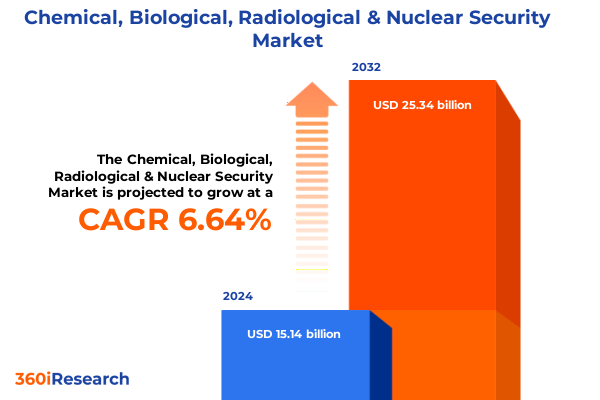

The Chemical, Biological, Radiological & Nuclear Security Market size was estimated at USD 16.03 billion in 2025 and expected to reach USD 16.98 billion in 2026, at a CAGR of 6.75% to reach USD 25.34 billion by 2032.

Navigating the Ever-Changing Chemical, Biological, Radiological, and Nuclear Security Environment to Safeguard Communities and Critical Infrastructure

The contemporary chemical, biological, radiological, and nuclear security environment is defined by an intricate interplay of state-sponsored programs, non-state actors, industrial hazards, and geopolitical tensions that continuously reshape threat vectors. Over the past decade, advancements in biotechnology and the proliferation of dual-use chemical facilities have elevated the risk of sophisticated biological incidents, while legacy nuclear sites and radiological sources pose enduring concerns for both deliberate misuse and accidental release. Furthermore, evolving chemical weapon stockpiles in contested regions underscore the urgency for robust detection and response frameworks. This multifaceted threat landscape demands that security stakeholders adopt a cohesive and forward-looking posture, integrating policy, technology, and operational best practices to mitigate potential catastrophes.

Amid this complexity, alliances such as NATO have underscored the importance of resilience and readiness in their CBRN defence policy, committing to bolstered deterrence, enhanced training, and interoperability across the Euro-Atlantic area. Through such strategic alignment, military and civilian agencies can synchronize their efforts to detect emerging threats, decontaminate affected zones, and maintain continuity of critical infrastructure under adverse conditions. By fostering a unified approach grounded in shared standards and joint exercises, practitioners can anticipate and neutralize hazards before they escalate, thereby safeguarding communities and preserving national security interests.

Harnessing Emerging Technologies and Operational Innovations to Redefine Detection, Protection, and Response in CBRN Security Landscape

The paradigm of CBRN security is undergoing a transformative shift as artificial intelligence, autonomous systems, and advanced sensor networks converge to deliver unprecedented levels of situational awareness. AI-driven analytic platforms are now capable of correlating complex biosurveillance data streams to identify anomalous molecular signatures days before traditional diagnostics detect a threat, thereby enabling preemptive public health interventions and strategic containment measures. At the same time, multi-sensor fusion frameworks integrate radar, multispectral imaging, and RF detection to distinguish genuine threat vectors from background clutter, significantly reducing false positives and accelerating response timelines.

Alongside digital innovations, the proliferation of unmanned vehicles-both aerial and ground-has redefined hazardous zone operations by minimizing human exposure during reconnaissance, sampling, and decontamination missions. These platforms, equipped with high-fidelity chemical and radiological detectors, deliver real-time threat assessments and payload delivery functions that bolster first responder safety and operational efficiency. Simultaneously, advances in miniaturized spectroscopic sensors and portable polymerase chain reaction systems are democratizing field capabilities, allowing distributed teams in remote or resource-constrained environments to perform laboratory-grade analyses on-demand. Collectively, these technological and operational shifts are reshaping how agencies prepare for, detect, and respond to CBRN incidents, driving a new era of proactive and adaptive security practices.

