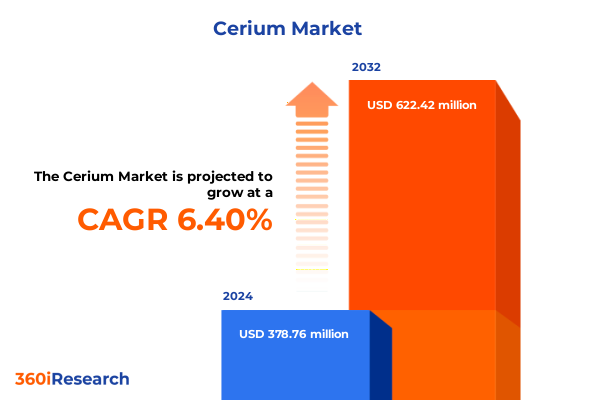

The Cerium Market size was estimated at USD 401.55 million in 2025 and expected to reach USD 431.63 million in 2026, at a CAGR of 6.46% to reach USD 622.42 million by 2032.

Exploring the Core Fundamentals and Strategic Importance of Cerium in Modern Industries to Frame a Comprehensive and Insightful Market Analysis Ahead

Cerium, as a critical component within the rare earth element family, has emerged at the forefront of advanced material applications and strategic supply discussions. It contains unique properties that lend themselves to catalytic converters, polishing powders, and alloy enhancements, rendering it indispensable for industries aiming to boost performance and sustainability. In recent years, shifting supply chain dynamics and technological innovations have amplified cerium’s importance, prompting stakeholders to reassess sourcing risk and downstream integration. Consequently, a holistic view of the cerium landscape is essential for decision makers seeking to navigate evolving regulatory frameworks and capitalize on value creation opportunities.

Building on this context, the present analysis delves into underlying market drivers, transformative shifts, and segmentation nuances that collectively shape cerium’s trajectory. With an emphasis on both upstream extraction practices and critical end use segments, the report outlines how emerging purity requirements and regional trade measures interplay with demand from catalysts, ceramics, and metallurgy applications. By synthesizing qualitative and quantitative insights, this study equips executives and technical leaders with the clarity needed to adapt strategic roadmaps, optimize resource allocation, and bolster resilience amid growing geopolitical complexities.

Identifying Transformative Technological and Regulatory Shifts That Are Reshaping Cerium Supply Chains and Application Dynamics

Over the past decade, the cerium market has experienced transformative shifts driven by advances in material science and heightened sustainability mandates. Novel catalyst formulations incorporating cerium oxide have redefined emission control standards in automotive and industrial sectors, while breakthroughs in high‐purity cerium alloys have unlocked performance gains in metallurgy. These technological disruptions have coincided with a pronounced push toward circular economy principles, spurring growth in recycling initiatives, particularly for spent catalysts and glass waste.

Moreover, evolving regulatory and environmental frameworks have intensified focus on transparent sourcing and responsible mining practices. Open pit and underground extraction methods for primary sources like bastnaesite and monazite are now subject to stringent reclamation requirements and community impact assessments. As a result, the balance between primary mining operations and secondary recycling streams is tilting toward a more sustainable equilibrium. Looking ahead, the convergence of digital traceability tools and AI‐driven process optimization promises to further reshape the landscape, enabling stakeholders to achieve both operational efficiency and compliance with global environmental directives.

Analyzing the Far-Reaching Effects of 2025 U.S. Tariff Measures on Cerium Supply Chains, Pricing Structures, and Strategic Sourcing

In early 2025, the United States implemented new tariff measures affecting critical rare earth materials, including cerium, with the objective of protecting domestic processing capacities and mitigating exposure to foreign supply risks. The cumulative impact of these trade policies has reverberated across the entire value chain. On the procurement side, import costs have risen for cerium oxide and cerium metal ingots, prompting downstream users to seek alternative sourcing strategies or to invest in in‐house refinement capabilities.

Consequently, manufacturers reliant on imported cerium for catalyst production have begun to explore localized partnerships and joint ventures aimed at securing tariff‐exempt processing within U.S. borders. At the same time, regional suppliers in EMEA and Asia‐Pacific have intensified outreach to diversify customer bases, leading to more competitive pricing structures outside the U.S. Despite higher upfront duties, some end users report greater stability in supply execution and lead times, underscoring a trade‐off between cost and continuity. As global stakeholders recalibrate their sourcing models, these tariffs serve both as a catalyst for enhanced domestic investment and as an impetus for broader collaboration across national boundaries.

