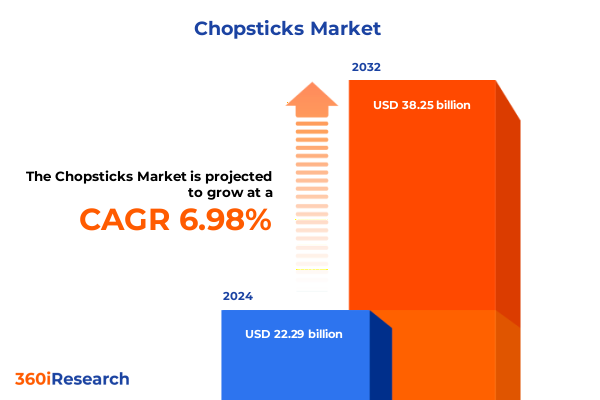

The Chopsticks Market size was estimated at USD 23.82 billion in 2025 and expected to reach USD 25.45 billion in 2026, at a CAGR of 6.99% to reach USD 38.25 billion by 2032.

Setting the Stage for a Comprehensive Examination of the Global Chopsticks Market by Unpacking Shifting Consumer Preferences and Multifaceted Industry Dynamics

The global chopsticks industry has matured into a multifaceted ecosystem shaped by evolving consumer tastes, sustainability imperatives, and dynamic supply chain configurations. In recent years, rising awareness around eco-friendly products has driven material innovation, prompting manufacturers and distributors to explore diverse raw inputs that balance cost efficiency with environmental stewardship. As disposable single-use utensils face scrutiny, reusable alternatives crafted from metal and resin have gained traction among eco-conscious consumers, while traditional materials such as bamboo and wood continue to command loyalty for their cultural resonance and biodegradability.

Simultaneously, shifting demographics and dining behaviors have redefined market dynamics. Urban populations, particularly in North America and Europe, are increasingly embracing pan-Asian cuisine, fueling demand for premium dining experiences that utilize artisanal chopstick designs and bespoke packaging. In parallel, growth in online grocery and specialty food e-commerce platforms has broadened access, allowing smaller producers to reach niche consumer segments. These converging drivers underscore a pivotal juncture in the chopsticks market, where tradition meets innovation and supply meets agility.

Exploring Pivotal Transformative Shifts Redefining the Chopsticks Industry with Sustainability Focus Innovations Technology Integration and Consumer Behavior Evolution

Over the past five years, the chopsticks landscape has been reshaped by transformative shifts that encompass sustainability, technology, and globalization. Most notably, the rise of biodegradable and sustainably sourced materials has challenged the industry’s reliance on virgin plastic, propelling bamboo composites and responsibly harvested wood to the forefront of product development. These material innovations have been complemented by advances in manufacturing processes-from precision molding of resin-based reusable chopsticks to laser etching techniques that create intricate designs-elevating consumer appeal and driving differentiation.

In parallel, digitalization has revolutionized distribution, with e-commerce platforms and direct-to-consumer brand websites enabling rapid product customization and on-demand production. This shift has empowered small and medium enterprises to compete alongside established players by offering limited-edition designs and subscription-based packaging solutions. At the same time, omnichannel retail strategies are blending offline specialty stores and large-format supermarkets to provide integrated shopping experiences, fostering brand loyalty through in-store demonstrations, pop-up events, and interactive packaging.

Furthermore, global trade realignments have introduced new supply chain paradigms. As manufacturers diversify sourcing away from single-country dependencies, regions in Southeast Asia, Eastern Europe, and South America are emerging as alternative hubs for both raw materials and assembly. These evolving dynamics underscore a market in flux, characterized by rapid innovation, agile distribution networks, and resilient supply chains designed to withstand geopolitical and logistical disruptions.

