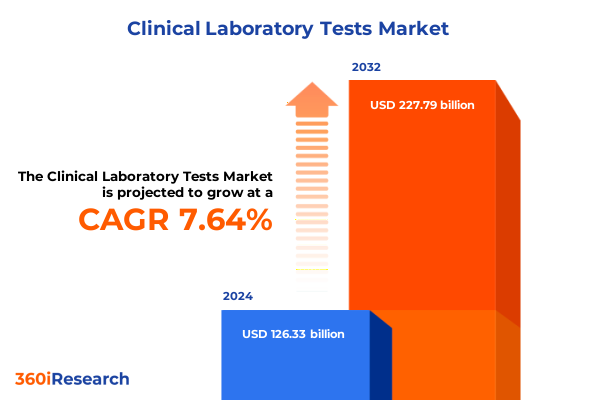

The Clinical Laboratory Tests Market size was estimated at USD 135.09 billion in 2025 and expected to reach USD 144.46 billion in 2026, at a CAGR of 7.74% to reach USD 227.79 billion by 2032.

Establishing a Comprehensive Perspective on Clinical Laboratory Testing Innovation and Trends Driving Diagnostic Excellence Worldwide

The field of clinical laboratory testing stands at the intersection of cutting-edge science and patient care, serving as the diagnostic backbone for modern healthcare delivery. With laboratories tasked with delivering accurate, timely, and cost-effective results, technological innovation and regulatory evolution have become critical drivers shaping industry dynamics. From the evolution of high-throughput analyzers to the proliferation of point-of-care diagnostic devices, every advancement continues to redefine how laboratories meet growing demands for precision medicine and personalized therapies.

Amid these accelerations, stakeholders across the clinical testing ecosystem-ranging from diagnostic laboratories to research institutions-face pressure to optimize workflows, enhance data integrity, and ensure compliance with stringent quality standards. Furthermore, emerging public health challenges and shifts in reimbursement frameworks underscore the need for a holistic understanding of market forces, relative cost structures, and innovation pathways. This executive summary thus consolidates the prevailing trends, regulatory influences, and competitive landscapes that collectively underpin the current state of clinical laboratory testing, setting the stage for deeper analysis in subsequent sections.

Uncovering Transformative Shifts in Laboratory Diagnostics through Automation, Artificial Intelligence, and Decentralized Testing Strategies

In recent years, the clinical laboratory sector has experienced transformative shifts driven largely by the integration of automation, artificial intelligence, and novel diagnostic modalities. Robotic sample handling and high-throughput platforms have streamlined routine workflows, reducing manual intervention and accelerating turnaround times. Concurrently, machine learning algorithms now assist in pattern recognition across complex datasets, enabling predictive analytics that elevate diagnostic accuracy and operational efficiency.

Moreover, the rise of molecular diagnostics has redefined pathogen detection and genetic analysis, with advanced sequencing technologies unlocking insights into rare genetic disorders and emerging infectious agents. Complementing these developments, digital pathology platforms facilitate remote slide review and collaborative consultations, breaking down geographical barriers to specialist expertise. Additionally, the decentralization of testing through point-of-care devices and home sampling solutions has expanded access to critical diagnostics, particularly in underserved regions.

Taken together, these shifts reflect a convergence of technology and clinical practice that not only enhances test performance but also drives more patient-centric models of care delivery. As laboratories adapt to these evolving paradigms, strategic alignment with digital transformation initiatives and investment in workforce training will prove pivotal for maintaining competitive advantage and responding to future demands.

Assessing the Cumulative Consequences of United States Tariff Policies on Clinical Laboratory Equipment and Consumables in 2025

The imposition of new tariff structures by the United States government in 2025 has introduced substantial cost considerations for clinical laboratory equipment and consumables. Import duties on analytical analyzers, reagent kits, and specialized instruments have elevated procurement expenses, prompting laboratory managers to reevaluate supplier contracts and sourcing strategies. In some cases, increased lead times and supply bottlenecks have emerged as direct consequences of these trade measures, resulting in potential delays for critical diagnostic services.

