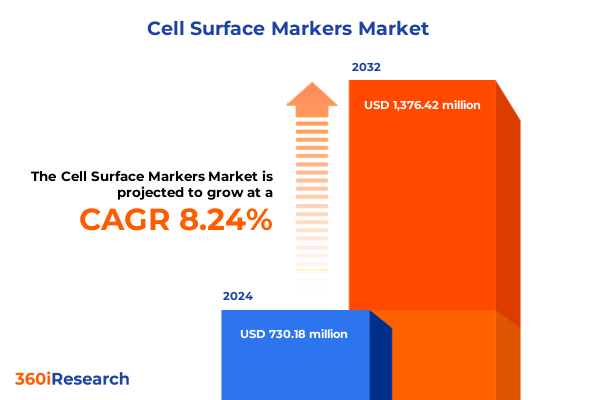

The Cell Surface Markers Market size was estimated at USD 771.93 million in 2025 and expected to reach USD 819.19 million in 2026, at a CAGR of 8.61% to reach USD 1,376.42 million by 2032.

Unveiling the Strategic Importance and Catalytic Role of Cell Surface Markers in Modern Biomedical Innovation and Clinical Diagnostics Research

Cell surface markers represent a cornerstone in unlocking the complexities of cellular communication, disease diagnostics, and therapeutic targeting. These molecular signposts adorn the membranes of diverse cell populations, facilitating the identification, isolation, and characterization of immune cells, stem cells, and malignancies. In diagnostics, they enable precise phenotyping of disease states, while in therapeutics, they serve as targets for monoclonal antibodies, cellular therapies, and drug conjugates. As research disciplines converge on the cellular microenvironment, the importance of reliable, high-affinity markers has never been more pronounced.

Advancements in antibody engineering, lectin chemistry, and reagent formulation have dramatically enhanced the specificity and sensitivity of marker detection. Complementary reagents, including fluorescent probes and enzymatic labels, now function with greater stability and reproducibility, driving a new era of multiparameter analysis. Concurrently, academic and commercial research teams are collaborating on next-generation panels that capture dynamic protein expression and post-translational modifications, reflecting a broader shift from static snapshots to real-time cellular monitoring.

Against this backdrop, stakeholders across pharmaceutical, biotechnology, and clinical research sectors are navigating a rapidly evolving ecosystem. Strategic partnerships between instrument manufacturers and antibody developers are emerging to deliver integrated solutions that streamline workflows and reduce time-to-result. This introduction frames the multifaceted potential of cell surface markers, setting the stage for an exploration of technological breakthroughs, market shifts, and strategic imperatives that will shape the future of biomedical innovation.

Navigating Paradigm Shifts Driven by Technological Advances and Evolving Regulatory Frameworks in Cell Surface Marker Development

In recent years, the landscape of cell surface marker analysis has undergone paradigm-shifting transformations driven by innovations in single-cell technologies, artificial intelligence, and high-dimensional cytometry. Researchers have embraced mass cytometry platforms that enable simultaneous measurement of dozens of protein parameters at the single-cell level, accelerating the discovery of rare cell subsets and functional immune signatures. These high-throughput pipelines, combining deep learning algorithms with automated gating strategies, have enhanced reproducibility and slashed analysis times, marking a significant departure from traditional manual methods.

The integration of single-cell RNA sequencing with protein-level data captured via mass cytometry has yielded unprecedented insights into cellular heterogeneity and lineage trajectories. Such multi-omic approaches have illuminated dynamic immune cell populations across the human lifespan, uncovering age-associated rewiring of T and B cell interactions and revealing novel cytotoxic B cell subsets in pediatric cohorts. By mapping transcriptional profiles onto surface marker signatures, scientists are now able to construct comprehensive atlases of the immune system, informing the development of precision diagnostics and targeted immunotherapies.

