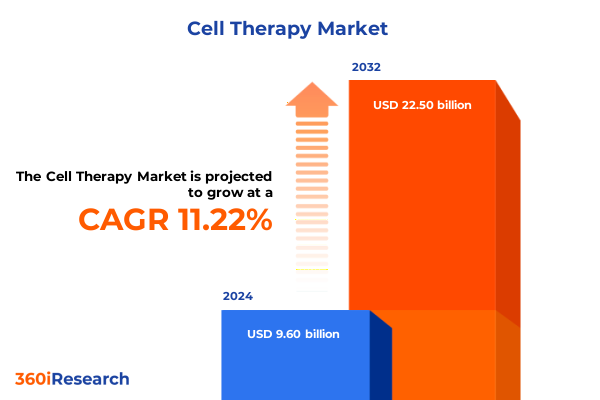

The Cell Therapy Market size was estimated at USD 10.54 billion in 2025 and expected to reach USD 11.58 billion in 2026, at a CAGR of 11.42% to reach USD 22.50 billion by 2032.

Cell Therapy Unveiled as a Breakthrough Treatment Frontier Redefining Disease Management and Therapeutic Innovation Across Diverse Clinical Landscapes

Cell therapy has emerged as a revolutionary treatment paradigm that harnesses living cells to restore function, combat disease, and unlock new therapeutic possibilities. This innovative approach spans a spectrum of modalities, from engineered immune cells that target malignancies to stem cell–based interventions that repair damaged tissues. By shifting the focus from traditional small molecules and biologics to living drugs, cell therapy offers the promise of one-time or limited-cycle treatments that address underlying pathologies rather than merely managing symptoms.

The maturation of cell therapy is underpinned by rapid scientific advances, robust clinical pipelines, and regulatory frameworks that have evolved to accelerate approval pathways. As of early 2025, the global cell and gene therapy industry encompasses more than 4,000 candidates in development, reflecting an 11% increase in Phase I trials over the previous year and signaling sustained R&D momentum across multiple therapeutic areas. This dynamic landscape has attracted significant investment from biopharma incumbents and emerging biotech companies alike, driving innovations in manufacturing, analytics, and clinical delivery.

With applications extending beyond oncology into autoimmune disorders, regenerative medicine, and infectious diseases, cell therapy stands at the threshold of broader clinical integration. The technology’s capacity to deliver personalized treatments, coupled with advances in genetic engineering and automation, is setting the stage for transformative impacts on patient outcomes and healthcare systems worldwide.

Emerging Manufacturing Paradigms and Digital Transformations Propelling Cell Therapy from Concept to Scalable Clinical Reality Worldwide

The cell therapy sector is experiencing a profound transformation driven by the convergence of decentralized manufacturing, advanced analytics, and collaborative ecosystems. Rather than relying solely on large-scale, centralized facilities, developers are increasingly adopting modular and point-of-care production models that reduce transit times and preserve cell viability. This shift not only enhances clinical access by bringing production closer to treatment centers but also mitigates logistical complexities associated with transporting living materials across long distances.

Simultaneously, the integration of inline and online analytical technologies is enabling real-time monitoring of critical quality attributes throughout the production workflow. These purpose-built platforms leverage digital twins, machine learning algorithms, and smart sensors to detect and correct process deviations instantly, reducing batch failures and ensuring consistent therapeutic potency. As developers accumulate evidence on the reliability of such digital tools, regulatory agencies are becoming more receptive to adaptive quality control frameworks, paving the way for faster batch releases and streamlined compliance routines.

Ecosystem collaboration has also evolved from transactional partnerships to integrated consortia that unite technology providers, biopharma corporations, academic institutions, and contract development organizations. Through open-innovation initiatives and co-development agreements, stakeholders are pooling resources to overcome manufacturing bottlenecks, scale next-generation facilities, and share best practices. This collaborative ethos is reinforcing the sector’s ability to translate early-stage discoveries into scalable clinical realities at an unprecedented pace.

Assessing the Compounding Consequences of 2025 United States Tariffs on Cell Therapy Supply Chains and Innovation Pipelines

In April 2025, the U.S. government enacted a broad 10% global tariff on nearly all imported goods, explicitly including active pharmaceutical ingredients, medical equipment, and key materials used in cell therapy manufacturing. While intended to bolster domestic production, these measures have swiftly driven up raw material costs, constraining profit margins and escalating operational budgets across the life sciences sector. Companies reliant on specialized reagents, viral vectors, and single-use bioreactor components are confronting immediate pricing pressures that ripple through supply chains and challenge established sourcing strategies.

