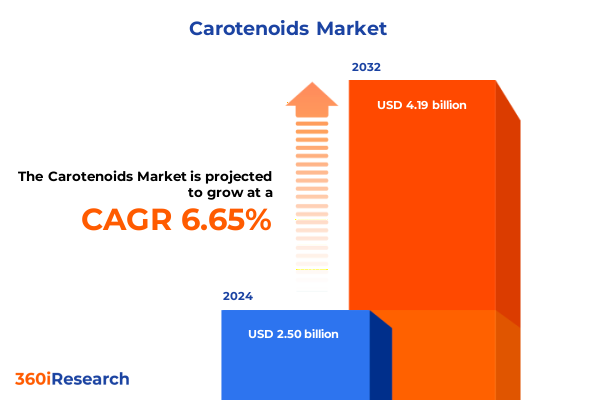

The Carotenoids Market size was estimated at USD 2.65 billion in 2025 and expected to reach USD 2.81 billion in 2026, at a CAGR of 6.75% to reach USD 4.19 billion by 2032.

Exploring the Vital Role and Diverse Applications of Carotenoids Across Industries with a Comprehensive Look at Their Biological Functions and Market Drivers

Carotenoids are naturally occurring pigments found in plants, algae, and bacteria, responsible for the red, orange, and yellow hues in a wide array of organisms. Beyond their visual impact, these compounds function as potent antioxidants, scavenging free radicals and contributing to immune support. As precursors to vitamin A, carotenoids play a critical role in vision health, cellular communication, and skin integrity, underscoring their multifaceted importance across both human and animal nutrition.

Across numerous industries, carotenoids have become indispensable ingredients, valued for their dual functionality as nutritional enhancers and natural colorants. The dietary supplement sector, in particular, relies heavily on carotenoids to meet consumer demand for antioxidant-rich formulations, while animal feed producers incorporate these pigments to improve livestock health and product quality. Simultaneously, the food and beverage market has embraced carotenoids to fulfill clean-label requirements, replacing synthetic dyes with naturally derived alternatives to align with evolving regulatory standards and consumer preferences.

As consumer focus on health and wellness intensifies, the momentum behind carotenoid adoption has accelerated. Brands across cosmetics, dietary supplements, and functional foods are leveraging the bioactive properties of carotenoids to differentiate products, promoting benefits such as enhanced skin protection, eye health, and anti-inflammatory effects. This convergence of aesthetic and functional attributes positions carotenoids as a cornerstone of innovation in the broader nutraceutical landscape, setting the stage for continued exploration of novel delivery formats and application areas.

Given this foundational understanding of carotenoid biology and utility, the following sections delve into emerging technological advances, regulatory shifts, trade developments, market segmentation patterns, regional variations, and competitor strategies shaping the future of this dynamic sector.

Uncovering the Technological Innovations, Sustainability Initiatives, and Consumer Trends Fuelling Transformative Shifts within the Carotenoid Industry Landscape

The carotenoid industry is undergoing a period of rapid transformation driven by technological innovation and evolving consumer expectations. Advanced encapsulation techniques, such as microencapsulation and nano-delivery systems, are redefining how these pigments are stabilized, protected from oxidation, and delivered in end products. These innovations enhance bioavailability while maintaining the structural integrity of carotenoids during processing, thereby unlocking new applications in functional beverages, fortified foods, and high-performance cosmetics.

Meanwhile, sustainability has emerged as a core priority, prompting companies to explore renewable sourcing strategies. Traditional extraction from plant materials has given way to algae cultivation and microbial fermentation, reducing land use and environmental impact. Microalgae-derived compounds, cultivated in controlled photobioreactors, offer consistent purity and yield, while fermentation-based methods enable scalable production of high-value pigments without relying on petrochemical feedstocks.

Biotechnology is playing a pivotal role in streamlining manufacturing processes. Genetic engineering of yeast and bacterial strains has accelerated the development of high-yield carotenoid-producing microbes, facilitating cost-effective generation of beta-carotene, lutein, and astaxanthin. These methods not only support greater production efficiency but also pave the way for tailored carotenoid profiles, enabling formulators to fine-tune pigment composition to meet specific formulation and regulatory requirements.

