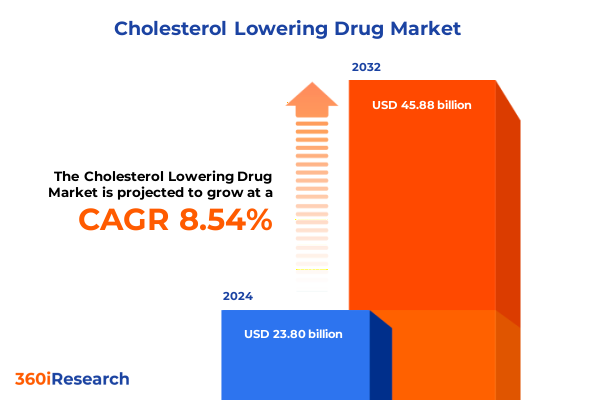

The Cholesterol Lowering Drug Market size was estimated at USD 25.44 billion in 2025 and expected to reach USD 27.20 billion in 2026, at a CAGR of 8.78% to reach USD 45.88 billion by 2032.

Unveiling the Evolving Dynamics of Cholesterol Reduction Therapies Amidst Changing Clinical Practices and Advancing Treatment Modalities

The cholesterol lowering drug market has experienced dynamic evolution as healthcare providers, patients, and policymakers seek more effective strategies to address cardiovascular risk. With heart disease remaining a leading cause of morbidity and mortality, therapeutic innovation and improved clinical guidelines have propelled the development and adoption of advanced lipid-lowering agents. As medical science moves beyond statins alone, new drug classes and combination regimens have emerged to tackle unmet needs in populations with high residual risk or statin intolerance. Moreover, shifts in reimbursement frameworks and heightened focus on patient outcomes have created an environment where differentiation hinges on demonstrated clinical benefit, safety, and real-world value.

Consequently, industry stakeholders have intensified research into mechanisms of action that extend beyond cholesterol synthesis inhibition, driving interest in agents that leverage novel pathways such as angiopoietin-like protein modulation and mRNA-based therapies. Parallel advances in diagnostic technology, including point-of-care lipid profiling and digital risk prediction tools, have enhanced the precision of patient selection and treatment optimization. In this context, a rigorous understanding of market forces, regulatory landscapes, and competitive positioning is essential for pharmaceutical companies, payers, and healthcare providers. This report synthesizes these dimensions to provide a holistic overview of current trends and strategic imperatives.

Exploring Groundbreaking Innovations and Strategic Shifts Reshaping the Cholesterol Management Arena in Therapeutic Development

Recent years have witnessed a profound transformation in cholesterol management driven by groundbreaking scientific discoveries and strategic realignments. The introduction of PCSK9 inhibitors marked a pivotal shift, offering potent LDL-C reduction with a unique mechanism distinct from HMG-CoA reductase inhibition. Clinical trials demonstrating significant cardiovascular event reduction have further validated the role of these agents in high-risk cohorts, reshaping treatment algorithms and sparking investment in next-generation monoclonal antibodies and small interfering RNA therapies.

Simultaneously, combination strategies that integrate ezetimibe or bile acid sequestrants with statins have gained traction, particularly in patients with inadequate response to high-intensity therapy. Regulatory bodies have responded by updating guideline recommendations to reflect a more personalized, risk-based approach, endorsing early intervention in patients with polygenic hypercholesterolemia and encouraging broader use of non-statin modalities. Furthermore, digital therapeutics and remote monitoring platforms are being woven into care pathways, enabling continuous adherence support and outcome tracking. Collectively, these developments have fostered a more nuanced, patient-centric paradigm that transcends traditional one-size-fits-all strategies and underscores the importance of targeted innovation.

Assessing the Far Reaching Consequences of 2025 United States Tariff Adjustments on Cholesterol Lowering Drug Production and Supply Chain

The introduction of revised United States tariffs in 2025 has generated a ripple effect across the pharmaceutical supply chain, particularly affecting the importation of active pharmaceutical ingredients and key excipients utilized in cholesterol lowering drug manufacturing. Manufacturers have been prompted to reevaluate sourcing strategies, accelerating efforts to diversify raw material suppliers and secure domestic production agreements. This shift has influenced production timelines and cost structures, compelling firms to optimize operational efficiencies to maintain competitive pricing and ensure uninterrupted supply to healthcare providers.

In response to escalating import costs, some companies have initiated collaborative ventures with contract manufacturers based in regions unaffected by the new tariffs, thereby preserving access to specialized intermediates and accelerating time-to-market. At the same time, vertical integration strategies have gained prominence, with biopharmaceutical firms investing in in-house synthesis capabilities to reduce reliance on external vendors. Regulatory authorities have also shown greater flexibility in approving alternative sourcing pathways and manufacturing sites, acknowledging the strategic importance of supply chain resilience. Collectively, these developments have underscored the critical need for agile manufacturing and procurement frameworks that can swiftly adapt to policy-driven disruptions.

