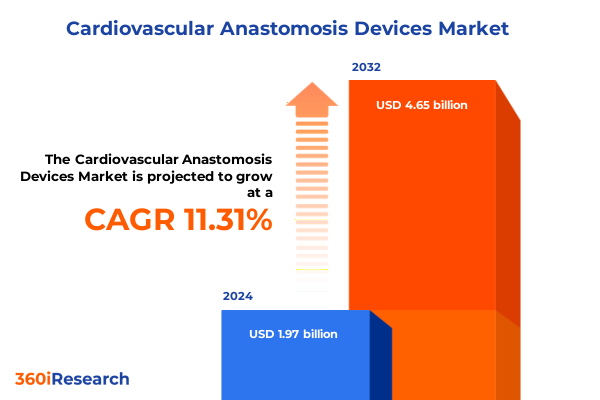

The Cardiovascular Anastomosis Devices Market size was estimated at USD 2.19 billion in 2025 and expected to reach USD 2.43 billion in 2026, at a CAGR of 11.34% to reach USD 4.65 billion by 2032.

Exploring how demographic shifts and clinical demands are driving innovation and adoption of cardiovascular anastomosis devices to revolutionize surgical care worldwide

Cardiovascular diseases remain the leading global health challenge, accounting for an estimated 17.9 million deaths each year according to the World Health Organization. This staggering human toll underscores the critical need for precision surgical solutions that restore vascular continuity while minimizing patient risk and recovery time. As populations age and the incidence of heart attacks and peripheral vascular disorders rises, healthcare systems worldwide are placing renewed emphasis on techniques and devices that can reliably perform anastomoses under increasingly complex clinical conditions.

In this evolving clinical landscape, cardiovascular anastomosis devices have emerged as indispensable tools for surgeons. From traditional suture-based techniques to advanced staplers and automated suturing platforms, these devices serve as the backbone for procedures such as coronary artery bypass grafting and peripheral bypass surgeries. Single-use hemostatic clips and disposable staplers have gained prominence due to stringent infection control protocols and the need for sterility in high-volume operating rooms. Simultaneously, reusable instruments are witnessing renewed interest as cost-containment and environmental sustainability become priorities in modern healthcare procurement.

The interplay between demographic pressures, procedural complexity, and the imperative for value-based care creates both challenges and opportunities for device developers and providers. This introduction sets the stage for an in-depth exploration of how technological innovations, regulatory dynamics, and shifting economic considerations are converging to redefine the anastomosis landscape. Readers will gain clarity on the forces driving device evolution and the strategic inflection points that promise to shape surgical practice and business models alike.

Examining breakthrough technological and procedural innovations that are fundamentally reshaping cardiovascular anastomosis practices and device development trajectories

The cardiovascular anastomosis device arena is witnessing a series of transformative shifts driven by converging technological breakthroughs and evolving clinical protocols. Three-dimensional stapling technology combined with advanced gripping surfaces, exemplified by Ethicon’s 2024 ECHELON LINEAR Cutter launch, has substantially reduced staple-line leaks and enhanced overall procedural outcomes. Energy-based sealing modalities, including electrothermal and ultrasonic platforms, are integrating with staple lines to minimize collateral tissue injury, offering surgeons unprecedented precision during anastomotic transections.

Concurrently, the rise of automated suturing continues to accelerate, with robotic-assisted platforms and handheld devices empowering clinicians to maintain consistent needle placement and tension control even within minimally invasive corridors. Innovations in micro-anastomosis tools tailored for platforms like the da Vinci Surgical System have demonstrated patency rates above 98 percent, rivaling traditional manual methods while significantly reducing operative time. This shift is bolstered by emerging adhesives that replicate physiological healing cascades without foreign body retention, allowing seamless vascular fusion in anatomically constrained scenarios.

Beyond product innovation, value-based procurement models are reshaping purchasing paradigms. Hospitals and ambulatory surgery centers now demand outcome-focused performance metrics, incentivizing manufacturers to collaborate with payers on new reimbursement frameworks. Moreover, digital supply chain solutions and additive manufacturing techniques are enabling localized production of patient-specific clips and rings, shortening lead times and mitigating inventory risks. These developments collectively mark a transition from commoditized device procurement toward integrated, data-driven ecosystems that align clinical efficacy with economic value.

