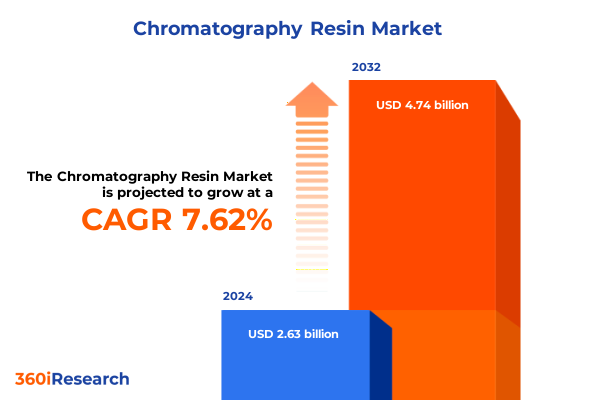

The Chromatography Resin Market size was estimated at USD 2.82 billion in 2025 and expected to reach USD 3.03 billion in 2026, at a CAGR of 7.68% to reach USD 4.74 billion by 2032.

Unlocking the Future of Chromatography Resin Technologies Through a Holistic Market Overview, Strategic Framework, and Emerging Industry Dynamics Fueling Innovation

The chromatography resin market stands at a pivotal moment where technological evolution converges with heightened industry expectations, forging new pathways for innovation and efficiency. This introduction provides a panoramic lens through which the fundamental drivers shaping the market can be understood, setting the stage for a deeper exploration of catalysts, challenges, and opportunities. By contextualizing the current landscape in terms of recent breakthroughs and shifting stakeholder priorities, we aim to equip decision-makers with a clear understanding of the strategic imperatives that will define success in the coming years.

Amid an era of rapid biopharmaceutical innovation and increasing demand for high-purity products, chromatography resins have transformed beyond conventional separation media into sophisticated platforms optimized for selectivity, capacity, and scalability. This shift underpins the broader narrative of amplified R&D investment, regulatory scrutiny, and application diversification. The introduction thus frames the subsequent analysis, highlighting how nuanced resin design, advanced manufacturing techniques, and evolving end-user requirements coalesce to drive market momentum. Transitioning from this overview, the report will examine the transformative shifts that are actively reshaping competitive dynamics and technological trajectories in the chromatography resin domain.

Exploring the Pivotal Technological and Market Disruptions Redefining Chromatography Resin Applications and Competitive Landscapes

The chromatography resin sector has witnessed a series of transformative shifts that are redefining performance benchmarks and commercial strategies. Foremost among these is the integration of novel ligand chemistries and engineered pore structures, enabling unprecedented levels of selectivity and throughput. This technological leap has facilitated the purification of increasingly complex biomolecules, from multispecific antibodies to gene therapy vectors, while minimizing processing times and buffer consumption. Innovators are leveraging high-resolution resins that combine multimodal interactions with tunable binding sites, marking a departure from one-dimensional separation methodologies.

Concurrently, digitalization and automation are accelerating resin screening and process optimization. Machine learning algorithms are now applied to predict resin behavior under diverse conditions, reducing experimental cycles and resource expenditure. Automated high-throughput systems enable parallel evaluation of resin libraries, significantly enhancing the velocity of discovery and scale-up. Alongside these capabilities, heightened collaboration between resin manufacturers, bioprocessing equipment suppliers, and contract development organizations has engendered end-to-end purification platforms that streamline supply chains and reduce time to market.

Regulatory evolution also constitutes a major shift, with agencies emphasizing process analytical technologies and quality by design principles. Resin suppliers are responding by providing comprehensive characterization data, robust validation protocols, and real-time monitoring solutions. This convergence of technology and regulation is catalyzing a new paradigm of transparent, risk-mitigated purification, paving the way for consistent product quality and faster regulatory approvals. As these shifts continue to unfold, stakeholders must adapt their R&D, investment, and partnership strategies to remain at the forefront of innovation.

Assessing the Multifaceted Effects of 2025 Trade Tariffs on United States Chromatography Resin Supply Chains and Cost Structures

The imposition of targeted tariffs on chromatography resin imports into the United States in early 2025 has introduced a complex layer of strategic recalibration for industry participants. These measures aim to encourage domestic manufacturing and reduce reliance on certain overseas suppliers, but they also have ripple effects throughout supply chains, cost structures, and procurement strategies. Organizations reliant on high-purity resins must navigate a delicate balance between maintaining supply continuity and managing increased price pressures that could affect downstream processing expenses.