Deriving Actionable Insights from Multidimensional Market Segmentation to Navigate the Complex Cholesterol Lowering Drug Landscape

A nuanced view of market segmentation reveals distinct dynamics across the therapeutic landscape. In the context of drug class analysis, the bile acid sequestrants category continues to provide a foundational alternative, while ezetimibe’s cholesterol absorption inhibition mechanism complements statin therapy. The PCSK9 inhibitor segment, encompassing alirocumab and evolocumab, has carved out a premium niche by addressing residual risk in high-risk populations. Within the statin class itself, atorvastatin, rosuvastatin, and simvastatin remain the backbone of standard care, each differentiated by potency, safety profile, and patient tolerance.

Shifting focus to route of administration, injectable therapies have introduced new adherence paradigms and require specialized patient education, whereas oral agents maintain dominance due to convenience and established prescribing familiarity. Age group stratification highlights that adult patients form the core user base, yet pediatric applications are gaining traction through early intervention programs and growing safety data. The senior population remains a critical demographic given age-associated lipid profile changes and polypharmacy considerations. Distribution channels reflect evolving patient preferences, with hospital pharmacies serving acute care needs, online pharmacies catering to digital adopters, and retail pharmacies sustaining broad community access. Finally, the branded segment continues to drive innovation through proprietary combinations and novel delivery systems, while generics reinforce accessibility and cost containment in mature markets.

This comprehensive research report categorizes the Cholesterol Lowering Drug market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route Of Administration

- Patient Age Group

- Distribution Channel

- Prescription Type

Analyzing Regional Variations in Adoption and Access of Cholesterol Lowering Therapies across Key Global Markets and Health Systems

Regional analysis uncovers heterogeneous adoption patterns shaped by regulatory frameworks, healthcare infrastructure, and patient demographics. In the Americas, emphasis on cardiovascular outcomes research and value-based contracting has accelerated uptake of high-cost biologics, supported by a robust network of specialty pharmacies. Meanwhile, reimbursement mechanisms enable broader use of combination therapies and foster public-private initiatives aimed at early screening and intervention. Transitioning to Europe, the Middle East & Africa region, stakeholders grapple with diverse economic landscapes that influence therapy access and affordability. Tiered pricing models and international reference pricing policies have shaped launch strategies, compelling manufacturers to tailor programs that reconcile cost constraints with clinical efficacy goals.

Across Asia-Pacific, rapid expansion of healthcare spending and rising awareness of cardiovascular risk factors have driven demand for both established and novel lipid-lowering agents. Government-led screening campaigns and decentralized care models have elevated the role of primary care in chronic disease management, creating opportunities for digital health integration and patient education platforms. At the same time, local manufacturing initiatives and compulsory licensing provisions have enhanced the availability of generics and biosimilars, contributing to competitive pressure on multinational brands. Collectively, these regional distinctions underscore the importance of flexible entry strategies that align with local market dynamics and regulatory considerations.

This comprehensive research report examines key regions that drive the evolution of the Cholesterol Lowering Drug market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Priorities and Competitive Positioning of Leading Pharmaceutical Companies in the Cholesterol Management Sector

Industry leaders have responded to evolving market demands through a variety of strategic initiatives. Major biopharmaceutical companies have pursued research collaborations and mergers to bolster their cholesterol lowering portfolios, while biotech innovators have focused on disruptive platforms such as RNA interference and gene editing. The emergence of patent expirations for certain statins has opened avenues for generic entrants to capture volume, prompting originators to differentiate through lifecycle management tactics, including novel formulations and fixed-dose combinations.

Simultaneously, partnerships between established pharma and digital health providers have materialized, bridging gaps in patient adherence and real-world evidence generation. Notably, leading companies have leveraged real-world data registries to demonstrate long-term outcomes and support value-based pricing agreements with payers. Additionally, investments in localized manufacturing facilities and supply chain redundancies have become a strategic imperative to mitigate geopolitical and policy-driven uncertainties. Through these combined efforts, companies are positioning their portfolios to address both existing patient segments and emerging markets, ensuring resilience in a competitive and rapidly shifting environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cholesterol Lowering Drug market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Alnylam Pharmaceuticals, Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bayer AG

- Biogen Inc.

- Boehringer Ingelheim International GmbH

- Eli Lilly and Company

- Esperion Therapeutics, Inc.

- Gilead Sciences, Inc.

- Johnson & Johnson

- Merck & Co., Inc.

- Mylan N.V.

- Novartis AG

- Novo Nordisk A/S

- Pfizer Inc.

- Regeneron Pharmaceuticals, Inc.

- Sandoz International GmbH

- Sanofi S.A.

- Shionogi & Co., Ltd.

