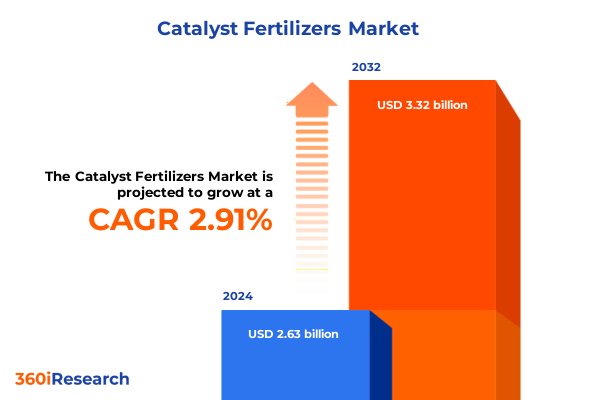

The Catalyst Fertilizers Market size was estimated at USD 2.71 billion in 2025 and expected to reach USD 2.78 billion in 2026, at a CAGR of 2.91% to reach USD 3.32 billion by 2032.

Setting the Stage for Opportunity and Innovation in the Catalyst Fertilizers Market Against a Backdrop of Dynamic Agricultural Needs

The catalyst fertilizers market occupies a pivotal role in modern agriculture, serving as a lynchpin between scientific innovation and global food security. As farmers and policymakers converge on the imperative of sustainably boosting crop yields, the demand for specialized nutrient formulations has surged, prompting producers to refine their offerings and logistics frameworks. In this context, catalyst fertilizers-engineered to enhance nutrient efficiency and environmental compatibility-have captured the attention of industry stakeholders seeking to reconcile productivity with ecological responsibility.

Against a backdrop of fluctuating climate patterns and evolving regulatory mandates, producers are accelerating research into novel chemistries that optimize nitrogen, phosphorus, and potassium uptake. This adaptive drive gains further momentum as precision farming technologies integrate real-time soil and plant diagnostics, enabling granular application rates tailored to specific field conditions. Consequently, catalyst fertilizers that are compatible with both dry granular and liquid suspension delivery systems are rising to prominence. This intersection of agronomic science, supply chain agility, and sustainability imperatives sets the stage for substantial innovation and strategic realignment across the fertilizer value chain.

Identifying the Critical Transformative Forces Redefining Supply Chains Sustainability and Technology Adoption in Catalyst Fertilizer Production

The catalyst fertilizers landscape is undergoing fundamental transformation driven by a convergence of environmental priorities, digital technologies, and shifting stakeholder expectations. Accelerated by mounting regulatory scrutiny on greenhouse gas emissions and nutrient runoff, producers are embracing low-carbon manufacturing pathways and enhanced efficiency additives. These sustainability mandates have spurred investments into bio-based inoculants and polymer-coated granules that slow nutrient release, effectively bridging the gap between crop requirements and environmental stewardship.

Meanwhile, the digital farming revolution has ushered in data-driven application strategies. Satellite imaging, IoT-enabled soil probes, and AI-powered decision-support platforms are enabling agricultural enterprises to fine-tune fertilizer dosing down to sub-field zones. In response, catalyst fertilizer manufacturers are collaborating with agtech innovators to co-develop integrated solutions, ensuring that their products seamlessly interface with prescription maps and automated applicators. This symbiotic evolution between product innovation and precision agronomy underscores a transformative shift in how fertilizers are formulated, marketed, and deployed, reinforcing the vital role of catalyst fertilizers in meeting the dual challenge of productivity and sustainability.

Analyzing the Cumulative Impact of United States Tariff Actions in 2025 on Production Costs Supply Dynamics and Trade Flows

The imposition of new United States tariffs in 2025 has substantially influenced catalyst fertilizer trade flows, cost structures, and sourcing strategies across the supply chain. With levies targeting imported phosphatic and potassic inputs, domestic producers and end-users have recalibrated procurement networks to mitigate input cost inflation. As import prices rose by double-digit percentages, distributors looked to alternate suppliers in regions outside traditional export hubs, prompting greater diversifications in partner portfolios.

In addition, fertilizer blenders and formulators reevaluated long-standing commercial agreements in favor of bulk purchasing to secure volume discounts under the new tariff regime. This shift accelerated demand for domestically sourced nitrogenous components such as urea and ammonium nitrate, reinforcing the strategic importance of local manufacturing capacity. Simultaneously, logistics providers adapted by optimizing inland rail and barge movements to offset elevated ocean freight rates. Collectively, these adjustments have underscored the industry’s resilience but also highlighted the need for agile supply frameworks able to pivot rapidly in response to policy shifts.

