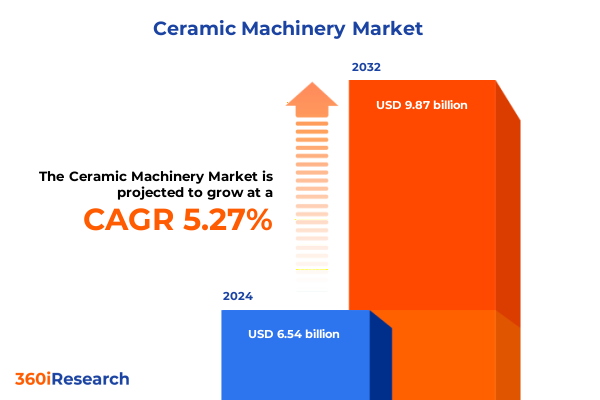

The Ceramic Machinery Market size was estimated at USD 6.85 billion in 2025 and expected to reach USD 7.19 billion in 2026, at a CAGR of 5.34% to reach USD 9.87 billion by 2032.

Exploring the Evolution and Strategic Imperatives Shaping the Ceramic Machinery Landscape in the Global Manufacturing Ecosystem

The ceramic machinery sector underpins a vital segment of global manufacturing, delivering the specialized equipment necessary for producing advanced ceramic products. From the earliest clay-pressing devices to today’s digitally integrated kilns and glazing systems, technological evolution has enabled manufacturers to achieve greater precision, efficiency, and consistency.

As end-user industries demand more customized and high-performance ceramic components, machinery providers are innovating across multiple fronts. Digital controls now optimize thermal cycles, while vision-based inspection machines enhance quality assurance. This convergence of smart manufacturing and materials science drives the sector forward, presenting both opportunities and challenges for equipment suppliers and plant operators alike.

In the wake of shifting trade policies, heightened sustainability concerns, and accelerated digital transformation, stakeholders must understand emerging trends and strategic imperatives. This executive summary provides a concise exploration of the forces reshaping the landscape of ceramic machinery, guiding leaders through key insights on tariffs, segmentation dynamics, regional developments, and competitive positioning.

Unraveling the Technological, Sustainability, and Operational Innovations That Are Redefining Modern Ceramic Machinery Production Methods

Ceramic machinery production is undergoing a profound shift driven by Industry 4.0 and the imperative of sustainable operations. Automakers, electronics manufacturers, and healthcare providers now require highly reliable ceramic parts, spurring adoption of advanced mixing machines that leverage twin-shaft mixers and high-speed dispersers for consistent slurry preparation. At the same time, digital glazing solutions complement traditional roller and spray glazing, enabling refined surface finishes tailored to specific performance requirements.

Inspection processes have also transformed, with ultrasonic and vision-based systems replacing manual checks. These technologies detect sub-micron defects early, reducing waste and ensuring compliance with rigorous quality standards. Kiln technology adapts in parallel, as tunnel and roller hearth kilns integrate real-time temperature profiling and energy recovery modules to limit emissions and energy consumption.

Moreover, the transition from conventional to digital manufacturing extends across production capacity tiers. High-capacity operations increasingly deploy fully automatic lines, while small and medium-capacity facilities leverage semi-automatic solutions to balance cost and throughput. This blend of flexibility and precision reflects a market in which technology choices and automation levels must align with evolving customer demands and environmental targets.

Assessing the Complex Layered Effects of 2025 United States Trade Policies and Tariff Actions on the Ceramic Machinery Supply Chain and Market Dynamics

In late 2024, the Biden administration confirmed substantial tariff hikes on Chinese imports encompassing critical machinery components, including semiconductors and industrial hardware, designed to safeguard domestic manufacturing sectors and strategic supply chains. These measures, set to take effect in September 2024, encompassed increases ranging up to 100 percent on electric vehicles and related battery technologies, with ancillary duties on steel, aluminum, and minerals that indirectly influenced kiln and pressing machine supply chains.

Shortly after, in December 2024, additional duties were imposed under Section 301 on goods such as polysilicon wafers, reinforcing the administration’s stance on protecting critical materials used in advanced inspection and digital glazing equipment. These tariffs aimed to complement domestic investments while addressing perceived unfair practices, though they introduced supply constraints and cost variability for ceramic machinery manufacturers and end users reliant on imported electronic ceramics.

Then, in April 2025, the so-called “Liberation Day” tariffs announced a universal 10 percent import duty effective April 5, with differentiated reciprocal rates rolling out on April 9. This sweeping policy sought to leverage emergency economic powers to counter persistent trade deficits, impacting a broad array of capital equipment imports. However, the May 2025 decision by the U.S. Court of International Trade blocked enforcement of these emergency-based tariffs, underscoring a dynamic regulatory environment and the importance of agile supply chain strategies for the ceramic machinery sector.

