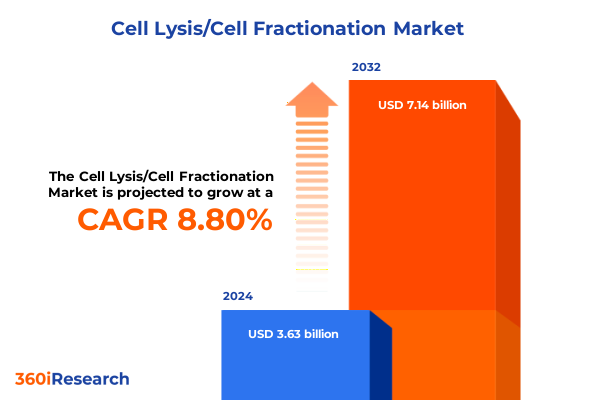

The Cell Lysis/Cell Fractionation Market size was estimated at USD 3.95 billion in 2025 and expected to reach USD 4.29 billion in 2026, at a CAGR of 8.82% to reach USD 7.14 billion by 2032.

Unveiling the Essential Role of Cell Lysis and Fractionation Techniques in Accelerating Breakthrough Discoveries Across Biomedical and Biotech Research

Cell lysis and fractionation techniques lie at the very heart of modern life science research, enabling scientists to dissect cellular architecture, isolate critical biomolecules, and unlock biological mechanisms that underpin health and disease. These methods form the cornerstone of laboratories worldwide, providing the foundational preparative steps for downstream applications such as proteomics, genomics, metabolomics, and drug discovery. As research questions become more specialized and complex, the quest for higher sensitivity, reproducibility, and throughput in cell disruption workflows has intensified, driving continuous refinement of existing approaches and the development of new platforms.

Today’s laboratories require solutions that balance efficiency with precision, allowing researchers to tailor their protocols according to the unique characteristics of their sample types and analytical goals. From gentle enzymatic digestion for preserving protein complexes to robust mechanical homogenization for challenging tissue matrices, the array of available methodologies reflects decades of innovation and responds to a diverse set of experimental demands. In this context, strategic decisions regarding instrument selection, reagent compatibility, and workflow integration are critical to achieving reliable outcomes, accelerating discovery timelines, and optimizing resource utilization across both academic and industrial settings.

Exploring the Fundamental Technological and Methodological Transformations Shaping the Cell Lysis and Fractionation Landscape in Recent Years

The cell lysis and fractionation landscape has undergone a remarkable transformation as laboratories embrace high-throughput objectives and integrate multi-omics analyses into their research pipelines. Advances in microfluidics have enabled miniaturized disruption systems that deliver precise shear forces at the single-cell level, setting new benchmarks for resolution in proteomic and transcriptomic studies. Simultaneously, the automation of bead milling platforms and high-pressure homogenizers has streamlined sample processing, reducing hands-on time while increasing reproducibility.

On the reagent front, the emergence of next-generation detergent formulations and solvent systems has expanded the toolkit available for selective membrane solubilization, facilitating the preservation of labile protein complexes and improving downstream analytical performance. Enzymatic lysis protocols have also been refined through engineered proteases and lysozymes with enhanced specificity, further broadening the scope of applications from bacterial cell wall disruption to gentle release of organelle-bound proteins. Moreover, hybrid workflows that combine mechanical disruption with targeted chemical or enzymatic steps are gaining traction, allowing researchers to fine-tune lysis parameters and maintain the integrity of subcellular structures for fractionation studies. These cumulative shifts underscore an ecosystem that is increasingly modular, adaptable, and capable of meeting the exacting standards of contemporary biological research.

Analyzing the Multifaceted Impacts of United States Tariff Policies in 2025 on the Global Cell Lysis and Fractionation Equipment and Reagents Industry

In 2025, new tariff measures instituted by United States authorities have introduced additional duties on a range of imported laboratory instruments and reagents commonly used for cell lysis workflows, including bead mills, French press systems, homogenizers, sonicators, buffer kits, detergents, and protease inhibitors. The adjustments, which took effect at the start of the calendar year, have applied incremental duties that vary by Harmonized Tariff Schedule subheadings, impacting both mechanical disruption equipment and associated consumables. As a result, procurement teams are reassessing supplier portfolios and exploring alternative sourcing strategies to mitigate cost increases and potential supply chain disruptions.

The tariff revisions have also prompted a reevaluation of domestic manufacturing capabilities, spurring investments in local production of critical reagents and the in-house assembly of instruments where feasible. For multinational research organizations, this has translated into complex decisions balancing the benefits of established vendor relationships against the imperative to control operating expenses in a tightening budgetary climate. Moreover, the layered impact of additional duties has highlighted the strategic importance of total cost of ownership analyses, encompassing not only initial acquisition prices but also maintenance agreements, reagent replacement cycles, and the logistical dynamics of import compliance.