Assessing the cumulative effects of newly imposed U.S. tariffs on cardiovascular anastomosis device supply chains, cost structures, and strategic industry responses

In 2025, newly expanded U.S. tariffs on imported medical equipment have introduced added complexity to the cardiovascular anastomosis device supply chain. Tariffs ranging up to 25 percent on steel and aluminum derivatives, as well as duties on surgical instruments and electronic device components, have driven procurement executives to reevaluate sourcing strategies. Many manufacturers report increased lead times and heightened production costs, leading to preliminary forecasts of multi-million dollar impacts across major medtech portfolios.

To counterbalance these headwinds, several leading firms have diversified manufacturing footprints by ramping up domestic capacity. Boston Scientific and Abbott, for instance, have accelerated investments in U.S.-based facilities while also exploring near-shoring options in Mexico and Canada to reduce exposure to punitive duties. Simultaneously, strategic alliances with group purchasing organizations are being leveraged to secure fixed-price contracts and volume discounts that can absorb tariff hikes without passing excessive costs onto healthcare providers.

Healthcare systems themselves are mobilizing in response. Task forces within hospital networks are prioritizing stockpiling of critical anastomosis devices and components, while finance teams are engaging insurers to adjust reimbursement allowances for tariff-driven cost increases. Although these measures mitigate immediate disruptions, they underscore the need for long-term supply chain resilience and proactive engagement between manufacturers, providers, and policymakers.

Delivering nuanced insights into the diverse product, mechanism, procedural, and end-user segments shaping the cardiovascular anastomosis device ecosystem

The cardiovascular anastomosis device market can be understood through a multi-dimensional segmentation framework encompassing product type, operational mechanism, clinical procedure, and end-user environment. Within the product landscape, the industry spans clips, staplers, and suture devices, each addressing specific surgical requirements. Clips-both hemostatic and ligating-have evolved to include metal and polymer variants, while staplers range from circular to linear configurations, with the latter offering non-reinforced and reinforced staple lines. Suture devices bifurcate into automated and manual platforms, where automated options include both handheld and robotic suturers designed for high-precision applications.

Mechanism-based classification further highlights adhesive, clamping, compression, energy-based, and stapling modalities. Adhesive solutions encompass fibrin and synthetic sealants that promote vessel coaptation, whereas compression rings and bioabsorbable or metal buckles apply controlled mechanical force. Energy-based technologies leverage electrothermal, laser, and ultrasonic energy to facilitate secure anastomoses without physical implants.

Procedurally, anastomosis devices serve diverse applications from coronary artery bypass grafting-both off-pump and on-pump-to peripheral vascular surgeries such as carotid, femoropopliteal, and renal interventions, as well as complex valve repair cases. Device selection frequently aligns with procedure complexity and anatomical access requirements.

Finally, the end-user segmentation underscores demand across ambulatory surgery centers, hospitals, and specialty clinics. Each setting imposes unique sterility, throughput, and cost-management criteria that influence device design, usability features, and packaging strategies. By synthesizing insights across these segmentation vectors, stakeholders can identify priority areas for product innovation and market expansion.

This comprehensive research report categorizes the Cardiovascular Anastomosis Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Mechanism

- Procedure Type

- Surgery Type

- End User

Highlighting how distinct regional dynamics across the Americas, EMEA, and Asia-Pacific are influencing adoption, regulation, and growth of anastomosis devices

The Americas maintain leadership in cardiovascular anastomosis device utilization, buoyed by advanced healthcare infrastructure, robust reimbursement frameworks, and early adoption of cutting-edge technologies. Major U.S. hospital systems continue to invest in minimally invasive and automated anastomosis platforms, where the confluence of high procedural volumes and value-based payment models accelerates capital deployment in premium devices. Meanwhile, momentum in Canada and Brazil reflects expanding surgical capacity and national strategies aimed at reducing postoperative complications.

