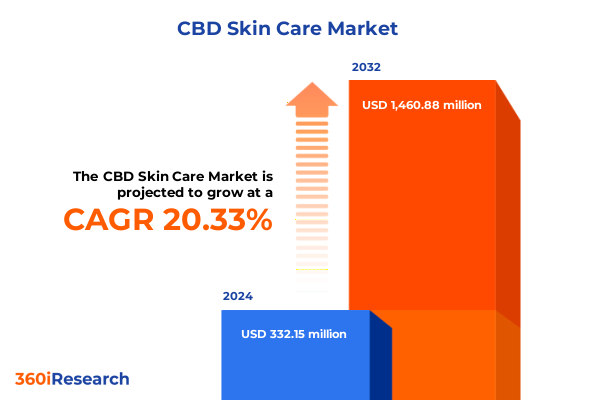

The CBD Skin Care Market size was estimated at USD 399.88 million in 2025 and expected to reach USD 475.19 million in 2026, at a CAGR of 20.33% to reach USD 1,460.88 million by 2032.

Exploring the Pioneering Emergence of CBD-Infused Skin Care Solutions and Their Rapid Adoption Across Diverse Consumer Profiles in Today’s Wellness-Driven Marketplace

The shift toward plant-based wellness has triggered profound curiosity in cannabidiol (CBD) as an active ingredient for skin care. This introduction explores how CBD’s potential to soothe inflammation, balance oil production, and support the skin’s endocannabinoid system has captivated both established beauty houses and emerging indie brands. As consumers increasingly seek transparent ingredient sourcing and evidence-based benefits, CBD formulations have moved beyond niche boutiques into mainstream personal care aisles.

Transitioning from awareness to mainstream appeal, the rise of digital influencers and wellness communities has accelerated product trial and purchase. Social media channels have played a pivotal role in educating users about extraction methods, formulation types, and visible performance outcomes. This digital dialogue has lowered barriers to entry for new brands and elevated consumer expectations for efficacy and safety testing. Consequently, market participants are refining their formulations and communication strategies to build trust and differentiate in a crowded landscape.

Uncovering the Latest Technological Advances and Regulatory Clarifications That Are Reshaping the Competitive Dynamics of CBD Skin Care

In recent years, a series of transformative shifts has redefined the competitive terrain for CBD skin care. One fundamental change has been the maturation of extraction technology, which now enables greater purity and consistency in broad-spectrum, full-spectrum, and CBD isolate ingredients. This technical evolution has translated into more stable formulations with reproducible performance, giving manufacturers the confidence to invest heavily in research and development.

Concurrently, regulatory clarifications at the federal and state levels have reshaped go-to-market strategies. The removal of hemp-derived cannabinoids from controlled substance scheduling at the national level, paired with updated cosmetic regulations, has spurred accelerated product launches. Brands that once prioritized lower-potency wellness tinctures now allocate R&D budgets to higher-margin topical applications. These parallel developments in technology and legislation have jointly created an inflection point, forcing all players to reassess their positioning and prioritize consumer education and compliance.

Examining How 2025 United States Tariff Adjustments on Hemp-Derived Inputs Are Redefining Sourcing, Pricing, and Supply Chain Collaboration

In early 2025, the United States implemented additional tariffs on certain imported hemp-derived ingredients, directly influencing ingredient sourcing strategies for skin care manufacturers. These new levies have increased landed costs for imported broad-spectrum and full-spectrum extracts, prompting a strategic pivot toward domestic cultivation and vertically integrated supply chains.

As companies absorb these higher input costs, many have renegotiated supplier agreements and passed modest price adjustments onto consumers. The tariff-driven realignment has also accelerated strategic partnerships between cultivators and formulators, consolidating supply stability and mitigating future tariff risks. These collaborations have yielded novel co-branded products that emphasize traceability, as brands leverage pricier inputs to justify premium positioning. The tariff landscape of 2025 has therefore reinforced the value of supply chain resilience and transparency as a core competitive lever.

Unearthing the Intricacies of Product, Formulation, End User, Application, Age Group, and Distribution Channel Dynamics That Shape Industry Segmentation

Breaking down the market by product category reveals distinct trajectories. Balm remains a foundational entry point for consumers seeking targeted relief, while body lotion formulations have surged as daily maintenance solutions. Face cream products command a premium position, leveraging specialized textures and delivery systems. Meanwhile, oil-based serums deliver rapid absorption and bioavailability, and concentrated serums attract seasoned enthusiasts seeking maximum potency.

When viewed through the lens of formulation, broad-spectrum options have become the default choice for brands balancing efficacy with regulatory compliance. Full-spectrum extracts appeal to niche consumers drawn to the entourage effect, whereas isolate products cater to those prioritizing purity and predictable dosing. This interplay between consumer preferences and formulation mandates has driven marketers to craft clearer on-pack messaging and certification seals.