Uncovering Actionable Insights from Multifaceted Segmentation Approaches Spanning Product Crop Form and Sales Channel Perspectives

A nuanced understanding of market segmentation offers invaluable clarity for stakeholders seeking targeted growth strategies in the catalyst fertilizers sphere. Dissecting trends by product type reveals that nitrogenous formulations, notably ammonium nitrate, ammonium sulfate, calcium ammonium nitrate, and urea, remain central to widespread cropping systems, while phosphatic and potassic variants cater to niche soil correction requirements. Concurrently, crop-based differentiation shows that fertilizer uptake patterns vary markedly between cereals and grains, fruits and vegetables, and oilseeds and pulses, reflecting divergent nutrient demands and harvesting cycles.

Moreover, the choice between dry granular or powder formulations and liquid solutions or suspensions influences procurement and application preferences. Dry granules dominate broadacre mechanized farming due to ease of storage and precise metering, whereas liquid forms gain traction in high-value horticulture for rapid nutrient availability. Finally, the interplay between offline distributors-who maintain established relationships with conventional cooperatives-and online platforms-offering digital procurement convenience-underscores the importance of omnichannel strategies. Recognizing these intersecting segmentation layers empowers manufacturers and channel partners to tailor product development, marketing, and distribution in lockstep with end-user requirements.

This comprehensive research report categorizes the Catalyst Fertilizers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Crop Type

- Form

- Sales Channel

Revealing Regional Nuances and Emerging Growth Patterns across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics exert a pronounced influence on catalyst fertilizer adoption, driven by agronomic conditions, infrastructure maturity, and regulatory frameworks. In the Americas, extensive mechanized row-crop systems underpin robust demand for advanced nitrogenous and blended formulations, with major producing zones in the Midwest and Argentina leveraging rail-centric logistics corridors. Supply chain stakeholders in this region prioritize yield optimization and environmental compliance, fostering rapid uptake of enhanced-efficiency catalyst products.

Across Europe, the Middle East and Africa, diverse climatic zones and soil profiles imbue the market with a tapestry of requirements. Western Europe’s stringent nutrient application standards accelerate adoption of controlled-release and polymer-coated granules, whereas emerging agricultural hubs in North Africa emphasize cost-effective potassic and phosphatic boosters to rehabilitate degraded soils. Meanwhile, Asia-Pacific remains a growth fulcrum, propelled by intensifying high-intensity cropping in China and India and the expansion of precision-application infrastructure in Australia. These regional variations spotlight the need for flexible product portfolios and local partnership models to meet differentiated market conditions and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Catalyst Fertilizers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants Their Strategic Priorities Collaborative Ventures and Competitive Differentiators in Catalyst Fertilizer Space

Leading industry participants are actively redefining competitive landscapes through strategic investments and partnerships. Global agribusinesses such as Nutrien and Mosaic have bolstered their portfolios via targeted acquisitions of specialty fertilizer innovators, enhancing their capabilities in slow-release and micronutrient-enriched blends. Meanwhile, Yara has deepened its research collaborations with universities and agtech startups, accelerating the development of bio-enhanced catalyst formulations that promise reduced environmental footprints.

In parallel, CF Industries has optimized its ammonia synthesis plants for greater energy efficiency, positioning itself to meet burgeoning demand for low-carbon nitrogen sources. Smaller specialists like ICL Group have strengthened presence in high-margin horticulture segments by customizing liquid suspension formulations tailored to greenhouse cultivation. Collectively, these competitive maneuvers underscore a strategic pivot toward differentiated product performance, sustainability credentials, and integrated service offerings, reinforcing the importance of continual innovation in maintaining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Catalyst Fertilizers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Products and Chemicals, Inc.

- BASF SE

- Casale SA

- CF Industries Holdings, Inc.

- China National Chemical Engineering Co., Ltd.

- Clariant AG

- EuroChem Group AG

- Haldor Topsoe A/S

- Honeywell UOP

- Johnson Matthey PLC

- KBR, Inc.

- Linde plc

- Mitsubishi Heavy Industries, Ltd.

- OCI N.V.