In response, many stakeholders have pivoted toward domestic manufacturing partners in order to mitigate exposure to fluctuating import tariffs. Collaborations between equipment providers and in-country distributors are gaining prominence, helping to streamline logistics and reduce compliance risks. Meanwhile, laboratories are exploring inventory optimization techniques and flexible contract models to absorb cost pressures without compromising service quality. Strategic alliances with reagent manufacturers for volume commitments have also surfaced as an approach to secure favorable pricing and supply assurances.

Overall, the cumulative impact of these tariff policies has catalyzed a more localized supply chain framework, reinforcing the importance of agility and risk management. As the landscape continues to evolve, laboratories and suppliers alike will need to balance cost containment efforts with the imperative of maintaining rigorous testing standards and uninterrupted service delivery.

Revealing Critical Market Segmentation Insights Based on Test Types, Consumables, Specimens, Applications, and End User Dynamics

Understanding the clinical laboratory testing landscape requires a nuanced view of its diverse modalities, supported by comprehensive segmentation across multiple dimensions. The market’s examination by type encompasses biochemical analyses, genetic testing platforms, immunology and serology assays, microbiology culture systems, and pathology diagnostics, each demanding distinct instrumentation, expertise, and regulatory pathways. Meanwhile, consumables form a second critical pillar: assay kits, specialized laboratory equipment, personal protective gear, essential reagents, and sample collection devices collectively define the materials ecosystem that underpins every diagnostic process.

Additionally, the choice of specimen drives methodological design and result interpretation, whether laboratories focus on blood-based assays, saliva-derived biomarkers, stool sample analyses, or urine examinations. Application segmentation further refines this picture, with testing geared toward autoimmune disorder screening, cardiovascular disease risk stratification, genetic disorder identification, infectious disease detection, and oncological malignancy surveillance. Finally, end-user insights shed light on how diagnostic laboratories, hospital-based labs, and research institutes each leverage these products and services according to their operational contexts and clinical objectives.

By weaving together these segmentation layers, stakeholders can appreciate the interdependencies between test types, material requirements, specimen considerations, application needs, and end-user environments. This integrated perspective supports more informed decision-making around product development, distribution strategies, and service offerings tailored to evolving market demands.

This comprehensive research report categorizes the Clinical Laboratory Tests market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Consumables

- Specimen

- Application

- End User

Illuminating Regional Paradigms in the Clinical Laboratory Sector across the Americas, Europe Middle East & Africa, and Asia Pacific Markets

Regional dynamics in clinical laboratory testing reveal distinct drivers and challenges across the Americas, Europe Middle East & Africa, and Asia Pacific geographies. In the Americas, robust healthcare infrastructure and well-established reimbursement frameworks fuel continual investment in advanced diagnostic platforms, with public and private institutions prioritizing rapid-turnaround molecular assays and precision medicine solutions. This environment also catalyzes strong collaboration between research institutes and industry leaders, fostering innovation in areas such as companion diagnostics and oncology panels.

Transitioning to Europe, the Middle East, and Africa, regulatory complexity and varied economic landscapes shape adoption patterns for laboratory technologies. While Western European markets maintain high demand for next-generation sequencing and digital pathology, many Middle Eastern countries are actively expanding laboratory capacity to meet public health objectives. In contrast, several African regions focus on point-of-care systems and portable analyzers to overcome infrastructural limitations, with non-governmental organizations often spearheading deployment initiatives and capacity building.

In the Asia Pacific corridor, dynamic population demographics and rising healthcare expenditures underpin rapid growth in diagnostic services. Nations within this region increasingly emphasize domestic manufacturing of reagents and equipment to capitalize on cost efficiencies and reduce reliance on imports. Simultaneously, government programs aimed at enhancing rural healthcare access have accelerated the rollout of mobile testing units and telehealth-integrated collection models. Recognizing these region-specific trends enables market participants to calibrate their strategies in alignment with local regulatory, economic, and clinical priorities.

