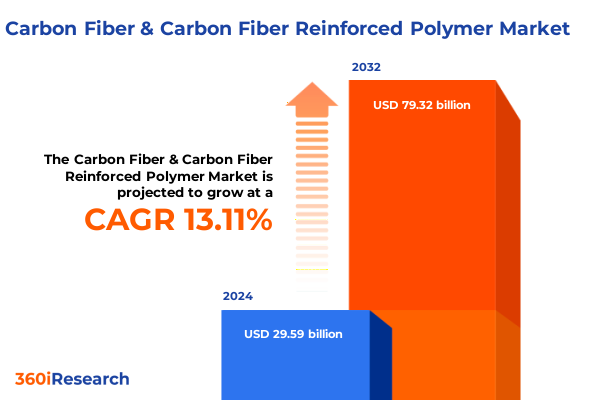

The Carbon Fiber & Carbon Fiber Reinforced Polymer Market size was estimated at USD 33.27 billion in 2025 and expected to reach USD 37.45 billion in 2026, at a CAGR of 13.21% to reach USD 79.32 billion by 2032.

Exploring the Emergence of Carbon Fiber and CFRP as Cornerstones of Advanced Materials Shaping Modern Industry Landscapes

In the realm of advanced materials, carbon fiber and carbon fiber reinforced polymers have emerged as pivotal constituents, driving weight reduction, performance optimization, and design freedom across multiple industries. These composites, comprised of ultra-strong carbon filaments embedded in polymer matrices, marry exceptional mechanical properties with corrosion resistance and fatigue durability. As applications evolve, the unique attributes of carbon-based composites are unlocking new possibilities from high-speed aerostructures to lightweight automotive components, underpinning their ascent as foundational materials in modern manufacturing.

Recent years have witnessed a proliferation of process innovations that have further cemented carbon fiber’s status. Automated fiber placement and robotic layup systems have significantly enhanced production throughput, enabling complex shapes and large-scale components to be fabricated with minimal waste and heightened precision. Alongside these manufacturing improvements, additive processes incorporating carbon fiber–reinforced thermoplastics are democratizing customization, making bespoke, lightweight parts viable for small-scale production runs. These technological advancements are reducing per-unit costs and accelerating time to market, while simultaneously expanding design horizons for engineers and product developers.

Global demand dynamics reflect this transformative trajectory. In 2024, aggregate consumption of carbon fiber materials reached approximately 300 million pounds, signaling robust uptake across core sectors such as aerospace, wind energy, and high-performance automotive applications. China’s rapid capacity build-out has reshaped the competitive landscape; accounting for nearly 45% of worldwide production capacity, it has become a central hub for both commodity-grade fibers and specialized aerospace-grade materials. Legacy players in Japan and Europe are adapting to this new paradigm by pursuing efficiency gains and supply chain diversification, while emerging markets in North America intensify efforts to foster domestic fiber production and recycling initiatives to balance dependency on imports.

Unveiling Disruptive Innovations and Sustainable Recycling Practices Transforming Carbon Fiber Composites Across Strategic Industry Verticals

A pronounced shift toward sustainable practices and resource circularity is redefining the carbon fiber sector’s innovation landscape. Recycled carbon fiber is no longer confined to niche applications; it has penetrated automotive interiors, non-structural aerospace modules, and consumer goods, delivering cost efficiencies of up to 70% compared to virgin fiber. Leading automakers are integrating recycled stream composites into electric vehicle underbody panels and interior trims, spurred by regulatory pressures and corporate sustainability targets. Simultaneously, aerospace manufacturers are piloting recycled fiber in lavatory and galley structures after successful validation against stringent performance criteria.

Concurrently, low-cost precursor materials and alternative polymer matrices are enabling broader adoption. Research into lignin-based and recycled-polymer precursors is gaining momentum, promising to alleviate supply chain constraints and reduce the carbon footprint of precursor production. In tandem, developments in continuous 3D printing techniques, which embed carbon fiber filaments within thermoplastic matrices, are offering design flexibility that transcends traditional mold-based layouts. These additive approaches not only minimize material waste but also allow complex geometries to be manufactured in a single build sequence, fostering rapid prototyping and on-demand part fabrication in sectors such as defense and medical devices.

