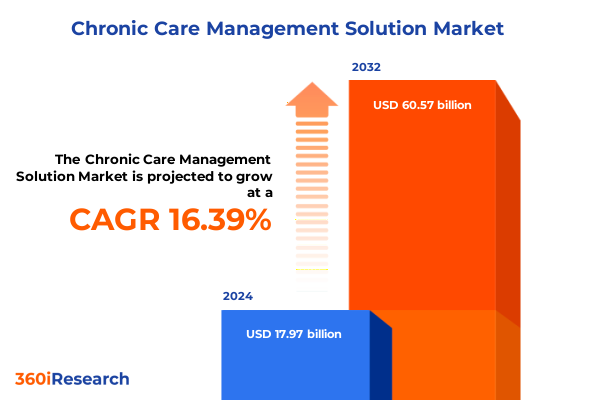

The Chronic Care Management Solution Market size was estimated at USD 20.66 billion in 2025 and expected to reach USD 23.74 billion in 2026, at a CAGR of 16.60% to reach USD 60.57 billion by 2032.

Exploring the Essential Value Proposition of Integrated Chronic Care Management Solutions for Enhancing Patient Outcomes and Optimizing Healthcare Operations

The critical importance of chronic care management solutions has never been more evident as healthcare systems grapple with rising prevalence of long-term conditions and mounting cost pressures. An integrated approach to supporting patients with persistent illnesses demands sophisticated coordination among clinical teams, technology platforms, and payers. Innovation in digital tools and service models is reshaping how providers deliver longitudinal care, helping to mitigate complications and reduce hospital readmissions. Against this backdrop, healthcare leaders must understand the transformative potential of new chronic care management offerings and the strategic implications for clinical and financial outcomes.

Through dedicated care coordination services and advanced analytics, providers can identify at-risk populations earlier and intervene proactively, rather than relying on episodic treatment. Telehealth and remote patient monitoring extend the reach of care teams, fostering continuous engagement even beyond traditional clinical settings. As health systems evolve toward value-based care frameworks, these solutions integrate seamlessly with electronic health records and mobile health applications to generate actionable insights, guide personalized care plans, and track progress over time. Consequently, organizations embracing chronic care management capabilities stand to improve patient satisfaction and operational efficiency, while aligning with regulatory incentives aimed at quality improvement.

In this executive summary, we outline the key shifts driving adoption, examine regulatory and economic influences such as tariffs shaping solution delivery in 2025, explore deep segmentation and regional dynamics, highlight leading company strategies, and provide strategic recommendations. Each section builds on the last to deliver a cohesive narrative on how chronic care management can serve as a cornerstone of modern healthcare delivery.

Identifying the Pivotal Technological and Regulatory Transformations Redefining Chronic Care Management Practices Across Healthcare Delivery Channels

The landscape of chronic care management is undergoing a profound transformation driven by converging technological breakthroughs and evolving regulatory frameworks. Innovations in data analytics and risk stratification are enabling health systems to move from reactive treatment pathways toward predictive, personalized interventions. Artificial intelligence and machine learning algorithms applied to large datasets allow clinicians to forecast exacerbations and tailor care plans accordingly, which amplifies the impact of clinical coaching and care coordination services.

Concurrently, significant policy shifts and reimbursement reforms are reshaping provider incentives. Governments and payers are increasingly aligning on value-based reimbursement models that reward improved clinical outcomes and lower total cost of care, encouraging participation in chronic care initiatives. Regulatory enhancements around telehealth billing and compliance support are lowering barriers for remote engagement, while rising emphasis on interoperability standards is unlocking seamless data exchange across electronic health records and patient management platforms.

These seismic shifts converge to create a more integrated ecosystem where services and technology work in concert. Care coordination teams leverage mobile health apps to engage patients between visits, while providers deploy remote patient monitoring software to track vital signs and medication adherence in real time. The alignment of service-based and software-driven models is forging a cohesive delivery framework, and the resulting synergy is poised to accelerate value realization for stakeholders across the continuum.

Analyzing the Multifaceted Economic Repercussions of 2025 United States Tariffs on Chronic Care Management Technology Supply Chains

The introduction of new tariffs in the United States for 2025 has injected complex cost considerations into the chronic care management technology supply chain. Increases in import duties on hardware components used for remote patient monitoring devices and telehealth equipment have led solution providers to reassess procurement and distribution strategies. Voltage sensor modules, wearable sensors, and peripheral monitoring kits that were previously sourced at lower cost from global manufacturers now face higher landing prices, compelling vendors to diversify sourcing or localize manufacturing to alleviate margin pressures.

