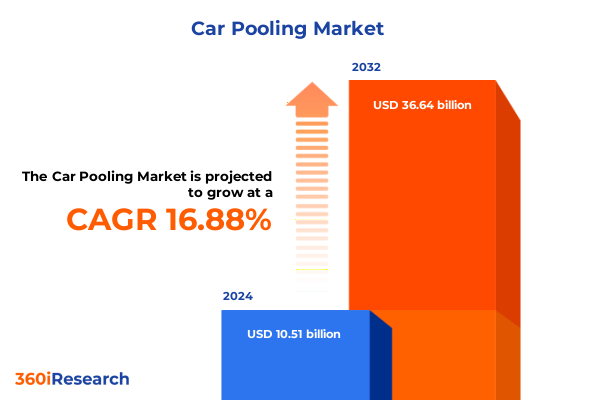

The Car Pooling Market size was estimated at USD 12.20 billion in 2025 and expected to reach USD 14.16 billion in 2026, at a CAGR of 17.01% to reach USD 36.64 billion by 2032.

Setting the Stage for Next-Generation Car Pooling Solutions That Drive Efficiency, Sustainability, and Urban Mobility Transformation

As urban centers confront mounting congestion, shifting work patterns, and heightened environmental mandates, car pooling emerges as an indispensable solution for efficient and sustainable mobility. Traditionally viewed as an informal, community-driven practice, modern car pooling has been transformed by digital platforms that match riders and drivers in real time, streamline payments, and leverage data analytics to optimize routes. This convergence of technology and social behavior is reshaping the way commuters travel to work, attend events, and connect between cities, offering new avenues for shared transport that reduce single-occupancy vehicle trips and associated emissions.

The COVID-19 pandemic initially disrupted shared mobility models, but it also galvanized innovation as platforms evolved to meet safety requirements and fluctuating demand. In the aftermath, hybrid and remote work arrangements have permanently altered peak-hour volumes, prompting operators to introduce flexible scheduling and subscription-based passes to accommodate irregular commuter flows. Meanwhile, regulatory bodies and corporate employers are increasingly embracing car pooling as part of broader emissions reduction and congestion mitigation strategies, incentivizing shared rides through dedicated lanes, preferential parking, and commuter benefits.

Looking ahead, the car pooling ecosystem is poised for further acceleration, driven by advancements in artificial intelligence, vehicle electrification, and integrated multimodal networks. As cities and companies seek scalable, cost-effective mobility solutions, car pooling stands at the intersection of technology, policy, and consumer demand, offering a pragmatic pathway to alleviate traffic, enhance connectivity, and bolster environmental stewardship.

Uncovering Pivotal Technological, Behavioral, and Infrastructure Shifts Reshaping Car Pooling’s Operational and Strategic Landscape

The car pooling industry has entered a phase defined by rapid technological adoption and evolving consumer expectations. Leading platforms now employ dynamic routing algorithms powered by machine learning, allowing real-time adjustments to driver paths based on traffic conditions, accident reports, and rider proximity, resulting in travel time reductions of up to 20 percent in some major urban corridors. Concurrently, data analytics have become central to service design, enabling operators to identify peak demand windows, high-traffic segments, and personalized matching opportunities, thereby improving both operational efficiency and user satisfaction.

Perhaps most significant is the integration of electric vehicles into shared fleets. In California, for example, nearly one in five vehicles in leading car pooling networks was electric as of mid-2024, a fourfold increase over the previous four years. This electrification trend not only aligns with corporate environmental, social, and governance (ESG) mandates but also benefits from lower operating costs and supportive incentives such as charging infrastructure grants and preferred lane access. Meanwhile, subscription-based car pooling passes and gamification features-such as ride streaks and carbon-savings badges-have driven increased engagement, with some users completing nearly twice as many shared journeys per month compared to traditional on-demand services.