Trade tensions with major API suppliers have compounded these challenges, particularly for cell and gene therapy developers who source critical inputs from a limited number of overseas partners. Small and mid-sized biotech firms, operating on lean capital and narrow funding tranches, are especially vulnerable; industry analyses warn that rising costs could force delays or cancellations of early-stage clinical programs, with cash-strapped ventures lacking the financial cushion to absorb sudden tariff spikes. Moreover, the complexity of renegotiating supplier contracts and qualifying alternative vendors means that supply chain restructurings often span 12 to 24 months, prolonging uncertainty and introducing regulatory friction when trial protocols require amendments.

In response, established pharmaceutical players have announced multi-billion-dollar reshoring investments to expand U.S. manufacturing capacity, while industry coalitions advocate for tariff exemptions on orphan drugs and critical cell therapy inputs to safeguard patient access. Despite these mitigation efforts, the cumulative impact of tariffs threatens to slow the pace of innovation, elevate therapy costs, and strain the delicate balance between domestic supply resilience and global R&D collaboration.

Multidimensional Segmentation Reveals Critical Market Pathways Spanning Cell Types Therapeutic Modalities Administration Routes and End Users

Market segmentation by cell type distinguishes between non-stem cell therapies-such as CAR-T, dendritic cell, and natural killer cell modalities-and stem cell approaches, including embryonic, hematopoietic, and mesenchymal stem cells. Each subset addresses distinct clinical needs: CAR-T therapies have demonstrated striking efficacy against hematologic malignancies, while mesenchymal stem cell platforms are advancing regenerative applications in cardiac and orthopedic disorders. This bifurcation underscores the importance of tailored manufacturing capabilities and regulatory strategies attuned to the biological characteristics of each cell source.

The distinction between autologous and allogeneic therapies further refines product development pathways. Autologous approaches, leveraging a patient’s own cells, offer personalized specificity but incur higher per-dose costs and extended production timelines. Conversely, allogeneic “off-the-shelf” products promise immediate availability and economies of scale, yet necessitate additional engineering to prevent rejection and ensure safety. Balancing these trade-offs is central to portfolio diversification and market adoption strategies.

Administratively, the route of delivery-from intramuscular and intratumoral injections to systemic infusions-dictates clinical trial design, logistics, and infrastructure requirements. Intravenous delivery remains the predominant mode for immune cell therapies targeting disseminated disease, while localized administration is gaining traction in solid tumor and tissue regeneration indications. Meanwhile, application segments span autoimmune disorders like multiple sclerosis and rheumatoid arthritis, oncology subsegments including hematologic malignancies and solid tumors, infectious disease interventions for bacterial and viral infections, and emerging regenerative medicine uses that seek to repair or replace damaged tissues.

Across these therapeutic and delivery dimensions, end-user segmentation reveals diverse adoption landscapes. Academic and research institutes drive early clinical innovation and protocol development, whereas clinics and hospitals form the backbone of commercial deployment. Commercial laboratories and contract facilities provide critical manufacturing support, emphasizing the need for collaboration across the value chain to streamline technology transfer and ensure consistent product quality.

This comprehensive research report categorizes the Cell Therapy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Therapy Type

- Mode of Administration

- Application

- End User

Regional Dynamics Shaping Cell Therapy Adoption Highlighting Strengths Opportunities and Emerging Hubs Across The Americas EMEA And Asia-Pacific

North America continues to lead global cell therapy activity, hosting over 1,100 active clinical trials-more than 55% of the worldwide total-and anchoring a robust ecosystem of research institutions, biopharma corporations, and specialized treatment centers. The United States in particular benefits from expedited FDA pathways, established reimbursement frameworks, and a dense network of GMP-certified facilities that collectively accelerate both development and patient access. Canada and Latin American markets are also witnessing incremental growth, driven by cross-border collaborations and targeted government incentives aimed at expanding regional manufacturing capabilities.

The Europe, Middle East & Africa (EMEA) cluster exhibits a fragmented yet cohesive regulatory landscape, with the European Medicines Agency harmonizing standards across 27 member states. This has enabled easier cross-border trial conduct and technology exchange, although divergent national reimbursement policies pose adoption challenges. Israel and the Gulf Cooperation Council countries are investing heavily in precision medicine initiatives and GMP infrastructure, positioning themselves as emerging hubs for cell therapy scale-up in the EMEA region.