In Europe, Middle East, and Africa, universal healthcare systems and aging populations drive demand for reliable and cost-effective anastomosis solutions. Countries such as Germany and France emphasize standardized training programs and evidence-based device evaluations, ensuring that new implants and instruments meet rigorous clinical performance thresholds. Across the Middle East, significant healthcare investments and initiatives to develop medical tourism hubs are fostering interest in state-of-the-art anastomosis technologies that support shorter hospital stays and enhanced patient experiences.

Asia-Pacific markets exhibit the most rapid trajectory of adoption, underpinned by escalating healthcare expenditures, a surge in elective cardiovascular procedures, and government-led infrastructure expansion. China’s multi-year health plans allocate substantial funding toward cardiac care modernization, while India’s reimbursement schemes have broadened coverage for device-assisted surgeries following studies demonstrating reduced readmission rates and infection incidence. Southeast Asian economies continue to upgrade hospital networks, signaling sustained growth for manufacturers capable of delivering scalable, cost-efficient anastomosis solutions.

This comprehensive research report examines key regions that drive the evolution of the Cardiovascular Anastomosis Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading cardiovascular anastomosis device manufacturers and detailing their innovation strategies, supply chain adjustments, and market positioning

Key participants in the cardiovascular anastomosis domain are deploying a variety of strategic initiatives to sustain differentiation and operational resilience. Ethicon, a division of Johnson & Johnson, enhanced its portfolio in 2024 with the ECHELON LINEAR Cutter featuring novel 3D Stapling and Gripping Surface technologies designed to reduce staple line complications. Getinge secured FDA 510(k) clearance for its Vasoview Hemopro 3 endoscopic vessel harvesting system, reinforcing its commitment to procedural efficiency in cardiovascular surgery.

Medtronic continues to refine its Tri-Staple platforms, reporting superior perfusion and reduced leak rates compared to legacy systems. Boston Scientific and Abbott have announced expansions of U.S. manufacturing capabilities-with Boston Scientific opening new facilities in Georgia and Abbott directing multi-million dollar investments into R&D centers in Illinois and Texas-to mitigate tariff exposure and support localized production. Siemens Healthineers has committed $150 million toward U.S. growth initiatives, relocating key manufacturing operations to California and integrating real-time sensor analytics into its compression clamp offerings.

Beyond device launches and site expansions, these companies are forging partnerships with clinical networks and academic institutions to validate next-generation anastomosis techniques, optimize training curricula, and secure pathway reimbursement. Such collaborations aim to align product roadmaps with evolving procedural standards and payer requirements, thereby anchoring long-term competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiovascular Anastomosis Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- B. Braun Melsungen AG

- Baxter International Inc.

- Boston Scientific Corporation

- Cardio Medical GmbH

- Cook Medical Incorporated

- CryoLife, Inc.

- Edwards Lifesciences Corporation

- Getinge AB

- Johnson & Johnson

- LeMaitre Vascular, Inc.

- LivaNova PLC

- Medtronic plc

- Péters Surgical SASU

- Teleflex Incorporated

- TERUMO Corporation

- VasoPrep Surgical, LLC

- Vitalitec International, Inc.

- W. L. Gore & Associates, Inc.

Actionable strategies for industry leaders to navigate regulatory, technological, and supply chain challenges while capitalizing on emerging opportunities

Industry leaders must adopt a multifaceted approach to navigate a landscape marked by regulatory shifts, technological disruptions, and supply chain volatility. First, investing in automation platforms that seamlessly integrate with existing surgical workflows will differentiate product offerings and meet growing demand for reproducible, high-quality outcomes. Second, diversifying manufacturing footprints-through reshoring, near-shoring, and additive production-can insulate organizations from tariff-induced cost pressures and minimize lead-time uncertainties.

Third, strengthening partnerships with payers and healthcare systems to develop outcome-based reimbursement models will align incentives around device performance and patient value. These collaborations should leverage real-world evidence from registries and post-market studies to substantiate safety and efficacy claims. Fourth, accelerating digital supply chain transformation-employing predictive analytics and blockchain-enabled traceability-will enhance inventory management, mitigate component shortages, and streamline regulatory compliance across global operations.

