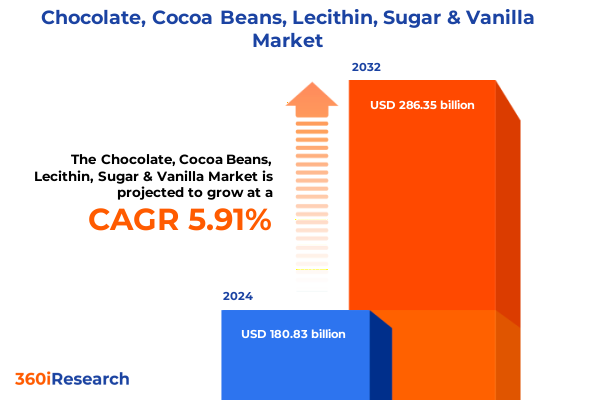

The Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla Market size was estimated at USD 190.92 billion in 2025 and expected to reach USD 201.72 billion in 2026, at a CAGR of 5.96% to reach USD 286.35 billion by 2032.

Unveiling the intricate dynamics shaping the global chocolate and allied ingredients sector through exploration of key drivers and foundational market contexts

The global chocolate and allied ingredients ecosystem has evolved into a dynamic arena defined by shifting consumer palettes, technological breakthroughs, and strategic imperatives across every stage of the value chain. As the world’s appetite for premium, sustainable, and innovative chocolate experiences intensifies, stakeholders must understand the forces that set the stage for growth, disruption, and transformation. This analysis delves into the core drivers that underpin the market, examining how raw material sourcing, manufacturing processes, evolving formulations, and emerging consumption trends collectively shape industry trajectories.

In recent years, heightened consumer awareness of ethical sourcing and environmental stewardship has elevated traceability and certification to the forefront of strategic considerations. Companies are increasingly aligning with fair trade, organic, and carbon-neutral initiatives to differentiate their offerings and build brand equity. Simultaneously, advances in food science have unlocked novel formulations-from high-cocoa dark chocolates formulated for wellness attributes to innovative plant-based lecithin applications that cater to allergen-conscious consumers-underscoring the industry's commitment to continuous product innovation and diversification.

Amid these developments, supply chain resilience has emerged as a critical priority. Events such as climate-driven harvest disruptions, geopolitical tensions, and logistics bottlenecks have underscored the importance of adaptive sourcing strategies and collaborative partnerships from bean to bar. This introduction frames the landscape by highlighting these foundational contexts and setting the tone for an in-depth exploration of transformative shifts, policy impacts, segmentation intelligence, regional dynamics, and actionable strategic imperatives.

Exploring how technological innovation, evolving consumer preferences, and sustainability imperatives are reshaping chocolate production and processing

The past few years have witnessed a surge of transformative shifts that are reframing production paradigms and consumer engagements across the chocolate sector. Technological innovation-from precision fermentation techniques for cocoa-derived ingredients to advanced emulsification technologies in lecithin-has streamlined workflows and enhanced product quality. These breakthroughs not only optimize resource utilization but also expand the potential for novel textures, flavor profiles, and functional benefits that resonate with discerning consumers.

Concurrently, consumer preferences have shifted toward experiences that prioritize wellness, sustainability, and authenticity. This trend has elevated premium dark and single-origin chocolates, while fueling growth in natural flavor enhancers like vanilla and minimally processed sugar. As a result, manufacturers have invested in traceable supply chains and stakeholder partnerships to ensure ethical sourcing and consistent quality. In addition, the rising demand for indulgent yet health-oriented formulations has encouraged collaboration between ingredient suppliers and R&D teams to co-create blends that balance taste and nutritional value.

Moreover, sustainability imperatives have catalyzed a reimagining of operations-from regenerative agriculture practices in cocoa farming to eco-friendly packaging solutions. Producers are adopting carbon footprint reduction targets, water stewardship programs, and circular economy principles to meet environmental commitments and regulatory requirements. These combined forces are not isolated; rather, they interweave to form a new ecosystem where technology, consumer ethos, and sustainability converge to reshape every aspect of how chocolate and its core ingredients are developed, processed, and delivered to end users.

