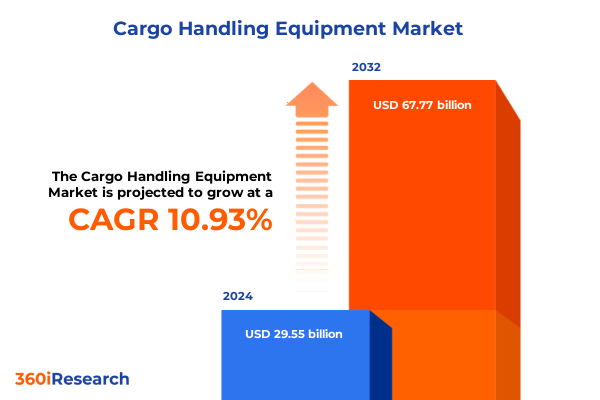

The Cargo Handling Equipment Market size was estimated at USD 32.55 billion in 2025 and expected to reach USD 35.86 billion in 2026, at a CAGR of 11.04% to reach USD 67.77 billion by 2032.

Setting the Stage for Cargo Handling Equipment Transformation in an Era of Technological Innovation and Global Supply Chain Complexity

The cargo handling equipment sector stands at the crossroads of rapid technological advancement and evolving global supply chain demands. As industries across transportation, logistics, and manufacturing seek greater throughput and cost efficiencies, equipment providers are integrating digital capabilities and automation to meet these imperatives. In parallel, heightened geopolitical tensions and shifting trade policies have introduced new complexities into sourcing and procurement, compelling stakeholders to reassess their operational frameworks.

Against this backdrop, the market narrative is being rewritten by innovations in robotics, data analytics, and sustainable power systems. Automation not only enhances reliability and safety but also addresses labor shortages by streamlining material movement across ports, warehouses, and manufacturing floors. Meanwhile, data-driven asset management tools enable predictive maintenance and real-time visibility into cargo flows, offering a strategic advantage for operators aiming to minimize downtime and optimize resource allocation. These converging trends underscore the critical need for a holistic understanding of emerging capabilities and risk factors as organizations chart their future investments in cargo handling infrastructure.

Unraveling the Technological and Operational Disruptions Redefining Cargo Handling Equipment Strategies and Capabilities

Over the past several years, cargo handling has undergone a seismic shift driven by the convergence of digitalization, robotics, and sustainability imperatives. Advanced sensing technologies and autonomous navigation systems have transitioned from pilot programs to full-scale deployments, radically altering how goods are transferred, sorted, and stored. Moreover, the rise of hybrid and electric powertrains has redefined equipment reliability metrics, reducing emissions while delivering the operational performance that modern facilities require.

In tandem with these technological forces, business models are evolving as as-a-service offerings gain traction, allowing operators to outsource equipment management and pay based on utilization rather than ownership. This shift facilitates rapid scalability, enabling companies to adapt swiftly to demand fluctuations without incurring significant capital outlays. Consequently, incumbent players and start-up ventures alike are forging alliances to combine domain expertise with software platforms, resulting in ecosystems that integrate material handling, warehouse management, and supply chain orchestration into cohesive solutions.

Examining the Far‐Reaching Effects of 2025 U.S. Trade Tariffs on Cargo Handling Equipment Sourcing, Costs, and Competitive Positioning

The introduction of additional United States tariffs on imported cargo handling systems in early 2025 has had a profound ripple effect across procurement strategies and total cost structures. Manufacturers reliant on overseas components and assemblies have faced increased landed costs, prompting a reevaluation of global supplier networks. In response, some operators have accelerated near-shoring initiatives, shifting production closer to end markets to mitigate exposure to tariff escalations and reduce lead times.

At the same time, the tariff environment has encouraged domestic equipment investments, sparking conversations around reshoring and supply chain resilience. Equipment providers with in-country manufacturing capabilities have reported heightened demand as end users seek to minimize price volatility. However, the increased costs have also pressured service providers to optimize equipment utilization and introduce more flexible leasing arrangements. As a result, the industry is experiencing a strategic realignment, balancing short-term cost inflation against longer-term benefits derived from localized production and streamlined logistics.