Deriving Critical Market Segmentation Perspectives from Machinery Types, Product Lines, End-User Industries, Automation Levels, Technologies, and Capacity Profiles

The market’s machinery type segmentation spans glazing, inspection, kilns, mixing, and pressing equipment, each embedding further subcategories that shape competitive and innovation landscapes. Within glazing, digital, roller, and spray technologies reflect diverging priorities between automated precision and cost-efficient throughput. Inspection machinery divides into ultrasonic and vision systems, with the former excelling in internal defect detection while the latter offers rapid surface analysis across high-speed lines.

Kiln segmentation spans roller hearth, shuttle, and tunnel configurations, where energy performance and load flexibility directly influence operational viability. Mixing solutions break down into ball mills, high-speed dispersers, and twin-shaft mixers, reflecting an emphasis on particle size control and slurry homogeneity. Pressing machines consist of hydraulic, isostatic, and mechanical presses, each catering to different force profiles, production volumes, and dimensional tolerances.

Beyond equipment classification, segmentation by product type highlights the diversity of end applications: refractories and fibrous products meet extreme-temperature needs, sanitaryware and tiles cater to construction aesthetics, tableware addresses consumer markets, and technical ceramics-ranging from bioceramics to electronic substrates-serve high-technology industries. Layered alongside these, end-user industry segmentation across automotive, construction, electrical and electronics, healthcare, and home furnishings reveals distinct value propositions. Automation level, technology orientation, and production capacity further inform how suppliers and users align strategic investments with performance, cost, and regulatory objectives.

This comprehensive research report categorizes the Ceramic Machinery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Machinery Type

- Product Type

- Automation Level

- Technology

- End-User Industry

Identifying the Strategic Opportunities and Challenges in the Americas, Europe Middle East Africa, and Asia-Pacific Ceramic Machinery Markets

The Americas region anchors a mature market characterized by robust demand for advanced inspection and digital glazing systems, underpinned by significant investments in automotive ceramics and sustainable building materials. North American manufacturers have prioritized retrofit projects, upgrading shuttle kilns and mechanical presses to meet stringent emissions standards and labor efficiency goals. Meanwhile, Latin American operations focus on lower-cost manual and semi-automatic solutions to serve burgeoning tile and sanitaryware installations, reflecting a divergence between high-tech hubs and cost-sensitive markets.

In Europe, the Middle East, and Africa, regulatory pressures on energy usage and emissions drive adoption of tunnel and roller hearth kilns equipped with waste heat recovery and precision thermal controls. Manufacturers in Western Europe have embraced fully automatic, digitalized lines to support premium technical ceramic applications, while Eastern European producers balance capital costs with medium-capacity solutions targeting construction and home furnishings. The Middle East leverages large-scale production capacity for refractories, supported by abundant energy resources, whereas African markets are gradually integrating basic mixing machines and manual glazing equipment in infrastructure projects.

Asia-Pacific remains the largest regional contributor, combining rapid industrialization with leading equipment manufacturing capabilities. China, India, and Southeast Asian nations invest heavily in digital glazing, high-speed dispersers, and vision inspection to serve both domestic demand and export markets. Japan and South Korea continue to push the envelope in advanced pressing and kiln design, contributing to global machinery exports and reinforcing the region’s role as an innovation center.

This comprehensive research report examines key regions that drive the evolution of the Ceramic Machinery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Positions, Innovations, and Competitive Strengths of Leading Global Ceramic Machinery Manufacturers in the Evolving Market

Leading ceramic machinery manufacturers have solidified their positions through targeted innovation, strategic partnerships, and regional production footprints. Sacmi Group’s modular glazing lines and integrated digital controls have enhanced surface customization for tile producers across Europe and Asia. System Ceramics capitalizes on automated inspection and tunnel kiln solutions, leveraging advanced material handling to optimize throughput for technical ceramic clients.

Bottero’s focus on energy-efficient kiln systems and lean assembly platforms has resonated in the Americas market, where retrofit demand and sustainability mandates drive modernization projects. Bonfanti’s expertise in hydraulic and isostatic pressing technologies supports high-precision applications in aerospace and electronics, while KEDA Group’s diverse portfolio spans ball mills to digital spraying systems, addressing the full spectrum of sanitaryware and tableware producers.

Across these players, competitive advantages derive from the depth of engineering services, local support networks, and integration of smart factory capabilities. Collaborative ventures between machinery suppliers and materials innovators further accelerate product performance, reducing cycle times and enabling new ceramic material formulations. This collaborative ecosystem not only strengthens individual company profiles but also elevates the broader industry through shared breakthroughs and best practices.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ceramic Machinery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cerim Technology S.r.l.

- Fives FCB S.A.

- Hangzhou Chuanghong Machinery Co., Ltd.

- IFID S.p.A.

- KEDA Industrial Group Co., Ltd.

- LSP Industrial Ceramics, Inc.

- Ronghui Investment Holding Co., Ltd.

- SACMI Imola S.C.

- Shanghai Joinus Machinery Co., Ltd.

- SITI B&T Group S.p.A.

- System Ceramics S.p.A.