Examining the comprehensive effects of United States 2025 tariff adjustments on supply chains, ingredient sourcing, and cost structures within chocolate sector

In 2025, the United States enacted a series of tariff adjustments that have reverberated across global cocoa, chocolate, lecithin, sugar, and vanilla supply chains. By recalibrating import duties on key raw materials and finished products, these policy changes have influenced sourcing decisions, pricing strategies, and operational alignments for stakeholders at every level. The revised duty structures have encouraged some manufacturers to diversify procurement, while prompting others to explore onshoring or nearshoring alternatives to mitigate cost volatility.

These developments have prompted ingredient buyers and cocoa processors to reassess long-established partnerships. Farms and cooperatives in traditional producing countries are now exploring new trade corridors and direct-to-consumer models to sustain export volumes. At the same time, refiners and emulsifier producers have accelerated negotiations with alternate origins and contract manufacturers to maintain production continuity. Cost structures have been impacted unevenly; while premium and niche ingredient segments may absorb incremental duties through sustainable price premiums, cost-sensitive mainstream segments are facing margin pressures that necessitate efficiency improvements and recipe reformulations.

Furthermore, the tariff landscape has influenced competitive positioning, with some domestic players gaining a relative advantage in sourcing locally produced sugar and lecithin, while others leverage vertical integration to streamline costs. In this context, supply chain transparency tools and real-time analytics have become vital for tracking landed costs and forecasting demand. As companies navigate this new terrain, strategic agility and a deep understanding of regulatory frameworks will be paramount for sustaining profitability and securing market share.

Leveraging insights from segmentation across product categories, packaging formats, application domains, distribution channels, and end user verticals

An insightful segmentation lens reveals the multifaceted nature of the chocolate and ingredient market, offering clarity on areas of strategic focus. Within the product dimension, chocolate itself is differentiated into compound, dark, milk, ruby, and white variants, each appealing to distinct consumer segments and use cases, while cocoa beans are categorized as Criollo, Forastero, and Trinitario, each bearing unique flavor and yield characteristics. Lecithins-spanning egg, rapeseed, soy, and sunflower sources-deliver specialized functional properties tailored to diverse applications. Sugar and vanilla rounds out the product spectrum, each with its own pedigree in flavor development and ingredient performance.

Packaging formats further refine market dynamics, where bulk bags, glass bottles, plastic tubs, and vacuum-sealed packs address the needs of industrial buyers, artisanal producers, and retail consumers alike. The application domain spans bakery and pastry, beverages, confectionery, foodservice, ice cream and desserts, and industrial processes, underscoring the pervasive role of these ingredients across food and beverage value chains. Distribution channels bifurcate into offline channels-convenience stores, specialty outlets, and supermarkets and hypermarkets-and online platforms, the latter of which has surged in relevance as digital commerce and omnichannel strategies underpin modern purchasing behaviors.

Finally, end users encompass cosmetic and personal care formulators, food and beverage manufacturers, pharmaceutical ingredient buyers, and retail consumers seeking premium at-home experiences. Each vertical presents unique regulatory, technical, and branding challenges, necessitating nuanced go-to-market approaches and tailored value propositions. By synthesizing these segmentation layers, stakeholders can pinpoint high-potential niches, optimize product portfolios, and craft resonant positioning strategies that drive growth in a competitive landscape.

This comprehensive research report categorizes the Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Packaging Type

- Application

- Distribution Channel

- End User

Navigating regional dynamics and growth drivers across Americas, Europe Middle East and Africa, and Asia Pacific markets to inform strategic market approach

Regional dynamics play a pivotal role in shaping strategic priorities and operational footprints within the chocolate and ingredients ecosystem. In the Americas, established cocoa origins and captive sugar industries coalesce to support robust manufacturing hubs, while emerging e-commerce adoption has spurred direct-to-consumer innovations and niche artisanal brands. North American and Latin American supply chain corridors are evolving with advanced cold-chain logistics and shared distribution infrastructures that enhance flexibility and reduce lead times.