Concurrently, application trends are shifting as cross-industry collaboration intensifies. In aquaculture, carotenoids are essential for pigmentation in farmed salmon and shrimp, while the cosmetics sector leverages their antioxidant properties for skin health formulations. Dietary supplements, functional foods, and pharmaceutical products are increasingly incorporating carotenoids to address emerging consumer concerns around eye health, immune function, and chronic inflammation. This confluence of innovation and demand is reshaping the competitive dynamics of the carotenoid landscape.

Assessing the Complex Impacts of 2025 United States Tariff Policies on Carotenoid Supply Chains, Pricing Structures, and Strategic Sourcing Decisions

Beginning on April 5, 2025, the U.S. government implemented a universal 10 percent tariff on imports from non-exempt countries, impacting a broad spectrum of raw materials, including carotenoids. These measures, introduced under an executive order addressing trade imbalances, added a new layer of complexity for businesses reliant on imported pigments, driving immediate cost increases for importers and downstream manufacturers.

Within days, additional reciprocal tariffs came into effect, raising rates for key sourcing partners. Notably, imports from China faced cumulative duties of up to 145 percent when accounting for combined reciprocal and existing Section 301 tariffs, while goods originating in India experienced similar upward adjustments. Given that a significant portion of global carotenoid production is concentrated in these regions, the new tariff structure has materially altered sourcing economics and encouraged stakeholders to reevaluate supply chain configurations.

These elevated duties have translated into higher input costs across multiple sectors. Nutritional supplement manufacturers, feed additive producers, and cosmetic formulators have all reported significant price pressures, leading to narrower margins or the need to adjust end-product pricing. The tariffs have also disrupted established logistics and procurement strategies, creating challenges in inventory planning and contractual negotiations with suppliers.

Importantly, the tariff exemptions outlined in Annex II of the executive order did not include major carotenoid pigments. While a range of vitamins, fatty acids, and peptides secured relief, carotenoids such as beta-carotene, lutein, and astaxanthin remained subject to the full duty structure. This exclusion has underscored the strategic urgency for companies to explore alternative sourcing routes and engage with policymakers to seek carve-outs for these essential ingredients.

In response, industry leaders are accelerating diversification efforts, expanding domestic production capacities, and seeking partnerships with suppliers in tariff-exempt jurisdictions. These strategic adaptations aim to mitigate the immediate financial impact of tariffs and bolster long-term supply chain resilience, while maintaining the consistent quality and availability of carotenoid ingredients.

Gaining Strategic Insights into Market Segmentation Based on Source, Form, Application, and Type to Guide Targeted Carotenoid Product Development

Market segmentation based on source reveals two primary categories: synthetic carotenoids, produced via petrochemical processes, and natural carotenoids, derived through biological methods. Within the natural segment, distinct pathways exist, including microalgae cultivation, microbial fermentation platforms, and direct extraction from plant tissues. Each source presents unique advantages in terms of purity, sustainability, and cost, guiding strategic positioning within the ingredient value chain.

Formulation-driven segmentation delineates the market into emulsion systems, liquid concentrates, oil suspensions, and dry powders. Liquid carotenoid concentrates have emerged as a particularly dynamic format, prized for their ease of incorporation into beverages and fluid-based products. Nevertheless, powder-based solutions continue to command adoption in solid dosage forms and dry mixes, balancing stability with flexibility across diverse applications.

Applications of carotenoids span animal feed additives, cosmetic actives, dietary supplement ingredients, food and beverage colorants, and pharmaceutical intermediates. In animal nutrition, carotenoids improve pigmentation and health metrics in aquaculture and poultry, whereas in cosmetics they deliver antioxidant protection and visual appeal. The dietary supplement sector emphasizes health functionality, while the food industry leverages carotenoids for clean-label color enhancement, and pharmaceutical developers explore their role in disease prevention and therapeutics.

Classification by chemical type further segments the landscape into key pigments: astaxanthin, beta-carotene, canthaxanthin, lutein, lycopene, and zeaxanthin. These core compounds vary in molecular structure, bioactivity, and regulatory status, informing formulation strategies and end-use positioning. The distinct nutritional and functional properties associated with each carotenoid type enable targeted product development to address evolving consumer and industrial requirements.