- QAFCO

- Saudi Basic Industries Corporation

- Stamicarbon B.V.

- thyssenkrupp AG

- Toyota Tsusho Corporation

- Yara International ASA

Delivering Targeted Actionable Recommendations for Industry Stakeholders to Navigate Challenges and Capitalize on Emerging Fertilizer Market Dynamics

Industry leaders must embrace a suite of targeted initiatives to navigate evolving market forces and unlock new growth horizons. First, accelerating investment in enhanced-efficiency technologies-such as polymer-coated granules and enzyme inhibitors-will yield both agronomic and environmental dividends, aligning with tightening regulatory thresholds on nutrient runoff. Concurrently, forging deeper alliances with precision-agriculture platforms and satellite-mapping providers can facilitate data-driven application protocols that optimize input usage and downstream yields.

Moreover, diversifying supply sources by leveraging alternative feedstocks-including green ammonia produced via renewable energy electrolysis-can mitigate exposure to tariff volatility and geopolitical disruptions. Expanding omnichannel distribution models that integrate digital procurement portals will also broaden market reach, particularly among next-generation growers. By championing these strategic imperatives, stakeholders can strengthen resilience, differentiate offerings, and capture value across the catalyst fertilizers landscape.

Detailing the Rigorous Research Methodology Underpinning Data Collection Analysis and Validation for High Credibility in Fertilizer Market Insights

Our research framework combines extensive secondary intelligence with rigorous primary validation to ensure robust, actionable insights. Initially, we conducted a thorough review of publicly available sources, including regulatory filings, patent databases, and trade association reports, to chart the competitive landscape and technological trajectories. This foundational research was augmented by an extensive program of interviews with senior executives, technical specialists, and procurement officers, providing firsthand perspectives on strategic priorities and operational challenges.

To triangulate quantitative data, we integrated customs statistics, trade flow records, and logistics performance indicators, applying advanced analytics to distill patterns and correlations. Each data point underwent a multi-stage validation process, encompassing cross-referencing against corporate disclosures and internal quality audits to ensure accuracy. Throughout, methodological rigor was maintained via peer review checkpoints and standardized reporting protocols, delivering a high-fidelity analytical foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Catalyst Fertilizers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Catalyst Fertilizers Market, by Product Type

- Catalyst Fertilizers Market, by Crop Type

- Catalyst Fertilizers Market, by Form

- Catalyst Fertilizers Market, by Sales Channel

- Catalyst Fertilizers Market, by Region

- Catalyst Fertilizers Market, by Group

- Catalyst Fertilizers Market, by Country

- United States Catalyst Fertilizers Market

- China Catalyst Fertilizers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing the Pivotal Takeaways Strategic Imperatives and Future Directions Shaping the Catalyst Fertilizers Landscape for Decision Makers

The overarching analysis distills several pivotal takeaways. Enhanced-efficiency catalyst fertilizers are rapidly transitioning from niche applications to mainstream adoption, driven by converging environmental regulations and precision-agronomy innovations. U.S. tariff adjustments in 2025 have underscored the criticality of agile sourcing strategies, prompting a pivot toward domestic inputs and diversified trade networks. Moreover, segmentation insights reveal that tailoring formulations by product chemistry, crop type, form factor, and distribution channel unlocks meaningful differentiation in highly competitive markets.

At the regional level, the Americas and Asia-Pacific are sustaining robust demand, while Europe, the Middle East and Africa display heterogeneous growth patterns shaped by varied regulatory and soil conditions. Leading companies are responding with targeted M&A, R&D partnerships, and manufacturing optimizations to secure competitive advantage. Collectively, these dynamics outline a fertilizer landscape defined by innovation, strategic collaboration, and supply chain agility, providing a clear roadmap for stakeholders seeking to thrive amid evolving agricultural imperatives.

Connect with Associate Director for Personalized Insights and Secure Your Comprehensive Catalyst Fertilizer Market Research Report Today

I invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how our in-depth analysis can inform your strategic decisions and drive competitive advantage in the catalyst fertilizers arena. He stands ready to tailor solutions to your organization’s unique priorities and guide you through the rich insights contained in the comprehensive report. Connect today and secure unrivaled clarity on market trends, regulatory impacts, and growth prospects to position your business for success in an evolving agricultural landscape.

- How big is the Catalyst Fertilizers Market?

- What is the Catalyst Fertilizers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?