Assessing the Comprehensive Effects of 2025 United States Tariff Escalations on Carbon Fiber Supply Chains and Cost Structures

The introduction of escalated duties by the United States in March 2025 has significantly complicated the importation of raw carbon fiber tow and prepreg materials. Under the revised tariff schedule, unidirectional fiber tow faces a jump from 7.5% to 25%, while prepreg composite sheets are now subject to a 17.5% levy, compared to the previous 4.2%. This policy shift, articulated as part of a broader trade enforcement initiative, responded to concerns over national security and perceived unfair trade advantages enjoyed by certain exporting nations.

Heightened tariffs have catalyzed a reevaluation of procurement and logistics strategies among composite fabricators and original equipment manufacturers. To mitigate cost escalations, many firms have accelerated nearshoring projects, establishing domestic compounding and intermediate processing facilities to secure supply continuity. Long-term supply agreements with tariff-exempt partners and investments in local precursor synthesis have become prevalent, as companies strive to stabilize input pricing in the face of elevated duties. Nevertheless, these transitions carry capital intensity and require rigorous cost–benefit analyses to ensure that the benefits of tariff avoidance outweigh the upfront expenditures of local infrastructure development.

Uncovering Strategic Market Segmentation Insights Shaping Product Development Across Carbon Fiber and CFRP Domains

Insight into market segmentation provides clarity on where growth and innovation are converging within the carbon fiber ecosystem. Product type delineation reveals a dual landscape: virgin carbon fiber, prized for its high-strength applications in aerospace and premium automotive components, coexists with a burgeoning recycled fiber segment that targets cost-sensitive markets. Within polymer composites, the dichotomy between thermoset and thermoplastic matrices underscores divergent performance priorities, with thermosets dominating structural aerospace parts and thermoplastics gaining traction where recyclability and rapid processing are paramount.

Fiber typology further refines the picture. Woven fabric architectures deliver multidirectional strength profiles suited to pressure vessels and wind turbine blades, while unidirectional yarn systems enable optimized stiffness-to-weight ratios for primary structural elements. The physical form of fiber-whether continuous rovings, long-cut strands, or short cropped fibers-determines processing compatibility and end-use performance, influencing resin impregnation dynamics and fiber orientation control.

The choice of precursor material introduces another axis of differentiation. Pitch-based carbon precursors are valued for high thermal conductivity and modulus, often specified in advanced electronics or heat-dissipation applications, whereas rayon-based precursors, with their lower-density profiles, fit weight-sensitive roles. Application segmentation highlights the breadth of demand: aerospace and defense command stringent certification and traceability standards, the automotive sector prioritizes cost and cycle time, and emerging domains like renewable energy leverage composite durability and corrosion resistance. Finally, distribution channels delineate between direct sales to OEMs-fostering deep technical collaboration-and distributor networks, which cater to smaller fabricators and rapid-response supply needs.

This comprehensive research report categorizes the Carbon Fiber & Carbon Fiber Reinforced Polymer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Fiber Type

- Fiber Form

- Carbon Fiber Precursor

- Application

- Distribution Channel

Deep Dive into Regional Carbon Fiber Dynamics Highlighting Unique Growth Drivers Across Americas, EMEA, and Asia-Pacific Markets

The Americas region continues to leverage its historical leadership in aerospace manufacturing and a vibrant automotive sector to drive composite adoption. Stimulated by federal incentives under the Inflation Reduction Act, domestic production of recycled carbon fiber has accelerated, with several DOE-backed ventures advancing pilot-scale pyrolysis and solvolysis recycling facilities. This momentum has bolstered supply chain resilience while aligning with corporate sustainability mandates that prioritize circular material streams.

