Inc

- P21S Inc

- Simoniz USA Inc

- SOFT99 Corporation

- Sonax GmbH

- Stoner Car Care

- Tetrosyl Ltd

- Turtle Wax Inc

- ValetPRO Ltd

- Zymol Enterprises Inc

Outlining Strategic Actions and Operational Tactics that Industry Leaders Can Adopt to Capitalize on Emerging Trends in Car Care Products

To thrive in this evolving marketplace, industry leaders must adopt a multifaceted strategy that aligns product offerings with emerging customer demands and regulatory trajectories. Accelerating the development and launch of eco-certified formulations will not only satisfy tightening environmental legislation but also resonate with a growing cohort of sustainability-focused consumers. Additionally, deepening engagement in digital channels through personalized content, interactive tutorials, and subscription-based replenishment models can foster stronger brand loyalty and recurring revenue streams.

Equally critical is the optimization of global supply chains to mitigate the impact of tariffs and logistical bottlenecks. By diversifying raw material sourcing, leveraging nearshore manufacturing, and implementing advanced inventory-management systems, companies can enhance resilience and cost efficiency. Partnerships with logistics providers and reverse-logistics specialists can further streamline returns and recycling initiatives, bolstering overall value propositions. Finally, investing in targeted training programs for both DIY end users and professional detailers will empower sales channels to effectively communicate product benefits, driving incremental adoption across diverse market segments.

Detailing the Robust Research Methodology and Analytical Framework Employed to Ensure Rigor, Reliability, and Insightfulness of Market Findings

The insights presented in this report are underpinned by a rigorous research methodology combining secondary and primary data sources. Initially, extensive secondary research was conducted, encompassing industry publications, regulatory databases, trade journals, and financial reports to establish a macro-level understanding of market drivers and competitive dynamics. Subsequently, in-depth interviews were held with executives from manufacturers, distributors, retail partners, and detailing professionals to capture nuanced perspectives and validate emerging trends.

Quantitative data collection involved structured surveys distributed across key regions, with sampling stratified by distribution channel, end user type, and vehicle category to ensure representative coverage. Data triangulation was performed by cross-referencing survey findings with proprietary shipment data and aftermarket service statistics. Furthermore, a series of workshops and expert panels were convened to scrutinize preliminary findings and refine interpretative frameworks. Together, these methodologies furnish a robust analytical foundation, ensuring that the report’s conclusions are both reliable and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Car Care Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Car Care Products Market, by Product Type

- Car Care Products Market, by Car Type

- Car Care Products Market, by End User

- Car Care Products Market, by Application

- Car Care Products Market, by Distribution Channel

- Car Care Products Market, by Region

- Car Care Products Market, by Group

- Car Care Products Market, by Country

- United States Car Care Products Market

- China Car Care Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings and Forward-Looking Reflections to Emphasize Key Takeaways and Implications for Stakeholders in Car Care

This report has highlighted the interplay of innovation, market segmentation, regional dynamics, and geopolitical factors that define the current state of the car care products industry. Technological breakthroughs in coating and cleaning systems have elevated performance standards, while consumer preference shifts toward sustainable and convenient solutions continue to reshape demand patterns. The imposition of new tariffs in 2025 has underscored the critical importance of resilient supply chains, compelling companies to adapt through diversified sourcing and operational agility.

Segment-level insights illuminate divergent opportunities across product categories, channels, end user segments, and application contexts, enabling stakeholders to precisely target offerings and optimize go-to-market strategies. Regional analysis has revealed distinctive growth drivers in the Americas, Europe, Middle East & Africa, and Asia-Pacific, suggesting that tailored approaches are essential for sustained success. Finally, profiles of leading companies and their strategic initiatives underscore the competitive advantages gained through innovation, sustainability commitments, and digital channel mastery. Taken together, these findings furnish a comprehensive roadmap for market participants seeking to capitalize on evolving opportunities and navigate emerging challenges in the car care products arena.

Engage with Ketan Rohom Today to Unlock Comprehensive Market Intelligence and Drive Strategic Decision-Making for Car Care Product Success

To explore the full depth of insights contained in the comprehensive market research report for car care products and to secure your competitive advantage, get in touch with Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through tailored data packages, custom analyses, and licensing options that align precisely with your strategic priorities. Whether you require a deep dive into tariff impacts, segmentation breakdowns, or regional performance matrices, Ketan can ensure you receive the deliverables that best support your decision-making processes and investment planning. Act now to gain immediate access to exclusive data visualizations, actionable forecasts, and expert commentary that will empower your organization to thrive in the rapidly evolving car care products landscape.

- How big is the Car Care Products Market?

- What is the Car Care Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?