As a result, several leading vendors have announced contingency plans to shorten supply chains, ramp up U.S.-based assembly lines, and negotiate long-term contracts with alternative suppliers. These measures aim to stabilize pricing for end users of care coordination tools and RPM platforms. Moreover, payers are closely monitoring the impact of these cost shifts on total cost of care metrics and reimbursement rates, prompting providers to refine budget allocations for software subscriptions and service bundles.

Despite the headwinds introduced by tariffs, the chronic care management market continues to advance as service providers adapt to the new economic landscape. Tariff-induced inflation on capital expenditures is balanced by the need to meet regulatory mandates for patient monitoring and value-based outcome reporting. This dynamic underscores the importance of agile procurement strategies and operational flexibility for organizations seeking to sustain growth and deliver high-quality chronic care management services in 2025.

Unveiling Comprehensive Segmentation Patterns That Illuminate Service Types, Tiers, Delivery Channels, Disease Focus and End-User Preferences

A nuanced understanding of market segmentation reveals the multilayered nature of service and technology adoption in chronic care management. When examining service offerings, differentiation between services and software becomes essential to discern the drivers of growth. Billing and compliance support, care coordination services, clinical coaching, data analytics and risk stratification, and telehealth services each address critical components of patient outreach and regulatory adherence. In parallel, software solutions such as care coordination tools, electronic health records, mobile health applications, patient management platforms, and remote patient monitoring software form the digital backbone of end-to-end care delivery, enhancing clinical decision-making and operational efficiency.

Delineation by tier offers insight into the level of sophistication sought by stakeholders. Basic offerings typically encompass core coordination functionalities and essential telephonic support, whereas standard solutions introduce integrated clinical coaching modules and basic analytics dashboards. Premium tiers further incorporate advanced predictive algorithms, video conferencing capabilities, and seamless electronic health record interoperability, catering to organizations with complex patient cohorts and robust IT infrastructures.

Delivery mode segmentation uncovers how engagement methods evolve across hybrid arrangements, traditional in-person workflows, telephonic check-ins, and video-based consultations. While in-person initiatives foster rapport and clinical trust, telephonic and video conferencing modalities expand reach into remote or underserved areas, and hybrid models combine digital touchpoints with occasional site visits to offer a balanced approach.

Chronic disease focus affects service prioritization and platform customization. Arthritis and cardiovascular disease management rely heavily on structured exercise coaching and medication adherence tracking, diabetes and hypertension control emphasize continuous glucose monitoring paired with data analytics, and respiratory disease programs leverage remote spirometry and symptom tracking to mitigate exacerbations.

Within deployment models, cloud-based solutions deliver rapid scalability and lower upfront IT costs, whereas on-premise deployments provide greater data control and customization for organizations with stringent security requirements. Organization size dictates resource allocation and vendor engagement strategy: health systems and large hospitals seek enterprise-class platforms with deep integration capabilities; medium hospitals require adaptable solutions with support for moderate patient volumes; and small clinics prioritize cost-effective tools that streamline care coordination without extensive capital investment.

End users of these services-healthcare providers, patients, and payers-each derive distinct but overlapping value. Clinics and hospitals leverage comprehensive care coordination frameworks to reduce readmission rates and comply with quality benchmarks. Patients benefit from increased access to care through mobile applications, virtual coaching, and continuous monitoring. Government programs and private insurers assess program efficacy through collected data, using insights from patient management platforms to refine reimbursement policies and align incentives across payer-provider networks.

This comprehensive research report categorizes the Chronic Care Management Solution market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Tier

- Delivery Mode

- Chronic Disease

- Deployment Mode

- Organization Size

- End User

Highlighting the Diverse Regional Dynamics Influencing Adoption of Chronic Care Management with Tailored Technology and Service Strategies

Regional considerations play a pivotal role in shaping adoption and innovation trajectories within the chronic care management market. In the Americas, healthcare organizations are driven by robust reimbursement frameworks and mature technological ecosystems. Providers are increasingly partnering with software developers to integrate sophisticated patient management platforms and remote monitoring solutions into established care pathways, leveraging policy support for value-based reimbursements to accelerate program rollouts.

