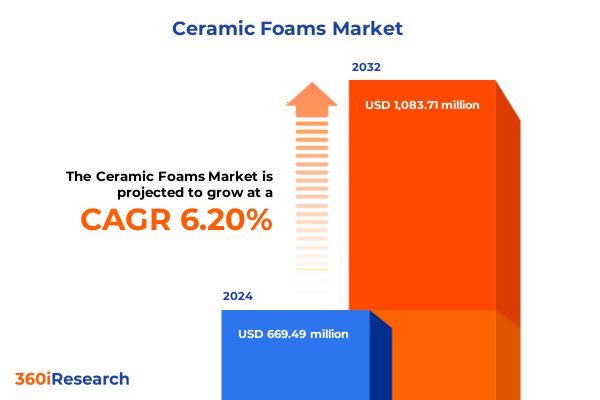

The Ceramic Foams Market size was estimated at USD 711.53 million in 2025 and expected to reach USD 759.34 million in 2026, at a CAGR of 6.19% to reach USD 1,083.70 million by 2032.

Discover the Unique Advantages and Evolving Significance of Ceramic Foams Across High-Temperature Stability, Filtration, and Insulation Sectors

Ceramic foams have emerged as indispensable materials across industries that demand exceptional thermal stability, high porosity, and chemical inertness. Initially developed to address the limitations of traditional refractory media, these highly porous structures now play critical roles in applications ranging from molten-metal filtration in foundries to thermal insulation in energy-intensive processes. Their unique combination of open and closed-cell architectures offers both mechanical robustness and controlled permeability, enabling precise control over fluid flow and heat transfer. Consequently, manufacturers have adopted ceramic foams for performance-driven applications where legacy materials fall short.

Building on decades of materials science research, the recent evolution of ceramic foam formulations has focused on enhancing structural toughness, tailoring pore geometries, and integrating composite phases to meet increasingly stringent operational requirements. Transitioning from basic alumina-based foams to advanced silicon carbide and mullite systems, producers have unlocked new high-temperature capabilities exceeding 1,500°C. Simultaneously, the adaptation of detailed production techniques such as replica foaming and sol-gel strategies has expanded the design envelope, making it possible to engineer pore sizes, wall thicknesses, and cell distributions for specific filtration, catalyst support, and insulation needs. These advancements set the stage for sustained growth and innovation in ceramic foam technologies.

Explore How Digitalization, Additive Manufacturing, and Sustainability Imperatives Are Redefining the Ceramic Foam Industry Landscape

The ceramic foam industry is experiencing a transformative phase driven by converging technological, environmental, and process innovations. Additive manufacturing techniques now enable the fabrication of complex, graded-porosity architectures that were previously unattainable through conventional methods. By depositing ceramic precursors in precise patterns, producers can tailor mechanical and thermal gradients within a single component, thereby enhancing performance in aerospace thermal protection, chemical reactors, and energy storage systems. This digital shift also shortens prototyping cycles, fostering rapid experimentation and co-development partnerships between material suppliers and end users.

At the same time, sustainability imperatives are reshaping raw material selection and process design. Manufacturers are exploring bio-derived pore formers, low-energy sintering protocols, and recycled ceramic feedstocks to curb the carbon footprint of production. Regulatory pressures on energy efficiency in building codes and emissions controls in foundries reinforce the adoption of advanced insulation-grade foams and eco-friendly filtration solutions. Consequently, firms that integrate digital workflows, additive capabilities, and green chemistry principles are positioned to capture competitive advantage as market dynamics pivot toward performance optimization and environmental stewardship.

Examine the Broad Economic and Strategic Implications of 2025 U.S. Tariff Adjustments on Ceramic Foam Supply Chains, Raw Materials, and Cost Structures

The implementation of U.S. Section 301 tariff increases, effective January 1, 2025, has amplified cost pressures on imported intermediate goods, including select ceramic raw materials and related equipment. Notably, the USTR raised tariffs on certain tungsten products to 25 percent and solar wafers and polysilicon to 50 percent, signaling heightened scrutiny of strategic supply chains for advanced materials. Although these measures did not explicitly target ceramic foams, they have a cascading impact on associated production inputs, such as pore-forming agents and high-purity ceramic powders sourced through shared logistics channels.

In parallel, the expansion of steel and aluminum tariffs to 25 percent from March 12, 2025 onward has driven up costs for processing machinery and furnace components essential to foam fabrication, prompting many producers to accelerate domestic sourcing strategies or invest in nearshoring partnerships. As a result, industry participants are reevaluating supplier networks and inventory policies to mitigate margin erosion. While some companies are capitalizing on increased protectionism to bolster local manufacturing capacities, others are pursuing collaborative ventures in tariff-exempt jurisdictions to maintain cost competitiveness.

