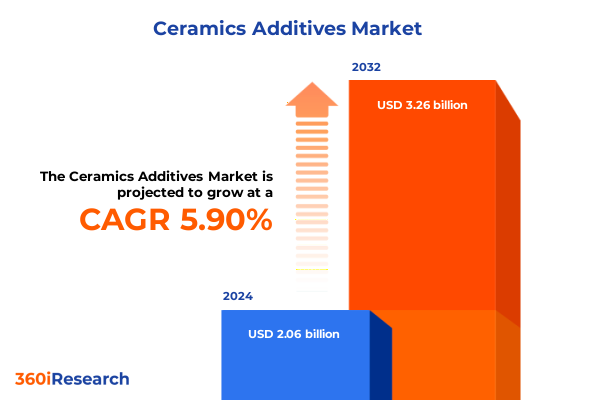

The Ceramics Additives Market size was estimated at USD 2.18 billion in 2025 and expected to reach USD 2.30 billion in 2026, at a CAGR of 5.93% to reach USD 3.26 billion by 2032.

Unveiling the Strategic Significance of Ceramics Additives in Driving Enhanced Performance, Sustainability, and Innovation Across Advanced Manufacturing Ecosystems

The ceramics additives sector has emerged as a critical enabler for modern manufacturing, underpinning breakthroughs in performance, durability, and sustainability. As manufacturers across industries-from automotive to electronics-seek to enhance the functional properties of ceramic components, the strategic deployment of specialized additives has become indispensable. These formulations not only refine rheology and improve processability but also unlock new potential in high-temperature stability, electrical insulation, and wear resistance.

Moreover, the drive toward sustainable production practices has amplified the importance of environmentally benign additives that can reduce energy consumption and minimize waste. Consequently, research and development efforts are increasingly focused on bio-derived plasticizers, water-based deflocculants, and low-toxicity dispersants. In this context, industry stakeholders must stay attuned to ongoing innovations while navigating complex global supply chains to ensure consistent quality and cost-effectiveness.

Exploring the Pivotal Shifts Reshaping Ceramics Additive Applications Through Digital Transformation, Sustainability Imperatives, and Advanced Materials Integration Strategies

Over recent years, the ceramics additives landscape has undergone transformative shifts fueled by digital technologies, evolving customer priorities, and the integration of advanced materials. Additive manufacturing, or 3D printing, has accelerated the need for precisely tuned binders and dispersants that can achieve exceptional green strength and dimensional accuracy. At the same time, digital formulation tools leveraging machine learning are enabling rapid optimization of additive packages, reducing development cycles by predicting performance outcomes before laboratory validation.

Simultaneously, growing sustainability imperatives have prompted a pivot toward low-VOC and bio-based chemistries, driving partnerships between additive suppliers and biotech innovators. These collaborations aim to reconcile performance demands with stringent environmental regulations, thereby fostering circular economy models in ceramic production. As a result, the market is witnessing a convergence of digitalization and green chemistry, signaling a new era of smarter, more responsible ceramics processing.

Assessing the Compounding Effects of Newly Imposed United States Import Tariffs in 2025 on Ceramics Additive Supply Chains, Costs, and Pricing Dynamics

In 2025, the United States introduced a series of incremental tariffs on key ceramic precursor materials and proprietary additive components, magnifying cost pressures throughout the value chain. These measures targeted selected oxide and non-oxide raw materials sourced from major exporting nations, compelling additive manufacturers to reassess supplier portfolios. Consequently, many firms have redirected procurement toward domestic and tariff-exempt origins, albeit at the expense of reduced supplier diversity and elevated lead times.

Beyond direct raw material cost increases, the tariff regime has had a cascading effect on downstream processing expenses. Ceramics producers have grappled with higher overall ceramic input costs, prompting cautious negotiations with additive vendors to offset projected margin erosion. In parallel, the tariffs have spurred an uptick in strategic partnerships and joint ventures aimed at localizing production of critical additive intermediates. This shift toward regional manufacturing hubs helps mitigate future tariff risks while bolstering supply chain resilience.

While the immediate aftermath saw incremental price adjustments, longer-term implications are manifesting in accelerated R&D investments targeting alternative chemistries that bypass tariff-sensitive feedstocks. Consequently, the tariffs of 2025 have not only reshaped cost structures but also catalyzed innovation trajectories, compelling the industry to evolve amid an increasingly complex trade environment.

Decoding Segmentation Dynamics by Material, Form, Ceramic Composition, and End-Use to Illuminate Foundational Growth Drivers and Potential Barriers

When the market is examined through the lens of material type segmentation, binders continue to anchor formulations by providing critical green strength, while deflocculants enable optimal viscosity control during slip casting and extrusion. Dispersants have likewise demonstrated pivotal roles in achieving homogeneous particle distribution, thereby enhancing final product density. Meanwhile, plasticizers contribute to enhanced flexibility and reduced cracking risk in unfired ceramics, and wetting agents facilitate improved interfacial interaction between powders and liquids.