Deconstructing Cargo Handling Equipment Demand Through Equipment Type, Application, End‐User Industry, and Deployment Perspectives

Analyzing market demand through an equipment-type lens reveals a spectrum of solutions tailored to distinct operational requirements. Automated guided vehicles have gained momentum due to their ability to navigate complex pathways using laser guidance and magnetic guidance, offering precision in high-density environments. Conveyors and sortation architectures, differentiated by belt and roller mechanisms, continue to underpin high-throughput facilities, while cranes ranging from mobile platforms to overhead systems-encompassing gantry and jib configurations-serve heavy-lift and bulk handling applications. The reach stacker segment is indispensable in intermodal terminals, providing agility for container stacking, whereas straddle carriers deliver flexibility in transshipment yards. Forklift fleets, powered by diesel, electric, or gas, remain foundational for last-mile repositioning.

Shifting to application trends, airports necessitate high-speed sortation and automated baggage handling to minimize dwell times, whereas logistics centers prioritize scalable conveyor networks and guided vehicles for order fulfillment. Manufacturing settings demand integrated crane and conveyor systems to optimize material flow, and ports and terminals rely on robust straddle carrier and reach stacker operations to maintain continuous vessel turnaround. Rail yards integrate specialized lifts and conveyors to transition bulk goods efficiently, while warehouses and distribution centers require versatile forklifts and sortation lines to satisfy omnichannel requirements.

Examining end-user verticals, the aviation sector emphasizes reliability and safety certifications, construction and mining sectors favor heavy-duty cranes and stackers for rugged terrain, and the oil & gas industry demands explosion-proof designs. Logistics and warehousing operators seek modular installations that can be reconfigured quickly to address seasonality, and the manufacturing domain prioritizes systems that support just-in-time workflows.

Deployment type analysis highlights the dichotomy between fixed installations, such as permanent conveyor networks in distribution hubs, and mobile assets, which enable dynamic yard operations and pop-up facilities. Together, these segmentation perspectives provide a multi-dimensional view of cargo handling equipment adoption, guiding stakeholders to align investments with operational use cases and technology trajectories.

This comprehensive research report categorizes the Cargo Handling Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Application

- End User Industry

- Deployment Type

Assessing Regional Divergence in Cargo Handling Equipment Adoption Across the Americas, Europe, Middle East & Africa, and Asia‐Pacific Markets

Regional dynamics are reshaping the global cargo handling equipment landscape, reflecting diverging infrastructure investments and regulatory frameworks. In the Americas, modernization of port terminals and expansion of warehousing capacity driven by e-commerce growth have catalyzed demand for automated guided vehicles and advanced sortation solutions. Policy incentives aimed at domestic manufacturing have further bolstered onshore production capabilities, enabling end users to secure equipment with shorter lead times and reduced tariff risk.

Across Europe, Middle East & Africa, sustainability mandates and stringent emissions regulations are driving the adoption of electric forklifts and hybrid cranes. At the same time, strategic investment in inland connectivity and rail infrastructure under the African Continental Free Trade Area is creating new opportunities for mobile handling equipment in emerging trade corridors. The service-oriented economies of Western Europe continue to invest in turnkey warehouse automation, while the Gulf region focuses on large-scale port expansions and smart terminal projects.

In Asia-Pacific, rapid urbanization and manufacturing growth in countries such as India and Southeast Asia are underpinning strong uptake of straddle carriers and reach stackers. The region’s leading ports are piloting full-scale autonomous container handling, leveraging advancements in artificial intelligence and computer vision. Moreover, domestic equipment manufacturers are scaling production to serve both local and export markets, intensifying competition and accelerating technology transfer.

This comprehensive research report examines key regions that drive the evolution of the Cargo Handling Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cargo Handling Equipment Providers and Evaluating Their Strategic Moves, Partnerships, and Innovation Trajectories

Leading players in the cargo handling equipment arena are forging partnerships, investing in R&D, and expanding service networks to differentiate their offerings. Strategic alliances between established OEMs and software innovators have yielded integrated fleet management platforms that combine hardware reliability with real-time analytics. Similarly, some manufacturers are establishing localized assembly plants and spare-parts hubs in key logistics corridors to expedite maintenance response times and drive customer loyalty.

Innovation roadmaps are prioritizing modular system architectures that enable plug-and-play enhancements, such as retrofitting existing cranes with digital twin capabilities or upgrading conveyor lines with smart sensors. In parallel, service providers are introducing outcome-based contracts that tie fees to throughput or uptime metrics, shifting risk and incentivizing continuous performance improvements. As competitive pressures intensify, companies are also exploring adjacent markets, including intralogistics software and robotics, to broaden their value propositions and hedge against cyclical demand swings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cargo Handling Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anhui Heli Co., Ltd.