Assessing the Far-Reaching Effects of 2025 Tariff Policy on the U.S. CBRN Security Supply Chain and Defense Industry Resilience

Throughout 2025, changes in U.S. trade policy have exerted profound ripple effects across the CBRN security supply chain, altering procurement costs and strategic sourcing considerations. An additional $55 billion in tariffs collected on imports has translated into heavier financial burdens for domestic equipment manufacturers and integrators, many of whom have absorbed these costs to remain competitive in critical defense contracts. In parallel, a 50 percent tariff increase on steel and aluminum introduced in June has disproportionately impacted producers of detection instruments, protective garments, and decontamination systems that rely on specialized metals within their core assemblies.

Lawmakers and defense stakeholders have expressed growing concern that higher input costs could erode the purchasing power of the Department of Defense, stifle innovation among smaller suppliers, and strain program budgets intended to maintain readiness. In a letter to the Pentagon, Senator Jeanne Shaheen highlighted that rising tariff expenses may compel industrial base companies to absorb additional costs or risk exiting the defense supply chain altogether, with long-term repercussions for warfighter support. Major prime contractors have responded with mixed strategies: while one firm projected an $850 million headwind if tariffs remained unchanged, others outlined mitigation plans through domestic sourcing, inventory stockpiling, and duty drawback mechanisms. These adaptations underscore the dynamic interplay between trade policy and national security procurement in the CBRN domain.

Unpacking Market Segmentation to Reveal Tailored Solutions across Product, Application, End User, Technology, Deployment, Service, and CBRN Type

The CBRN security market is characterized by a nuanced segmentation that informs both product innovation and end-user adoption. Within product type, the spectrum spans specialized decontamination equipment for biological, chemical, nuclear, and radiological agents alongside detection instruments tailored to biological, chemical, nuclear, and radiological identification tasks. Monitoring systems extend these capabilities through air, soil, and water surveillance networks, while protective equipment-including filters, gas masks, gloves, and suits-ensures frontline operator safety under high-risk conditions. The inclusion of simulants and standards, such as biological simulants and nuclear reference materials, supports validation and training efforts.

Diverse applications drive demand across defense, environmental monitoring, healthcare, homeland security, and industrial safety sectors, each imposing distinct performance and regulatory requirements. End users from healthcare providers to military units and public safety agencies leverage these technologies to manage day-to-day hazards and emergency scenarios. Underpinning the product and application framework, advanced analytical technologies-ranging from chromatography and mass spectrometry to immunoassays, PCR, and spectroscopy-enable precise threat characterization, while flexible deployment modes, including airborne, fixed, mobile, and portable systems, adapt to varied operational theaters. Complementary services such as calibration, consulting, maintenance, and training further ensure sustained operational readiness, and the market’s inherent CBRN type classification-biological, chemical, nuclear, radiological-ensures that stakeholders can align solutions with evolving threat priorities. This layered segmentation underscores the strategic imperative of tailoring CBRN security offerings to the specific risk profiles and operational demands of diverse end users without resorting to a one-size-fits-all approach.

This comprehensive research report categorizes the Chemical, Biological, Radiological & Nuclear Security market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Deployment Mode

- Service

- CBRN Type

- Application

- End User

Analyzing Regional Dynamics in the Americas, Europe, Middle East & Africa, and Asia-Pacific to Identify Divergent CBRN Security Priorities

Regional dynamics reveal distinct CBRN security priorities shaped by geopolitical context, regulatory frameworks, and investment patterns. In the Americas, the United States leads through comprehensive procurement programs and stringent Section 232 measures that support domestic manufacturers while emphasizing interoperability across federal, state, and local agencies. Collaborative exercises and public–private partnerships drive the deployment of integrated detection networks and decontamination capabilities, cementing North America’s role as a hub for advanced CBRN innovation.

In Europe, the Middle East, and Africa, strategic coordination through the European Defence Agency’s live agent training and the EU Centres of Excellence initiative has bolstered multinational preparedness, with eight Member States recently completing ruggedized sampling and containment drills using real agents. These initiatives highlight the region’s commitment to standardizing CBRN protocols, fostering capacity building across member states, and integrating novel SaaS-based surveillance platforms to enhance cross-border threat mitigation. Concurrently, NATO policy continues to refine collective resilience measures to deter and defend against CBRN threats in contested theaters.