Domestic producers have responded by scaling up resin production capabilities and accelerating investments in advanced manufacturing infrastructure. This surge in local capacity has helped to partially offset higher landed costs, yet it also underscores the importance of continued innovation to differentiate premium offerings. At the same time, some multinational resin suppliers are exploring tariff mitigation strategies, including tariff engineering through component segmentation and strategic re-shoring of critical ligand synthesis. These approaches aim to preserve competitive positioning while adhering to new trade regulations.

End users are adjusting procurement policies to incorporate total cost of ownership assessments that factor in tariff-induced price variability and potential supply constraints. Biopharmaceutical companies and research institutions are reevaluating long-term agreements and exploring volume commitments with domestic suppliers to secure preferential pricing. Overall, the tariff landscape of 2025 has catalyzed a strategic shift toward greater supply chain resilience, fostering an environment in which localized production, transparent cost modeling, and collaborative supplier relationships become paramount.

Unveiling Deep-Dive Insights into Chromatography Resin Market Segmentation Spanning Resin Types, Base Materials, Applications, End Users, and Sales Channels

Deep segmentation analysis reveals distinct trends and growth drivers across the diverse resin landscape, offering granular insights crucial for targeted strategy development. When considering resin types, Affinity Resins (AF) continue to garner attention for their ability to selectively capture biomolecules, but Ion Exchange Resins (IEX)-further subdivided into Cation Exchange and Anion Exchange-retain broad utility due to their versatility in protein separation. Meanwhile, Mixed-Mode Resins (MM) have carved a niche by combining multiple interaction modalities, and Size Exclusion or Gel Filtration Resins (SEC) remain indispensable for desalting and buffer exchange operations.

Turning to base materials, the dichotomy between Natural and Synthetic Polymers frames distinct value propositions. Natural substrates such as Agarose and Cellulose offer established track records in biocompatibility and ease of functionalization, while Synthetic Polymers deliver enhanced mechanical stability and broader pH tolerance. This interplay shapes resin selection decisions based on process stress conditions and purification objectives.

Application-driven segmentation highlights the dual imperatives of precision and throughput. In Diagnostics, high-resolution resins enable rapid assay development and point-of-care testing, whereas in Drug Discovery & Biopharmaceutical Production, robust resins facilitate large-scale purification with consistent performance. Research applications continue to thrive on flexible resin formats that support method development and exploratory studies.

End users further diversify the market dynamics. Academic & Research Institutes prioritize cost-effective, modular solutions that support cutting-edge experimentation, while Biopharmaceutical Companies demand scalable, regulatory-compliant resins with comprehensive documentation. Contract Research Organizations bridge both worlds, requiring adaptable resin portfolios to meet varied client specifications.

Sales channel segmentation underscores the evolving procurement paradigm. Traditional Offline Sales paths remain vital for bulk orders and specialized technical support, but Online Sales-through both Company Websites and Third-Party Marketplaces-have surged, offering streamlined ordering and rapid fulfillment. This digital shift is reshaping go-to-market strategies and redefining customer engagement models.

This comprehensive research report categorizes the Chromatography Resin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Base Material

- Application

- End User

- Sales Channel

Analyzing Regional Market Dynamics Across the Americas, Europe, Middle East and Africa, and Asia-Pacific Chromatography Resin Sectors

Regional dynamics in the chromatography resin sector reflect varied maturity stages, regulatory landscapes, and end-user demands across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, established bioprocessing hubs in North America drive strong demand for high-performance resins, supported by robust R&D ecosystems and advanced manufacturing capabilities. Latin American markets are emerging, characterized by growing academic research and nascent biopharma investment, though infrastructure constraints continue to temper rapid expansion.

Europe, Middle East & Africa present a heterogeneous tapestry. Western Europe maintains leadership in innovative resin development and stringent quality standards, while Eastern European markets exhibit cost-driven adoption of proven resin platforms. Regulatory harmonization initiatives across the European Union facilitate cross-border market access but also necessitate rigorous compliance measures. In the Middle East and Africa, strategic partnerships and technology transfer agreements are accelerating knowledge transfer, though reliance on imported resins remains significant.