In Europe, Middle East & Africa, stringent environmental regulations and ambitious decarbonization targets are fostering adoption of composites in wind energy, rail transportation, and architectural applications. The EU’s Ecodesign for Sustainable Products Regulation mandates minimum recycled content thresholds by 2027, prompting OEMs to integrate recycled carbon composites into non-critical structures. Additionally, a growing network of specialized recyclers and compounding houses across Western Europe is facilitating closed-loop material flows, underscoring the region’s leadership in lifecycle management and eco-design.

Asia-Pacific is characterized by exponential capacity expansion, driven predominantly by China’s state-sponsored investments in carbon fiber production. Accounting for nearly half of global capacity today, Chinese manufacturers are rapidly scaling PAN precursor facilities and downstream composite fabrication hubs. This influx of supply is reshaping global trade patterns, as exports to neighboring markets and strategic alliances with Japan and South Korea redefine cost structures and access to high-performance grades. South East Asian nations, meanwhile, are emerging as assembly and finishing centers, capitalizing on expertise in electronics and automotive subcomponents to embed composite parts in regional value chains.

This comprehensive research report examines key regions that drive the evolution of the Carbon Fiber & Carbon Fiber Reinforced Polymer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Competitive Footprint of Leading Carbon Fiber Producers and Innovators Shaping Industry Evolution

Global leadership in carbon fiber production remains concentrated among a cadre of established players and ambitious new entrants. Japanese firms such as Toray and Teijin continue to set the benchmark for aerospace-grade fibers, leveraging decades of process optimization and stringent quality control. European stalwarts including Hexcel and SGL Carbon maintain a strong position in specialty and performance segments, underpinned by robust R&D investments in high-modulus and nano-enhanced fibers. In parallel, Chinese giants like Jilin Chemical Fibre Group and Zhongfu Shenying are ascending rapidly, capitalizing on integrated precursor-to-fiber facilities and favorable state policies to gain scale and cost competitiveness.

On the innovation frontier, a new cohort of recyclers and material specialists is reshaping supply chain economics. Companies such as Vartega and ELG Carbon Fibre are pioneering microwave-assisted and pyrolysis-based recycling processes that recover near-virgin-quality fibers. Their strategic partnerships with OEMs secure long-term off-take agreements, while U.S. Department of Energy grants have catalyzed expansion of domestic recycling capacity. These developments are not only mitigating tariff pressures but also embedding circularity into the carbon fiber value chain, with reclaimed fibers now validated for non-structural aerospace and automotive applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbon Fiber & Carbon Fiber Reinforced Polymer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aeron Composite Pvt. Ltd.

- Carbon Light

- Clearwater Composites

- Crosby Composites Ltd.

- Dexcraft

- DowAksa Advanced Composites Holdings BV

- Formosa Plastics Corporation

- Hexcel Corporation

- Hyosung Corporation

- Kureha Corporation

- Leggaro Composites

- Mitsubishi Chemical Group Corporation

- NIPPON STEEL Chemical & Material Co., Ltd.

- Protech Composites Inc.

- Reliance Composite

- Röchling Corporation

- Schunk Group

- SGL Carbon SE

- Shimadzu Corporation

- Sigmatex (UK) Limited

- Syensqo

- Teijin Limited

- TIP composite Co., Ltd.

- Toray Industries, Inc.

- UMATEX

Actionable Strategies for Industry Leaders to Enhance Resilience, Spur Innovation, and Navigate the Evolving Carbon Fiber Ecosystem

Industry leaders must prioritize supply chain diversification to navigate tariff volatility and geopolitical uncertainties. Establishing multi-source procurement strategies that include domestic precursors, recycled fiber, and strategic partnerships with tariff-exempt suppliers will be vital to maintaining cost stability and production continuity.

Investing proactively in next-generation recycling technologies and low-carbon precursor research offers the dual benefit of securing feedstock availability and addressing sustainability imperatives. By collaborating with academic institutions and government agencies, companies can accelerate innovation cycles and position themselves as suppliers of choice for environmentally conscious end markets.