Across Europe, the Middle East, and Africa, diverse healthcare infrastructures and regulatory landscapes require adaptive solutions. Western European nations capitalize on unified digital health initiatives and interoperable electronic health record systems to deploy scalable chronic care management services, while emerging markets in Eastern Europe and the Middle East prioritize telehealth and mobile health applications to extend specialist support to underserved communities. Africa is witnessing pilot programs that utilize solar-powered remote patient monitoring kits to address resource constraints and broaden access to essential chronic disease management.

In the Asia-Pacific region, technological innovation and government-driven health modernization efforts are shaping market dynamics. Countries such as Australia and New Zealand emphasize cloud-based deployment models and stringent data privacy regulations to ensure secure patient data exchange. In Southeast Asia and China, rapidly growing digital health adoption is fueling demand for comprehensive care coordination tools and AI-driven analytics, as payers and providers seek cost containment and improved outcomes in densely populated urban centers.

This comprehensive research report examines key regions that drive the evolution of the Chronic Care Management Solution market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Navigating the Competitive Terrain of Chronic Care Management Through Strategic Partnerships and Innovative Market Entrants

The competitive landscape of chronic care management is characterized by a mix of established healthcare IT titans and innovative niche players. Prominent technology vendors have expanded their portfolios through strategic partnerships and targeted acquisitions, integrating electronic health record systems with remote monitoring and analytics capabilities. These integrated offerings enable greater interoperability and streamlined workflows, positioning established IT firms as comprehensive solution providers for large health systems.

At the same time, specialized service providers have gained traction by focusing exclusively on high-touch care coordination and clinical coaching. These organizations often differentiate themselves through robust risk stratification methodologies and bespoke telehealth protocols that align with complex disease management needs. By harnessing advanced data analytics, they are able to deliver predictive insights that reduce hospital admissions and improve patient engagement.

Emerging digital health startups are also influencing competitive dynamics by introducing mobile-first patient management applications and video-enabled virtual care platforms. These agile entrants capitalize on user-centric design and rapid feature iteration, appealing to smaller clinics and medium hospitals seeking scalable, cost-effective solutions. Their disruption compels larger incumbents to enhance user experience and accelerate development cycles.

Additionally, payer-led consortiums and government health programs are directly investing in technology and service models to manage chronic disease expenditures. Such initiatives create new partnership opportunities for vendors to demonstrate value and secure multi-year contracts based on performance metrics. Overall, collaboration among technology companies, service firms, and payers is intensifying as the market evolves toward more integrated, outcome-driven chronic care management ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chronic Care Management Solution market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Monitored Caregiving, Inc.

- Caremerge, Inc.

- Cognizant Technology Solutions Corporation

- Epic Systems Corporation

- EXL Service Holdings, Inc.

- HealthSnap, Inc.

- HealthViewX

- Infosys Limited

- Koninklijke Philips N.V.

- NextGen Healthcare, Inc.

- Oracle Corporation

- Panda Health, Inc.

- Pegasystems Inc.

- Rijuven Corp.

- RXNT

- ScienceSoft USA Corporation

- Siemens Healthineers AG

- Signallamp Health, Inc.

- Thinkitive Technologies Pvt. Ltd.

- ThoroughCare, Inc.

- TimeDoc Health

- Vatica Health, Inc.

- Vivify Health, Inc. by Optum

- ZeOmega, Inc.

Driving Sustainable Value From Chronic Care Management Through Integrated Governance, Interoperable Architectures and Outcome-Based Partnerships

To harness the full potential of chronic care management solutions, industry leaders should prioritize the alignment of clinical protocols with technological capabilities. First, establishing multidisciplinary governance committees that include physician champions, IT architects, and financial stakeholders will ensure cohesive decision-making and clear accountability structures. This integrated oversight mitigates risk and accelerates solution deployment, driving clinical adoption and system-wide engagement.

Investment in interoperable technology infrastructures is critical. Organizations should adopt cloud-native architectures that support real-time data exchange across electronic health records, care coordination tools, and patient management platforms. Leveraging open APIs and adherence to interoperability standards will facilitate the integration of best-in-class remote monitoring and analytics modules, enhancing scalability and reducing vendor lock-in.