Within Asia-Pacific, China and India have emerged as dual engines of resin demand, fueled by rapidly expanding biopharmaceutical manufacturing and strong government support for biotechnology. Local resin manufacturers in these markets are investing heavily in R&D to capture domestic demand and serve export markets, challenging incumbent global suppliers. Meanwhile, markets such as Japan, South Korea, and Australia continue to emphasize premium resin adoption, underpinned by advanced research infrastructures and stringent regulatory oversight.

As regional players pursue diverse growth trajectories, cross-regional collaboration and technology licensing will be instrumental in addressing capacity constraints, driving standardization, and fostering knowledge exchange across global chromatography resin communities.

This comprehensive research report examines key regions that drive the evolution of the Chromatography Resin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Chromatography Resin Manufacturers and Innovators Driving Market Excellence Through Advanced Product Portfolios and Strategic Alliances

The competitive landscape of chromatography resin manufacturing is defined by a blend of legacy industry leaders and agile innovators. Established manufacturers leverage decades of expertise in polymer science, ligand chemistry, and process engineering to offer comprehensive resin portfolios. These companies maintain international production footprints, robust technical support networks, and deep regulatory knowledge to serve global biopharma customers.

In parallel, emerging players are carving strategic niches by focusing on differentiated product attributes such as custom ligand functionalization, next-generation bead engineering, and cloud-enabled process analytics. Strategic alliances between resin developers and bioprocessing equipment suppliers have resulted in integrated purification platforms that reduce total cycle times and simplify scale-up.

Contract Research Organizations and specialized service providers are also making inroads by offering end-to-end purification services, capitalizing on their ability to rapidly screen and deploy optimal resin types for diverse client projects. Partnerships between academic research groups and commercial resin companies have accelerated the translation of novel separation technologies from lab bench to production line.

Intellectual property considerations, particularly around proprietary ligand attachments and bead morphology techniques, remain a key competitive lever. Companies with robust patent portfolios are able to command premium positioning, while agile entrants navigate the IP landscape through collaborative licensing or open-innovation frameworks. These dynamics underscore the importance of strategic differentiation based on both technical excellence and partnership ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chromatography Resin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avantor, Inc.

- Bio-Rad Laboratories, Inc.

- Bio-Works Technologies AB

- Changzhou Smart-Lifesciences Biotechnology Co., Ltd.

- Chemra GmbH

- CliniSciences S.A.S

- Cytiva

- DuPont de Nemours, Inc.

- GE Healthcare

- JNC CORPORATION

- JSR Life Sciences, LLC

- Kaneka Corporation

- Merck KGaA

- Purolite Corporation

- Repligen Corporation

- Samyang Corporation

- Sartorius AG

- Sepragen Corporation

- Thermo Fisher Scientific Inc.

- Tosoh Corporation

- Triskem International

- VWR International, LLC

- YMC America

Delivering Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends and Navigate Complex Regulatory and Competitive Environments

Industry leaders seeking to capitalize on the robust opportunities within the chromatography resin market must adopt proactive strategies that align innovation, operational excellence, and customer intimacy. First, investing in adaptive ligand design and bead engineering will ensure that resin offerings meet the evolving demands for higher selectivity and throughput. Allocating resources toward co-development partnerships with key end users can accelerate iterative improvements and reinforce long-term customer loyalty.

Second, enhancing supply chain resilience through diversified sourcing, strategic stock positioning, and nearshoring initiatives will mitigate risks associated with tariff fluctuations and global disruptions. Collaborating with logistics partners to optimize inventory models and lead times can further bolster reliability and cost transparency.

Third, embracing digital tools for resin screening, process monitoring, and predictive maintenance can streamline product development cycles and minimize scale-up bottlenecks. Industry leaders should integrate machine learning platforms that leverage historical process data to refine resin selection algorithms and anticipate performance deviations.

Fourth, cultivating comprehensive service models that encompass technical training, regulatory support, and lifecycle management will differentiate full-service providers from commodity suppliers. Tailored educational programs and virtual process analytic demonstrations can deepen customer engagement and drive long-term retention.