- Cargotec Oyj

- Crown Equipment Corporation

- Daifuku Co., Ltd.

- Hyster-Yale Group, Inc.

- Jungheinrich AG

- KION Group AG

- Komatsu Ltd.

- Komatsu Ltd.

- Konecranes Oyj

- Mitsubishi Logisnext Co., Ltd.

- Terex Corporation

- Toyota Industries Corporation

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Cargo Handling Equipment Opportunities and Mitigate Operational Risks

Industry leaders should prioritize the harmonization of equipment digitalization initiatives with enterprise resource planning systems to unlock end-to-end visibility. By integrating predictive maintenance algorithms with supply chain orchestration platforms, organizations can preempt disruptions and optimize asset utilization. Furthermore, adopting flexible financing models, such as equipment-as-a-service, enables operators to scale capacity in line with demand dynamics without compromising balance sheets.

Another recommendation is to cultivate collaborative ecosystems that bring together OEMs, software developers, and end users. Co-development programs can accelerate the refinement of autonomous handling solutions and foster shared standards for interoperability. Additionally, companies should explore near-shoring opportunities to diversify supply chains, balancing cost considerations with geopolitical resilience. Finally, embedding sustainability benchmarks into procurement criteria will not only support regulatory compliance but also resonate with stakeholders demanding lower carbon footprints across logistics operations.

Articulating the Rigorous Research Methodology That Underpins the Integrity and Depth of the Cargo Handling Equipment Analysis

This analysis is grounded in a multi-stage research methodology that combines primary interviews with senior executives at equipment manufacturers, port authorities, and logistics operators alongside extensive secondary research. Detailed technical briefings and site visits provided firsthand perspectives on installation challenges, uptime performance, and operator feedback. Concurrently, patent filings, regulatory filings, and corporate disclosures were evaluated to map innovation trajectories and investment patterns.

Quantitative data were cross-verified using customs databases, financial statements, and trade association reports to ensure accuracy and consistency. Segmentation matrices were developed to capture nuanced distinctions across equipment types, applications, end-user industries, and deployment models. Finally, regional market assessments were refined through local expert consultations, ensuring that geopolitical factors, policy frameworks, and infrastructure developments were fully integrated into the conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cargo Handling Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cargo Handling Equipment Market, by Equipment Type

- Cargo Handling Equipment Market, by Application

- Cargo Handling Equipment Market, by End User Industry

- Cargo Handling Equipment Market, by Deployment Type

- Cargo Handling Equipment Market, by Region

- Cargo Handling Equipment Market, by Group

- Cargo Handling Equipment Market, by Country

- United States Cargo Handling Equipment Market

- China Cargo Handling Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Critical Insights to Illuminate the Future Trajectory of Cargo Handling Equipment and Strategic Priorities

The collective insights illuminate a sector in flux, driven by the interplay of automation, digitalization, and shifting trade dynamics. Stakeholders who embrace flexible deployment models and invest in intelligent asset management will be best positioned to capitalize on evolving operational requirements. Meanwhile, regional disparities underscore the importance of tailoring strategies to local infrastructure priorities and regulatory landscapes.

Looking ahead, the most successful organizations will be those that foster cross-industry collaboration, align technological innovation with sustainability goals, and maintain agility in their supply chain architectures. As cargo handling equipment continues to evolve, the convergence of hardware excellence, data-driven decision making, and resilient sourcing strategies will define the competitive frontier. By synthesizing these elements, decision-makers can navigate uncertainty and secure long-term growth pathways.

Partner with Ketan Rohom to Unlock Comprehensive Cargo Handling Equipment Market Intelligence and Drive Strategic Growth

Elevate your strategic decision-making with bespoke market intelligence tailored to the nuances of cargo handling equipment. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this report can inform investment choices, operational enhancements, and competitive positioning. Connect with an expert who can guide you through the actionable insights and deliver a customized briefing that aligns with your organizational objectives. Embark on the next phase of growth and operational excellence by securing the comprehensive analysis that will empower you to navigate evolving market dynamics with confidence and foresight.

- How big is the Cargo Handling Equipment Market?

- What is the Cargo Handling Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?