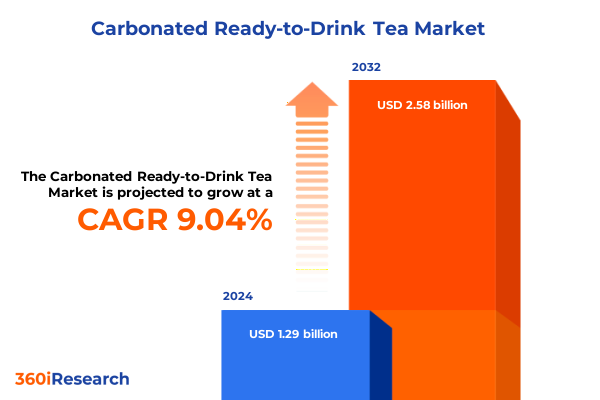

The Carbonated Ready-to-Drink Tea Market size was estimated at USD 1.39 billion in 2025 and expected to reach USD 1.51 billion in 2026, at a CAGR of 9.18% to reach USD 2.58 billion by 2032.

Unveiling the Rising Wave of Carbonated Ready-to-Drink Tea: Context, Drivers, and Strategic Imperatives for Modern Beverage Markets

Unveiling the Rising Wave of Carbonated Ready-to-Drink Tea: Context, Drivers, and Strategic Imperatives for Modern Beverage Markets

The beverage industry has witnessed a dynamic evolution in recent years, fueled by consumers’ growing appetite for novel flavors, functional attributes, and on-the-go convenience. Within this broader transformation, carbonated ready-to-drink tea has emerged as a pivotal segment that intertwines two major consumer trends: the popularity of tea as a natural, antioxidant-rich beverage and the undeniable appeal of fizzy, refreshing experiences. This confluence has reshaped beverage portfolios across large and niche producers alike, prompting an array of innovations in flavors, packaging, and positioning.

Transitioning from traditional tea consumption patterns to carbonated formats reflects a desire for hybrid beverage experiences that offer both familiarity and excitement. Consumers are increasingly drawn to products that deliver perceived health benefits-such as antioxidants and low-calorie formulations-while satisfying a craving for effervescence. This dynamic has motivated manufacturers to expand their offerings, blending classic tea varieties such as black, green, and herbal infusions with carbonation and complementary flavor profiles. Consequently, the introduction of vitamin fortifications, natural sweeteners, and exotic botanicals has further diversified the competitive landscape.

Looking ahead, industry stakeholders must remain vigilant to evolving consumer preferences, regulatory changes, and technological advancements in production and packaging. Effective strategies will hinge on harmonizing taste experiences with health-conscious formulations, optimizing supply chain efficiencies, and anticipating emerging market niches. Establishing a nuanced understanding of these core drivers sets the foundation for navigating the complexities of the carbonated ready-to-drink tea sector and positioning for sustained growth.

Navigating the Transformative Currents Shaping the Carbonated Ready-to-Drink Tea Market: Technological Innovations, Consumer Preferences, and Competitive Dynamics

Navigating the Transformative Currents Shaping the Carbonated Ready-to-Drink Tea Market: Technological Innovations, Consumer Preferences, and Competitive Dynamics

The carbonated ready-to-drink tea segment has undergone profound shifts as innovation cycles accelerate and consumers seek differentiated experiences. Advancements in carbonation technology, such as precision-controlled microcarbonation systems, have enabled manufacturers to fine-tune bubble structure and mouthfeel, elevating the sensory profile of tea-based sodas. Simultaneously, developments in flavor encapsulation techniques have broadened the palette of natural flavors that can be stably integrated into carbonated beverages, enabling the seamless fusion of exotic fruits, botanicals, and functional extracts without compromising shelf life.

In parallel, a growing emphasis on clean labels and ingredient transparency has spurred the adoption of natural sweeteners, plant-based preservatives, and minimal processing methods. This shift aligns with health-oriented consumers who scrutinize ingredient lists and favor products that balance indulgence with wellness. As a result, producers are increasingly leveraging sugar alternatives such as stevia, monk fruit, and allulose, alongside organic certifications, to bolster credibility and premium positioning.