This comprehensive research report categorizes the Carotenoids market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Form

- Type

- Application

Examining Regional Carotenoid Market Dynamics Across the Americas, Europe Middle East Africa, and Asia Pacific to Illuminate Growth Opportunities

In the Americas, robust demand for natural and functional ingredients has positioned the United States as a leading market. Strong consumer awareness of the benefits of antioxidants and clean-label colorants continues to drive adoption of carotenoid-based products across dietary supplements, functional beverages, and animal feeds. Investment in domestic fermentation and extraction facilities further reinforces the region’s supply chain strength, enabling faster response times and localized product formulations.

The Europe, Middle East, and Africa region is characterized by stringent regulatory frameworks and a pronounced focus on sustainability. European Union directives promoting natural additives and minimizing chemical residues have accelerated the shift toward plant- and algae-derived carotenoids. In the Middle East and Africa, expanding food processing capabilities and growing consumer purchasing power are creating new opportunities for carotenoid applications in both food and non-food sectors, supported by strategic partnerships and technology transfer initiatives.

Asia Pacific is witnessing the fastest growth trajectory, fueled by rapid industrialization, a rising middle class, and increasing health consciousness. Countries such as China, India, and Japan are investing heavily in biotechnology research, with several new algae cultivation and microbial fermentation facilities coming online. These developments are enabling cost-effective production of high-purity carotenoids, while the growing pharmaceutical and personal care markets in the region further amplify demand for these versatile compounds.

This comprehensive research report examines key regions that drive the evolution of the Carotenoids market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Competitive Landscape and Strategies of Major Carotenoid Producers to Highlight Key Industry Leaders Driving Innovation and Expansion

One of the largest industry players, BASF has faced significant supply disruptions following a fire at its Ludwigshafen complex, which halted production of vitamins and carotenoids. Initially declaring force majeure on carotenoid supplies, the company outlined a phased restart with aroma ingredients resuming by late 2024 and carotenoid manufacturing set to come back online by July 2025. This incident has underscored the critical importance of contingency planning and capacity redundancy among major producers.

DSM Nutritional Products has pursued an innovation-led growth strategy, exemplified by its acquisition of Massachusetts-based Microbia. This deal expanded DSM’s proprietary fermentation platform for natural carotenoids such as beta-carotene and canthaxanthin, leveraging microbial strains capable of generating high yields of lycopene and other pigments. The firm’s focus on biotechnology-driven solutions and recent GRAS approval for its bio-based beta-carotene portfolio underscore its commitment to sustainable and scalable production methods.

Beyond these giants, other key competitors shape the market landscape. Major companies profiled in recent industry studies include FMC, Kemin Industries, Allied Biotech, Lycored, Divis Laboratories, Cyanotech, D.D. Williamson, Vidya Herbs, Chr. Hansen, Algatech, Brenntag, Valensa, ExcelVite, BioExtract, Sensient, EID Parry, DDW, and Döhler. These organizations are pursuing diverse strategies-ranging from targeted acquisitions and joint ventures to geographic expansion and product line extensions-to capture emerging opportunities and address evolving customer needs.

Strategic initiatives such as DSM-Firmenich’s precision fermentation investments and Novus International’s focus on specialized feed pigments highlight the emphasis on R&D and collaboration. Companies including Kemin Industries have formed partnerships with academic institutions to advance microbiome and bioavailability research, while several players are integrating digital tools to optimize supply chain visibility and demand forecasting. These efforts collectively drive competitiveness and innovation across the carotenoid sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carotenoids market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Algatech

- Allied Biotech Corp. Ltd.

- BASF SE

- BioExtract

- Chr. Hansen Holding A/S

- Cyanotech Corporation

- Divi’s Laboratories Ltd.

- Doehler Group SE

- DSM Nutritional Products AG

- EID Parry Limited

- Flavorchem Corporation

- FMC Corporation

- Fuji Chemical Industry Co. Ltd.

- Givaudan SA

- Kemin Industries, Inc.

- LycoRed Ltd.

- Novus International, Inc.

- Nutralliance

- Sensient Cosmetic Technologies SAS

- Zhejiang Medicine Co. Ltd.

Presenting Actionable Strategic Recommendations for Industry Leaders to Navigate Supply Chain Disruptions and Capitalize on Emerging Carotenoid Opportunities

Industry leaders should prioritize diversification of raw material sources to mitigate the risks associated with concentrated supplier geographies and tariff exposure. Establishing multiple fermentation partnerships, investing in modular extraction facilities, or forming alliances with regional producers can create redundancy and flexibility. This approach not only buffers against trade policy shifts but also supports rapid adaptation to evolving sustainability standards.