Across Asia-Pacific, rising defense budgets and heightened risk perceptions have catalyzed investments in next-generation reconnaissance vehicles, AI-enhanced autonomous drones, and wearable detection devices. Collaborative programs such as India’s DRDO-led integration of chemical agent detection units and Australia’s partnership with BAE Systems on AI-powered CBRN drones illustrate a strategic focus on indigenization and technological sovereignty. Meanwhile, joint exercises fostered by regional alliances reinforce interoperability and knowledge sharing among militaries, law enforcement, and emergency responders, driving the Asia-Pacific region’s evolution into a critical growth corridor for CBRN security solutions.

This comprehensive research report examines key regions that drive the evolution of the Chemical, Biological, Radiological & Nuclear Security market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Players Shaping the Future of Chemical, Biological, Radiological, and Nuclear Security Solutions

Leading organizations across the CBRN security landscape demonstrate a blend of heritage expertise and forward-leaning innovation. General Dynamics integrates hardened detection systems and protective ensembles to support both military and industrial applications, leveraging decades of defense engineering to meet stringent MILSPEC criteria. BAE Systems has advanced miniaturized sensor arrays that integrate AI for anomaly detection, while Smiths Detection focuses on seamless user interfaces and cloud-enabled analytics to accelerate field decision making. Honeywell’s convergence of automation and safety control frameworks provides holistic situational awareness, embedding CBRN modules within broader industrial IoT architectures.

FLIR Systems continues to pioneer thermal-based radiological and chemical vapor detection, harnessing proprietary imaging algorithms to identify trace signatures in complex environments. Northrop Grumman and Raytheon Technologies couple multi-domain sensor fusion with command-and-control platforms to deliver end-to-end CBRN threat management, spanning reconnaissance UAVs to centralized response dashboards. Thales Group complements these capabilities with cybersecurity-hardened data links and cross-border information sharing protocols, ensuring that CBRN intelligence is protected against digital disruption. Each of these players underscores the importance of R&D investment, strategic partnerships, and lifecycle support to navigate the evolving CBRN threat matrix and address the full spectrum of stakeholder needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chemical, Biological, Radiological & Nuclear Security market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Ansell Limited

- Avon Technologies Plc

- BAE Systems plc

- Bertin Technologies SAS

- BioFire Defense, LLC

- Bruker Corporation

- Chemring Group plc

- Cristanini S.P.A.

- Emergent BioSolutions Inc.

- Honeywell International Inc.

- Krauss-Maffei Wegmann GmbH & Co. KG

- Kromek Group plc

- Leonardo S.p.A.

- QinetiQ Group plc

- Raytheon Technologies Corporation

- Smiths Group plc

- Teledyne Technologies Inc.

- Thales Group

Strategic Roadmap for Industry Leaders to Enhance CBRN Security Posture through Collaboration, Innovation, and Sustainable Practices

To fortify CBRN security postures and maintain competitive advantage, industry leaders should adopt a collaborative innovation model that spans interagency coalitions, academic research, and vendor ecosystems. Establishing pre-competitive consortia enables shared development of open standards for AI-driven threat detection and data interoperability, reducing integration costs across platforms and jurisdictions. Simultaneously, prioritizing agile procurement frameworks and modular architecture design will accelerate fielding of new capabilities, allowing stakeholders to adapt rapidly to emerging threats without extensive system overhauls.

Moreover, investing in comprehensive workforce training programs-incorporating scenario-based exercises, digital twins, and augmented reality simulations-will cultivate the specialized expertise required to operate advanced CBRN equipment under duress. By aligning commercial R&D roadmaps with public-sector threat assessments, companies can anticipate capability gaps and co-create solutions that meet both regulatory mandates and end-user expectations. Finally, embedding sustainability principles into product lifecycles-through recyclable materials, low-energy sensors, and service-based maintenance models-will enhance long-term readiness while minimizing environmental impact. These strategic actions will empower businesses to respond effectively to evolving threats, deliver mission-critical value propositions, and sustain growth in a dynamic CBRN security arena.