Europe, Middle East, and Africa exhibit a complex tapestry of mature markets, high penetration of specialty retail, and intensifying sustainability mandates. Cocoa refining centers in Western Europe continue to drive product innovation, leveraging legacy expertise in chocolate craftsmanship. Concurrently, regulatory emphasis on traceability and environmental compliance is prompting suppliers to fortify upstream partnerships and invest in digital traceability platforms. In Middle Eastern and African markets, growing urbanization and premiumization trends are expanding demand, albeit tempered by infrastructure constraints and currency fluctuations.

In Asia Pacific, rapid urban growth, rising disposable incomes, and a burgeoning middle class have elevated chocolate consumption across confectionery, dairy-based desserts, and beverage applications. India, China, and Southeast Asian countries are witnessing increased private-label penetration and local flavor adaptations, such as infusion of regional spices and functional botanicals. Trade facilitation initiatives and port modernization projects are gradually enhancing import capabilities, yet logistical bottlenecks and seasonality factors continue to influence inventory management. By unpacking each region’s unique drivers and challenges, decision-makers can tailor market entry tactics, resource allocations, and partnership models to capture regional growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating competitive strategies, innovation trajectories, and partnership developments among leading players shaping the chocolate value chain

The competitive landscape is marked by an interplay of legacy conglomerates, specialized ingredient innovators, and emerging challengers that are redefining value creation across the chocolate and ingredient value chain. Leading chocolate manufacturers are doubling down on branded experiences, leveraging premium dark and single-origin portfolios, while simultaneously integrating upstream into cocoa and lecithin extraction to secure supply and margins. Ingredient suppliers are forging co-development partnerships with food manufacturers to fast-track novel product launches, focusing on functionality such as improved emulsification performance and clean-label transparency.

Innovation ecosystems have also formed around plant-based lecithins and alternative sweeteners, where start-ups emphasize sustainable sourcing, allergen-free claims, and next-generation processing methods. These specialized players attract strategic investment and joint ventures with established industry participants seeking to diversify their portfolios. Moreover, companies with robust digital capabilities-spanning e-commerce platforms, data-driven consumer insights, and supply chain visibility tools-gain a competitive edge by enabling agile responses to shifting demand patterns and operational disruptions.

The pursuit of value chain integration remains a defining trend, with several major players acquiring or partnering with upstream farms, fermentation technology firms, and packaging innovators to bolster resilience and foster end-to-end traceability. Proactive investments in sustainability programs, such as regenerative cocoa programs and carbon neutral certifications, further distinguish industry leaders in the eyes of conscientious consumers and institutional buyers. Collectively, these strategic maneuvers combine to shape a marketplace where scale, innovation, and sustainability credentials determine competitive positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- ASKINOSIE CHOCOLATE

- Barry Callebaut AG

- Birmingham Chocolate

- Blommer Chocolate Company

- Cargill, Incorporated.

- Chocoladefabriken Lindt & Sprüngli AG

- Cocoa Mill Chocolate Company

- Dandelion Chocolate

- Ferrero International

- Guittard Chocolate Company

- Guylian NV

- IRCA S.p.A.

- JB Foods Limited

- Lotte India Corporation Ltd.

- Mars, Incorporated

- Meiji Holdings Co., Ltd.

- Mondelez Global LLC

- Nestlé S.A.

- Olam Group Limited

- pladis Foods Ltd

- Puna Chocolate Company

- Tate & Lyle

- The Hershey Company

- Touton S.A.

Empowering industry leaders with actionable strategies to navigate supply chain complexities, embrace sustainability, and drive product innovation

To thrive amid evolving market dynamics, industry leaders must adopt a multifaceted action framework that balances operational resilience, product innovation, and sustainable growth. Firstly, organizations should implement integrated supply chain monitoring solutions that leverage real-time data to anticipate disruptions and optimize sourcing decisions. Such systems can be complemented by cultivating strategic partnerships with diversified origin suppliers and contract manufacturers to mitigate concentrated risk exposure.