Competitive pressures have also intensified as both global beverage giants and agile craft producers vie for shelf space in retail and foodservice channels. Collaboration with co-packers, agile manufacturing strategies, and targeted marketing campaigns have become instrumental in responding to regional taste preferences and seasonal demand spikes. Looking forward, market participants that can swiftly adapt to evolving distribution paradigms-particularly the integration of direct-to-consumer models and omnichannel retailing-will be best positioned to capture emerging growth opportunities.

Assessing the Cumulative Impact of 2025 United States Tariffs on Carbonated Ready-to-Drink Tea: Trade Barriers, Cost Structures, and Supply Chain Realignments

Assessing the Cumulative Impact of 2025 United States Tariffs on Carbonated Ready-to-Drink Tea: Trade Barriers, Cost Structures, and Supply Chain Realignments

The implementation of new tariff measures in 2025 has introduced complexities for import-dependent carbonated ready-to-drink tea producers, prompting a reevaluation of sourcing strategies and pricing models. As tariffs impact glass bottles, aluminum cans, and certain botanical extracts, manufacturers are experiencing upward pressure on input costs. This, in turn, has necessitated a closer examination of packaging alternatives, ingredient sourcing, and contractual arrangements to mitigate margin erosion.

Some brands have responded by shifting raw material procurement to domestic suppliers, fostering closer partnerships that reduce logistical uncertainties and buffer against punitive duties. Others have accelerated investments in innovative packaging materials-such as lightweight aluminum variants and recyclable PET blends-which can lower duty liabilities while reinforcing sustainability commitments. The strategic reallocation of operations to free trade zones and bonded warehouses has further enabled companies to optimize cash flow and defer duty payments until goods reach end markets.

Moreover, the tariff landscape has catalyzed consolidation among smaller players, as elevated cost pressures compel some to seek acquisition or joint-venture opportunities with larger industry incumbents. Importantly, these trade dynamics are also influencing product pricing and consumer affordability. While premium segments have been able to absorb cost increases, value-oriented offerings may see tighter margins or strategic reformulations to maintain price competitiveness. Navigating this intricate terrain will require continuous scenario planning, agile supply chain adjustments, and proactive stakeholder engagement.

Dissecting Key Segmentation Insights in Carbonated Ready-to-Drink Tea: Packaging Materials, Size Tiers, Product Formulations, and Distribution Pathways

Dissecting Key Segmentation Insights in Carbonated Ready-to-Drink Tea: Packaging Materials, Size Tiers, Product Formulations, and Distribution Pathways

An examination of the market through the lens of packaging material reveals distinct performance patterns across cans, glass bottles, PET bottles, and Tetra Pak cartons. Each material offers unique cost structures, sustainability profiles, and consumer perceptions. Cans often deliver a cost-effective solution with high recyclability and robust carbonation retention, while glass bottles are associated with premium positioning and perceived quality by discerning consumers. PET bottles, with their lightweight nature and shatter resistance, cater to on-the-go usage, and Tetra Pak cartons appeal to environmentally conscious buyers seeking renewable or plant-based packaging alternatives.

When considering packaging size, the dichotomy between multi-serve and single-serve formats uncovers divergent consumption occasions and purchase drivers. Multi-serve packaging, spanning containers from 500 to 1500 milliliters and above, is frequently selected for family consumption, office settings, or hospitality environments. In contrast, single-serve offerings thrive in impulse-driven channels and capture demand tied to personal hydration needs. Notably, smaller formats often drive premium margins due to convenience and portability attributes, whereas larger volumes support value-oriented promotions and bulk purchasing strategies.

Diving into product type segmentation, the interplay between flavored, sweetened, and unsweetened variants underscores the breadth of consumer taste profiles and health considerations. Flavored teas combine natural infusions-such as citrus, berry, or floral extracts-with carbonation to create vibrant sensory experiences. Sweetened formulations leverage both cane sugar and alternative sweeteners to balance indulgence and caloric transparency, whereas unsweetened options cater to purists seeking authentic tea flavor and minimal additive presence.

Evaluating the nature of products further, the conventional versus organic distinction illuminates divergent supply chain implications and labeling regulations. Organic certification can command price premiums and resonate with eco-conscious buyers but entails rigorous supplier audits and certification costs. Conventional offerings benefit from broader ingredient availability and streamlined procurement but may face scrutiny in markets with heightened sustainability expectations.