End-user segmentation underscores a dual focus: individuals exploring CBD for personal wellness and professional practitioners integrating topical solutions into dermatological or aesthetic services. Brands targeting individuals concentrate on digital engagement and direct-to-consumer branding, whereas those serving professionals emphasize clinical data, training partnerships, and bulk channel agreements.

Based on intended application, acne treatment products appeal to younger demographics grappling with breakout concerns, while anti-aging formulations resonate with adult consumers seeking wrinkle reduction and skin tone improvement. Anti-inflammatory applications attract users dealing with localized irritation, whereas moisturizing and formulations designed for sensitive skin speak to broad wellness audiences.

Age group analysis shows that adult consumers represent the core trial cohort, seniors seek gentle textures and soothing benefits, and teen users increasingly explore CBD-infused products as a natural alternative to traditional spot treatments. This age-driven variation in product selection has encouraged brands to innovate on texture, fragrance, and educational content.

Finally, distribution channels reveal a bifurcation between offline and online retail. Offline retail encompasses pharmacies and specialty beauty stores, where consumers expect in-person guidance and professional endorsement. Online retail offers expansive assortment, subscription models, and accelerated delivery, enabling digital-first brands to scale swiftly across regions. These channels collectively define the pathways through which CBD skin care reaches the end user.

This comprehensive research report categorizes the CBD Skin Care market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Formulation

- End User

- Application

- Age Group

- Distribution Channel

Revealing How Distinct Regional Legislative Frameworks and Consumer Preferences Are Crafting Unique Growth Opportunities Across Americas, EMEA, and Asia-Pacific

Across the Americas, CBD skin care adoption continues to be driven by the convergence of wellness culture and a maturing regulatory environment. In the United States, the normalization of hemp-derived ingredients and the expansion of specialty retailers have spotlighted regional supply hubs. Latin America has followed suit with progressive hemp legislation in key markets, fostering localized product innovation and distribution partnerships.

Within Europe, Middle East & Africa, regulatory heterogeneity presents both challenges and opportunities. Western European markets benefit from clear cosmetic regulations and high consumer purchasing power, whereas Eastern European and Middle Eastern countries are at varying stages of legal acceptance. In Africa, pilot programs and advocacy efforts are laying the groundwork for future market entry, with a keen eye on agricultural development and export potential.

Asia-Pacific exhibits a tapestry of regulatory approaches. In markets like Australia, carefully defined hemp thresholds have enabled clinical trials and consumer trials for anti-inflammatory formulations. Japan remains cautious, maintaining stringent limits on cannabinoid content, but a growing appetite for innovative beauty solutions has encouraged select partnerships and imports. Southeast Asian nations, balancing traditional herbal medicine practices with modern regulatory frameworks, present both nascent commercialization avenues and educational hurdles.

This comprehensive research report examines key regions that drive the evolution of the CBD Skin Care market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Competitive Contrast Between Established Cosmetic Giants and Agile Startups Leveraging Science, Authenticity, and Strategic Partnerships

Leading companies in the CBD skin care space are distinguished by their depth of scientific investment and brand authenticity. Some heritage cosmetic houses have quietly integrated hemp-derived actives into legacy lines, leveraging established R&D capabilities to ensure regulatory compliance and consistent performance. These incumbents capitalize on existing distribution networks to scale new CBD-infused offerings with minimal friction.

Meanwhile, nimble startups have disrupted traditional marketing paradigms with direct-to-consumer launches, social-media-led brand narratives, and influencer collaborations that resonate with younger audiences. Their agility in product development enables rapid iteration based on consumer feedback, driving continuous innovation in scents, textures, and pack formats. Strategic acquisitions by larger personal care conglomerates have accelerated further consolidation, with multinationals seeking to diversify portfolios and capture growth in wellness-driven categories.

Supply chain partnerships have emerged as a key differentiator. Some firms have invested in carbon-neutral cultivation facilities and full vertical integration to guarantee traceability, while others outsource extraction to GMP-certified third parties to optimize cost and compliance. These supply models influence brand storytelling and consumer trust, making them central to competitive positioning. Overall, the interplay between established players and disruptive challengers is fueling a dynamic landscape where scientific rigor and brand purpose must align.

This comprehensive research report delivers an in-depth overview of the principal market players in the CBD Skin Care market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bluebird Botanicals

- Cannuka, LLC

- cbdMD, Inc.

- Charlotte's Web Holdings, Inc.

- CV Sciences, Inc.

- Elixinol Global Limited

- Gaia Botanicals, LLC

- Green Roads Worldwide, LLC

- HempFusion Wellness Inc.

- Herbivore Botanicals

- Isodiol International Inc.

- Kana Skincare, LLC

- Kat's Naturals

- Leef Organics

- Lord Jones

- Medical Marijuana, Inc.