Uncover Actionable Segmentation Insights That Illuminate Material Choices, Foam Configurations, Fabrication Techniques, and End-Use Applications

Evaluating the ceramic foam market through multiple segmentation lenses reveals deep insights into customization opportunities and strategic growth vectors. Across material types, alumina-based foams retain a cost-effective position for general-purpose foundry filters, while silicon carbide variants dominate high-temperature filtration due to superior thermal conductivity and chemical resistance. Mullite systems occupy a middle ground, balancing price and performance for emerging thermal insulation mandates. Understanding these material-driven value propositions is critical for producers aiming to optimize product portfolios by matching matrix composition with application-specific requirements.

Equally significant is the foam form, where closed-cell architectures offer enhanced strength and gas isolation for catalyst supports, and open-cell networks excel in melt filtration and fluid transport. Fabrication methods further differentiate offerings: ceramic coating delivers conformal thin films for complex geometries; direct foaming achieves high-throughput production of standardized blocks; replica methods enable precise cell replication from polymer templates; and sol-gel processes produce ultra-fine pore distributions for filtration and biomedical scaffolds. Finally, mapping applications and end-user industries-from biomedical implants and catalyst support to gas, liquid, and molten metal filtration, as well as thermal insulation for environmental engineering, metallurgy, chemical processing, oil & gas, and power generation-highlights the imperative for tailored, segment-specific strategies in product development, marketing, and channel alignment.

This comprehensive research report categorizes the Ceramic Foams market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Form

- Fabrication Method

- Application

- End User Industry

Gain a Comprehensive Understanding of Regional Dynamics Shaping Demand for Ceramic Foams in the Americas, EMEA, and Asia-Pacific Markets

Regional demand drivers for ceramic foams exhibit distinct economic, regulatory, and infrastructure influences. In the Americas, investments in electric-vehicle manufacturing plants, steel mini mills, and clean-energy projects have spurred demand for filtration-grade foams in metal casting and advanced insulation solutions for hydrogen, fuel cell, and battery production environments. North American producers benefit from robust R&D ecosystems and established logistics networks, enabling rapid deployment of customized foam components to address automotive and aerospace supply chain requirements.

In Europe, Middle East & Africa, stringent environmental regulations and tightening energy efficiency mandates have heightened the adoption of ceramic foams in emissions control and building insulation applications. Germany’s automotive and foundry sectors, the U.K.’s renewable energy hubs, and the Gulf’s petrochemical complexes are key growth pockets. Meanwhile, Asia-Pacific remains the largest revenue contributor, driven by China’s vast foundry base, India’s expanding infrastructure spending, and Southeast Asia’s growing EV castings and steel capacity. Regional market entries often hinge on joint ventures and licensing agreements that navigate local tariffs, certifications, and raw material availability.

This comprehensive research report examines key regions that drive the evolution of the Ceramic Foams market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze the Strategic Positioning and Innovation Trajectories of Key Global Players Driving Advancement in Ceramic Foam Technologies

The competitive landscape of the ceramic foam industry blends global conglomerates and specialized regional players, each deploying distinct innovation and market strategies. Vesuvius plc leverages its extensive molten metal flow engineering expertise to co-develop filtration modules with foundries, embedding sensors for real-time melt quality monitoring and predictive maintenance. Pyrotek Inc. has built a reputation for advanced thermal management materials, investing heavily in R&D to expand its portfolio of customized foam geometries for automotive and aerospace applications. SELEE Corporation maintains leadership in premium ceramic foam filters by continually optimizing pore structures and ceramic formulations to reduce inclusion defects in aluminum and iron casting processes.

Other influential participants include Saint-Gobain Performance Ceramics & Refractories and CeramTec GmbH, which focus on high-performance insulation foams for energy systems and biomedical scaffolds, respectively. Morgan Advanced Materials and Ultramet further extend the market with solutions tailored for industrial heat shields and defense-grade components. Emerging disruptors, such as Lithoz and 3DCeram, bring additive-manufacturing platforms that challenge traditional replica methods by enabling multi-material foam composites and intricate cellular architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ceramic Foams market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altech Alloys India Pvt. Ltd.

- Boading Ningxin Cast Material Co., Ltd

- CeramTec GmbH

- Compagnie de Saint-Gobain S.A.

- CoorsTek, Inc.

- Cotronics Corporation

- Drache GmbH

- ERG Materials & Aerospace Corp.

- FCRI Group

- Ferro-Term Sp. z o.o.

