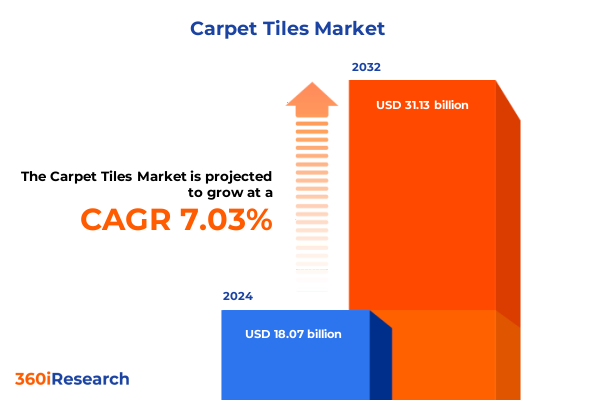

The Carpet Tiles Market size was estimated at USD 19.33 billion in 2025 and expected to reach USD 20.69 billion in 2026, at a CAGR of 7.04% to reach USD 31.13 billion by 2032.

Exploring the Growing Versatility and Strategic Value of Carpet Tiles in Commercial and Residential Spaces Driven by Innovation and Sustainability Trends

Carpet tiles have emerged as a highly versatile and strategic flooring solution, addressing a vast array of aesthetic, functional, and sustainability demands across built environments. In the commercial sphere they support high-traffic durability, acoustic comfort, and design flexibility, while in residential settings they offer homeowners the ability to create unique visual narratives without sacrificing performance. This modular format has evolved beyond simple square panels to sophisticated offerings that respond to changing workplace requirements, evolving design sensibilities, and growing sustainability expectations.

Transitioning from traditional wall-to-wall broadloom carpet and hard surface alternatives, modern carpet tiles are engineered with recycled and bio-based yarns, enhanced backing systems for ease of installation, and advanced stain-resistant treatments. These innovations reflect a broader shift toward circular economy principles, as manufacturers increasingly incorporate take-back programs and closed-loop recycling. As a result, specifiers and end users alike are rethinking flooring choices to align with environmental goals, occupants’ health requirements, and lifecycle cost considerations. This introduction sets the foundation for understanding how modular carpet tile solutions have risen to prominence at the intersection of design, functionality, and sustainability.

Advances in Material Innovation and Installation Technology Are Reshaping Modular Carpet Tile Solutions Toward Enhanced Sustainability and Performance

In recent years, material innovation and installation technology have converged to reshape the landscape of modular carpet flooring. Bio-based nylon alternatives and advanced polyester blends now offer performance properties on par with traditional polymers, reducing dependency on fossil feedstocks. At the same time, next-generation backing systems leverage interlocking and loose-lay mechanisms to eliminate adhesives, dramatically reducing installation time and facilitating rapid reconfiguration of interior layouts. Digital printing capabilities have unlocked new degrees of customization, empowering designers to translate brand narratives directly onto floor surfaces with unprecedented color fidelity and pattern complexity.

Furthermore, environmentally focused initiatives have spurred manufacturers to embed recycled content and low-emission adhesives, while facility managers benefit from improved indoor air quality and acoustic attenuation. Advances in sensor integration allow real-time monitoring of indoor conditions, guiding maintenance schedules and optimizing occupant comfort. The combined effect of these transformative shifts is a flooring ecosystem that not only meets evolving aesthetic preferences but also supports health, wellness, and operational agility across diverse end-use scenarios.

Evaluating the Far Reaching Consequences of Recently Instituted United States Tariffs on Raw Materials and Finished Carpet Tile Supply Chains

The imposition of newly instituted United States tariffs on key raw materials and completed flooring products has sent ripples across carpet tile supply chains. Manufacturers reliant on nylon and polypropylene imports have faced immediate cost pressures, prompting a strategic reassessment of sourcing networks. Consequently, many producers have accelerated collaborations with Asia-Pacific partners offering competitive feedstock prices, while domestic recyclers have seen an uptick in demand for reclaimed yarn. The interplay of tariffs and rising transportation expenses has steered innovation toward alternative fiber blends and regionally sourced materials to mitigate cost volatility.

As designers and end users become more price-sensitive, value engineering has emerged as a critical lever. Suppliers are recalibrating product specifications to maintain performance standards while managing per-square-foot expenses. In parallel, logistics teams are exploring direct-to-site shipping models and regional distribution hubs to dampen the impact of import duties. These cumulative adaptations demonstrate the industry’s agility in responding to external policy shifts, while highlighting the importance of dynamic supplier relationships and flexible manufacturing footprints.