Unraveling the Cumulative Impact of the 2025 United States Tariff Regime on Chopsticks Supply Chains Raw Material Sourcing and Industry Cost Structures

The implementation of additional tariffs on Chinese goods in early 2025 has markedly affected chopsticks supply chains, raw material costs, and industry pricing structures. On February 4, 2025, an executive order introduced a 10 percent tariff on all Chinese imports, which was increased to a 20 percent levy effective March 4, 2025, in response to unmet cooperative actions on precursor chemicals enforcement. These measures directly impacted wooden and bamboo chopsticks, which are classified under China’s export categories and thus subject to the enhanced duty.

Many restaurants and distributors experienced immediate cost pressures following these tariff hikes. For example, an artisanal Sichuan eatery in Washington, D.C. reported significant inflation in the price of traditional wooden chopsticks, contributing to higher operational costs and menu adjustments for takeout and dine-in offerings. In response, several suppliers began seeking alternative sources, including domestic wood manufacturing facilities, while others shifted to composite materials that, although initially more expensive to produce, offered stable long-term pricing and improved durability.

Additionally, the unpredictability of trade policy generated caution among industry stakeholders. The abrupt escalation from a 10 percent to a 20 percent duty within one month underscored the volatility of the geopolitical environment, prompting manufacturers to reassess inventory buffers and consider nearshoring production closer to end markets. This recalibration has begun to drive capital investment into automated production lines in North America and Europe, aimed at mitigating future tariff risks and shortening delivery lead times.

Delving into Key Segmentation Insights Based on Material Composition Use Type Distribution Channel and End Use to Illuminate Market Nuances and Opportunities

A nuanced understanding of the chopsticks marketplace emerges through segmentation by material composition, demonstrating how choices between bamboo, composite, metal, plastic, and wood shape product positioning. Bamboo chopsticks, prized for their renewability and lightweight profile, dominate eco-friendly disposable offerings, while composite variants have gained ground where durability and aesthetic versatility are paramount. Metal options, often stainless steel or titanium, cater to the premium reusable segment, delivering longevity and ease of maintenance, whereas plastic remains prevalent for low-cost disposables, particularly in fast-casual dining.

Examining product types highlights the interplay between disposable and reusable models. Within disposables, bamboo embodies the convergence of sustainability and affordability, while wooden iterations maintain cultural authenticity in traditionalist markets. Plastic disposables persist in high-volume foodservice channels but face growing regulatory restrictions in regions targeting single-use reduction. Reusable chopsticks, segmented into metal and resin lines, demonstrate divergent value propositions: metal emphasizes resilience and hygiene, whereas resin blends aim to mimic wood textures with minimal environmental impact.

Distribution channels further contextualize market dynamics, with offline specialty stores and supermarkets & hypermarkets serving as critical touchpoints for mass distribution, whereas brand websites and e-commerce platforms facilitate direct engagement and customization in the online space. Finally, the end-use segmentation between commercial and residential scenarios reveals distinct consumption patterns, as cafeterias, institutions, hotels, and restaurants prioritize bulk procurement and standardized quality, contrasted with individual households and multi-family units that favor design variety, giftable packaging, and sustainable credentials.

This comprehensive research report categorizes the Chopsticks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Type

- Distribution Channel

- End Use

Highlighting Comprehensive Regional Insights into the Americas Europe Middle East Africa and Asia Pacific to Map Geographical Trends Demand Drivers and Market Characteristics

Regional analysis underscores divergent growth trajectories and consumer behaviors across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, the rise of Asian culinary culture within urban centers has catalyzed demand for premium and artisanal chopsticks, while federal and municipal single-use plastic bans have accelerated the adoption of bamboo and compostable disposables. North American manufacturers are capitalizing on this trend by certifying products under rigorous environmental standards and developing partnerships with local forestry programs.

