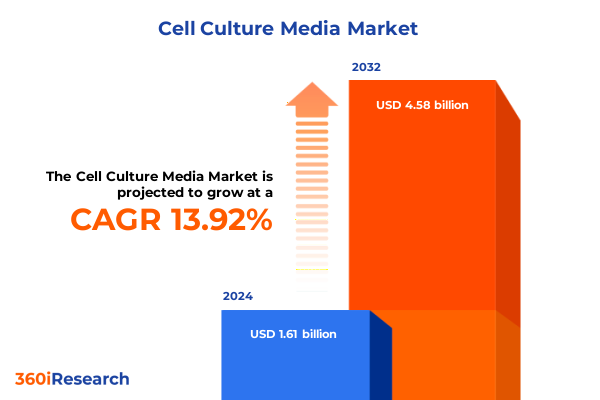

The Cell Culture Media Market size was estimated at USD 1.79 billion in 2025 and expected to reach USD 2.00 billion in 2026, at a CAGR of 14.28% to reach USD 4.58 billion by 2032.

Establishing the critical context of evolving scientific innovations and strategic demands driving the cell culture media market

The cell culture media landscape is experiencing an era of unprecedented complexity and technological advancement, as traditional formulations intersect with innovations in biotechnology and automation. From the laboratories of academic institutions to the production lines of biopharmaceutical firms, the demand for reliable, customizable media solutions has never been higher. Underpinning this surge is a convergence of scientific breakthroughs in stem cell research, personalized medicine, and high-throughput screening, each placing distinct demands on media performance. Consequently, the industry must navigate multifaceted challenges involving regulatory frameworks, supply chain agility, and sustainable sourcing. By understanding these dynamics, stakeholders can position themselves to harness emerging opportunities and anticipate the next wave of transformation in cell culture practice.

Recent progress in serum alternatives and chemically defined formulations is reshaping expectations around consistency, safety, and scalability. Furthermore, advances in single-use technologies and continuous bioprocessing are redefining how media is prepared, stored, and deployed at scale. This introductory overview sets the stage for a deeper exploration of how these paradigm shifts influence market behavior, cost structures, and customer preferences across global regions and discrete application segments.

How breakthrough product innovations and sustainable bioprocessing trends are redefining competitive dynamics across the industry

Over the past several years, the cell culture media space has witnessed a profound transformation driven by shifts toward serum-free and chemically defined products, enabling greater reproducibility and regulatory compliance. These product innovations have been further accelerated by the advent of high-throughput drug screening platforms, which require media capable of supporting complex cell models under tightly controlled conditions. Simultaneously, the rise of regenerative medicine has propelled demand for specialized media formulations that support tissue engineering and stem cell expansion without compromising product quality or safety.

Another significant shift is the growing adoption of advanced bioprocessing approaches-such as continuous manufacturing and single-use bioreactors-which demand media with extended shelf life, reduced variability, and compatibility with automated systems. These trends have been compounded by increasing emphasis on sustainability, prompting suppliers to develop more eco-friendly components and reduce reliance on animal-derived ingredients. Together, such transformative shifts are redefining competitive parameters, compelling established companies and agile newcomers alike to innovate in formulation science, production efficiency, and customer service models.

Assessing the cumulative repercussions of new 2025 U.S. tariff measures on raw material sourcing and cost management strategies

The imposition of new U.S. tariffs in 2025 has introduced a layer of complexity for manufacturers and distributors of cell culture media, particularly those reliant on imported components and specialized raw materials. Key reagents, such as recombinant growth factors and vitamin supplements, have seen cost fluctuations as tariff schedules vary by HS code and country of origin. These changes have intensified pressure on supply chains and prompted many organizations to reevaluate sourcing strategies, shifting toward more localized procurement to mitigate duty burdens.

In response, certain suppliers have accelerated vertical integration, investing in domestic production of critical ingredients to stabilize costs and ensure continuity. Others have pursued strategic partnerships with international producers to secure preferential tariff treatment through free-trade agreements or certificate-of-origin protocols. While these measures buffer the impact of levies, the cumulative effect of tariff uncertainty continues to influence pricing negotiations, inventory strategies, and long-term capital planning for all players operating within the U.S. market.