Turning attention to form type, granular additives facilitate precise dosing in automated feed systems, whereas liquid formulations-encompassing both concentrated liquids and emulsions-offer rapid miscibility and streamlined integration into aqueous slurries. Powdered variants remain integral for dry blending processes that demand prolonged shelf stability, and slurry-based forms deliver immediate dispersion advantages in continuous processing lines.

From a ceramic type perspective, glass-ceramics benefit from specialized deflocculants that balance flow with minimal air entrapment. Non-oxide ceramics require high-purity dispersants to prevent contaminant-induced defects, while oxide ceramics rely on plasticizers and binders engineered for high-temperature burnout. Silicate ceramics leverage wetting agents to optimize glaze adhesion and surface finish.

In terms of end-use applications, building materials have embraced water-based dispersants for eco-friendly tile and sanitary ware production, whereas the electrical equipment sector demands ultra-pure additive systems to maintain insulation properties in capacitors and substrates. The medical equipment segment places premium value on biocompatible plasticizers and dispersants for advanced ceramic implants, and tableware manufacturers focus on color-stable binders and wetting agents to deliver consistent aesthetic appeal.

This comprehensive research report categorizes the Ceramics Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Form Type

- Ceramic Type

- Application

Mapping Regional Growth Patterns Across the Americas, Europe Middle East and Africa, and Asia Pacific to Reveal Unique Market Nuances and Emerging Prospects

Across the Americas, North American producers are spearheading demand for advanced additive solutions tailored to high-performance ceramics used in automotive and aerospace sectors. Latin American markets are showing early-stage growth, with increasing investments in ceramic infrastructure and a gradual shift toward higher-value additive chemistries. These regional dynamics underscore both mature demand centers and emerging pockets of opportunity.

Europe Middle East and Africa markets reflect a pronounced emphasis on green chemistry, driven by stringent regulatory frameworks that incentivize low-emission and bio-derived additive systems. Western Europe leads in sustainable formulation adoption, while Middle Eastern ceramic hubs are investing heavily in capacity expansion to serve construction and consumer goods industries. In Africa, burgeoning manufacturing initiatives signal forthcoming demand for foundational additive technologies.

In the Asia Pacific region, China and India continue to dominate volume consumption, supported by robust ceramics manufacturing ecosystems ranging from traditional tableware to cutting-edge electronics substrates. Southeast Asian countries are accelerating the uptake of advanced additives to enhance local competitive positioning. At the same time, Japan and South Korea remain innovation hotspots, pioneering nano-enabled dispersants and precision rheology modifiers for next-generation ceramic composites.

This comprehensive research report examines key regions that drive the evolution of the Ceramics Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Movements by Leading Ceramics Additive Manufacturers Emphasizing Innovation, Partnerships, and Competitive Differentiation Tactics

Key industry participants have intensified their focus on innovation-driven strategies to maintain leadership in the ceramics additives domain. Several global chemical companies have launched new binder platforms with enhanced thermal decomposition profiles, effectively reducing residual ash and improving ceramic purity. Concurrently, specialty additive suppliers have entered collaborative agreements with universities and research centers to co-develop bio-based plasticizers that meet exacting environmental and performance criteria.

Strategic acquisitions have also shaped the competitive landscape, enabling regional players to expand geographic footprints and integrate complementary additive portfolios. Partnerships between additive innovators and ceramics equipment manufacturers have facilitated turnkey processing solutions, integrating customized rheology packages with digital control systems. These alliances underscore a broader trend toward end-to-end service offerings that combine chemistry expertise with process engineering.

In addition, select companies are pioneering advanced analytics tools to deliver real-time monitoring of additive performance, thereby empowering clients to fine-tune ceramic formulations on the fly. This shift toward data-driven support services differentiates market leaders by offering not only products but also predictive insights that enhance manufacturing yields and reduce scrap rates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ceramics Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- Albemarle Corporation

- Arkema Group

- Ashland Inc.

- BASF SE

- BioCote Limited

- Black Rose Industries Limited

- Bozzetto Group by Aimia Inc.

- BYK-Chemie GmbH by ALTANA Group

- Chemische Fabrik Budenheim KG

- ChemPoint by Univar Solutions Inc.

- Croda International PLC

- Entekno Materials

- ExOne Operating, LLC

- HighChem Co., Ltd.

- IQE Group

- Kimyagaran Emrooz Chemical Industries Co.

- Kuraray Co., Ltd.

- Kyoeisha Chemical Co., Ltd.

- Lamberti S.p.A.

- S.R. Chemical

- San Nopco Limited by Sanyo Chemical Industries, Ltd.

- Shandong Jufu Chemical Technology Co., Ltd.