Meanwhile, in the Europe, Middle East & Africa region, regulatory frameworks targeting plastic waste have fostered a transition toward medical-grade reusable metal chopsticks in high-end hospitality and specialist retail channels. European retailers are incorporating traceability measures, leveraging blockchain to verify sustainable sourcing, whereas Middle Eastern luxury hotel groups are commissioning custom-engraved metal sets. In Africa, informal markets continue to rely on imported wood and plastic disposables, though local artisans are beginning to experiment with indigenous woods and hand-crafted resin composites.

Asia-Pacific remains the largest consumption zone, anchored by deep cultural traditions and expansive manufacturing capacity. Japan and Korea maintain strong preferences for lacquered wood and stainless steel reusable chopsticks, with significant emphasis on artisanal craftsmanship and packaging innovation. In Southeast Asia, bamboo remains the predominant disposable material, supported by abundant local supply, while China’s diverse output spans all material types. As intra-regional trade agreements evolve, manufacturers are poised to optimize cross-border value chains, enhancing efficiency and fostering product diversification to meet both domestic and export requirements.

This comprehensive research report examines key regions that drive the evolution of the Chopsticks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Key Company Strategies and Competitive Landscapes of Leading Chopsticks Manufacturers Distributors and Innovators Driving Growth and Sustainability Initiatives

Leading companies in the chopsticks industry are pursuing differentiated strategies to capture emerging opportunities and address supply chain vulnerabilities. Some manufacturers have vertically integrated operations, acquiring or partnering with forestry and composite resin producers to secure raw material stability and cost control. Others focus on product innovation, investing in precision molding and surface treatment technologies to create differentiated offerings such as antibacterial coatings and ergonomic designs tailored to premium dining establishments.

Simultaneously, distributors and branded manufacturers are forging alliances with hospitality chains to establish exclusive supply agreements, thereby ensuring consistent volume demand and collaborative development of bespoke packaging. Digital-first enterprises are leveraging data analytics from e-commerce platforms to refine product assortments, pricing strategies, and personalized marketing campaigns. Furthermore, sustainability certifications and third-party audits have become table stakes, with leading firms publicizing environmental and social governance metrics to appeal to institutional buyers and regulatory bodies.

Collectively, these initiatives reflect an industry-wide emphasis on resilience, traceability, and brand differentiation. As trade policies continue to evolve, organizations that balance agile sourcing, technological innovation, and robust partnerships will be best positioned to navigate market complexities and deliver value to both commercial and residential end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chopsticks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Besta Bamboo Machine Co., Ltd.

- Bin Hong Import and Export Co., Ltd.

- Hangzhou Friendlywood Co., Ltd.

- Hengyu Bamboo & Wood Development Co., Ltd.

- Huhtamaki Oyj

- Mingzhu Houseware Co., Ltd.

- Mizuba Co., Ltd.

- Nanchang Sanyou Industrial Co., Ltd.

- Ngoc Chau Enterprise Pte.

- Nine Zero Trade Development Limited

- Performance Food Group Company

- Qingdao Sunpaper Products Co., Ltd.

- Sysco Corporation

- US Foods, Inc.

- Wanli Paper Co., Ltd.

- Wenzhou Linglong Paper Co., Ltd.

- Yuhua Bamboo Product Industry Co., Ltd.

- Zhangzhou Xinhe Paper Products Manufacturing Co., Ltd.

Formulating Actionable Recommendations for Industry Leaders to Navigate Material Innovation Trade Policy Disruptions and Digital Distribution Channel Optimization

Industry leaders should prioritize material diversification strategies to reduce exposure to single-source dependencies and tariff fluctuations. By establishing alternative supply relationships with suppliers in Southeast Asia and Eastern Europe, organizations can create risk-buffering inventory frameworks while maintaining product quality. Moreover, investing in composite and metal reusable lines will future-proof portfolios against regulatory constraints on single-use plastics.

To capitalize on the digital shift, companies must integrate omnichannel distribution strategies, harmonizing offline partnerships with specialty retailers and supermarkets alongside robust online brand websites and e-commerce platforms. This integration should be supported by data-driven inventory management and dynamic pricing models that respond to seasonal demand patterns and trade policy changes.