Leveraging differentiated insights across product, cell type, form, application, and end-user dimensions for targeted strategic planning

A nuanced understanding of market segmentation is essential to target investments and product development effectively, beginning with the distinction between serum-containing and serum-free media. While serum-containing formulations remain a go-to for certain legacy protocols and academic research settings, the drive for consistency and regulatory compliance has elevated serum-free solutions as the new standard in many commercial applications.

When examining the media landscape through the lens of cell type, mammalian cell culture dominates, supported by extensive adoption in biologics manufacturing, whereas microbial and insect cell culture techniques are increasingly important for vaccine production and specialty proteins. Plant cell culture, still an emerging niche, holds promise for novel metabolite extraction and secondary compound research.

The physical form of media also shapes purchasing and logistics decisions. Liquid media offer convenience and reduced preparation time, catering to high-throughput environments, while powdered media provide advantages in shipping costs, storage stability, and on-demand reconstitution for flexible workflows.

Diverse application areas further segment demand: bioprocessing and production require formulations optimized for large-scale bioreactors; drug discovery and testing demand high-volume, consistent media for screening assays; research and development workflows prioritize adaptability and customization; and tissue engineering initiatives need media that support three-dimensional culture and regenerative models.

Finally, the profiles of end users highlight differing requirements and procurement behaviors. Academic and research institutes often favor flexible, small-batch orders for experimental work. Contract research organizations emphasize reliability and supplier support to meet client timelines. Pharmaceutical and biotechnology companies, meanwhile, demand robust quality systems, global supply networks, and regulatory track records to underpin critical manufacturing processes.

This comprehensive research report categorizes the Cell Culture Media market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Cell Type

- Form

- Application

- End User

Uncovering the distinct drivers and innovation priorities shaping cell culture media demand across the Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in shaping the evolution of cell culture media, with the Americas driven by substantial investments in biopharmaceutical R&D and a robust ecosystem of contract manufacturing organizations. In North America, the emphasis on personalized medicine and immunotherapy has spurred the development of highly specialized media, particularly in metropolitan biotech hubs where close collaboration between academia and industry accelerates adoption.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts and public-private partnerships have supported expansion in biosimilars production, boosting demand for cost-effective, scalable media solutions. Western European centers of excellence have focused on sustainable manufacturing practices, prompting suppliers to introduce eco-certified formulations and waste-minimization initiatives.

Asia-Pacific remains a powerhouse of manufacturing capacity and emerging innovation, led by China, Japan, South Korea, and India. Substantial government funding for vaccine production and cell therapy research has catalyzed local media producers, while multinational corporations continue to establish production hubs to serve rapidly growing domestic and regional markets. Additionally, the region’s cost-competitive landscape makes it an attractive destination for large-scale media manufacturing, complemented by rising quality benchmarks to align with global regulatory expectations.

This comprehensive research report examines key regions that drive the evolution of the Cell Culture Media market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining how leading suppliers and emerging innovators are forging partnerships and R&D pipelines to deliver integrated media solutions

Key players in the cell culture media arena continue to expand their portfolios through a combination of internal R&D and strategic alliances. Longstanding industry leaders have focused on enhancing the versatility and performance of existing media products while integrating services such as custom formulation and application support. At the same time, specialized biotech firms and start-ups have carved out niches by pioneering next-generation formulations tailored for advanced cell types and bioprocessing platforms.

Collaborative ventures between media suppliers and bioreactor or single-use system manufacturers have become increasingly prevalent, creating bundled solutions that streamline workflow integration and reduce technical risk. In parallel, service providers offering analytical testing, quality certification, and regulatory consulting are adding value by ensuring compliance and accelerating product time to market. Collectively, these strategic moves underscore a broad industry trend toward end-to-end solutions that address both product performance and operational efficiency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cell Culture Media market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avantor, Inc.

- Becton, Dickinson and Company

- Bio‑Techne Corporation

- Caisson Laboratories, Inc.

- CellGenix GmbH

- Corning Incorporated

- Danaher Corporation

- Eppendorf AG

- FUJIFILM Corporation

- HiMedia Laboratories Pvt Ltd.

- Janssen Pharmaceuticals

- Kohjin Bio Corporation

- Lonza Group AG

- Merck KGaA

- Miltenyi Biotec B.V. & Co. KG

- Nucleus Biologics LLC

- PeproTech, Inc.

- PromoCell GmbH

- Sartorius AG

- STEMCELL Technologies Inc.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

- Wako Pure Chemical Industries, Ltd.