Simultaneously, advances in flow cytometry technology-spanning conventional laser-based systems to imaging and mass cytometers-have democratized access to high-parameter analysis. Improved detector sensitivity, expanded reagent panels, and user-friendly software suites have lowered barriers to adoption, enabling clinical laboratories and research institutes to perform complex phenotyping in-house. These technological advances, coupled with the integration of AI-driven data analytics, are redefining the capabilities of cell surface marker research, propelling the field toward a future where multi-dimensional cellular profiling is routine and actionable.

Assessing the Far-Reaching Consequences of Recent United States Tariff Policies on Cell Surface Marker Reagent Supply Chains

The introduction of robust United States tariff measures in 2025 has reverberated across the cell surface marker supply chain, reshaping reagent availability, pricing structures, and procurement strategies. Early announcements by the administration suggested tariffs of up to 200% on drug and biologic imports, creating uncertainty around the applicability of such duties to critical research reagents and sparking widespread debate among industry stakeholders. As the threat of steep import levies loomed, organizations began to reassess sourcing practices, accelerate inventory build-up, and explore alternative supplier networks to mitigate potential disruptions.

A survey conducted by the Biotechnology Innovation Organization revealed that nearly 90% of U.S. biotech firms depend on imported components for at least half of their FDA-approved therapies, with 94% anticipating sharp cost increases should tariffs be implemented on European Union imports. These findings underscore the vulnerability of biomedical research to trade policy shifts, prompting manufacturers to consider dual sourcing and partial re-shoring initiatives to safeguard continuity of supply.

The tangible impact of tariffs on laboratory operations became evident with the imposition of 25% duties on key scientific imports from Mexico and Canada and a subsequent rise from 10% to 20% on Chinese-sourced lab equipment and consumables. Concurrently, life science tool providers reported average increases of 2% to 4% in cost of goods sold, depending on regional manufacturing footprints, translating into tighter margins and elevated end-user prices. These cumulative shifts have not only prompted procurement teams to diversify suppliers but also accelerated investments in local manufacturing capabilities, challenging traditional global supply chain paradigms.

Illuminating Market Dynamics Through Comprehensive Multidimensional Segmentation and Strategic Market Positioning of Cell Surface Marker Solutions

A nuanced examination of the cell surface marker market reveals a rich tapestry of segments defined by product type, technology, application, and end-user specialization. Within the product type dimension, complementary reagents coexist alongside lectins, monoclonal antibodies, and polyclonal antibodies. Monoclonal offerings, subdivided into IgA, IgG, and IgM classes, cater to diverse research and diagnostic needs, while polyclonal reagents, sourced from goat, mouse, or rabbit hosts, provide versatile binding profiles for complex assays.

Delving deeper, the technological segmentation encompasses enzyme-linked immunosorbent assays as foundational screening tools; flow cytometry platforms that range from conventional laser-based instruments to imaging flow cytometers and cutting-edge mass cytometers; and microscopy-based approaches including immunocytochemistry and immunohistochemistry. Each modality offers distinct advantages in throughput, spatial resolution, and multiplexing capacity, aligning with varied research objectives.

Application-based stratification further highlights the role of cell surface markers in diagnostics, research, and therapeutics. Within diagnostics, cardiovascular, infectious disease, and oncology assays leverage marker panels to enhance early detection and patient stratification. Research-driven deployments span cancer biology, immunology, and stem cell investigations, where markers underpin lineage tracing and functional characterization. Therapeutics focus on autoimmune disease and oncology indications, harnessing markers to guide targeted drug delivery and immune cell engagement.

Finally, the end-user landscape is populated by academic research institutes, contract research organizations, hospital and diagnostic laboratories, and pharmaceutical and biotechnology companies. Each constituency demands tailored reagent formats, support services, and regulatory compliance features, collectively shaping the competitive environment and driving innovation in product design and service models.

This comprehensive research report categorizes the Cell Surface Markers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Discerning Regional Opportunities and Challenges Across the Americas, EMEA, and Asia-Pacific Cell Surface Marker Markets Landscape

Regional dynamics in the cell surface marker market are shaped by varying regulatory frameworks, research investment profiles, and infrastructure maturity across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, a robust ecosystem of academic institutions and commercial laboratories benefits from significant public and private funding. This abundance of resources fuels demand for advanced marker panels and integrated analytics platforms, while the presence of leading instrument manufacturers fosters rapid adoption of state-of-the-art cytometry and immunoassay technologies.