- Filtec Precision Ceramics Co., Ltd.

- Fraunhofer IKTS

- Galaxy Enterprise

- Goodfellow Corp.

- Honeywell International Inc.

- Induceramic

- Jiangxi Jintai Special Material LLC

- Jincheng Fuji Material Co., Ltd.

- LANIK S.R.O.

- Pingxiang Yingchao Chemical Packing Co., Ltd.

- Pyrotek Inc.

- SELEE Corporation

- TechCeramic Co., Ltd.

- Ultramet, Inc.

- Vertix Co.

- Vesuvius Plc

Implement These Actionable Strategic Recommendations to Optimize Supply Chains, Foster Innovation, and Drive Growth in the Ceramic Foam Sector

Industry leaders should prioritize vertical integration of raw material supply and manufacturing to shield margins from tariff volatility and raw-material price swings. Establishing captive production of key feedstocks such as high-purity alumina and silicon carbide powders can reduce dependence on fluctuating import tariffs and strengthen control over quality. Additionally, diversifying geographic manufacturing footprints-through joint ventures in Asia-Pacific and nearshoring in North America-can optimize logistics, customer proximity, and regulatory compliance.

Simultaneously, investment in digital twins and sensor-embedded foam components will unlock predictive maintenance and service-based revenue streams, differentiating suppliers in a commoditized market. Collaborating with end-user OEMs to co-create application-specific foam solutions enhances value capture and fosters long-term contracts. Lastly, incorporating sustainable practices-such as low-temperature sintering and recycled pore formers-will not only address environmental regulations but also resonate with corporate ESG commitments, opening doors to green financing and premium pricing for eco-friendly ceramic foam lines.

Understand the Rigorous Research Methodology Leveraging Primary Interviews, Data Triangulation, and Market Validation Processes

This research exercise combined systematic secondary research with targeted primary interviews and quantitative data triangulation. Secondary sources included government tariff notices, industry journals, and selected financial disclosures to ensure factual accuracy. Primary research comprised structured discussions with subject matter experts from manufacturing, foundry, and end-user sectors, gathered through surveys and in-depth telephonic interviews to validate market drivers and segmentation logic.

Quantitative estimates and qualitative insights were triangulated using top-down and bottom-up approaches. The former leveraged macroeconomic indicators, key import-export statistics, and tariff schedules to quantify supply-chain impacts. The latter synthesized individual company revenue data and end-use volume metrics to corroborate segmentation findings. Throughout this process, rigorous data-cleaning protocols and bias mitigation techniques guaranteed a consistent, auditable knowledge base underpinning all analyses.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ceramic Foams market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ceramic Foams Market, by Material

- Ceramic Foams Market, by Form

- Ceramic Foams Market, by Fabrication Method

- Ceramic Foams Market, by Application

- Ceramic Foams Market, by End User Industry

- Ceramic Foams Market, by Region

- Ceramic Foams Market, by Group

- Ceramic Foams Market, by Country

- United States Ceramic Foams Market

- China Ceramic Foams Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarize the Core Insights and Forward-Looking Perspectives That Define the Ceramic Foam Industry’s Path Forward into 2025 and Beyond

Ceramic foams stand at the intersection of high-performance materials science and critical industrial process optimization. Their evolving material systems, from alumina and mullite to silicon carbide, combined with advanced fabrication techniques, have unlocked new applications in filtration, insulation, and catalyst support. As global supply chains adapt to tariff changes and sustainability targets, the industry is poised for selective consolidation, digitalization, and nearshoring trends.

Moving forward, the imperative for strategic alignment between material innovation, production agility, and regulatory compliance will define the success trajectories of key stakeholders. The insights presented in this report offer a roadmap for navigating market complexities, from segmentation-driven product development to region-specific growth strategies. By leveraging these core findings, manufacturers and end users alike can anticipate emerging demand patterns and position themselves for resilient, sustainable growth in the ceramic foam sector.

Connect with Ketan Rohom to Access the Full Ceramic Foam Market Research Report and Secure Strategic Insights for Informed Decisions

To gain the full strategic value from this comprehensive ceramic foam market research report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through tailored insights, ensuring the analysis meets your specific business objectives. Secure actionable intelligence, competitive benchmarking, and bespoke data interpretations to support critical decision-making initiatives.

Connect with Ketan Rohom today to discuss your research requirements and obtain immediate access to the detailed findings, in-depth segmentation analyses, and regional outlooks covered in this authoritative report. Leverage this exclusive opportunity to drive innovation, optimize supply chains, and chart a confident path forward in the evolving ceramic foam industry.

- How big is the Ceramic Foams Market?

- What is the Ceramic Foams Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?