- Wuxi AppTec Co., Ltd.

- Xell AG

Implementing co-innovation frameworks and digital platforms to drive media customization, supply resilience, and sustainable differentiation

Industry leaders should prioritize the development of modular media platforms that can be rapidly customized to emerging cell models and process technologies, thereby addressing the dual imperatives of agility and consistency. Establishing co-innovation labs with key customers and academic centers will accelerate formulation breakthroughs and foster deeper customer loyalty.

Investment in digital workflow tools-from online ordering portals with real-time inventory visibility to AI-driven media optimization software-can streamline procurement and technical support services, creating differentiated customer experiences. Additionally, exploring localized production models or strategic toll-manufacturing alliances can insulate supply chains against geopolitical risks and tariff fluctuations.

Finally, embedding sustainability into product design and manufacturing operations-through ingredient traceability, waste-reduction programs, and carbon-neutral packaging-will resonate with both regulatory stakeholders and end users seeking to meet corporate responsibility goals. By aligning innovation agendas with broader scientific trends and customer pain points, companies can cultivate resilient growth pathways in the evolving cell culture media ecosystem.

Detailing the comprehensive primary and secondary research processes used to gather, validate, and analyze industry insights

This research synthesizes primary data from in-depth interviews with senior R&D leaders, production managers, and procurement executives across academic, contract, and commercial manufacturing settings. Secondary sources include peer-reviewed publications, patent filings, regulatory agency guidelines, and thematic white papers from industry associations. Qualitative insights were triangulated through cross-referencing key product launches, partnership announcements, and technology roadmaps over the past three years.

Quantitative analysis involved evaluating shipment patterns, import-export flows, and tariff schedules to elucidate cost pressures and supply-chain dynamics. Vendor and end-user feedback on product performance and service quality were systematically captured via structured surveys, yielding comparative benchmarks that inform segmentation insights. All findings were subjected to rigorous validation by subject-matter experts to ensure both accuracy and relevance for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cell Culture Media market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cell Culture Media Market, by Product Type

- Cell Culture Media Market, by Cell Type

- Cell Culture Media Market, by Form

- Cell Culture Media Market, by Application

- Cell Culture Media Market, by End User

- Cell Culture Media Market, by Region

- Cell Culture Media Market, by Group

- Cell Culture Media Market, by Country

- United States Cell Culture Media Market

- China Cell Culture Media Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing scientific advances, regional nuances, and strategic imperatives to outline a clear roadmap for leadership in media innovation

The cell culture media domain stands at a critical intersection of scientific innovation, regulatory evolution, and supply-chain realignment. The transition toward defined, serum-free formulations has unlocked new possibilities in reproducibility and safety, while the proliferation of advanced bioprocessing methods demands ever-higher performance standards. Amid the uncertainties of tariff shifts and geostrategic dynamics, the ability to adapt sourcing strategies and embrace localized production has become a key differentiator.

Segmentation analysis reveals that understanding the interplay between product type, cell model, form factor, application niche, and end-user requirements is foundational for precise market positioning. Regional insights underscore the importance of tailoring approaches to distinct regulatory climates and innovation ecosystems, whether in North America’s personalized medicine hubs, Europe’s sustainable manufacturing corridors, or Asia-Pacific’s high-growth production centers.

Ultimately, organizations that integrate co-innovation partnerships, digital support platforms, and sustainability imperatives will be best positioned to navigate the next frontier of cell culture media development. The insights presented herein form a roadmap for decision-makers seeking to align scientific advancements with commercial strategy in a rapidly evolving landscape.

Take decisive action now and engage directly with Ketan Rohom to secure the definitive cell culture media research that will power your strategic decisions

If you’re ready to capitalize on emerging opportunities and gain unparalleled insights into the evolving cell culture media landscape, reach out to Ketan Rohom, Associate Director, Sales & Marketing, for personalized guidance on how this comprehensive research can inform your growth strategy. Ketan can walk you through key findings, answer your questions in real time, and arrange access to the full study so you can integrate the latest intelligence into critical business decisions. Don’t miss the chance to equip your organization with high-impact data and expert analysis that drives innovation-contact Ketan Rohom today to secure your copy and start unlocking competitive advantage.

- How big is the Cell Culture Media Market?

- What is the Cell Culture Media Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?