Furthermore, proactive engagement with policymakers and participation in sustainability coalitions will empower firms to shape regulations and gain early insights into emerging plastic bans or import duty revisions. Collaborating with certification bodies on environmental and social governance metrics will also differentiate brands in both B2B and B2C segments. Lastly, investing in automated, nearshored production capabilities-particularly in North America and Europe-will shorten lead times and mitigate the impact of future tariff escalations, reinforcing overall operational agility.

Detailing Rigorous Research Methodology Incorporating Structured Secondary Data Analysis Primary Interviews and Triangulation to Ensure Robust Market Intelligence Reliability

This research employed a multifaceted methodology combining comprehensive secondary data analysis, primary stakeholder interviews, and triangulation techniques to ensure robustness and reliability. Extensive secondary research included sourcing industry publications, trade databases, government trade notices, and regulatory filings to map out tariff timelines and material trade flows. Key insights into import duty changes were corroborated through official executive orders and tariff schedules issued in early 2025.

Complementing this desk research, structured interviews were conducted with procurement managers at leading hospitality chains, R&D directors at chopsticks manufacturing firms, and sustainability experts specializing in biodegradable materials. These conversations provided qualitative validation of market drivers, material preferences, and regulatory impacts. Additionally, data from e-commerce and retail sales platforms were analyzed to identify emerging product trends, adoption rates of reusable chopsticks, and shifts in consumer purchasing channels.

Finally, a triangulation approach was applied to reconcile quantitative trade figures with qualitative stakeholder perspectives, ensuring that the insights presented are both empirically grounded and reflective of on-the-ground realities. Rigorous quality checks, including peer reviews and cross-validation against multiple data sources, underpin the credibility of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chopsticks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chopsticks Market, by Material

- Chopsticks Market, by Type

- Chopsticks Market, by Distribution Channel

- Chopsticks Market, by End Use

- Chopsticks Market, by Region

- Chopsticks Market, by Group

- Chopsticks Market, by Country

- United States Chopsticks Market

- China Chopsticks Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Drawing Conclusive Perspectives that Synthesize Market Dynamics Competitive Drivers and Disruptive Trends to Inform Strategic Decision Making in the Chopsticks Industry

In summary, the chopsticks market stands at a crossroads defined by the interplay of sustainability imperatives, technological advancements, and evolving trade landscapes. Material innovation has transcended traditional bamboo and wood to include composites and metal variants, reshaping product portfolios across disposable and reusable domains. Digital transformation in distribution has broadened market access, empowering smaller players and stimulating demand for customized designs.

Meanwhile, the onset of enhanced tariffs on Chinese imports in 2025 has illuminated the strategic importance of supply chain diversification and nearshoring production. Companies that embrace alternative sourcing and invest in resilient manufacturing capabilities will be better equipped to manage cost volatility and geopolitical uncertainty. Regional dynamics further highlight the need for tailored approaches, as consumer preferences and regulatory environments vary markedly across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Overall, stakeholders who synthesize these insights into cohesive strategies-balancing innovation, operational agility, and regulatory engagement-will capture competitive advantage and drive sustainable growth in this dynamic market. The convergence of tradition and innovation within the chopsticks industry promises both challenges and opportunities for those prepared to adapt and lead.

Connect with Associate Director of Sales Marketing at 360iResearch to Secure Your Copy of the Comprehensive Chopsticks Market Research Report and Empower Strategic Growth

To access the full depth of analysis, proprietary insights, and detailed market segmentation driving the chopsticks industry’s future, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive market research report today. His expertise will guide you through how to leverage these insights to inform your strategic planning, unlock new growth opportunities, and stay ahead of emerging market shifts. Connect now to empower your organization with data-driven clarity and competitive advantage.

- How big is the Chopsticks Market?

- What is the Chopsticks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?