Finally, distribution channel insights reveal nuanced performance across convenience stores, online retail platforms, and supermarkets hypermarkets. Convenience stores capture the immediacy of single-serve consumption, especially in high-traffic urban settings, while online retailing has flourished through subscription models and targeted digital marketing. Supermarkets and hypermarkets remain the primary battleground for mass-market visibility and promotional activities, leveraging high foot traffic and endcap displays to drive trial and repeat purchases.

Exploring end-user segments highlights divergent usage scenarios between the food service and household arenas. Within food service, cafes, hotels, and restaurants integrate carbonated tea offerings into menu diversification strategies, often emphasizing premium flavor pairings and brand collaborations. In the household context, consumers prioritize convenience, perceived health benefits, and packaging sustainability when selecting beverages for at-home consumption. Bridging these segmentation dimensions provides a comprehensive framework for tailoring product innovation, pricing strategies, and channel investments to targeted consumer cohorts.

This comprehensive research report categorizes the Carbonated Ready-to-Drink Tea market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Size

- Packaging Material

- Product Type

- Nature

- Distribution Channel

- End User

Highlighting Regional Dynamics in Carbonated Ready-to-Drink Tea Markets: Growth Drivers, Regulatory Environments, and Consumer Behaviors Across Major Global Zones

Highlighting Regional Dynamics in Carbonated Ready-to-Drink Tea Markets: Growth Drivers, Regulatory Environments, and Consumer Behaviors Across Major Global Zones

In the Americas region, the carbonated ready-to-drink tea market is propelled by strong health and wellness trends, where consumers increasingly seek functional beverages with transparent ingredient listings. Regulatory frameworks around sugar reduction and labeling requirements have accelerated the introduction of low- and zero-calorie sweetening options. North American markets demonstrate high receptivity to flavor innovation and premiumization, while Latin American markets exhibit rapid adoption of affordable multi-serve formats and traditional tea infusions adapted with local fruit flavors.

Turning to Europe, Middle East, and Africa, market maturity levels vary significantly across subregions. Western Europe’s stringent sustainability regulations and recycling mandates have driven the uptake of eco-friendly packaging options, incentivizing producers to invest in returnable glass systems and recyclable can formats. Middle Eastern markets often showcase a cultural affinity for tea consumption, leading to hybrid products that blend classic black tea with regional spices and carbonation. In Africa, urbanization and retail modernization are creating fertile ground for premium and on-the-go beverage options, though challenges persist in cold-chain logistics and distribution reach.

The Asia-Pacific domain stands out for its dynamic growth trajectory, driven by burgeoning middle-class populations and escalating demand for both functional ingredients and novel taste experiences. East Asian consumers, accustomed to tea as a staple beverage, are now experimenting with carbonated variants that incorporate botanical extracts like ginseng and jasmine. Southeast Asia’s diverse flavor preferences have inspired localized formulations featuring tropical fruits, while South Asian markets are witnessing the entry of organic and craft tea brands targeting health-conscious millennials.

Navigating these regional nuances requires a multi-faceted approach that accounts for local regulatory landscapes, cultural taste profiles, and logistical infrastructures. Market participants should calibrate product assortments and promotional strategies to resonate with region-specific drivers, ensuring alignment with consumer values around health, sustainability, and premium experiences.

This comprehensive research report examines key regions that drive the evolution of the Carbonated Ready-to-Drink Tea market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Competitive Landscapes in Carbonated Ready-to-Drink Tea: In-Depth Company Profiles, Strategic Initiatives, and Market Positioning Tactics

Uncovering Competitive Landscapes in Carbonated Ready-to-Drink Tea: In-Depth Company Profiles, Strategic Initiatives, and Market Positioning Tactics

Leading players in the carbonated ready-to-drink tea arena have adopted diverse strategies to differentiate their offerings and capture market share. Some multinational beverage conglomerates have leveraged extensive distribution networks and deep R&D capabilities to introduce innovative product lines, including limited-edition seasonal flavors and cross-brand collaborations. Their focus on scale economies and global sourcing has enabled cost-effective production of both core and premium segments, driving widespread shelf presence in supermarkets, convenience chains, and digital platforms.

