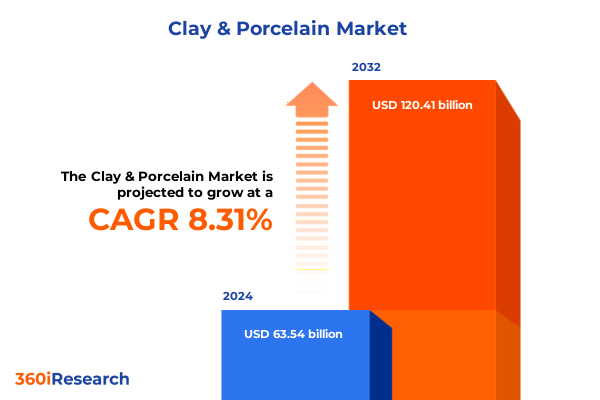

The Clay & Porcelain Market size was estimated at USD 68.84 billion in 2025 and expected to reach USD 73.54 billion in 2026, at a CAGR of 8.31% to reach USD 120.41 billion by 2032.

Unveiling the Evolving Dynamics of the Global Clay and Porcelain Market Through Technological Innovation and Sustainability-Driven Demand

Unveiling the Evolving Dynamics of the Global Clay and Porcelain Market Through Technological Innovation and Sustainability-Driven Demand

In recent years, the clay and porcelain industry has experienced a profound transformation driven by the convergence of digital innovation, environmental priorities, and shifting consumer preferences. As manufacturers integrate advanced materials science into traditional ceramic techniques, new product attributes such as enhanced durability, lightweight structures, and eco-friendly compositions have become vital differentiators. Meanwhile, end users across automotive, healthcare, construction, and food service sectors are demanding higher performance standards, prompting producers to refine formulations and optimize production methods.

Transitioning from conventional retail channels to a hybrid distribution model has further reshaped the competitive terrain. Market participants are leveraging e-commerce platforms and direct sales portals to reach a broader audience, while simultaneously maintaining relationships with specialty stores and independent shops to preserve the tactile buying experience that is often critical for high-end tableware and sanitaryware. These shifts underscore the necessity of a multifaceted strategic approach that balances digital reach with personalized service to meet nuanced buyer expectations.

Against this backdrop of rapid change, industry leaders are challenged to adopt a holistic perspective that embraces both technological sophistication and sustainability imperatives. By fostering partnerships across the supply chain and investing in research and development, organizations can harness the potential of next-generation clay and porcelain applications, ultimately securing their foothold in a competitive global landscape.

How Digital Transformation, Sustainability Imperatives, and Supply Chain Resilience Are Redefining Clay and Porcelain Production

How Digital Transformation, Sustainability Imperatives, and Supply Chain Resilience Are Redefining Clay and Porcelain Production

The landscape of clay and porcelain manufacturing is being reshaped by three interlinked drivers: digital transformation, sustainability mandates, and supply chain resilience. Advancements in automation and Industry 4.0 technologies have enabled real-time monitoring of kilns and production lines, reducing defects and minimizing energy consumption. As a result, companies are now capable of producing more consistent, high-quality ceramics while lowering operational costs and carbon footprints.

Concurrently, stringent environmental regulations and growing consumer demand for eco-friendly products have accelerated the adoption of green chemistry and circular economy principles. Manufacturers are substituting raw clay sources with recycled ceramic aggregates and incorporating bio-based binders to reduce landfill waste. This transition not only addresses regulatory pressures but also serves as a market differentiator, particularly in regions where sustainability credentials influence procurement decisions in construction and healthcare sectors.

The third pillar of transformation is supply chain resilience. Geopolitical tensions, raw material shortages, and logistics disruptions have underscored the vulnerability of globally dispersed networks. Companies are responding by diversifying supplier bases, investing in localized production hubs, and leveraging predictive analytics to anticipate disruptions. Together, these strategic shifts are enabling stakeholders to navigate volatility, secure reliable input streams, and meet escalating end-use requirements without compromising quality or delivery timelines.

Analyzing the Far-Reaching Consequences of New United States Tariffs on Clay and Porcelain Imports Implemented in Early 2025

Analyzing the Far-Reaching Consequences of New United States Tariffs on Clay and Porcelain Imports Implemented in Early 2025

The introduction of expanded tariffs on clay and porcelain imports in the United States effective January 2025 has had a cascading impact across the value chain. Tariffs imposed at rates ranging from 10 to 25 percent on primary import categories have elevated landed costs for many finished and intermediate products. As importers passed higher costs downstream, distributors experienced margin compression, prompting a reassessment of supply strategies and inventory buffers.

Domestic manufacturers, meanwhile, have seen a partial advantage with improved pricing parity against previously lower-cost foreign competitors. However, restrictions on key raw materials-particularly specialized clays and glazes historically sourced from overseas-have complicated production planning. Producers have prioritized securing long-term agreements with alternative suppliers in Central America and Europe to mitigate dependency on regions subject to the highest duties.