Deeply Analyzing Market Dynamics Through Segmentation by End Use Installation Methods Product Styles Material Composition Applications and Distribution Channels

A holistic view of the carpet tile landscape reveals nuanced dynamics when observed through multiple segmentation lenses. Commercial spaces, characterized by concentrated foot traffic and elevated brand standards, adopt interlocking and glue-down installations to ensure stability, whereas residential markets often embrace loose-lay and peel-and-stick options for their ease of replacement and DIY appeal. Within these settings, product expressions range from bold graphics and complex patterned compositions to striated motif sequences and understated tonal palettes, serving both functional and decorative imperatives.

Material composition further stratifies the market as nylon continues to dominate with its resilience, polyester captures attention through cost efficiency, polypropylene appeals for moisture resistance, and wool retains its premium cachet among upscale clients. Application sectors present distinct opportunities: educational environments demand enhanced slip resistance; healthcare settings spanning clinics hospitals and laboratories prioritize hygiene and acoustic performance; hospitality venues seek rapid installation turnarounds; offices including conference rooms open-plan areas and private offices call for balanced aesthetics and durability; and retail spaces require design versatility to align with brand identity. Finally, distribution channels encompass direct sales relationships with large-scale developers, distributor partnerships offering local inventory support, growing online platforms catering to smaller projects, and brick-and-mortar retailers serving immediate needs. By weaving these segmentation frameworks together a granular perspective emerges on where growth, innovation, and competitive advantage can be cultivated.

This comprehensive research report categorizes the Carpet Tiles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Installation Type

- Product Type

- Material Type

- End User

- Application

- Sales Channel

Comparative Analysis of Regional Market Drivers and Adoption Patterns in the Americas Europe Middle East Africa and Asia Pacific Carpet Tile Sectors

Regional markets exhibit distinct behavior shaped by economic maturation regulatory environments and cultural preferences. In the Americas sustainable mandates in North America propel adoption of recycled backing systems, while Latin American expansion in hospitality and corporate construction drives demand for rapid install solutions. Environmental compliance frameworks across Canada and the United States have reinforced interest in lifecycle assessments and take-back programs.

Across Europe the Middle East and Africa, stringent circular economy targets have catalyzed recycling initiatives and closed-loop design collaborations. Customizable modules and intricate pattern overlays resonate with clients seeking to reflect regional architectural traditions. In the Asia Pacific basin sustained urbanization and hospitality growth continue to spur investment in education infrastructure and high-end commercial developments, prompting manufacturers to accelerate localized production, streamline logistics, and tailor materials to meet both climatic variations and cost sensitivities in emerging urban centers.

This comprehensive research report examines key regions that drive the evolution of the Carpet Tiles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insights into Strategic Innovations Collaboration Approaches and Sustainability Commitments Shaping Competitive Dynamics Among Leading Carpet Tile Manufacturers

Leading manufacturers have differentiated themselves through distinct strategic imperatives. One global pioneer has set ambitious carbon negative targets, integrating regenerated nylon and bio-resins into its supply chain and pioneering closed-loop takeback initiatives with major facility operators. Another industry heavyweight has invested heavily in digital tools to enable virtual space planning and real-time product visualization, bolstering its partnership network with interior design studios and architecture firms.

A third key competitor has concentrated on developing hybrid fiber blends that offer a balance between cost performance and environmental attributes, forging alliances with logistics providers to optimize delivery timelines. Additional market participants are exploring performance-enhancing nanocoatings that confer stain resistance and ultraviolet stability, while smaller niche brands capitalize on differentiated acoustical solutions to address the growing demand for sound management in open-plan workspaces. Collectively these varied approaches illustrate how innovation investment and collaborative ventures are redefining competitive dynamics within the carpet tile space.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carpet Tiles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbey Carpet & Floor

- All Tile Inc. by Crown Products, Inc.

- ANKER Gebr. Schoeller GmbH + Co. KG

- Beaulieu of Australia Pty Ltd.

- Dixie Group Inc.

- Engineered Floors, LLC

- EO Technology Co. Ltd.

- Flor, LLC

- Forbo Holding Ltd

- Gerflor Group

- Hunan Tianxin Technology Co.Ltd.

- Interface, Inc.

- J + J Flooring Group, LLC

- Japan Carpet Co., Ltd.

- Kent International

- Milliken & Company

- Mohawk Industries, Inc

- Paragon Carpet Tiles

- Scott Group Studio

- Shaw Industries, Inc.

- Suminoe Textile Co., Ltd.

