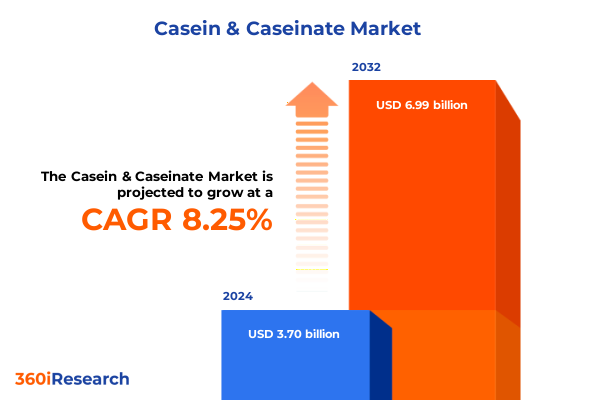

The Casein & Caseinate Market size was estimated at USD 3.98 billion in 2025 and expected to reach USD 4.29 billion in 2026, at a CAGR of 8.34% to reach USD 6.99 billion by 2032.

Embracing the Versatility of Milk-Derived Proteins by Exploring the Unique Attributes and Wide-Ranging Applications of Casein and Caseinate

The landscape of milk-derived proteins has undergone a profound evolution, spotlighting casein and caseinate as cornerstone ingredients for a diverse range of applications. Known for their exceptional functional properties-including emulsification, gelation, and water-binding capabilities-these proteins have become indispensable in formulating high-performance food products, specialized pharmaceuticals, and resilient animal feed solutions. As consumer demand intensifies for protein enrichment, clean-label formulations, and targeted nutrition, the role of casein and caseinate has expanded beyond traditional dairy applications to encompass innovative health and wellness sectors.

In response to these dynamics, industry stakeholders are seeking a nuanced understanding of both scientific and commercial dimensions. This executive summary offers a comprehensive orientation to the multifaceted attributes of casein and caseinate, framing the critical drivers, regulatory influences, and technological breakthroughs that define the current market environment. By exploring key trends, segmentation dynamics, and strategic imperatives, this introduction sets the stage for a detailed examination of opportunities and challenges within the global marketplace.

Navigating the Key Transformative Shifts Impacting the Casein and Caseinate Market Driven by Consumer Trends and Technological Advancements

Rapidly evolving consumer preferences and technological advancements have catalyzed transformative shifts within the casein and caseinate sector. On one hand, the surge in demand for protein-fortified beverages and functional foods has led manufacturers to harness the superior emulsifying and stabilizing properties of caseinates, driving innovation in ready-to-drink formulations. Simultaneously, a growing emphasis on clean-label solutions has prompted producers to refine extraction processes, minimizing chemical inputs and enhancing transparency from farm to shelf.

Moreover, breakthroughs in membrane filtration, enzymatic fractionation, and microencapsulation have enabled the creation of high-purity ingredients with tailored performance characteristics. These technological leaps have not only improved solubility and sensory profiles but also opened avenues for targeted nutraceutical delivery. In tandem, sustainability concerns and regulatory tightening around environmental footprints have incentivized collaborations across the value chain, fostering more efficient dairy byproduct utilization and reducing waste. As a result, the market is witnessing a paradigm shift toward integrated supply chain models, where traceability and resource optimization are as crucial as functional efficacy.

Assessing the Comprehensive Impact of the Latest United States Import Tariffs on Casein and Caseinate Supply Chains and Pricing Dynamics

The implementation of new United States import tariffs in early 2025 has introduced a layer of complexity for global casein and caseinate supply chains. These levies, designed to protect domestic producers, have led to incremental cost pressures for manufacturers reliant on imports. As duties accumulate on shipments from major exporting regions, end-users have grappled with margin compression that has, in many instances, necessitated strategic recalibrations in procurement and pricing strategies.

In consequence, domestic production capacities have seen revitalization, as processors invest in capacity expansions to capture displaced volumes. Nevertheless, the higher cost base has prompted manufacturers to explore alternative sourcing geographies and to renegotiate long-term contracts to contain pricing volatility. Furthermore, downstream formulators are increasingly leveraging contractual hedging mechanisms and fostering closer partnerships with suppliers to lock in preferential terms. These combined efforts aim to strike a balance between securing uninterrupted supply and safeguarding competitive positioning amid evolving trade policies.