In-Depth Examination of Product, Technology, Application, and End User Segmentation Insights Driving Cell Lysis and Fractionation Market Dynamics

Insights into product segmentation reveal that instrument offerings encompass bead mills engineered for high-energy disruption, French press systems optimized for consistent pressure application, advanced homogenizers equipped with variable flow controls, and sonicators designed for precise acoustic cavitation. In parallel, the consumable landscape spans buffer kits formulated for specific cell types, a diverse range of detergents that address both ionic and non-ionic solubilization requirements, disruption kits that integrate multiple lytic components, and targeted protease inhibitors that safeguard protein integrity. This layered product architecture empowers researchers to tailor lysis strategies according to sample complexity and downstream analytical needs.

The technological segmentation underscores differentiated lysis modalities, from detergent-based and solvent-based chemical approaches to lysozyme and protease enzymatic digestion protocols, as well as bead milling, high-pressure homogenization, and sonication mechanical methods, complemented by thermal freeze-thaw cycles. Each pathway offers unique advantages in terms of throughput, selectivity, and sample preservation, driving end users to align methodology with experimental objectives. In application, the protocols support an array of research domains: flow cytometry and western blotting in cell biology; assay development and high-throughput screening in drug discovery; DNA and RNA isolation in genomics; GC-MS and NMR analyses in metabolomics; and 2D electrophoresis and LC-MS in proteomics. End users span government laboratories and universities within academic and research institutes, biopharma and startup entities in the biotechnology sector, clinical and preclinical contract research organizations, as well as generic and large pharmaceutical companies. Together, these classification layers illuminate a highly intricate ecosystem where customization and interoperability define competitive differentiation and shape investment priorities.

This comprehensive research report categorizes the Cell Lysis/Cell Fractionation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Application

- End User

Comprehensive Regional Perspectives Highlighting Growth Drivers and Challenges Across Americas, Europe Middle East Africa, and Asia Pacific Territories

Regional dynamics demonstrate pronounced variances in adoption patterns and investment trajectories. In the Americas, sustained public funding and private investment in life sciences research drive demand for both high-capacity mechanical disruption instruments and premium consumable kits. Regulatory frameworks that emphasize stringent quality and reproducibility standards further reinforce the adoption of validated platforms, while collaborative consortia between academic institutions and industry sponsors accelerate the translation of lysis innovations into commercial workflows.

Across Europe, the Middle East, and Africa, harmonized regulatory standards and pan-regional research initiatives underpin a diverse ecosystem in which laboratories prioritize modular and flexible systems capable of supporting cross-border collaborations. In regions with emerging research infrastructure, local distributors and OEM partnerships play a critical role in bridging access gaps, while established research hubs continue to invest in cutting-edge enzymatic and chemical lysis methodologies.

The Asia-Pacific territory exhibits rapid growth in biotechnology R&D centers and biomanufacturing facilities, leveraging cost-competitive production capabilities to serve global supply chains. Governments in key markets are advancing incentives to localize reagent manufacturing and instrument assembly, fostering an increasingly self-sufficient network of suppliers and service providers. This regional momentum is complemented by active participation in international research consortia, driving demand for scalable, automated lysis solutions tailored for high-throughput and large-scale applications.

This comprehensive research report examines key regions that drive the evolution of the Cell Lysis/Cell Fractionation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles Revealing Competitive Advantages and Innovation Leadership Among Key Players in the Cell Lysis and Fractionation Arena

Leading companies in the cell lysis and fractionation arena continue to refine their strategic positioning through targeted R&D investments, collaborative partnerships, and selective acquisitions. Several established instrument manufacturers are expanding their core portfolios with modular add-ons and digital controls to enhance workflow integration and data traceability, while consumable specialists are unveiling next-generation buffer formulations and protease inhibitors that deliver enhanced performance under demanding experimental conditions.

Innovation leadership is further exemplified by companies that leverage artificial intelligence and machine learning algorithms to optimize lysis parameters in real time, offering users pre-programmed protocols that adapt to sample variability. At the same time, several industry participants are forging alliances with omics platform providers and contract research organizations to co-develop customized solutions, bundling instruments with tailored reagent kits and protocol services. This ecosystem approach not only deepens customer engagement but also accelerates time to data, positioning these companies as indispensable partners in the life science research continuum.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cell Lysis/Cell Fractionation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Eppendorf AG

- F. Hoffmann-La Roche Ltd

- Lonza Group AG

- Merck KGaA

- PerkinElmer, Inc.

- Promega Corporation

- QIAGEN N.V.

- Sartorius AG

- Thermo Fisher Scientific Inc.