This comprehensive research report examines key regions that drive the evolution of the Clinical Laboratory Tests market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives and Competitive Dynamics of Leading Clinical Laboratory Testing Companies Shaping Industry Trajectories

Leading companies in the clinical laboratory testing domain are advancing strategic partnerships, product innovation pipelines, and global expansion plans to capture emerging opportunities. Several major diagnostics providers now place a strong emphasis on integrating digital connectivity within their instrumentation portfolios, enabling seamless data exchange, remote monitoring, and cloud-based analytics. Joint ventures between reagent manufacturers and equipment suppliers are becoming more prevalent, aimed at delivering end-to-end diagnostic solutions that optimize accuracy and throughput.

Moreover, mergers and acquisitions continue to redefine competitive dynamics as organizations seek to bolster their molecular diagnostics capabilities and geographic reach. Collaboration with academic institutions and research organizations remains a key avenue for accessing novel biomarkers and accelerating the translation of emerging assays into clinical practice. Customer support frameworks are also evolving, with enhanced training modules, virtual service platforms, and localized application laboratories reflecting an industry-wide commitment to elevating laboratory performance and minimizing downtime.

Taken together, these strategic initiatives illustrate how top-tier companies are leveraging innovation, scalability, and integrated service offerings to solidify their market positions, anticipate shifting customer requirements, and reinforce their roles as partners in advancing patient-centric diagnostic care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Laboratory Tests market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Accu Reference Medical Lab, LLC

- Apollo Health and Lifestyle Limited

- Arup Laboratories Inc.

- Aster Clinical Lab LLP

- Bioscientia Healthcare GmbH

- Biosino Bio-technology and Science Inc.

- Charles River Laboratories, Inc

- Cinven Ltd.

- Clinical Reference Laboratory, Inc.

- DaVita Inc. by UnitedHealth Group Inc.

- Dr Lal PathLabs Pvt. Ltd

- Eurofins Scientific SE

- Fresenius Medical Care AG & Co KGaA

- Laboratory Corporation of America Holdings

- Merck KgaA

- Metropolis Health Products Retail Pvt Ltd.

- NeoGenomics, Inc.

- Novartis International AG

- OPKO Health, Inc.

- PerkinElmer, Inc.

- Qiagen .N.V.

- Quest Diagnostics Incorporated

- Siemens Healthineers AG

- Sonic Healthcare Limited

- SYNLAB Group

- Thermo Fisher Scientific Inc.

Driving Forward Actionable Strategies for Industry Leaders to Enhance Resilience, Innovation, and Operational Excellence in Clinical Laboratory Testing

To navigate the complexities of clinical laboratory testing today, industry leaders should prioritize investments in digital transformation and supply chain resilience. Establishing cross-functional teams to evaluate emerging technologies, such as AI-driven analytics and decentralized testing platforms, will enable organizations to identify pilot opportunities rapidly and scale successful models across multiple sites. Simultaneously, diversifying supplier portfolios and forging alliances with domestic producers can mitigate tariff-related cost impacts and safeguard against logistical disruptions.

Equally important is the cultivation of workforce expertise through continuous education and certification programs, ensuring that laboratory personnel remain proficient with advanced instrumentation and data interpretation techniques. Aligning procurement strategies with turnkey solution providers can streamline vendor management while enhancing service-level guarantees. Furthermore, amplifying collaboration with healthcare providers, payers, and regulatory bodies will facilitate the adoption of value-based testing models, driving both clinical utility and cost effectiveness.

By pursuing these actionable steps, laboratory operators and diagnostics suppliers alike can strengthen their competitive positioning, enhance operational agility, and deliver improved patient outcomes in an increasingly dynamic environment.