Uncovering Critical Market Segmentation Insights Spanning Applications Products Sources Forms and Distribution Channels Shaping Demand Patterns

An in-depth analysis of market segmentation highlights the intricate ways in which end-use applications, product variations, biological sources, ingredient forms, and distribution pathways interact to shape demand. Based on application, the market spans Animal Feed, Food & Beverages, and Pharmaceuticals, with Food & Beverages further subdivided into Bakery & Confectionery, Beverages, Dairy Products, and Meat Processing. This stratification reveals that functionality requirements differ markedly from nutritional fortification in beverages to texturizing roles in confectionery.

Examining product types, the distinction between Casein and Caseinate underscores diverging processing techniques and performance characteristics. Casein itself is further classified into Acid Casein and Rennet Casein, each selected for its specific coagulation properties and solubility profiles, whereas Caseinate is differentiated into Ammonium Caseinate, Calcium Caseinate, Potassium Caseinate, and Sodium Caseinate, reflecting variations in mineral ion interactions and resultant functionality in emulsions and gels.

Source-based segmentation draws attention to bovine, caprine, and ovine origins, each offering unique protein profiles, allergenicity considerations, and cost structures. These source choices influence both the sensory and nutritional attributes of final products, driving targeted application in specialized nutrition segments. Additionally, form segmentation, which distinguishes Liquid from Powder, reflects logistical considerations around shelf life, solubility, and ease of handling. Liquid formats are favored for direct integration in continuous processes, while powders provide storage stability and dosage precision.

Lastly, the division between Industrial and Retail distribution channels illuminates distinct supply chain orchestration models. Industrial channels prioritize bulk shipments and long-standing supplier relationships, enabling large-scale formulation, whereas Retail channels focus on branded ingredient offerings, packaging innovations, and technical support services to cater to smaller-scale or niche producers. Together, these segmentation lenses offer a granular framework for understanding demand drivers and aligning product development strategies accordingly.

This comprehensive research report categorizes the Casein & Caseinate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Source

- Form

- Application

- Distribution Channel

Revealing Strategic Regional Dynamics Across the Americas Europe Middle East Africa and Asia Pacific Influencing Casein and Caseinate Markets

Regional dynamics play an instrumental role in shaping the global trajectory of casein and caseinate markets. In the Americas, robust dairy production infrastructure underpins a mature supply landscape, with both North and South American players focusing on value-added protein derivatives. North American formulators, in particular, capitalize on stringent food safety standards and advanced R&D ecosystems to introduce novel functional beverages and nutritional bars, while South American producers emphasize cost-competitive sourcing to supply global industrial channels.

The Europe, Middle East & Africa region exhibits a diverse tapestry of growth drivers. Western European markets are characterized by high consumer consciousness around clean-label and natural ingredients, driving demand for certified non-GMO and organic casein variants. Meanwhile, Middle Eastern and African markets are emerging as high-growth corridors, propelled by expanding food processing sectors and government incentives supporting local dairy development. Import substitution strategies in these regions have elevated the importance of localized processing capabilities.

In Asia-Pacific, a dynamic fusion of population growth, rising disposable incomes, and evolving dietary preferences propels significant demand for protein-fortified foods and specialized clinical nutrition products. Nations such as China, India, and Australia are investing heavily in dairy modernization and cold chain enhancements, enabling streamlined casein and caseinate production. Additionally, local regulatory frameworks are progressively aligning with international standards, paving the way for accelerated market expansion and cross-border collaborations.

This comprehensive research report examines key regions that drive the evolution of the Casein & Caseinate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Strategic Collaborations Driving Innovation and Competitive Differentiation in the Casein and Caseinate Sector

The competitive arena of milk-derived proteins is anchored by a cadre of globally integrated dairy cooperatives and specialized ingredient firms. Leading players have pursued growth through horizontal integration, capacity expansions, and targeted acquisitions to bolster their casein and caseinate portfolios. Strategic collaborations with food and beverage manufacturers have further enabled co-development of application-specific formulations, enhancing customer stickiness and accelerating time to market.

Innovation pipelines remain a critical battleground, with several companies investing in advanced processing technologies and proprietary fractionation systems to improve yield and functional performance. Sustainability agendas have emerged as differentiators, as firms adopt carbon-footprint reduction initiatives, water-use efficiency programs, and waste valorization schemes. These combined efforts serve to reinforce brand reputation among environmentally conscious buyers while driving operational efficiencies that offset upstream cost pressures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Casein & Caseinate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agri-Mark, Inc.

- Agropur Cooperative

- Arla Foods amba

- Armor Protéines S.A.

- Danone S.A.