The proliferation of seamless multimodal connections has further bolstered car pooling’s appeal. Integration with public transit schedules and bike-share systems enables commuters to plan door-to-door journeys that blend collective and mass transit modes. In select European and North American markets, partnerships between digital car pooling platforms and transit authorities have unlocked access to high-occupancy vehicle lanes, reserved parking, and real-time intermodal ticketing, creating a truly unified mobility experience for passengers. As consumer preferences continue to shift toward flexible, eco-friendly options, these transformative shifts are setting a new benchmark for shared mobility services.

Assessing the Tangible Effects of Latest United States Tariff Policies on Vehicle Availability and Operational Costs in the Car Pooling Ecosystem

In April 2025, the U.S. government expanded tariffs under Section 301 to include a 25 percent duty on imported automobiles and key auto parts, directly impacting the cost structure for shared mobility providers that rely on imported vehicles or components sourced from global supply chains. Electric vehicle manufacturers, in particular, face compounded expenses due to further levies on battery materials such as graphite and critical minerals, potentially increasing production costs by over 100 percent for some components. With tariffs effectively adding up to $4,000 per imported EV, operators have begun absorbing these expenses, though sustained impacts may necessitate higher fares or shifts toward domestically assembled fleets.

Major automakers have reported significant margin pressures as a result. General Motors disclosed a $1.1 billion hit to second-quarter earnings attributable to tariffs on parts and vehicles imported under North American supply chains, underscoring the broader risk to profits even as consumer prices remain temporarily insulated. In response, some carriers are accelerating investments in U.S.-based assembly plants and forging partnerships with domestic suppliers to secure exemptions worth up to 3.75 percent of vehicle price when domestic content thresholds are met. However, infrastructure and workforce ramp-up timelines mean these measures will take over a year to yield material relief.

Consequently, car pooling platforms are intensifying strategic adjustments. Operators are exploring mixed-fleet models that blend imported vehicles with domestically sourced alternatives, while adapting dynamic pricing algorithms to partially offset increased costs without eroding ridership. Simultaneously, several platforms are leveraging lease-back arrangements and short-term bulk purchases to lock in favorable terms before tariff escalations, ensuring continuity of service and protecting user affordability. As the tariff landscape evolves, these adaptive strategies will be instrumental in preserving the viability of shared mobility offerings in the United States.

Illuminating Distinct Car Pooling Segments Through Booking Preferences, Vehicle Choices, Use Cases, and User Demographics

Insights into car pooling patterns reveal pronounced variations across critical dimensions of service delivery and user engagement. When passengers select between immediate ride matches and scheduled trips, operators observe that last-minute bookings deliver higher utilization during off-peak periods, while advance reservations foster reliability for routine commuters and corporate clients. Fleet composition also plays a decisive role: while internal combustion engine vehicles remain prevalent in regions with limited charging infrastructure, electric models are increasingly adopted in urban centers seeking reduced emissions and lower operating expenses.

Different trip purposes elicit distinct usage profiles. Airport transfers often require predictable scheduling and premium service options, whereas daily commutes benefit from dynamic pooling algorithms that aggregate travelers along major corridors. Event transport, by contrast, generates episodic peaks of demand for which platforms deploy surge-responsive pricing and temporary fleet expansions. Finally, service offerings tailored to corporations tend to emphasize security, customizable reporting, and integration with employee benefit systems, while individual users prioritize cost savings and convenience. These multifaceted segment dynamics underscore the necessity for providers to design modular service architectures that can address diverse user needs without diluting operational efficiency.

This comprehensive research report categorizes the Car Pooling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Booking Type

- Vehicle Type

- Application

- User Type

Revealing Regional Variations in Car Pooling Adoption and Market Dynamics Across Americas, Europe Middle East & Africa, and Asia Pacific

Geographical context profoundly influences car pooling adoption and service characteristics. In the Americas, strong commuter incentives and expansive high-occupancy vehicle lane networks in key U.S. states encourage daily pooling for cost-conscious professionals, while burgeoning microtransit initiatives in Brazil leverage on-demand scheduling to unlock mobility in underserved urban peripheries. In Europe, Middle East & Africa, mature community platforms in Western Europe coexist with nascent regional operators in emerging markets: the European Union’s regulatory frameworks and sustainability targets have stimulated partnerships between digital car pooling providers and municipal transit agencies, while Gulf nations experiment with integrated HOV corridors to alleviate urban congestion.