- Suzhou Tuntex Fiber & Carpet Co., Ltd.

- Tarkett Floor Covering (Shanghai) Co.,Ltd.

- Victoria PLC

- Wuxi Diamond Carpet Manufacturing Co., Ltd.

Actionable Strategies and Proven Frameworks to Empower Industry Leaders in Leveraging Emerging Trends Optimizing Operations and Driving Sustainable Growth

Industry leaders seeking to capitalize on emerging trends should prioritize investments in sustainable material portfolios by forging relationships with advanced recyclers and bio-feedstock developers. Simultaneously, diversifying supply networks to incorporate regional manufacturing hubs can reduce exposure to policy-driven cost volatility and streamline delivery times. Embracing digital design and visualization platforms will accelerate decision cycles and foster stronger client engagement, while equipping installation teams with training on interlocking, peel-and-stick, and loose-lay techniques ensures consistent quality and supports rapid project turnarounds.

Moreover, establishing collaborative frameworks with end-use segments such as healthcare and education can yield co-developed solutions tailored to specialized performance requirements. Expanding direct online channels alongside traditional distributor partnerships will capture both small-scale and large-volume projects, enhancing market reach. By integrating these strategies into a cohesive roadmap, industry decision-makers can drive operational efficiency, unlock new revenue streams, and build resilient business models aligned with evolving environmental and design imperatives.

Comprehensive Overview of the Rigorous Multi Stage Research Methodology Ensuring Data Validity Reliability and Actionable Insights for Decision Makers

The research methodology underpinning this analysis combined rigorous primary and secondary techniques to ensure data validity and actionable insights. Primary investigations included in-depth interviews with facility managers architects designers and installation contractors to capture qualitative perspectives on performance criteria, sustainability goals, and installation challenges. These conversations were supplemented by a structured online survey engaging finance executives and procurement specialists across verticals, providing quantitative context on purchasing priorities and price sensitivity.

Secondary research encompassed a review of industry publications regulatory filings standards documents and corporate sustainability reports to map material innovations and policy shifts. Data triangulation was performed through cross-validation of supplier disclosures and end-user feedback, while regional case studies offered localized snapshots of adoption patterns. This multi-stage methodology allowed for trend identification, segmentation analysis, and strategic recommendation development, ensuring the findings are both robust and directly relevant to decision makers seeking market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carpet Tiles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carpet Tiles Market, by Installation Type

- Carpet Tiles Market, by Product Type

- Carpet Tiles Market, by Material Type

- Carpet Tiles Market, by End User

- Carpet Tiles Market, by Application

- Carpet Tiles Market, by Sales Channel

- Carpet Tiles Market, by Region

- Carpet Tiles Market, by Group

- Carpet Tiles Market, by Country

- United States Carpet Tiles Market

- China Carpet Tiles Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Reflections on the Critical Importance of Modular Carpet Tile Solutions and Strategic Imperatives for Sustainable Success in Evolving Environments

As modular carpet tile solutions continue to evolve at the intersection of design innovation, material sustainability, and installation efficiency, their strategic importance in built environments has never been more pronounced. Organizations that align product development and procurement strategies with emerging trends in recycled content, digital customization, and rapid installation will secure a competitive edge. The interplay of regulatory drivers, end-use segment requirements, and distribution channel optimization necessitates a holistic approach to market engagement.

Looking ahead, the dynamic response to policy shifts such as import tariffs, alongside the accelerating adoption of circular economy principles, underscores the need for agility and strategic foresight. Stakeholders who leverage multi-lens segmentation insights, invest in robust partnerships, and maintain a relentless focus on performance outcomes are positioned to drive sustainable growth and resilience. By embracing the marketplace’s modular ethos, the industry can unlock new applications, enhance occupant well-being, and foster long-term success.

Partner Directly with Ketan Rohom Associate Director of Sales and Marketing to Unlock Exclusive Access to the Comprehensive Carpet Tile Market Research Report

To explore the full depth of these insights and gain a competitive advantage, connect directly with Ketan Rohom Associate Director of Sales & Marketing at our firm. He can guide you through the intricacies of the research findings, clarify any questions, and facilitate access to the complete market report. By engaging early you can tailor the intelligence to your unique strategic objectives and ensure that your next investment or product development initiative is backed by rigorous analysis and actionable recommendations. Reach out today to secure comprehensive intelligence on carpet tile market dynamics and empower your organization with data-driven decisions that drive growth and resilience.

- How big is the Carpet Tiles Market?

- What is the Carpet Tiles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?