Finally, prioritizing workforce development through surgeon training programs, simulation labs, and virtual reality platforms will ensure that clinical teams can maximize the benefits of next-generation anastomosis technologies. By synchronizing product innovation with clinical education and payer engagement, device manufacturers can unlock sustainable growth while delivering superior patient outcomes.

Outlining the comprehensive research framework and methodology used to ensure robust analysis and actionable insights in this cardiovascular devices report

This report employs a rigorous mixed-method research design to ensure comprehensive and credible insights. Secondary research involved an extensive review of peer-reviewed journals, clinical trial registries, regulatory filings, company disclosures, and industry association publications. Key data sources included the World Health Organization for epidemiological context and reputable medtech blogs and news outlets for tracking regulatory developments and product launches.

Primary research consisted of structured interviews and surveys with over 50 stakeholders, including cardiac surgeons, procurement executives, hospital administrators, and device engineers. These engagements provided firsthand perspectives on clinical requirements, purchasing decision criteria, and operational challenges. Data triangulation techniques were applied to validate findings, reconciling insights across multiple sources and mitigating potential biases.

Quantitative analyses leveraged descriptive statistics to map device utilization patterns and supply chain performance indicators, while qualitative thematic analysis distilled emerging trends and strategic imperatives. The combined approach ensures that the report’s conclusions and recommendations are grounded in robust evidence, offering stakeholders actionable intelligence for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiovascular Anastomosis Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiovascular Anastomosis Devices Market, by Product Type

- Cardiovascular Anastomosis Devices Market, by Mechanism

- Cardiovascular Anastomosis Devices Market, by Procedure Type

- Cardiovascular Anastomosis Devices Market, by Surgery Type

- Cardiovascular Anastomosis Devices Market, by End User

- Cardiovascular Anastomosis Devices Market, by Region

- Cardiovascular Anastomosis Devices Market, by Group

- Cardiovascular Anastomosis Devices Market, by Country

- United States Cardiovascular Anastomosis Devices Market

- China Cardiovascular Anastomosis Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3975 ]

Synthesizing key findings and strategic imperatives to underscore the transformative potential of cardiovascular anastomosis devices in modern healthcare

The landscape of cardiovascular anastomosis devices is undergoing rapid transformation driven by demographic pressures, clinical innovation, and evolving economic imperatives. As cardiovascular diseases continue to dominate global mortality profiles, the need for precise, efficient, and patient-centric anastomosis solutions has never been greater. Technological breakthroughs-from advanced stapling platforms and energy-based sealing to automated suturing systems-are redefining surgical capabilities and setting new benchmarks for procedural quality.

Meanwhile, complex dynamics such as tariffs and supply chain disruptions underscore the importance of strategic agility and operational resilience. Diversified manufacturing strategies, outcome-based reimbursement models, and digital supply chain solutions are emerging as critical levers for sustainable growth. Regional variations in adoption patterns highlight the necessity for market entry strategies tailored to local regulatory frameworks and healthcare infrastructures.

By integrating segmentation insights, regional perspectives, and competitive analyses, stakeholders can chart a path toward innovation and value creation. Moving forward, proactive collaboration with clinical, regulatory, and payer communities will be essential to unlock the full potential of next-generation anastomosis devices and improve patient outcomes across diverse healthcare settings.

Engage with Associate Director Ketan Rohom to secure exclusive insights and access this definitive cardiovascular anastomosis devices market research report today

Unlock unparalleled market intelligence and capitalize on strategic insights by purchasing the comprehensive cardiovascular anastomosis devices market research report today. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss tailored research deliverables that align with your organization’s objectives. Gain immediate access to detailed analyses, competitive benchmarking, and actionable frameworks designed to empower decision-making and fuel growth. Reach out to Ketan Rohom now to secure your copy and elevate your strategic planning.

- How big is the Cardiovascular Anastomosis Devices Market?

- What is the Cardiovascular Anastomosis Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?