In the Asia-Pacific region, surging urbanization and high-density traffic have elevated car pooling into a mainstream alternative to individual vehicle ownership. In metropolitan centers such as Delhi, Singapore, and Tokyo, mobile-first platforms facilitate millions of shared rides weekly, supported by government-backed incentives and embedded safety protocols. The convergence of digital payments, ride passes, and electric shuttle services in cities across China and Australia underscores the growing appetite for flexible, low-emission transport models that complement fixed-route bus and rail networks. These regional variations highlight the importance of localized adaptations in service design, pricing strategies, and partnership ecosystems for successful market penetration.

This comprehensive research report examines key regions that drive the evolution of the Car Pooling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positioning of Leading Car Pooling Providers Driving Market Innovation

Industry leaders continue to innovate across operational, technological, and partnership dimensions. Uber has reintroduced a commuter-focused offering-Route Share-enabling budget-conscious riders in seven major cities to share direct, fixed-route trips with up to two passengers at savings of up to fifty percent compared to standard single-ride services. By leveraging data-driven scheduling and designated pickup points, the company aims to capture peak-hour demand while reducing urban congestion and emissions.

Lyft’s strategic initiatives encompass both autonomous vehicle integration and personalized rider experiences. A recently announced collaboration with Holon will deploy U.S.-made autonomous electric shuttles in Jacksonville, Florida beginning in late 2026, extending into major airports and metropolitan corridors to complement its human-driven fleet. Simultaneously, Lyft is embedding AI-enhanced customer service tools that streamline issue resolution, yielding an eighty-seven percent reduction in average support times, while rolling out features like Price Lock and Women+ Connect to secure rider loyalty and improve safety perceptions.

Microtransit specialist Via is expanding its footprint through city partnerships and autonomous mobility ventures. Recent collaborations with municipal agencies in Torrance and Passaic County have extended on-demand, dynamically routed services to suburban and rural communities, enhancing first-mile/last-mile connectivity. Via’s ongoing alliance with May Mobility further positions it at the forefront of autonomous shuttle deployment, promising streamlined, sustainable transit solutions across diverse urban environments by leveraging AI-driven booking and routing algorithms.

Meanwhile, BlaBlaCar maintains its leadership in Europe’s long-distance car pooling sector, connecting over twenty-seven million active members across twenty-one countries and facilitating more than one hundred million ride matches in 2023 alone. Its community-centric model underscores the immense scalability of digitally mediated car pooling, further accelerated by strategic alliances with local transport authorities and infrastructure providers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Car Pooling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ANI Technologies Private Limited

- Beat Mobility Inc

- Bolt Technology OÜ

- Carma Technology Corporation

- Comuto S.A.

- Didi Chuxing Technology Co. (DiDi)

- Gett Ltd

- Grab Holdings Inc.

- Karos SAS

- Lyft, Inc.

- Meru Mobility Services Private Limited

- Ryde Group Ltd

- Scoop Technologies, Inc.

- SPLT, Inc.

- SRide / Swift Ride Pvt Ltd

- Uber Technologies, Inc.

- Via Transportation, Inc.

- Waze

- Wunder Mobility GmbH

- Zimride, Inc.

Presenting Actionable Strategic Recommendations to Enhance Service Differentiation, Partnerships, and Technological Integration for Industry Leaders

To sustain growth and competitiveness, industry stakeholders must adopt a multipronged approach focused on technological differentiation, strategic partnerships, and customer-centric service models. Providers should invest in advanced route-optimization algorithms that leverage real-time data feeds from traffic management centers and telematics, thereby enhancing match rates and reducing service delays. Concurrently, incorporating sustainability metrics-such as emissions saved per ride-into user-facing dashboards can strengthen engagement among eco-conscious customers and corporate program sponsors.