Asia-Pacific markets are distinguished by rapid regulatory innovation and government-backed funding programs. China leads with more than 180 registered cell therapy trials, supported by CNY 5 billion in government grants and streamlined review timelines averaging nine months. Japan’s Sakigake designation expedites approval for breakthrough therapies, while South Korea and Australia are building modular GMP facilities to serve both domestic and export markets. The APAC region’s growing clinical scale and cost-competitive manufacturing footprint are drawing strategic partnerships, licensing deals, and investment flows, signaling its ascent as a pivotal growth frontier for cell therapy.

This comprehensive research report examines key regions that drive the evolution of the Cell Therapy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles Highlighting Pioneering Leadership Investment Trends and Competitive Differentiators in Cell Therapy Development

A cohort of leading biopharma companies have solidified their positions in the cell therapy space through sustained R&D investment, strategic partnerships, and landmark clinical milestones. Novartis and Gilead Sciences (via Kite Pharma) are recognized for pioneering CAR-T platforms, each securing multiple FDA approvals and broadening indications across leukemia and lymphoma subtypes. In the allogeneic sphere, Mesoblast achieved a historic milestone with FDA approval of Ryoncil, the first bone marrow-derived MSC therapy for graft-versus-host disease, underscoring the viability of off-the-shelf cell products.

Similarly, Aurion Biotech’s recent commercial launch of Vyznova in Japan-the first cell therapy for corneal endothelial disease-highlights the expansion of regenerative applications in ophthalmology. Beyond these specialized developers, large pharmaceutical corporations including Johnson & Johnson, Roche, and Pfizer are actively expanding manufacturing capacity and forming external alliances to integrate cell therapy into broader oncology and immunology portfolios. Meanwhile, emerging players like Cellares have attracted significant venture funding to industrialize automated production platforms, aiming to reduce costs and scale throughput to match growing clinical demand.

These competitive dynamics are characterized by deal flows that include licensing agreements, co-development partnerships, and strategic acquisitions. The average upfront values in cell therapy collaborations have climbed into the low hundreds of millions, accompanied by high-value milestone structures tied to regulatory and commercial achievements. This evolving landscape underscores the importance of aligning scientific innovation with scalable business models to maintain differentiation and capture value in the rapidly maturing cell therapy market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cell Therapy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anterogen Co., Ltd.

- Astellas Pharma Inc.

- Athersys, Inc.

- BioNTech SE

- Bristol-Myers Squibb Company

- Castle Creek Biosciences, Inc.

- Catalent, Inc.

- FUJIFILM Holdings Corporation

- Gilead Sciences, Inc.

- JCR Pharmaceuticals Co., Ltd.

- Kolon TissueGene, Inc.

- Lonza Group Ltd.

- Medipost Co., Ltd.

- Mesoblast Ltd.

- Novartis AG

- NuVasive, Inc.

- Pfizer Inc.

- Sartorius AG

- Stemedica Cell Technologies, Inc.

- Stempeutics Research Pvt. Ltd.

- Takeda Pharmaceutical Company Limited

- TegoScience

- Thermo Fisher Scientific, Inc.

- Vericel Corporation

Action-Oriented Strategic Roadmap Guiding Industry Leaders to Optimize Manufacturing Collaborations Regulatory Engagement and Market Access

Industry leaders should prioritize diversification of supply chains by developing redundant sourcing strategies and exploring domestic manufacturing partnerships. Securing multiple qualified suppliers for viral vectors, media reagents, and single-use consumables will mitigate the impact of future tariffs and trade volatility. Concurrently, investing in decentralized production capabilities and modular facility designs can reduce logistical complexities and enhance clinical reach by localizing manufacturing near treatment sites.

To capitalize on digital transformation, organizations must integrate real-time analytics and process control platforms early in product development cycles. Collaborative pilots with technology providers to validate inline measurement techniques will build regulatory confidence in adaptive quality frameworks, accelerating batch release and reducing time-to-market. Embedding machine learning models within production workflows can optimize critical quality attributes and improve yield consistency across diverse cell sources.

Engagement with regulatory authorities through innovative trial designs and accelerated review programs remains crucial. Sponsors should leverage existing breakthrough and expedited pathways while advocating for tariff exemptions on critical cell therapy inputs to preserve cost efficiencies. Forming public–private partnerships and participating in cross-industry consortia will amplify collective influence on policy decisions and standard setting.