Detailing the Rigorous Multi-Source Research Framework Employed to Ensure Accurate and Authoritative CBRN Security Market Insights

This research synthesis draws upon a structured methodology that integrates primary and secondary intelligence streams to deliver rigorous, actionable insights. Primary data collection involved confidential interviews with defense procurement officers, first responder units, and CBRN equipment manufacturers to validate operational challenges and technology adoption drivers. These firsthand perspectives were complemented by attendance at specialized training exercises conducted by the European Defence Agency and U.S. Department of Homeland Security to observe real-world application of detection and decontamination tools.

Secondary research encompassed systematic reviews of official policy declarations, industry white papers, and open-access academic publications such as DHS reports on AI in biosecurity and peer-reviewed studies on multi-modal sensor fusion. Trade press coverage of U.S. tariff developments, including White House fact sheets and congressional correspondence, informed the analysis of supply chain impacts and procurement adjustments. All data were triangulated through cross-referencing disparate sources to mitigate bias and confirm consistency. Finally, the study’s findings were vetted by a panel of subject-matter experts to ensure technical accuracy and strategic relevance, thereby providing decision makers with a robust foundation for CBRN security planning and investment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chemical, Biological, Radiological & Nuclear Security market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chemical, Biological, Radiological & Nuclear Security Market, by Product Type

- Chemical, Biological, Radiological & Nuclear Security Market, by Technology

- Chemical, Biological, Radiological & Nuclear Security Market, by Deployment Mode

- Chemical, Biological, Radiological & Nuclear Security Market, by Service

- Chemical, Biological, Radiological & Nuclear Security Market, by CBRN Type

- Chemical, Biological, Radiological & Nuclear Security Market, by Application

- Chemical, Biological, Radiological & Nuclear Security Market, by End User

- Chemical, Biological, Radiological & Nuclear Security Market, by Region

- Chemical, Biological, Radiological & Nuclear Security Market, by Group

- Chemical, Biological, Radiological & Nuclear Security Market, by Country

- United States Chemical, Biological, Radiological & Nuclear Security Market

- China Chemical, Biological, Radiological & Nuclear Security Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3021 ]

Summarizing Strategic Imperatives and Key Takeaways to Guide Decision Makers in Strengthening CBRN Security and Resilience

The evolving CBRN security domain demands a holistic fusion of technology, policy, and operational agility to effectively mitigate chemical, biological, radiological, and nuclear threats. As transformative shifts in AI-enabled detection, autonomous platforms, and sensor fusion redefine risk management, stakeholders must recalibrate their strategic priorities to capitalize on these advancements. Concurrently, external factors such as tariff policies have underscored the importance of resilient supply chains and diversified sourcing strategies to sustain critical procurement pipelines.

By leveraging nuanced segmentation insights and regional trends-from North American procurement initiatives to Europe’s collaborative training programs and Asia-Pacific’s indigenization efforts-organizations can tailor their approaches to address unique threat profiles and regulatory landscapes. Profiling key companies highlights the imperative of sustained R&D investment and ecosystem partnerships, while actionable recommendations emphasize cross-sector collaboration, workforce development, and sustainable product design. This comprehensive synthesis equips decision makers with the contextual understanding and strategic pathways necessary to strengthen CBRN readiness and safeguard populations against complex, high-consequence hazards.

Engage Directly with Ketan Rohom, Associate Director, Sales & Marketing to Access Comprehensive CBRN Security Market Research Insights Today

If you are ready to deepen your understanding of the fast-evolving CBRN security landscape and harness actionable insights to strengthen your organizational resilience, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expertise in guiding clients through tailored research packages ensures that you obtain the precise intelligence needed to navigate regulatory shifts, competitive dynamics, and technological disruptions. Engage with Ketan to explore comprehensive report options, discuss customization opportunities, and secure the critical data that will inform your strategic initiatives. Act now to empower your decision-making with rigorous analysis and industry expertise-connect with Ketan Rohom today to take the next step in advancing your CBRN security capabilities.

- How big is the Chemical, Biological, Radiological & Nuclear Security Market?

- What is the Chemical, Biological, Radiological & Nuclear Security Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?