Partnerships with municipal and state agencies are equally vital. By collaborating on dedicated HOV lane corridors, preferred parking initiatives, and integrated ticketing systems, car pooling operators can elevate service value while contributing to public policy objectives. In emerging markets, co-investment in charging infrastructure and localized fleet electrification pilots can mitigate exposure to evolving trade tariffs and supply chain disruptions.

Finally, segment-tailored offerings-ranging from corporate commuter solutions with built-in expense reporting to event-based dynamic fleet scaling-will enable providers to diversify revenue streams and adapt to cyclical demand patterns. Emphasizing user safety through built-in verification, real-time monitoring, and responsive support channels will further differentiate services in a competitive landscape. By executing these recommendations, industry leaders can unlock new growth avenues while reinforcing car pooling’s role as a cornerstone of sustainable urban mobility.

Detailing Comprehensive Research Methodology Integrating Primary Interviews, Secondary Data Sources, and Analytical Frameworks for Robust Insights

This analysis integrates primary interviews with industry executives, policymakers, and end users, complemented by secondary research from reputable news outlets, academic publications, and corporate disclosures. Quantitative data points were validated through cross-referencing government databases, platform usage reports, and third-party transportation studies. The segmentation framework was defined by ride booking modality, vehicle propulsion type, application context, and user category, ensuring comprehensive coverage of market dynamics.

A bottom-up approach was employed to assess the tariff impact, leveraging company financial disclosures and expert commentary to estimate cost differentials across vehicle categories. Qualitative insights were enriched through expert roundtables and stakeholder workshops, while scenario analysis examined potential policy shifts and technology adoption curves. All findings were subject to rigorous triangulation to ensure methodological robustness and reproducibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Car Pooling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Car Pooling Market, by Booking Type

- Car Pooling Market, by Vehicle Type

- Car Pooling Market, by Application

- Car Pooling Market, by User Type

- Car Pooling Market, by Region

- Car Pooling Market, by Group

- Car Pooling Market, by Country

- United States Car Pooling Market

- China Car Pooling Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Core Findings to Provide a Forward-Looking Perspective on Car Pooling’s Role in Sustainable Urban Mobility and Market Evolution

In an era defined by environmental imperatives, digital transformation, and evolving commuter expectations, car pooling has reemerged as a strategic pillar of urban mobility. The sector’s embrace of artificial intelligence, electric vehicle integration, and multimodal collaborations has propelled service quality and expanded user adoption across regions. Yet the recent implementation of elevated import tariffs underscores the importance of adaptive strategies to preserve affordability and fleet availability.

Segmentation analysis reveals that success hinges on the ability to tailor service models to diverse use cases-from corporate commuter programs to on-demand event transport-while regional insights illustrate the necessity of localized partnerships and policy support. Leading providers such as Uber, Lyft, Via, and BlaBlaCar demonstrate how technological innovation and strategic alliances can unlock new efficiencies, enhance user experiences, and deliver on sustainability goals.

As the landscape evolves, industry participants must remain agile in responding to regulatory shifts, consumer behavior changes, and technological breakthroughs. By aligning operational excellence with customer-centric offerings and proactive stakeholder engagement, the car pooling ecosystem is well positioned to drive equitable, resilient, and low-carbon mobility solutions for communities worldwide.

Engage with Ketan Rohom to Secure Expert Market Intelligence and Unlock Strategic Advantages in the Evolving Car Pooling Landscape

To acquire this comprehensive car pooling market research report and translate insights into action, please reach out to Ketan Rohom, Associate Director, Sales & Marketing, who will guide you through the findings and help you secure the data-driven intelligence needed to stay ahead in this rapidly evolving sector.

- How big is the Car Pooling Market?

- What is the Car Pooling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?