Finally, strategic alliances between biopharma, academia, and contract manufacturing organizations should focus on shared investments in advanced infrastructure, such as automated bioreactor systems and GMP-compliant satellite facilities. These partnerships will distribute capital requirements, streamline technology transfer, and ensure alignment with evolving regulatory expectations, positioning stakeholders to capture growth opportunities and sustain innovation leadership.

Rigorous Research Methodology Combining Primary Interviews Data Triangulation and Expert Validation to Ensure Robust Market Insights

The research methodology underpinning this analysis combines primary interviews with C-level executives, manufacturing experts, and regulatory authorities to capture firsthand perspectives on emerging trends and operational challenges. Complementing these interviews, secondary research draws from peer-reviewed journals, government publications, and high-impact industry reports to ensure a comprehensive evidence base.

Data triangulation techniques were employed to validate key findings, cross-referencing trial registries, patent filings, and financial disclosures. Quantitative insights-such as the number of active clinical trials, therapeutic approvals, and investment volumes-were corroborated through reputable databases and public corporate announcements. Qualitative assessments of manufacturing innovations and strategic partnerships were synthesized from expert panels and conference proceedings.

Approach rigor was maintained through iterative review cycles, in which preliminary findings were shared with selected industry stakeholders for feedback and refinement. This stakeholder validation process enhanced accuracy, identified blind spots, and strengthened the relevance of actionable recommendations. Ethical considerations and confidentiality agreements governed all primary data collection, ensuring candid insights while respecting proprietary information.

By integrating diverse data sources and leveraging expert validation, this methodology delivers robust, reliable market intelligence designed to support strategic decision-making and inform investment priorities in the evolving cell therapy landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cell Therapy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cell Therapy Market, by Type

- Cell Therapy Market, by Therapy Type

- Cell Therapy Market, by Mode of Administration

- Cell Therapy Market, by Application

- Cell Therapy Market, by End User

- Cell Therapy Market, by Region

- Cell Therapy Market, by Group

- Cell Therapy Market, by Country

- United States Cell Therapy Market

- China Cell Therapy Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Cell Therapy Market Evolution Underscoring Future Growth Drivers Challenges and Strategic Imperatives for Stakeholders

The evolution of cell therapy reflects a remarkable intersection of scientific innovation, collaborative ecosystems, and strategic investment, all converging to redefine therapeutic paradigms. From the first FDA approvals in hematologic malignancies to the advent of allogeneic MSC products and regenerative platforms, this sector has demonstrated an unparalleled capacity for clinical impact and growth. Key drivers-including decentralized manufacturing, real-time analytics, and adaptive regulatory frameworks-are accelerating the transition from bench to bedside, while emerging regions are expanding the global footprint of cell therapy adoption.

Yet, the market faces critical headwinds, notably the recent tariff measures that threaten to disrupt supply chains and inflate development costs. Addressing these challenges will require concerted efforts to diversify sourcing, expand domestic production capacity, and engage proactively with policymakers to secure exemptions for orphan drugs and essential bioprocessing inputs. At the same time, continued investment in digital biomanufacturing platforms and integrated partnerships will be essential to maintain quality standards, optimize yields, and reduce costs in an increasingly competitive landscape.

Looking ahead, the maturation of allogeneic and off-the-shelf modalities, breakthroughs in solid tumor targeting, and advances in gene editing are poised to drive the next wave of clinical breakthroughs. As stakeholder collaboration intensifies across academia, biotech, and pharmaceutical sectors, the cell therapy market is positioned for sustained innovation, broader patient access, and transformative healthcare outcomes worldwide.

Connect with Associate Director Ketan Rohom to Secure Your Comprehensive Cell Therapy Market Report and Drive Data-Backed Strategic Decisions

Unlock unparalleled insights tailored to your strategic needs by connecting with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings deep expertise in market intelligence and can provide you with a comprehensive cell therapy report that combines rigorous analysis, actionable recommendations, and unparalleled data quality. Engage directly with him to discuss customizable research solutions, secure timely access to the latest industry findings, and ensure your organization remains at the forefront of therapeutic innovation. Don’t miss the opportunity to leverage cutting-edge insights and accelerate your decision-making process-reach out to Ketan Rohom today to purchase your definitive market research report.

- How big is the Cell Therapy Market?

- What is the Cell Therapy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?