Retailers and end-use customers have adapted by exploring nearshoring options and fostering strategic partnerships with regional fabricators. While these initiatives have increased lead times in certain segments, they have also stimulated investment in capacity expansions within the United States. Looking ahead, the interplay between tariff policy and supply chain optimization will remain a critical factor shaping competitiveness and innovation in the clay and porcelain industry.

Integrating Key Segmentation Dimensions to Illuminate Diverse Opportunities and Challenges Within the Clay and Porcelain Sector

Integrating Key Segmentation Dimensions to Illuminate Diverse Opportunities and Challenges Within the Clay and Porcelain Sector

Delineating the market by distribution channel reveals a dualistic structure: the Online segment has swiftly evolved to include dedicated direct sales and expansive e-commerce platforms, enabling manufacturers to engage end users with tailored product portfolios and digital customization tools. In contrast, the Retail segment persists through a network of independent shops, specialty stores, and large-format supermarkets, where tactile product evaluation and curated brand experiences continue to resonate with certain customer cohorts.

Examining the manufacturing process underscores the significance of Dry Press operations alongside the more intricate realms of Isostatic Pressing and Slip Casting. Cold and hot isostatic methods deliver unparalleled uniformity for high-performance applications, while advanced slip casting techniques have unlocked new geometries and ceramic composites that were previously unattainable with traditional slip methods.

Turning to product type, the market is comprised of classic material categories such as Bone China and Earthenware, alongside traditional Porcelain and durable Stoneware, each finding favor in distinct end-use contexts. Whereas Bone China and Porcelain remain aspirational in tableware and luxury sanitaryware, Stoneware and Earthenware often ground functional applications in food service and casual dining.

Analyzing end-use segmentation highlights automotive, construction, food service, and healthcare as primary demand pillars. Ceramic insulators, heat-resistant tiles, antibacterial sanitaryware, and precision tableware illustrate how tailored performance criteria influence material selection across industries.

Finally, the form factor segmentation encompasses insulators, sanitaryware, tableware, and tiles, demonstrating the breadth of functional and aesthetic requirements. From high-voltage transmission components to decorative architectural tiles, each form leverages the inherent advantages of clay and porcelain to deliver reliability, durability, and design flexibility.

This comprehensive research report categorizes the Clay & Porcelain market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Manufacturing Process

- Product Type

- Form

- Distribution Channel

- End Use

Unpacking Regional Variations in Demand Dynamics and Innovation Trajectories Across Major Markets

Unpacking Regional Variations in Demand Dynamics and Innovation Trajectories Across Major Markets

In the Americas, robust infrastructure spending and surging interest in sustainable building materials have catalyzed demand for ceramic tiles and sanitaryware. The shift toward energy-efficient housing and commercial renovations has encouraged the adoption of advanced porcelain composites for façade systems and interior applications. Meanwhile, manufacturers in North America are intensifying investments in local capacity to offset import tariffs and reduce lead times, positioning themselves as strategic partners for large-scale construction and automotive projects.

Europe, Middle East & Africa presents a heterogeneous landscape where mature markets in Western Europe emphasize green certification and circularity in product design. Stringent EU regulations on volatile organic compounds have driven innovation in low-emission glazes and recycled clay formulations. In contrast, emerging economies across the Middle East and Africa are witnessing rapid urbanization, fueling demand for cost-effective tile solutions in housing developments. Regional manufacturers are leveraging free trade agreements to optimize supply chains between production hubs in the Mediterranean and distribution centers in Northern Africa.

The Asia-Pacific region remains the epicenter of clay and porcelain production, with China and India leading global exports. Ongoing technological upgrades in kilns and automation have boosted output efficiency, while domestic consumption is being shaped by lifestyle trends favoring premium and artisanal ceramics. Southeast Asian economies are increasingly investing in ceramic R&D clusters, forging collaborations between academia and industry to develop high-performance materials tailored to tropical climates and seismic zones.

This comprehensive research report examines key regions that drive the evolution of the Clay & Porcelain market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players and Their Strategies That Are Shaping Competitive Dynamics in Clay and Porcelain

Profiling Leading Players and Their Strategies That Are Shaping Competitive Dynamics in Clay and Porcelain

Key manufacturers have differentiated themselves through a combination of scale, vertical integration, and targeted innovation investments. Some global conglomerates have expanded their product portfolios to include high-tech applications such as ceramic bearings for electric vehicles and bioceramic implants for medical devices, leveraging deep research capabilities to address cross-industry requirements.

Mid-sized specialists are carving out leadership positions in niche segments. By focusing on advanced slip casting processes or bespoke sanitaryware designs, these firms maintain agility and can rapidly adapt to emerging consumer trends. Strategic collaborations with technology partners have enabled them to incorporate digital printing and antimicrobial surface treatments, enhancing product appeal.

In parallel, vertically integrated groups are optimizing supply chains by acquiring raw material sources and kiln engineering firms. This approach has improved cost control and reduced exposure to commodity price fluctuations. Partnerships between raw clay suppliers and ceramic fabricators are further accelerating product development cycles, ensuring that new formulations progress from lab to market with minimal delay.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clay & Porcelain market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asian Granito India Ltd.

- CERA Sanitaryware Ltd.