Unlocking In-Depth Market Nuances by Integrating Product Type, Purity Grade, Raw Material Source, and End Use Industry Perspectives

A nuanced segmentation of the cerium market reveals distinct dynamics across product type, purity grade, raw material source, and end use industry that underscore varied value drivers. Within product categories, cerium alloys-encompassing iron-based mixes and traditional mischmetal blends-remain the cornerstone for enhancing metallurgical properties, while cerium metal in both ingot and powder forms caters to advanced manufacturing processes. Cerium oxide, available in granules and powder, dominates environmental and polishing applications, reflecting its versatility.

Turning to purity, the high purity grades address general industrial needs, technical grades serve specialized manufacturing, and ultra high purity materials-ranging from laboratory to semiconductor grade-are critical in cutting‐edge sectors such as microelectronics. The raw material matrix spans primary mining from bastnaesite and monazite, each via open pit and underground methods, alongside catalyst and glass recycling streams that embody circular principles. End use industries further stratify demand: automotive and industrial catalysts requiring fine oxide powders, functional and structural ceramics leveraging alloy components, precision glass polishing for both vehicle windshields and consumer electronics panels, and metallurgical applications encompassing aluminum alloys and iron-steel enhancements. Collectively, these segmentation layers illuminate opportunities for product differentiation, margin enhancement, and targeted innovation investment.

This comprehensive research report categorizes the Cerium market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- Raw Material Source

- End Use Industry

Comparing Cerium Market Drivers and Infrastructure Development Across the Americas, EMEA, and Asia-Pacific to Illuminate Regional Opportunities

Regional dynamics in the cerium market reflect a balance between resource endowments, processing infrastructure, and demand intensity. In the Americas, North American refiners are expanding processing capacities for cerium oxide and metal powders, driven by domestic catalysts and electronics needs. Resource development efforts in South America also signal emerging potential for bastnaesite mining, yet logistical challenges and regulatory scrutiny temper near-term expansion.

Meanwhile, Europe, Middle East & Africa regions benefit from a network of advanced recycling facilities, particularly in Western Europe, that reclaim cerium from spent automotive and industrial catalysts. Investment incentives for green chemistry and the European Union’s critical materials strategy further bolster local capacity. In the Middle East, chemical processing hubs are diversifying into rare earth oxide production, while select African jurisdictions advance monazite extraction under social and environmental governance frameworks.

Across Asia-Pacific, China’s integrated mining-refining ecosystem continues to anchor a dominant share of global cerium output, yet emerging Southeast Asian projects and Japanese investments in refinery technology signal a gradual diversification. Simultaneously, robust demand from automotive manufacturing, electronics, and catalyst producers in the region sustains steady uptake of both standard and ultra high purity grades, underscoring Asia-Pacific’s pivotal role in shaping global cerium flows.

This comprehensive research report examines key regions that drive the evolution of the Cerium market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping Competitive Leadership, Strategic Alliances, and Innovation Pipelines Among Leading Cerium Producers to Understand Market Differentiation

A handful of global entities lead the cerium landscape through vertically integrated operations, strategic partnerships, and continuous innovation. Key refiners and alloy producers leverage proprietary extraction and purification techniques to deliver differentiated cerium grades, while downstream collaborators focus on application‐specific formulations. Joint ventures between mining companies and specialty chemical firms have emerged as a prevalent model for de‐risking supply chains and accelerating capacity expansion.

Recent alliances include technology licensing agreements for advanced solvent extraction processes, enabling incremental yield improvements and reduced environmental impact. On the innovation front, several market participants have invested in pilot programs to harness AI for process control and quality assurance, targeting consistency in ultra high purity outputs. Furthermore, long-term offtake arrangements between cerium producers and catalyst OEMs underscore a growing trend toward supply continuity guarantees, reflecting mutual interest in stable pricing and uninterrupted feedstock availability. Collectively, these corporate strategies underscore the importance of alignment across upstream and downstream players to sustain competitive advantage in an increasingly complex marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cerium market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Engineering Materials Limited

- ALB Materials, Inc.

- Alkane Resources Ltd.

- Atlantic Equipment Engineers, Inc.

- Australian Strategic Materials Ltd.