By executing these strategies in concert, companies can not only maintain competitive differentiation but also unlock synergistic value across their portfolios, creating sustainable growth trajectories in an increasingly complex market environment.

Detailing the Rigorous Research Methodology Underpinning the Comprehensive Analysis of Chromatography Resin Market Data and Industry Intelligence

This market review is underpinned by a structured research approach combining primary and secondary information sources to ensure rigor and accuracy. Initially, a thorough review of industry publications, patent filings, and technical whitepapers provided foundational insight into recent technological advancements and regulatory changes. This desk research was supplemented with regulatory guidance documents and peer-reviewed articles to validate process analytical technology trends and compliance requirements.

Primary research involved in-depth interviews with key stakeholders, including resin manufacturers, biopharmaceutical process engineers, contract research managers, and academic experts. These dialogues yielded firsthand perspectives on innovation drivers, adoption barriers, and competitive dynamics. Additionally, structured surveys were deployed to a representative sample of end users to quantify preferences around resin performance attributes and sourcing strategies.

Data synthesis employed cross-validation techniques, triangulating findings from multiple sources to identify consistent patterns and outliers. Segment-level analyses were performed by mapping product portfolios against application-specific performance metrics, while regional dynamics were contextualized through macroeconomic and regulatory frameworks. Quality assurance measures encompassed peer review by industry veterans and statistical checks to ensure representativeness and methodological soundness.

This comprehensive methodology ensures that the insights presented herein reflect both the broad market context and the nuanced technical considerations driving decision-making among chromatography resin stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chromatography Resin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chromatography Resin Market, by Resin Type

- Chromatography Resin Market, by Base Material

- Chromatography Resin Market, by Application

- Chromatography Resin Market, by End User

- Chromatography Resin Market, by Sales Channel

- Chromatography Resin Market, by Region

- Chromatography Resin Market, by Group

- Chromatography Resin Market, by Country

- United States Chromatography Resin Market

- China Chromatography Resin Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Illuminate the Strategic Imperatives and Long-Term Prospects for the Chromatography Resin Industry

Bringing together the insights from transformative technological shifts, tariff-driven supply chain adjustments, and deep segmentation and regional analyses reveals a clear set of strategic imperatives for stakeholders in the chromatography resin domain. The market’s trajectory is defined by the dual demands of innovation-manifested in advanced ligand chemistries and digital integration-and resilience through diversified manufacturing footprints and adaptive procurement strategies.

As resin types evolve to address increasingly complex biomolecular targets, industry leaders must balance investment in high-performance platforms with operational agility. The tariff dynamics of 2025 highlight the necessity of dynamic cost modeling and domestic capacity expansion, while segmentation insights emphasize the importance of tailored offerings for applications ranging from diagnostics to large-scale biopharmaceutical production.

Regional nuances underscore the value of market-specific strategies, whether supporting burgeoning academic research in the Americas, aligning with regulatory harmonization efforts across Europe, Middle East & Africa, or partnering with fast-growing manufacturers in Asia-Pacific. Meanwhile, competitive dynamics are shaped by a mix of established legacy suppliers and nimble innovators, each leveraging unique capabilities in ligand design, intellectual property, and service integration.

Collectively, these findings underscore that the future of the chromatography resin market will be driven by collaborative ecosystems, technology-enabled differentiation, and proactive regulatory alignment. Stakeholders who embrace these themes will be best positioned to navigate the complexity of the market and deliver sustained value to end users.

Arrange a Personalized, No-Obligation Consultation with Ketan Rohom to Unlock Comprehensive, Customized Chromatography Resin Market Research Report and Strategic Insights

To explore how these comprehensive insights can directly inform your strategic planning and unlock new growth avenues in the chromatography resin landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing. By arranging a personalized, no-obligation consultation, you will gain tailored guidance on leveraging advanced separation technologies to maximize process efficiency and competitive advantage. This engagement offers direct access to the full research report, enriched data sets, and expert interpretation aligned to your organization’s unique needs. Connect with Ketan to secure your exclusive copy of the market research report and begin implementing evidence-based strategies that will propel your chromatography resin initiatives forward without delay

- How big is the Chromatography Resin Market?

- What is the Chromatography Resin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?