Across Europe, the Middle East, and Africa, harmonized regulatory standards and centralized procurement mechanisms have streamlined market entry for novel reagents, though national reimbursement policies and purchase volumes differ widely. This region emphasizes cost-effective solutions and quality certifications, prompting suppliers to develop flexible pricing strategies and local manufacturing partnerships to address the diverse needs of research hospitals, diagnostic coalitions, and centralized biobanks.

Asia-Pacific stands out for its fast-growing biotech hubs in China, Japan, South Korea, and India, underpinned by government initiatives that incentivize life science innovation. Lower production costs and expanding clinical research volumes have elevated the demand for both commodity reagents and premium marker kits. Simultaneously, an increasing number of domestic reagent developers are emerging, intensifying competition but also fostering collaborative ventures with global suppliers eager to tap into the region’s burgeoning markets.

This comprehensive research report examines key regions that drive the evolution of the Cell Surface Markers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Competitive Cell Surface Marker Industry Landscape Dynamics

Leading participants in the cell surface marker arena are orchestrating a blend of organic growth and strategic alliances to captivate market share and drive innovation. Prominent antibody manufacturers are expanding their portfolios by incorporating recombinant engineering techniques, enabling the design of bespoke binding domains and reduced immunogenicity. These companies are also forging collaborations with mass cytometry instrument providers to co-develop multiplexed reagent panels tailored to next-generation cytometers, thereby streamlining customer workflows and reinforcing platform stickiness.

Simultaneously, established cytometry firms are investing heavily in software enhancements, integrating artificial intelligence and machine learning modules that automate complex analyses and predictive modeling. By offering cloud-based data management and advanced visual analytics, they aim to lower the barrier to entry for emerging laboratories and to support large-scale multi-center studies.

Smaller, niche players are differentiating through specialization in high-affinity lectins and novel fluorophore conjugates, positioning themselves as valuable partners for research organizations seeking custom reagent solutions. In parallel, contract research organizations are extending their service portfolios to include high-parameter phenotyping and bespoke antibody development, creating end-to-end propositions that bridge reagent supply with assay execution and data interpretation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cell Surface Markers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abcam plc

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Danaher Corporation

- Merck KGaA

- PerkinElmer, Inc.

- Sartorius AG

- Thermo Fisher Scientific Inc.

Transformative Strategic Roadmap for Industry Leaders to Harness Cell Surface Marker Innovations and Navigate Market Complexities

To capitalize on emerging opportunities and to mitigate evolving market risks, industry leaders should prioritize strategic imperatives that balance innovation with operational resilience. First, investing in integrated platform development-spanning reagent design, automation, and data analytics-will create synergistic value propositions that meet the demands of high-throughput laboratories and translational research units alike. Such integration reduces time to insight and fortifies customer relationships through standardized workflows.

Second, forging diversified supply chains by cultivating alternative manufacturing bases and supplier alliances will buffer against geopolitical disruptions, tariff fluctuations, and raw material constraints. Companies should explore regional production partnerships and adopt flexible sourcing models that can pivot rapidly in response to policy changes.

Third, harnessing artificial intelligence and advanced bioinformatics for predictive marker selection and assay optimization can accelerate R&D cycles and enhance reproducibility. By embedding machine learning capabilities into product development pipelines, organizations can refine reagent affinity profiles and anticipate emergent biomarker trends before they reach mainstream adoption.

Lastly, engaging proactively with regulatory authorities and standardization bodies will ensure alignment with evolving compliance requirements and facilitate smoother market entry. A collaborative approach to policy dialogue and participation in industry consortia will position leaders as influential voices in shaping future guidelines for quality control, labeling, and clinical validation.