- Avalon Rare Metals Inc.

- C&L Development Corp.

- EdgeTech Industries, LLC

- ESPI

- Ferro Corporation

- HEFA Rare Earth Canada Co. Ltd.

- Iluka Resources Ltd.

- Lorad Chemical Corporation

- Lynas Rare Earths Ltd.

- Metall Rare Earth Limited

- Mitsui Mining & Smelting Co., Ltd.

- NEO Performance Materials

- Noah Chemicals Corporation

- ProChem, Inc.

- Rainbow Rare Earths Limited

- Spectrum Chemical Mfg. Corp.

- The Shepherd Chemical Company

Implement Strategic Partnerships, Circular Initiatives, and Digital Technologies to Fortify Cerium Supply Chains and Propel Innovation

Industry leaders should prioritize strengthening vertical integration by forging strategic partnerships with refinement facilities to mitigate tariff risks and enhance supply security. By investing in catalytic and glass recycling programs, organizations can unlock secondary cerium streams that not only lower raw material dependency but also resonate with corporate sustainability commitments. In addition, deploying digital twin and advanced analytics platforms within extraction and processing operations will enable real-time performance monitoring and predictive maintenance, thereby driving operational efficiency and reducing unplanned downtime.

Furthermore, end use manufacturers are advised to engage in collaborative R&D consortia focused on next-generation cerium applications, such as energy storage electrodes and photonic materials, to establish early mover advantage. Simultaneously, exploring localized processing hubs in strategic regions can circumvent tariff barriers and strengthen customer proximity. Finally, executives should cultivate regulatory foresight teams to anticipate policy shifts and align capital expenditure with evolving environmental and trade mandates. Through these coordinated efforts, industry participants can secure resilient supply chains, accelerate product innovation, and capture emerging growth vectors.

Detailing a Comprehensive Mixed-Method Research Architecture Integrating Secondary Data, Expert Interviews, and Triangulation to Ensure Analytical Integrity

This analysis is founded on a robust research framework combining comprehensive secondary research with primary stakeholder engagement. Secondary sources encompassed peer-reviewed journals, industry white papers, and government publications on rare earth regulations, extraction methodologies, and downstream applications. To validate these insights, in-depth interviews were conducted with senior executives, technical specialists, and procurement managers across the cerium value chain, ensuring a balanced perspective on market dynamics.

Quantitative data were corroborated through triangulation, blending information from trade databases, customs records, and publicly disclosed production figures. Qualitative validation involved cross-referencing interview responses with observed industry trends, while expert panel reviews provided additional checks on methodology and findings. Finally, a rigorous internal quality assurance process ensured that segmentation assumptions and thematic narratives accurately reflect current market realities and anticipate near-term developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cerium market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cerium Market, by Product Type

- Cerium Market, by Purity Grade

- Cerium Market, by Raw Material Source

- Cerium Market, by End Use Industry

- Cerium Market, by Region

- Cerium Market, by Group

- Cerium Market, by Country

- United States Cerium Market

- China Cerium Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Consolidating Strategic Imperatives and Core Takeaways to Illuminate Actionable Insights from the Cerium Market Analysis

In sum, cerium stands at a strategic inflection point where technological advancements, sustainability pressures, and evolving trade policies converge to redefine market contours. The interplay between primary mining, regional processing capabilities, and circular economy practices underscores a dynamic equilibrium in supply and demand. As stakeholders navigate the implications of new tariff regimes, the importance of diversification-whether through localized processing, strategic alliances, or recycling initiatives-becomes increasingly clear.

Ultimately, organizations that proactively embrace innovation, leverage data-driven decision making, and cultivate agile partnerships will be best positioned to capitalize on cerium’s expanding role in high-performance applications. By synthesizing these insights, this analysis provides a roadmap for market participants to chart resilient growth pathways in an ever-evolving sector.

Engage with Associate Director Ketan Rohom to Access the Full Cerium Market Research Report and Elevate Strategic Planning

Unlock exclusive access to a comprehensive exploration of market trends, strategic developments, and nuanced insights by connecting with Associate Director Ketan Rohom. Engage directly to secure the full Cerium market research report and leverage tailored guidance designed to align with your organization’s growth objectives. Take the next step toward informed decision making and strategic advantage in the Cerium sector.

- How big is the Cerium Market?

- What is the Cerium Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?