Detailing Rigorous Research Methodology Combining Primary and Secondary Data Sources to Deliver Reliable Insights in Clinical Laboratory Diagnostics

Our research methodology combines rigorous primary and secondary data collection to ensure comprehensive coverage and analytical integrity. Initially, extensive secondary research was conducted through peer-reviewed journals, regulatory publications, and industry association reports to map the current landscape of clinical laboratory technologies and supply chain factors. Publicly available financial disclosures and company presentations supplemented this foundational analysis, providing context on corporate strategies and capital investments.

Building on these insights, primary research was undertaken via structured interviews with senior executives, laboratory directors, and procurement specialists across diagnostic laboratories, hospitals, and research institutes. These discussions yielded qualitative perspectives on operational challenges, technology adoption patterns, and response strategies to regulatory and tariff-related influences. Additional quantitative surveys were deployed to capture detailed information on technology utilization, reagent preferences, and service delivery models.

The data inputs were triangulated through cross-verification of secondary data findings, interview transcripts, and survey responses, thereby enhancing the validity of insights. Statistical and thematic analyses were then performed to distill major trends and critical insights. This dual-pronged approach ensures that conclusions are grounded in both empirical evidence and expert viewpoints, delivering reliable intelligence for strategic decision-making in clinical laboratory diagnostics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Laboratory Tests market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Laboratory Tests Market, by Type

- Clinical Laboratory Tests Market, by Consumables

- Clinical Laboratory Tests Market, by Specimen

- Clinical Laboratory Tests Market, by Application

- Clinical Laboratory Tests Market, by End User

- Clinical Laboratory Tests Market, by Region

- Clinical Laboratory Tests Market, by Group

- Clinical Laboratory Tests Market, by Country

- United States Clinical Laboratory Tests Market

- China Clinical Laboratory Tests Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding the Executive Summary with Strategic Reflections on Market Dynamics and Opportunities in Clinical Laboratory Testing Landscape

Summarizing the strategic reflections presented herein, it is evident that the clinical laboratory testing landscape is undergoing profound transformation, driven by technological innovation, evolving regulatory frameworks, and shifting supply chain dynamics. Automation, digitalization, and decentralization are reshaping laboratory workflows and accelerating diagnostic capabilities, while tariff influences are prompting a reassessment of procurement and manufacturing strategies.

In addition, the diverse segmentation across test types, consumables, specimens, applications, and end-user contexts underscores the importance of a tailored approach to product development and service deployment. Regional variances further highlight the need for localized strategies that account for distinct regulatory, economic, and healthcare infrastructure considerations. Finally, the competitive maneuvers of leading industry players signal a continued emphasis on integrated solutions, strategic partnerships, and global scalability.

Collectively, these insights form a robust foundation for stakeholders seeking to navigate the complexities of clinical diagnostics. As laboratories adapt to new paradigms in patient care and diagnostics innovation, the ability to align operational practices with emerging trends will determine success in delivering precise, timely, and cost-effective diagnostic services.

Engaging with Ketan Rohom to Secure Tailored Access to Comprehensive Clinical Laboratory Testing Market Research and Strategic Sales Support

To explore how this comprehensive market research can inform your strategic decisions and unlock potential growth opportunities, we invite you to connect directly with Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive expertise in guiding organizations through tailored research solutions and strategic sales support to address nuanced challenges in clinical laboratory diagnostics. He will collaborate with you to understand your specific priorities, provide detailed insights from the report, and demonstrate how these findings can be operationalized within your organization.

Engaging with Ketan ensures that you receive personalized guidance on leveraging the in-depth analysis, actionable recommendations, and regional and segmentation insights contained within the study. Whether you seek to optimize procurement strategies in light of tariff impacts, refine product portfolios in alignment with emerging technological shifts, or benchmark against key competitors, Ketan offers the knowledge and support required to translate data into decisive action. Reach out today to schedule a consultation and secure access to the full research report, empowering your team to navigate the complexities of the clinical laboratory testing landscape with confidence and precision.

- How big is the Clinical Laboratory Tests Market?

- What is the Clinical Laboratory Tests Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?