Actionable Strategic Recommendations Empowering Industry Leaders to Optimize Operations and Capitalize on Emerging Opportunities Within Cell Lysis Sector

Industry leaders should prioritize the diversification of their supply chains to mitigate the effects of evolving tariff landscapes and geopolitical uncertainties by establishing regional manufacturing hubs and multi-tiered distribution networks. Investing in modular, automated platforms will unlock operational efficiencies, reducing manual intervention and standardizing workflows to enhance reproducibility across laboratories. Furthermore, fostering cross-sector partnerships with reagent developers and omics service providers can generate integrated offerings that address end-to-end sample preparation and analysis requirements.

Companies are advised to strengthen their value propositions through differentiated reagent formulations that address niche sample types and emerging application areas, alongside instrument upgrades that deliver predictive maintenance and remote monitoring capabilities. Aligning product roadmaps with forthcoming regulatory guidelines will not only ensure compliance but also build customer confidence in solution robustness. Finally, embracing sustainability initiatives-such as biobased buffer components and energy-efficient instrument designs-will resonate with stakeholders seeking to minimize environmental impact while maintaining scientific rigor.

Rigorous Research Methodology Framework Ensuring Robust Data Integrity and Analytical Rigor for Cell Lysis and Fractionation Industry Assessment

This research synthesis integrates both primary and secondary data sources to ensure comprehensive and balanced insights. Primary data were obtained through in-depth interviews with senior executives, R&D scientists, and procurement managers across academic institutions, biotechnology firms, contract research organizations, and pharmaceutical companies. These interviews provided firsthand perspectives on workflow challenges, adoption drivers, and emerging technology requirements.

Secondary research encompassed a thorough review of peer-reviewed publications, patent filings, regulatory documents, white papers, and technical datasheets, as well as analysis of company press releases and investor presentations. To validate findings, a rigorous triangulation methodology was applied, cross-referencing qualitative inputs with quantitative indicators such as instrument installation bases and reagent usage patterns. Expert panels further reviewed preliminary conclusions to refine thematic interpretations and ensure robustness of insights. Any limitations in data completeness or potential biases were systematically addressed through sensitivity analyses and supplemental stakeholder consultations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cell Lysis/Cell Fractionation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cell Lysis/Cell Fractionation Market, by Product

- Cell Lysis/Cell Fractionation Market, by Technology

- Cell Lysis/Cell Fractionation Market, by Application

- Cell Lysis/Cell Fractionation Market, by End User

- Cell Lysis/Cell Fractionation Market, by Region

- Cell Lysis/Cell Fractionation Market, by Group

- Cell Lysis/Cell Fractionation Market, by Country

- United States Cell Lysis/Cell Fractionation Market

- China Cell Lysis/Cell Fractionation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3180 ]

Conclusive Reflections on the Evolutionary Progress, Current Momentum, and Future Trajectories in Cell Lysis and Fractionation Techniques Worldwide

As the life sciences ecosystem continues to push the boundaries of what is technically possible, cell lysis and fractionation techniques remain indispensable enablers of discovery. The evolution from basic mechanical disruption to sophisticated multi-modal workflows has reshaped sample preparation, delivering unprecedented resolution and reproducibility for a broad spectrum of applications. At the same time, the interplay of regulatory dynamics, tariff adjustments, and regional investment initiatives underscores the complex global context that shapes procurement and innovation strategies.

Looking ahead, the integration of real-time analytics, artificial intelligence, and single-cell technologies promises to further revolutionize how researchers approach lysis and fractionation challenges. By combining high-throughput mechanical platforms with AI-driven protocol optimization and advanced reagent chemistries, the next wave of solutions will cater to personalized medicine, precision agriculture, and environmental monitoring with unparalleled flexibility. Ultimately, stakeholders that embrace these convergent trends will be best positioned to translate cellular insights into tangible benefits for health, industry, and society.

Compelling Invitation to Engage with Our Associate Director for Tailored Insights and Secure Comprehensive Access to Our Cell Lysis Market Report

We invite you to connect with Ketan Rohom, our Associate Director of Sales and Marketing, to explore how this report can drive strategic advantage and innovation within your organization. Ketan brings a wealth of experience in life science research solutions and will guide you through the report’s insights, ensuring you can align its findings with your strategic priorities. Whether you require a tailored briefing, a demonstration of key data modules, or an executive summary for internal stakeholders, Ketan can facilitate a seamless purchase process and provide ongoing support to maximize the report’s impact.

Engaging directly with Ketan ensures that you receive customized assistance-from understanding specific segmentation dynamics to navigating tariff implications and regional nuances-so you can make well-informed decisions. Reach out today to secure your copy of the comprehensive cell lysis and fractionation industry analysis and position your team at the forefront of technological innovation and market development.

- How big is the Cell Lysis/Cell Fractionation Market?

- What is the Cell Lysis/Cell Fractionation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?