Concurrently, nimble independent brands are carving out niche positions by emphasizing artisanal quality, small-batch production methods, and transparent sourcing stories. These companies often rely on direct-to-consumer channels and localized marketing partnerships to build loyal communities and drive brand advocacy. Through curated sampling events, social media engagement, and sustainability pledges-from zero-waste packaging to fair-trade ingredient certifications-these challengers create emotional connections that resonate with discerning consumers.

Strategic alliances between beverage manufacturers and co-packers have further optimized production flexibility, enabling swift scale-up of emerging flavor profiles in response to social media-driven trends. In addition, mergers and acquisitions continue to reshape the competitive landscape, as companies seek to augment their portfolios with complementary brands, regional footholds, or proprietary formulation technologies. Joint ventures with botanical extract specialists and sugar-alternative innovators have unlocked new product dimensions, strengthening value propositions in both mass and premium tiers.

Looking ahead, success in this fragmented environment will hinge on dynamic portfolio management, agile marketing tactics, and continuous investment in consumer insights. Companies that can coherently integrate quality differentiation, sustainability credentials, and omnichannel distribution will be best positioned to outpace competitors and capture evolving consumer demand.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbonated Ready-to-Drink Tea market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AriZona Beverage Company, LLC

- Danone S.A.

- Eastroc Beverage Co., Ltd.

- Grupo Aje

- Ito En, Ltd.

- Keurig Dr Pepper Inc.

- Kirin Holdings Company, Limited

- Monster Beverage Corporation

- Nestlé S.A.

- Pepsi Lipton International B.V.

- Starbucks Corporation

- Suntory Holdings Limited

- Talking Rain

- Tata Consumer Products Limited

- The Coca-Cola Company

- Tingyi Holding Corp.

- Unilever PLC

Actionable Strategies for Industry Leaders in Carbonated Ready-to-Drink Tea: Optimizing Innovation, Supply Chains, and Consumer Engagement for Sustainable Growth

Actionable Strategies for Industry Leaders in Carbonated Ready-to-Drink Tea: Optimizing Innovation, Supply Chains, and Consumer Engagement for Sustainable Growth

To excel in the carbonated ready-to-drink tea sector, industry leaders should prioritize innovation pipelines that align with emerging consumer values around health, flavor exploration, and environmental stewardship. Proactive investment in natural sweetener research and cold-extraction techniques can yield low-calorie formulations that maintain robust taste profiles. Meanwhile, exploring functional add-ons-such as adaptogenic herbs, probiotics, or vitamin infusions-can open new consumption occasions and premium price tiers.

Supply chain resilience is equally critical. Firms should conduct comprehensive audits of sourcing networks and evaluate alternative suppliers for key inputs like tea leaves, botanical extracts, and packaging substrates. Strategic relocation of manufacturing assets to tariff-free zones or low-cost regions can mitigate trade-related cost pressures. Moreover, digital tools for real-time inventory tracking and demand forecasting can reduce waste, optimize logistics, and improve responsiveness to seasonal or regional demand shifts.

Enhancing consumer engagement demands clear and consistent communication of product attributes and sustainability credentials. Investing in traceability platforms-such as blockchain-based provenance tracking-can strengthen consumer trust and differentiate brands in crowded retail environments. Digital marketing strategies that leverage micro-influencers and interactive social media campaigns will further amplify product launches and drive trial among targeted demographics.

Finally, embracing omnichannel distribution models will maximize market reach. Collaboration with premium foodservice operators and subscription-box platforms can introduce products to new consumer segments, while data-driven e-commerce initiatives can support personalized promotions and repeat purchase incentives. By harmonizing innovation, operational agility, and consumer-centric marketing, industry leaders can sustain momentum and unlock long-term growth in the dynamic carbonated ready-to-drink tea landscape.