Guiding Strategic Roadmaps and Operational Best Practices for Industry Leaders to Capitalize on Emerging Advances in Ceramic Machinery Technology

To maintain and amplify competitive advantage, industry leaders should prioritize modular, upgradeable designs that support incremental automation and digital integration. By focusing R&D efforts on adaptable glazing and inspection platforms, OEMs can offer scalable solutions that meet diverse end-user requirements without extensive capital overhaul. Collaboration with materials scientists is essential to tailor equipment capabilities to next-generation ceramic formulations and process parameters.

Operational excellence must remain a core objective, with manufacturers implementing predictive maintenance programs leveraging sensor networks and data analytics. This approach will minimize downtime, optimize energy consumption in kilns, and extend the service life of high-value pressing and mixing components. Additionally, forging strategic alliances with regional service partners can enhance responsiveness to local market fluctuations and regulatory developments.

Finally, stakeholders should actively engage in policy dialogue to anticipate regulatory changes, such as emissions standards and trade measures. By establishing cross-industry consortia, companies can share compliance strategies and advocate for balanced trade agreements that ensure both market access and domestic innovation incentives. This proactive stance will help mitigate supply chain disruptions and position the sector for sustainable growth.

Detailing the Comprehensive Research Framework, Data Collection Techniques, and Analytical Approaches Underpinning This Ceramic Machinery Market Study

This study employs a systematic research framework combining primary and secondary methodologies to ensure comprehensive coverage of the ceramic machinery sector. Primary inputs include structured interviews with equipment OEM executives, plant engineers, and end-users across key regions. These dialogues provided qualitative perspectives on emerging technology adoption, operational challenges, and tariff impacts.

Secondary research encompassed analysis of published trade data, regulatory filings, and industry association reports to track machinery shipments, equipment import classifications, and energy efficiency mandates. Beyond publicly available sources, specialized industry journals were reviewed to capture the latest advances in glazing and kiln technologies, while patent databases illuminated innovation trajectories among leading suppliers.

Data triangulation and cross-verification techniques underpin the study’s rigor, with insights validated through expert workshops and peer reviews. A segmentation matrix aligns machinery types, product applications, end-user industries, automation levels, technology orientations, and capacity tiers, providing a multidimensional view. Geographic insights derive from regional trade flows and facility investment patterns, while competitive profiling maps strategic initiatives and geographic footprints of major manufacturers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ceramic Machinery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ceramic Machinery Market, by Machinery Type

- Ceramic Machinery Market, by Product Type

- Ceramic Machinery Market, by Automation Level

- Ceramic Machinery Market, by Technology

- Ceramic Machinery Market, by End-User Industry

- Ceramic Machinery Market, by Region

- Ceramic Machinery Market, by Group

- Ceramic Machinery Market, by Country

- United States Ceramic Machinery Market

- China Ceramic Machinery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Summarizing the Strategic Imperatives, Critical Insights, and Future Considerations Driving the Ceramic Machinery Industry Forward

The ceramic machinery landscape is defined by accelerating technological integration, evolving trade policies, and diverse application demands. Digital glazing, advanced inspection systems, and energy-optimized kilns converge to meet the imperatives of quality, efficiency, and sustainability. Meanwhile, supply chain resilience has become paramount as tariff shifts and regulatory rulings introduce new variables into equipment procurement and operational planning.

Segmentation analysis reveals that customization and flexibility are critical differentiators, with equipment choices reflecting the unique requirements of refractories, sanitaryware, tableware, and technical ceramics. Regional insights underscore the necessity of aligning product portfolios with maturity levels across the Americas, EMEA, and Asia-Pacific, where regulatory pressures and industrial growth trajectories diverge.

Competitive dynamics favor manufacturers with robust R&D, localized support networks, and the ability to co-innovate with customers. To thrive, stakeholders must adopt data-driven decision-making, invest in scalable automation platforms, and actively monitor trade policy developments. By synthesizing these strategic imperatives, industry participants can navigate complexity and capitalize on emerging growth opportunities.

Engage with Ketan Rohom Today to Unlock In-Depth Plant Floor Insights and Strategic Advantages Through Purchasing the Ceramic Machinery Market Research Report

To gain direct access to the comprehensive insights presented in this executive summary, decision-makers are invited to engage with Ketan Rohom, Associate Director of Sales & Marketing. A brief conversation will provide tailored guidance on how this market intelligence can support strategic planning, operational improvement, and investment decisions in ceramic machinery.

By reaching out, stakeholders can secure the full market research report, ensuring their teams are equipped with the depth of analysis necessary to navigate evolving regulations, technological breakthroughs, and competitive dynamics. This interaction will outline available report formats and customization options, facilitating rapid integration of actionable findings into project roadmaps and capital expenditure planning.

Connect today to translate expert research into a strategic advantage, unlocking the detailed data and proprietary analyses that can inform procurement, R&D, and go-to-market strategies. Ketan Rohom stands ready to guide your organization through the next phase of growth in the ceramic machinery sector, helping you capitalize on emerging opportunities and stay ahead of industry shifts.

- How big is the Ceramic Machinery Market?

- What is the Ceramic Machinery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?