Secondly, embedding sustainability into every tier of the value chain is no longer optional. Companies should formalize regenerative agriculture collaborations in cocoa origins, advance eco-friendly packaging initiatives, and establish quantifiable environmental targets. Transparent communication of these efforts through consumer-facing channels and B2B reporting frameworks will reinforce brand credibility and foster lasting stakeholder trust. Concurrently, R&D teams should explore alternative lecithin sources and sugar substitutes to develop clean-label formulations that align with health-conscious consumer trends.

Thirdly, differentiating through digital engagement and product customization will drive competitive advantage. Firms can harness e-commerce platforms and direct-to-consumer models to test novel flavor combinations, limited-edition launches, and personalized packaging experiences. By integrating consumer feedback loops into the innovation cycle, they can rapidly iterate and refine offerings that resonate with target segments. Finally, a robust talent strategy-anchored in cross-functional expertise spanning agronomy, data science, and consumer insights-will enable companies to execute these initiatives and maintain agility in an ever-changing landscape.

Detailing a rigorous research methodology integrating primary interviews, secondary data validation, and qualitative analysis to ensure data reliability

The methodology underpinning this analysis rests on a structured approach combining primary stakeholder interviews, exhaustive secondary research, and qualitative synthesis. Expert interviews with manufacturers, ingredient suppliers, analytics providers, and channel partners yielded firsthand perspectives on operational challenges, innovation pipelines, and regulatory impacts. These insights were cross-validated with industry white papers, trade association reports, and peer-reviewed publications to ensure data integrity and contextual accuracy.

Secondary research encompassed a systematic review of public filings, corporate presentations, and trade journals to assemble a comprehensive repository of technological advancements, policy changes, and competitive developments. Qualitative analysis techniques, such as thematic coding and comparative case evaluations, were employed to distill overarching themes and identify best-practice frameworks. The triangulation of multiple data sources and methodologies provided a robust foundation for the strategic imperatives and recommendations outlined herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla Market, by Product

- Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla Market, by Packaging Type

- Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla Market, by Application

- Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla Market, by Distribution Channel

- Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla Market, by End User

- Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla Market, by Region

- Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla Market, by Group

- Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla Market, by Country

- United States Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla Market

- China Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing key findings to highlight overarching trends, strategic imperatives, and future pathways for stakeholders across the chocolate ecosystem

This comprehensive synthesis underscores an industry at a pivotal juncture, characterized by converging trends in technology, consumer behavior, policy, and sustainability priorities. The rise of advanced emulsification and fermentation technologies, coupled with growing demand for ethically sourced ingredients, has propelled the sector into a new era of innovation and differentiation. Meanwhile, geopolitical shifts and tariff realignments have injected fresh imperatives for supply chain flexibility and cost management.

Segmentation insights reveal the need for nuanced portfolio strategies that address distinct product forms, packaging preferences, and end use contexts. Regional analyses highlight the divergent drivers across the Americas, EMEA, and Asia Pacific, underscoring the importance of localized approaches. Competitive mappings illustrate the dynamic interplay between established conglomerates and agile specialists, each leveraging scale, integration, or niche positioning to secure advantage.

Collectively, these findings point to strategic imperatives for leaders: invest in data-driven resilience, embed sustainability across operations, and foster continuous innovation through collaborative partnerships. By aligning resources and capabilities to these priorities, stakeholders can confidently navigate uncertainties and capitalize on emerging growth avenues in the chocolate and ingredients ecosystem.

Unlock deep market intelligence today by connecting with Ketan Rohom to gain exclusive access to the comprehensive chocolate and ingredients sector report

Unlocking the full potential of the chocolate, cocoa bean, lecithin, sugar, and vanilla sectors demands rigorous analysis and strategic insight. To gain immediate access to a comprehensive report that distills market dynamics, competitive strategies, and actionable intelligence, connect with Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly, you will receive tailored guidance, exclusive data interpretations, and a pathway to harness market opportunities in 2025 and beyond.

- How big is the Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla Market?

- What is the Chocolate, Cocoa Beans, Lecithin, Sugar & Vanilla Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?