Operational agility should be reinforced through digitalization of planning and inventory systems. Real-time visibility into material flows, combined with predictive analytics for demand forecasting, will empower procurement teams to optimize safety stocks and reduce lead-time risks. Equally, manufacturing facilities should integrate modular processing lines that can switch between thermoset and thermoplastic composite production to capture emerging application opportunities.

Finally, fostering cross-industry alliances will drive broader acceptance of composite solutions. By engaging with standards bodies to harmonize certification protocols and support infrastructure development-such as composite repair networks-industry leaders can lower adoption barriers and expand the addressable market for carbon fiber and CFRP technologies.

Detailing the Rigorous Research Methodology Ensuring Data Integrity and Insight Reliability for Carbon Fiber Market Analysis

This analysis integrates insights from a blended research framework, combining extensive primary interviews with materials scientists, manufacturing executives, and procurement specialists to capture firsthand perspectives on technological adoption and strategic priorities. These qualitative inputs are complemented by secondary research across peer-reviewed journals, patent databases, and regulatory filings to ensure a comprehensive understanding of innovation trajectories and policy impacts. Quantitative data was sourced from global trade records and supply chain intelligence platforms, enabling triangulation of importation patterns, production capacities, and material flow dynamics.

Rigorous data validation protocols were applied, employing cross-verification techniques and consistency checks against publicly available financial disclosures and government publications. Methodological transparency was upheld by documenting assumptions, data sources, and analytical models, ensuring that findings are reproducible and decision-relevant. The synthesis of multiple data streams, coupled with domain expert review, underpins the reliability of the insights presented in this report, offering a robust basis for strategic planning and investment considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbon Fiber & Carbon Fiber Reinforced Polymer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbon Fiber & Carbon Fiber Reinforced Polymer Market, by Product Type

- Carbon Fiber & Carbon Fiber Reinforced Polymer Market, by Fiber Type

- Carbon Fiber & Carbon Fiber Reinforced Polymer Market, by Fiber Form

- Carbon Fiber & Carbon Fiber Reinforced Polymer Market, by Carbon Fiber Precursor

- Carbon Fiber & Carbon Fiber Reinforced Polymer Market, by Application

- Carbon Fiber & Carbon Fiber Reinforced Polymer Market, by Distribution Channel

- Carbon Fiber & Carbon Fiber Reinforced Polymer Market, by Region

- Carbon Fiber & Carbon Fiber Reinforced Polymer Market, by Group

- Carbon Fiber & Carbon Fiber Reinforced Polymer Market, by Country

- United States Carbon Fiber & Carbon Fiber Reinforced Polymer Market

- China Carbon Fiber & Carbon Fiber Reinforced Polymer Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Summarizing Key Takeaways and Emphasizing the Imperative for Agile Adaptation in the Carbon Fiber Arena

In conclusion, the carbon fiber and carbon fiber reinforced polymer sectors stand at an inflection point driven by sustainability imperatives, trade policy shifts, and relentless innovation in processing techniques. Organizations that proactively align their strategies with emerging recycling technologies, diversify their supply networks, and leverage advanced digital tools will secure a competitive edge. The convergence of cost reduction, environmental stewardship, and performance enhancement is redefining industry benchmarks, setting the stage for broader composite adoption across traditional and nascent markets. As the supply landscape evolves, agile adaptation and collaborative partnerships will be foundational to long-term success in this dynamic and essential materials arena.

Contact Associate Director Ketan Rohom to Secure Your Comprehensive Carbon Fiber Market Research Report and Unlock Strategic Insights Today

For a deeper exploration of these insights and to gain access to comprehensive data and strategic analysis, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engage with an expert who can guide you through the nuances of the carbon fiber and carbon fiber reinforced polymer sectors, and secure your copy of the full market research report today. Position your organization at the forefront of innovation by partnering with a specialist who understands your needs and can deliver tailored, actionable intelligence.

- How big is the Carbon Fiber & Carbon Fiber Reinforced Polymer Market?

- What is the Carbon Fiber & Carbon Fiber Reinforced Polymer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?