Maximizing production efficiency through advanced bioprocessing technologies will be essential. Companies should allocate resources to scale up precision fermentation and photobioreactor operations, while exploring continuous processing models that reduce energy consumption and increase output consistency. Collaborations with biotech startups and academic research centers can accelerate innovation and lower development timelines.

Engagement with policymakers and industry associations is critical for securing favorable regulatory frameworks. Stakeholders must advocate for balanced tariff exemptions, streamlined approval pathways for novel carotenoid strains, and recognition of sustainable production practices in trade negotiations. Proactive involvement in public consultations and tariff exclusion petitions can shape policies that underpin long-term industry stability.

Finally, enhancing digital capabilities across sales, procurement, and operations will yield strategic benefits. Deploying predictive analytics for demand forecasting, implementing blockchain for supply chain traceability, and integrating AI-driven formulation platforms can improve decision-making and drive competitive differentiation. By aligning technological advancements with market intelligence, organizations can optimize resource allocation and capture emerging growth pockets.

Detailing the Rigorous Research Methodology Incorporating Primary Interviews and Secondary Data to Ensure Accurate and Comprehensive Carotenoid Market Analysis

This research employed a dual-phase methodology integrating primary interviews and secondary data analysis to ensure robust and actionable insights. In the first phase, structured discussions were conducted with industry executives, fermentation experts, regulatory consultants, and supply chain managers to gather qualitative perspectives on emerging trends, competitive strategies, and operational challenges.

The secondary research phase involved exhaustive review of publicly available sources, including regulatory filings, scientific publications, trade publications, and company disclosures. This iterative process validated primary insights while enriching the analysis with quantitative frameworks and historical context.

Data triangulation techniques were applied to reconcile divergent viewpoints and data points, ensuring that conclusions reflect a balanced and accurate representation of market conditions. Supplementing these efforts, scenario modeling was used to test the potential impact of tariff shifts, technological breakthroughs, and demand evolutions under varying assumptions.

The combination of expert interviews, comprehensive literature review, and rigorous analytical modeling underpins the credibility of this report, offering stakeholders a well-founded basis for strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carotenoids market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carotenoids Market, by Source

- Carotenoids Market, by Form

- Carotenoids Market, by Type

- Carotenoids Market, by Application

- Carotenoids Market, by Region

- Carotenoids Market, by Group

- Carotenoids Market, by Country

- United States Carotenoids Market

- China Carotenoids Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing the Critical Findings and Strategic Takeaways Underscoring the Future Trajectory of the Global Carotenoid Industry

This executive summary has outlined the multifaceted role of carotenoids as critical ingredients across health, nutrition, and industrial applications. Technological innovations, such as advanced delivery systems and sustainable bioprocessing, are redefining the competitive landscape, while 2025 tariff policies have introduced new imperatives for supply chain resilience and sourcing diversification.

Segmentation analysis revealed the importance of aligning product strategies with specific source, form, application, and type requirements, enabling targeted formulation and market entry. Regional insights emphasized the leading roles of the Americas and EMEA in driving demand, with Asia Pacific poised for rapid expansion fueled by investment in biotechnology and shifting consumer preferences.

Major companies, including BASF and DSM, exemplify the dynamic interplay of capacity management, strategic acquisitions, and R&D focus. The recommendations presented-diversified sourcing, adoption of advanced bioprocesses, proactive policy engagement, and digital optimization-are designed to empower decision-makers in navigating complexities and capitalizing on growth opportunities.

By synthesizing these insights, industry participants can chart a path toward enhanced operational efficiency, market penetration, and sustainable value creation in the evolving global carotenoid arena.

Engage with Ketan Rohom to Secure the Comprehensive Carotenoid Market Research Report and Drive Strategic Growth for Your Business

To gain deeper insights into the evolving dynamics, detailed analysis, and strategic implications of the global carotenoid industry, reach out to Ketan Rohom, Associate Director, Sales & Marketing, and secure your copy of the comprehensive market research report. His expertise will ensure you receive tailored guidance and a full suite of data-driven findings to support your strategic initiatives and drive competitive advantage.

- How big is the Carotenoids Market?

- What is the Carotenoids Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?