- Shandong Sinoshine Advanced Materials Co.,Ltd

- Solvay SA/NV

- Synmac Chemicals Private Limited

- The Dow Chemical Company

- The Lubrizol Corporation

Formulating Proactive Strategic Recommendations Enabling Industry Leaders to Harness Emerging Ceramics Additive Opportunities While Managing Regulatory and Supply Complexities

Industry leaders should prioritize forging close collaborations with raw material suppliers to secure preferential access to high-purity feedstocks and mitigate exposure to tariff fluctuations. By co-investing in upstream processing capabilities, additive companies can exert greater control over supply continuity while optimizing cost structures. At the same time, diversifying the supplier base across geographies will further enhance resilience against future trade disruptions.

Another critical action is to accelerate the adoption of digital formulation and predictive analytics platforms. Integrating artificial intelligence into R&D workflows can significantly reduce time-to-market for next-generation additive systems, ensuring that clients benefit from tailored solutions ahead of competitive offerings. This technological edge will also enable rapid iteration of eco-friendly chemistries, aligning product development with tightening sustainability standards.

Moreover, market participants should explore joint venture opportunities with ceramics OEMs and academic institutions to co-create specialized additive blends for emerging high-growth applications, such as solid oxide fuel cells and advanced wear-resistant components. Such collaborations not only pool technical expertise but also facilitate shared investments in pilot-scale testing and validation. Finally, reinforcing a service-oriented business model-wherein additive suppliers offer comprehensive technical support, process audits, and training-can foster stronger customer loyalty and enhance value propositions.

Detailing a Robust Multi-Source Research Methodology Combining Primary Interviews, Trade Data Analytics, and Expert Validation for Comprehensive Market Insights

This research employed a rigorous methodology, initiating with extensive secondary research encompassing academic journals, patent databases, trade publications, and regulatory filings. Insights gleaned from these sources established a foundational understanding of historical trends, material innovations, and evolving application requirements.

Subsequently, primary research was conducted through in-depth interviews with senior R&D executives, process engineers, procurement directors, and industry consultants. These qualitative interactions provided nuanced perspectives on formulation challenges, regional supply chain dynamics, and customer preferences. Data gathered from these discussions underwent thorough triangulation against publicly available trade statistics and customs records to validate trends and quantify directional shifts.

Advanced analytics tools facilitated the dissection of interview insights and secondary data, enabling segmentation analysis across material types, form factors, ceramic classes, and application domains. Rigorous quality control measures, including cross-validation with technical white papers and peer-reviewed studies, ensured robustness and reliability of the findings. This comprehensive approach delivers an actionable, unbiased view of the ceramics additives market landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ceramics Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ceramics Additives Market, by Material Type

- Ceramics Additives Market, by Form Type

- Ceramics Additives Market, by Ceramic Type

- Ceramics Additives Market, by Application

- Ceramics Additives Market, by Region

- Ceramics Additives Market, by Group

- Ceramics Additives Market, by Country

- United States Ceramics Additives Market

- China Ceramics Additives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Core Insights to Reinforce the Critical Role of Ceramics Additives in Shaping Future-Ready Industry Growth and Sustainability Imperatives

The analysis underscores the critical role of ceramics additives in enhancing performance metrics, streamlining manufacturing processes, and advancing sustainability goals across diverse application sectors. As digitalization and green chemistry continue to reshape formulation strategies, industry stakeholders must adapt by leveraging advanced analytics and embracing collaborative innovation models.

The 2025 tariff adjustments have undeniably introduced new cost considerations, yet they have also catalyzed supply chain diversification and R&D breakthroughs aimed at alternative, tariff-exempt feedstocks. In parallel, segmentation insights reveal that targeted material and form factor selections can unlock significant benefits in specific ceramic classes and end-use scenarios. Regional nuances further emphasize the importance of localized strategies-whether optimizing for regulatory landscapes in Europe Middle East and Africa or capitalizing on technological leadership in Asia Pacific.

Overall, the dynamic interplay of regulatory, technological, and market forces affirms that a proactive stance-centered on strategic partnerships, digital transformation, and sustainability alignment-will determine competitive advantage in the ceramics additives arena. Embracing these imperatives today will position companies to thrive in an increasingly complex and opportunity-rich environment.

Engage with Ketan Rohom to Secure the Full Ceramics Additives Market Research Report and Accelerate Your Strategic Planning with Data-Driven Expertise

To gain unparalleled depth and clarity into the evolving dynamics of ceramics additives, reach out to Ketan Rohom, the Associate Director of Sales & Marketing. His expertise can facilitate immediate access to the comprehensive market research report, equipping your team with the actionable intelligence needed to outpace competitors and capitalize on emerging trends. Engage today to transform raw data into strategic growth initiatives and secure a competitive edge.

- How big is the Ceramics Additives Market?

- What is the Ceramics Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?