- Sun Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Formulating Targeted Strategic Recommendations to Drive Innovation, Market Access, and Sustainable Growth in Cholesterol Treatment

To capitalize on emerging opportunities and strengthen market positioning, industry leaders should prioritize differentiated R&D that targets residual cardiovascular risk and improves tolerability profiles. Allocating resources toward novel modalities such as siRNA and gene therapies can unlock new patient segments, while optimizing combination regimens will enhance therapeutic versatility. Concurrently, forging strategic alliances with diagnostic and digital health companies will support patient engagement and adherence, fostering data-driven care pathways that underscore the value proposition to payers and providers.

Moreover, proactive supply chain diversification and nearshoring initiatives can safeguard against policy shifts and tariff fluctuations, ensuring consistent product availability. Companies must also refine their market access strategies through outcome-based contracting and risk-sharing agreements, aligning pricing models with demonstrable clinical benefits. Finally, fostering transparent communication with regulatory agencies will expedite approval processes for next-generation therapies and facilitate the adoption of real-world evidence frameworks. Implementing these recommendations will enable stakeholders to navigate complexity, drive innovation, and cultivate sustainable growth in the competitive cholesterol lowering drug arena.

Detailing a Robust Research Methodology Underpinning the Comprehensive Analysis of Cholesterol Lowering Drug Market Dynamics

This analysis integrates a rigorous approach combining secondary research, primary stakeholder engagement, and robust data triangulation. Initially, an extensive literature review was conducted, encompassing peer-reviewed journals, clinical trial registries, regulatory filings, and public policy documents to establish a foundational understanding of therapeutic mechanisms, safety profiles, and guideline evolutions. Complementing this, primary interviews were held with key opinion leaders in cardiology, endocrinology, and pharmacoeconomics, alongside discussions with supply chain and commercial distribution executives to capture real-world perspectives and emerging practice patterns.

Quantitative data was synthesized from prescription databases, healthcare utilization reports, and import-export trade statistics, ensuring a comprehensive view of market dynamics without explicit reliance on proprietary market sizing metrics. Qualitative insights were validated through feedback sessions with industry stakeholders, enabling iterative refinement of thematic findings. The methodological framework emphasizes transparency, reproducibility, and multidimensional perspective, thereby delivering nuanced intelligence that supports strategic decision-making across research, development, and commercialization functions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cholesterol Lowering Drug market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cholesterol Lowering Drug Market, by Drug Class

- Cholesterol Lowering Drug Market, by Route Of Administration

- Cholesterol Lowering Drug Market, by Patient Age Group

- Cholesterol Lowering Drug Market, by Distribution Channel

- Cholesterol Lowering Drug Market, by Prescription Type

- Cholesterol Lowering Drug Market, by Region

- Cholesterol Lowering Drug Market, by Group

- Cholesterol Lowering Drug Market, by Country

- United States Cholesterol Lowering Drug Market

- China Cholesterol Lowering Drug Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Critical Findings and Strategic Implications for Stakeholders in the Evolving Cholesterol Therapy Ecosystem

In conclusion, the cholesterol lowering drug landscape is characterized by an accelerating pace of innovation, shifting regulatory expectations, and evolving payer-provider collaborations. The ascent of PCSK9 inhibitors alongside combination strategies has redefined treatment paradigms, while policy developments such as 2025 tariff adjustments have spotlighted the importance of agile supply chain management. Segmentation analysis underscores the need for tailored approaches across drug classes, administration routes, patient demographics, and distribution channels to capture diverse market opportunities.

Regional variations further highlight the necessity of context-specific entry strategies that reconcile reimbursement environments and healthcare infrastructure. Leading companies have demonstrated adaptability through R&D partnerships, lifecycle management tactics, and investments in digital platforms. By embracing the actionable recommendations outlined herein-spanning innovation focus, supply chain resilience, and outcome-based contracting-industry stakeholders can position themselves to deliver enhanced patient outcomes and sustained commercial success. This comprehensive perspective equips decision-makers with the clarity needed to navigate an increasingly complex and dynamic therapeutic arena.

Connect with Our Associate Director for Personalized Engagement and Exclusive Access to the Comprehensive Cholesterol Lowering Drug Market Report

We invite you to take the next decisive step toward unlocking comprehensive market intelligence on cholesterol lowering therapies. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss your specific requirements and explore customized research solutions tailored to your strategic objectives. By partnering with Ketan, you gain privileged access to in-depth analyses, nuanced insights, and actionable data that will empower your organization to navigate competitive landscapes, optimize market entry strategies, and drive sustainable growth.

Connect with Ketan to arrange a personalized consultation and secure early access to the full report, ensuring that your team is equipped with the most current and relevant perspectives on drug class innovations, regulatory influences, regional adoption trends, and competitive dynamics. This collaboration will position you at the forefront of decision-making, enabling your organization to capitalize on emerging opportunities and mitigate potential risks in the evolving cholesterol lowering drug market.

- How big is the Cholesterol Lowering Drug Market?

- What is the Cholesterol Lowering Drug Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?