Explaining Rigorous Research Methodology Behind the Carbonated Ready-to-Drink Tea Market Analysis: Data Sources, Analytical Frameworks, and Validation Processes

Explaining Rigorous Research Methodology Behind the Carbonated Ready-to-Drink Tea Market Analysis: Data Sources, Analytical Frameworks, and Validation Processes

The insights presented in this report stem from an exhaustive research methodology incorporating both primary and secondary data sources. Structured interviews with industry executives, beverage technologists, and supply chain experts provided qualitative perspectives on innovation trends and strategic priorities. Concurrently, secondary research encompassed analysis of trade publications, regulatory documents, and industry white papers to contextualize quantitative findings and interpret market drivers.

A multi-layered analytical framework guided the segmentation exercise. Market data were systematically categorized by packaging material, container size, product formulation, nature of the offering, distribution channel, and end-user application. Cross-referencing these dimensions enabled the identification of nuanced performance patterns and emerging thematic linkages. In parallel, a region-based evaluation employed macroeconomic indicators, regulatory overviews, and consumer behavior studies to capture geographic heterogeneity.

Validation processes included triangulation of data points across multiple sources to ensure consistency and accuracy. Where possible, proprietary industry databases and audited financial statements were used to corroborate company-level insights. Sensitivity analyses tested the robustness of key conclusions against possible variations in trade policies, raw material costs, and consumer preference shifts. Internal expert reviews and cross-functional workshops further reinforced methodological rigor, ensuring that all interpretations reflect both current realities and plausible market evolutions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbonated Ready-to-Drink Tea market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbonated Ready-to-Drink Tea Market, by Packaging Size

- Carbonated Ready-to-Drink Tea Market, by Packaging Material

- Carbonated Ready-to-Drink Tea Market, by Product Type

- Carbonated Ready-to-Drink Tea Market, by Nature

- Carbonated Ready-to-Drink Tea Market, by Distribution Channel

- Carbonated Ready-to-Drink Tea Market, by End User

- Carbonated Ready-to-Drink Tea Market, by Region

- Carbonated Ready-to-Drink Tea Market, by Group

- Carbonated Ready-to-Drink Tea Market, by Country

- United States Carbonated Ready-to-Drink Tea Market

- China Carbonated Ready-to-Drink Tea Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Insights on the Carbonated Ready-to-Drink Tea Market Landscape: Synthesizing Trends, Challenges, and Strategic Pathways for Future Success

Concluding Insights on the Carbonated Ready-to-Drink Tea Market Landscape: Synthesizing Trends, Challenges, and Strategic Pathways for Future Success

The carbonated ready-to-drink tea category stands at a pivotal juncture where innovation, regulation, and consumer engagement converge to define the next era of growth. Manufacturers that harness advanced carbonation technologies and functional ingredient integrations will craft differentiated offerings that resonate with both health-conscious and experience-driven demographics. Moreover, adapting to evolving trade environments and leveraging agile supply chain models will be essential to maintain cost competitiveness and operational resilience.

As segmentation insights reveal, success lies in tailoring strategies across packaging materials, size tiers, product formulations, distribution channels, and end-user applications. Regional dynamics further underscore the necessity of localized approaches, reflecting distinct regulatory landscapes, cultural preferences, and logistical infrastructures. Meanwhile, the competitive arena continues to evolve through alliances, mergers, and brand diversification tactics that reshape market hierarchies.

Ultimately, brands that blend sustainability credentials, clear consumer value propositions, and omnichannel capabilities will triumph in a landscape marked by evolving preferences and heightened competition. By systematically applying the research findings and strategic recommendations outlined in this report, industry participants can confidently navigate uncertainties and seize new opportunities within the vibrant carbonated ready-to-drink tea market.

Connect with Ketan Rohom to Secure Your Comprehensive Carbonated Ready-to-Drink Tea Market Research Report and Drive Informed Beverage Business Decisions

To obtain a comprehensive understanding of the carbonated ready-to-drink tea landscape and leverage data-driven strategies to elevate your market position, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise lies in translating complex market intelligence into actionable insights that empower beverage manufacturers, distributors, and investors alike. Engaging directly with him will ensure you receive a tailored overview of the report’s scope and how it aligns with your strategic objectives. Secure your copy now and gain a competitive edge with deep analysis on consumer behavior shifts, regulatory impacts, and emerging innovation trends that will shape the future of carbonated ready-to-drink tea.

- How big is the Carbonated Ready-to-Drink Tea Market?

- What is the Carbonated Ready-to-Drink Tea Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?