Ensuring Rigor and Transparency Through Robust Multifaceted Research Methodology and Analytical Precision for Market Intelligence

This analysis synthesizes insights from a blend of primary and secondary research methodologies, ensuring a rigorous and transparent foundation for all strategic conclusions. Primary research encompassed in-depth interviews with leading scientists, procurement managers, and decision-makers across academic, clinical, and commercial settings. These conversations provided nuanced perspectives on reagent performance, workflow integration, and emerging technical requirements.

Complementing this, quantitative surveys were deployed to capture preferences and pain points from a broad cross-section of end users, spanning contract research organizations, diagnostic laboratories, and biotechnology firms. The resulting data set was triangulated against secondary sources, including peer-reviewed literature, public regulatory filings, and competitor intelligence reports, to validate trends and identify anomalies.

Throughout the research process, data quality controls such as consistency checks, outlier examinations, and expert review panels were applied to ensure accuracy and reliability. Advanced analytical techniques, including trend mapping and scenario analysis, were utilized to project potential market trajectories under varied regulatory and economic conditions. This comprehensive methodology delivers high confidence in the strategic recommendations and insights presented within this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cell Surface Markers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cell Surface Markers Market, by Product Type

- Cell Surface Markers Market, by Technology

- Cell Surface Markers Market, by Application

- Cell Surface Markers Market, by End User

- Cell Surface Markers Market, by Region

- Cell Surface Markers Market, by Group

- Cell Surface Markers Market, by Country

- United States Cell Surface Markers Market

- China Cell Surface Markers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesis of Key Insights Underscoring the Strategic Imperatives and Future Horizons in Cell Surface Marker Research and Applications

Drawing together the examination of technological breakthroughs, policy dynamics, and competitive strategies, the cell surface marker landscape emerges as both richly complex and ripe for innovation. High-parameter single-cell platforms are transitioning from niche research tools to essential components of clinical and translational workflows, enabling unprecedented resolution in disease monitoring and therapeutic targeting. Concurrently, supply chain realignments driven by tariff policies and geopolitical shifts underscore the importance of agile procurement strategies and regional manufacturing diversification.

Segmentation analysis reveals that success hinges on the ability to deliver tailored reagent solutions across product types, technologies, applications, and end users. Companies that excel will seamlessly integrate complementary reagents and advanced cytometry capabilities with AI-enhanced analytics, thereby offering end-to-end value propositions. Moreover, regional market nuances highlight the necessity of customizing approaches to align with local regulatory frameworks, research funding environments, and logistical considerations.

As the field continues to evolve, stakeholders who embrace collaborative R&D models, uphold rigorous quality standards, and anticipate regulatory changes will be best equipped to lead. The strategic roadmap outlined herein offers a blueprint for navigating uncertainties, capitalizing on emerging trends, and driving the next wave of discoveries facilitated by cell surface marker technologies.

Contact Associate Director Ketan Rohom for Exclusive Access and Custom Insights from the Comprehensive Cell Surface Marker Market Research Report

For decision-makers seeking to leverage in-depth insights and tailor the findings to organizational needs, engaging directly with the Associate Director, Sales & Marketing provides unparalleled access to bespoke analysis and expert consultation. Ketan Rohom is prepared to guide prospective clients through the report’s comprehensive coverage of technological advancements, regional dynamics, and strategic recommendations, ensuring that each stakeholder finds the actionable intelligence necessary to drive innovation and competitive differentiation.

By reaching out to Ketan Rohom, organizations will benefit from a personalized demonstration of the report’s capabilities, an exploration of custom data deliverables, and a detailed discussion of how the research aligns with specific project goals or investment objectives. This collaborative approach empowers teams to derive maximum value from the research, transforming high-level market insights into concrete strategies that accelerate product development pipelines, optimize resource allocation, and mitigate emerging regulatory and supply chain risks.

Secure exclusive access to the full market research report and schedule a consultation by connecting with Ketan Rohom. Elevate your strategic planning and chart a course for success in the evolving cell surface marker landscape by partnering with an expert committed to delivering tailored, high-impact intelligence.

- How big is the Cell Surface Markers Market?

- What is the Cell Surface Markers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?