- Medterra CBD

- Saint Jane Beauty

- Vertly Hemp LLC

Adopting Evidence-Driven Validation, Multi-Region Sourcing Resilience, and Omnichannel Engagement to Fortify Market Positioning and Drive Sustainable Growth

Industry leaders should prioritize robust clinical validation as the foundational pillar of product credibility, commissioning third-party studies to confirm anti-inflammatory efficacy and skin barrier reinforcement. This evidence base can be leveraged in packaging claims and professional endorsement programs. By aligning R&D roadmaps with dermatological research centers, companies can deepen technical knowledge and gain access to clinical trial pathways for novel active combinations.

Supply chain resilience must be reinforced through multi-region sourcing strategies. Cultivating domestic hemp capacities in parallel with key international partnerships hedges against future tariff shifts and raw material scarcity. Contractual agreements that include price adjustment clauses linked to regulatory changes can provide additional cost certainty. These measures will empower businesses to maintain margin stability while preserving product affordability.

On the marketing front, brands should refine storytelling frameworks around sustainability, full ingredient transparency, and real-world efficacy. Digital experiences, such as virtual consultations and interactive content, can elevate consumer confidence and support conversion. Equally, engagement with professional communities through accredited training modules can cement brand authority in dermatology and aesthetic clinics.

Finally, channel strategies should embrace omnichannel integration. Seamless inventory visibility, consistent messaging across physical and digital touchpoints, and loyalty programs tailored to both individual consumers and professional clients will enhance lifetime value. Prioritizing data analytics to track cross-channel purchase behavior will reveal white-space opportunities for portfolio expansion and regional market entry.

Outlining the Comprehensive Mixed-Method Approach That Integrates Primary Expert Interviews, Quantitative Surveys, and Secondary Regulatory and Trade Data

This research framework combines primary and secondary sources to ensure methodological rigor. Toward this end, in-depth interviews with dermatologists, formulation chemists, and regulatory experts provided nuanced perspectives on product efficacy and compliance trends. Quantitative surveys of end users across varied age ranges offered insight into functional preferences and purchase drivers.

Secondary desk research encompassed peer-reviewed dermatological journals, cosmetic industry publications, and public regulatory filings to contextualize technological advances and tariff impacts. Trade associations and government agencies supplied commodity import data to map supply chain disruptions. All qualitative insights were systematically coded and triangulated with quantitative findings to validate thematic conclusions.

Segmentation analyses were conducted using a multi-tier cluster approach, examining product type, formulation spectrum, end-user group, application, age bracket, and distribution channel. Regional breakdowns leveraged macroeconomic indicators and trade flows to identify distinct market dynamics. Company profiles were developed through a combination of direct executive interviews, patent filings, and sustainability reporting. Rigorous cross-validation steps ensured that each insight holds up under changing regulatory and competitive scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our CBD Skin Care market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- CBD Skin Care Market, by Product Type

- CBD Skin Care Market, by Formulation

- CBD Skin Care Market, by End User

- CBD Skin Care Market, by Application

- CBD Skin Care Market, by Age Group

- CBD Skin Care Market, by Distribution Channel

- CBD Skin Care Market, by Region

- CBD Skin Care Market, by Group

- CBD Skin Care Market, by Country

- United States CBD Skin Care Market

- China CBD Skin Care Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing How Technological Innovation, Consumer Trust, and Regulatory Adaptation Will Dictate the Future Course of CBD Skin Care Innovations and Market Leadership

In summary, the CBD skin care market stands at a pivotal crossroads defined by technological sophistication, evolving consumer expectations, and an increasingly complex regulatory backdrop. The alignment of robust clinical evidence with agile supply chain strategies has emerged as the key to sustainable differentiation. As brands navigate tariff realignments and regional policy nuances, those that foreground transparency and efficacy will capture disproportionate loyalty.

Looking ahead, the interplay of science-driven validation, consumer education, and omnichannel orchestration will shape the next phase of growth. Leaders who embrace multidimensional segmentation insights and invest in professional partnerships will outpace competitors. Ultimately, the market’s trajectory will be determined by the capacity of innovators to balance aspirational brand narratives with hard-earned technical credibility.

Unlock Strategic Growth and Market-Leading Insights by Connecting with Our Associate Director of Sales & Marketing for the Definitive CBD Skin Care Report

To gain comprehensive, forward-looking insights into the expanding landscape of CBD skin care, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can walk you through the report’s full scope, tailored data tables, and actionable recommendations that address product innovation, regulatory considerations, and competitive dynamics. Connect today with Ketan Rohom to empower your strategic decision-making, unlock new growth opportunities, and secure your organization’s leadership position in the rapidly evolving CBD skin care market.

- How big is the CBD Skin Care Market?

- What is the CBD Skin Care Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?