- Ceramica Carmelo Fior Ltda

- Churchill China (UK) Limited

- Clay Craft India Private Limited

- Crossville Inc.

- Florim Ceramiche

- Grupo Cedasa

- Grupo Lamosa

- H & R Johnson (India) Ltd.

- Kajaria Ceramics Ltd.

- Lenox Corporation

- Mohawk Industries, Inc.

- Nitco Limited

- Noritake Co., Limited

- Orient Bell Limited

- Pamesa Ceramica

- RAK Ceramics PJSC

- Richard Ginori Srl

- Rosenthal GmbH

- SCG Ceramics

- Simpolo Ceramics

- Somany Ceramics Ltd.

- STN Ceramica

- Tognana Porcellane SpA

Actionable Strategic Initiatives to Strengthen Market Positioning and Drive Sustainable Growth in the Clay and Porcelain Arena

Actionable Strategic Initiatives to Strengthen Market Positioning and Drive Sustainable Growth in the Clay and Porcelain Arena

To thrive amid accelerating change, industry leaders should prioritize end-to-end digital integration, leveraging advanced analytics and cloud-based process controls to optimize production, reduce waste, and enhance traceability. Embedding digital twins and predictive maintenance tools can further boost operational efficiency and mitigate downtime risks.

Secondly, companies must elevate their sustainability agenda by adopting closed-loop manufacturing practices, increasing the use of recycled ceramic materials, and securing third-party certifications for low-carbon products. Transparent reporting on environmental performance will fortify brand credibility and meet the growing procurement requirements of multinational customers seeking green supply chain partners.

Third, diversifying supply networks through regional hubs and nearshore partnerships will buffer against geopolitical volatility and tariff fluctuations. Establishing strategic alliances with local fabricators not only ensures material availability but also allows faster response to market shifts and customer specifications.

Finally, fostering a culture of continuous innovation through collaborative R&D partnerships with universities and technology providers will unlock new opportunities in high-growth sectors such as electric mobility, renewable energy, and precision healthcare. By developing advanced ceramic composites with enhanced functional properties, companies can create defensible market niches and generate higher-value applications.

Employing a Rigorous, Multilayered Research Approach to Ensure Comprehensive Market Intelligence and Unbiased Insights

Employing a Rigorous, Multilayered Research Approach to Ensure Comprehensive Market Intelligence and Unbiased Insights

The foundation of this study rests on an extensive compilation of both primary and secondary sources. Industry experts, including production managers, R&D directors, and supply chain executives, were interviewed to gather nuanced perspectives on technological adoption, regulatory landscapes, and competitive strategies. These qualitative insights were triangulated with data drawn from company disclosures, patent filings, trade associations, and government publications to ensure accuracy and depth.

Secondary research encompassed an exhaustive review of publicly available documents, including white papers, academic journals, and corporate presentations. Quantitative data points were validated through cross-referencing independent databases and historical trend analyses, ensuring consistency and reliability. Additionally, advanced analytics tools were leveraged to identify emerging patterns in production volumes, import/export flows, and pricing trajectories.

Throughout the process, data integrity was maintained via a structured validation framework, where conflicting information was reconciled through follow-up consultations with subject matter specialists. The methodology emphasizes transparency and repeatability, enabling stakeholders to understand the research assumptions, data sources, and analytical techniques employed. This rigorous approach guarantees that conclusions and recommendations are grounded in robust evidence and actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clay & Porcelain market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clay & Porcelain Market, by Manufacturing Process

- Clay & Porcelain Market, by Product Type

- Clay & Porcelain Market, by Form

- Clay & Porcelain Market, by Distribution Channel

- Clay & Porcelain Market, by End Use

- Clay & Porcelain Market, by Region

- Clay & Porcelain Market, by Group

- Clay & Porcelain Market, by Country

- United States Clay & Porcelain Market

- China Clay & Porcelain Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Distilling the Critical Insights That Define the Present and Future Trajectory of the Clay and Porcelain Industry

Distilling the Critical Insights That Define the Present and Future Trajectory of the Clay and Porcelain Industry

In sum, the clay and porcelain sector stands at the cusp of a remarkable evolution. Technological breakthroughs in manufacturing, heightened sustainability expectations, and strategic supply chain realignments are collectively redefining market dynamics. The interplay between digitalization and eco-conscious product development is unlocking unprecedented performance gains, while regional diversification strategies are building resilience against external pressures.

As global tariffs recalibrate competitive positioning, and end-use demographics continue to shift, stakeholders who adopt a holistic, forward-looking mindset will capture the greatest opportunities. Embracing advanced materials science, forging collaborative partnerships, and prioritizing environmental stewardship will form the cornerstone of long-term success in this vibrant and ever-changing industrial landscape.

Take the Next Step Toward Competitive Advantage by Partnering with Ketan Rohom to Access the Definitive Clay and Porcelain Market Research Report

Ready to propel your strategic initiatives and gain exclusive insights into the clay and porcelain sector? Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report and unlock critical intelligence for sustainable growth

- How big is the Clay & Porcelain Market?

- What is the Clay & Porcelain Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?