Building robust payer-provider partnerships can unlock value-based reimbursement pathways. By negotiating shared-risk contracts that tie reimbursements to defined outcome metrics-such as reduction in hospitalization rates or improvement in chronic disease indicators-stakeholders can align incentives and distribute savings equitably. Incorporating patient-centric engagement strategies, including tailored mobile app notifications and telephonic check-ins, will drive adherence and support sustained health behavior changes.

Finally, continuous performance monitoring and iterative refinement are essential. Leaders must implement dashboards that capture utilization rates, clinical outcomes, and patient satisfaction metrics. Regularly analyzing these insights through a centralized analytics function enables proactive course corrections, informs resource allocation, and reinforces a culture of continuous improvement. Such a strategic framework ensures chronic care management initiatives deliver measurable value and remain adaptable to shifting market dynamics.

Applying Robust Primary Interviews, Secondary Data Triangulation and Statistical Segmentation to Illuminate the Chronic Care Management Ecosystem

Our research methodology combines rigorous primary and secondary data collection to ensure comprehensive, objective insights into the chronic care management market. Primary research included structured interviews and surveys with senior executives, clinical leads, and IT decision-makers across health systems, hospitals, and clinics. These engagements provided qualitative perspectives on adoption drivers, implementation challenges, and technology preferences, allowing for nuanced interpretation of market dynamics.

Secondary research encompassed an extensive review of public regulatory filings, healthcare policy documents, industry whitepapers, and peer-reviewed clinical studies. This approach enabled cross-validation of primary findings and offered historical context for emerging trends. Key sources included federal and state health department publications detailing telehealth reimbursement reforms, as well as technical reports on interoperability standards and remote monitoring efficacy.

Quantitative analysis involved statistical modeling and trend analysis of market developments, while segmentation mapping was applied to delineate service, technology, tier, delivery mode, disease focus, deployment, organization size, and end-user preferences. Data triangulation techniques were employed to reconcile discrepancies between various information streams, ensuring reliability and accuracy.

Finally, collaborative validation workshops with industry experts and vendor representatives were conducted to refine our insights and affirm the strategic relevance of our recommendations. This multi-phase research framework delivers a robust foundation for stakeholders seeking to navigate the complexities of the chronic care management ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chronic Care Management Solution market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chronic Care Management Solution Market, by Service Type

- Chronic Care Management Solution Market, by Tier

- Chronic Care Management Solution Market, by Delivery Mode

- Chronic Care Management Solution Market, by Chronic Disease

- Chronic Care Management Solution Market, by Deployment Mode

- Chronic Care Management Solution Market, by Organization Size

- Chronic Care Management Solution Market, by End User

- Chronic Care Management Solution Market, by Region

- Chronic Care Management Solution Market, by Group

- Chronic Care Management Solution Market, by Country

- United States Chronic Care Management Solution Market

- China Chronic Care Management Solution Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Summarizing the Critical Integration of Technology, Services and Regulatory Adaptation as the Cornerstone of Effective Chronic Care Management

Chronic care management has emerged as a strategic imperative for healthcare organizations aiming to improve long-term patient outcomes and control escalating costs. The integration of advanced analytics, remote monitoring, and coordinated service models is reshaping how providers and payers approach persistent conditions. By embracing these innovations, stakeholders can deliver more proactive, personalized care pathways that reduce hospital readmissions and enhance patient engagement.

As technology and regulatory environments continue to evolve, the ability to adapt to new reimbursement structures, tariff-related supply chain challenges, and shifting patient expectations will determine market leadership. Deep segmentation analysis reveals that success hinges on offering the right blend of services and software across multiple tiers, delivery modes, and disease-specific configurations. Regional nuances further underscore the need for tailored strategies that align with local policy frameworks and infrastructure maturity.

Strategic partnerships among technology developers, service providers, and payer organizations are accelerating the shift toward value-based care models. Ultimately, organizations that establish interoperable systems, robust governance structures, and outcome-oriented contracts will capture the greatest value. This comprehensive executive summary underscores the critical steps needed to thrive in the dynamic chronic care management landscape and sets the stage for action.

Empowering Strategic Decision Makers with Direct Engagement Opportunities to Unlock Comprehensive Chronic Care Management Market Intelligence

For deeper operational insights and a customized briefing on the strategic advantages of the chronic care management market, contact Ketan Rohom (Associate Director, Sales & Marketing) to secure your exclusive access to the comprehensive report and accelerate your competitive advantage immediately

- How big is the Chronic Care Management Solution Market?

- What is the Chronic Care Management Solution Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?