- Fonterra Co-operative Group Limited

- FrieslandCampina N.V.

- Glanbia plc

- Hilmar Cheese Company, LLC

- Hochdorf Holding AG

- Kerry Group plc

- Lactalis S.A.

- Lactalis Ingredients

- Milk Specialties Global, LLC

- Nestlé S.A.

- Royal FrieslandCampina N.V.

- Saputo Inc.

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in the Casein and Caseinate Market

To thrive in an increasingly competitive environment, industry leaders should prioritize investment in high-value application segments where casein’s intrinsic functional properties command premium positioning. This entails deepening customer partnerships to co-create bespoke ingredients that address specific textural, nutritional, or stability requirements. In parallel, companies must streamline supply chain integration by diversifying sourcing geographies and establishing forward-looking procurement contracts to mitigate tariff-induced volatility.

Furthermore, advancing sustainability credentials through renewable energy adoption, byproduct valorization, and transparent lifecycle assessments will resonate with end-customers and support regulatory compliance. Embracing digital tools-such as predictive analytics for demand forecasting and blockchain for traceability-can enhance operational agility and reinforce trust across the value chain. Ultimately, a balanced approach that marries product innovation with supply chain resilience will empower organizations to capitalize on emerging market opportunities while safeguarding profitability.

Detailing the Rigorous Research Methodology Employed to Ensure Comprehensive Analysis Accuracy and Reliability for the Casein and Caseinate Market Study

This study’s findings are underpinned by a rigorous research methodology that integrates comprehensive secondary research, primary interviews, and advanced data validation techniques. Secondary research encompassed the review of scientific journals, regulatory publications, industry white papers, and company disclosures to establish a foundational understanding of functional properties, production processes, and market drivers.

Primary research included structured interviews with key stakeholders across the value chain, encompassing ingredient manufacturers, end-use formulators, regulatory authorities, and logistics providers. These qualitative insights were synthesized to capture real-world perspectives on emerging trends, competitive strategies, and supply chain dynamics. Quantitative data points were triangulated through proprietary databases, shipment records, and trade association statistics to ensure reliability.

Furthermore, an advisory panel of subject matter experts was consulted to validate assumptions and refine segmentation frameworks, while internal quality control protocols were applied to uphold analytical rigor. The combined approach delivers a robust, multi-dimensional analysis that informs strategic decision-making for stakeholders throughout the casein and caseinate ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Casein & Caseinate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Casein & Caseinate Market, by Product

- Casein & Caseinate Market, by Source

- Casein & Caseinate Market, by Form

- Casein & Caseinate Market, by Application

- Casein & Caseinate Market, by Distribution Channel

- Casein & Caseinate Market, by Region

- Casein & Caseinate Market, by Group

- Casein & Caseinate Market, by Country

- United States Casein & Caseinate Market

- China Casein & Caseinate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Distilling the Key Takeaways and Strategic Implications to Navigate Future Growth and Innovation in the Evolving Casein and Caseinate Landscape

As the casein and caseinate market continues to evolve, the interplay of consumer demand shifts, regulatory changes, and technological innovations will define future trajectories. Stakeholders who proactively engage with transformative trends-such as clean-label imperatives, supply chain digitization, and sustainability mandates-will be best positioned to capture premium opportunities. Moreover, a nuanced appreciation of segmentation dynamics and regional heterogeneity is essential for crafting targeted growth strategies.

Ultimately, the competitive landscape will reward those organizations that balance innovation with operational excellence, forging partnerships that drive mutual value and resilience. By leveraging the insights outlined in this summary, industry participants can chart a path toward differentiated offerings, optimized supply chains, and sustained business performance in the ever-expanding world of milk-derived proteins.

Unlock Exclusive Access to In-Depth Casein and Caseinate Market Intelligence by Connecting with Ketan Rohom Today to Elevate Your Strategic Decisions

Seize the opportunity to delve deeper into the intricate dynamics of the casein and caseinate market by engaging directly with our Associate Director of Sales & Marketing. Ketan Rohom brings a wealth of expertise and can guide you through tailored insights that align with your strategic priorities. Connect today to unlock unparalleled access to in-depth analysis, competitive benchmarking, and proprietary data that will fortify your decision-making processes. Elevate your market intelligence and gain a distinctive edge by obtaining our full report, designed to empower your organization with actionable recommendations and a comprehensive understanding of evolving industry trends.

- How big is the Casein & Caseinate Market?

- What is the Casein & Caseinate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?