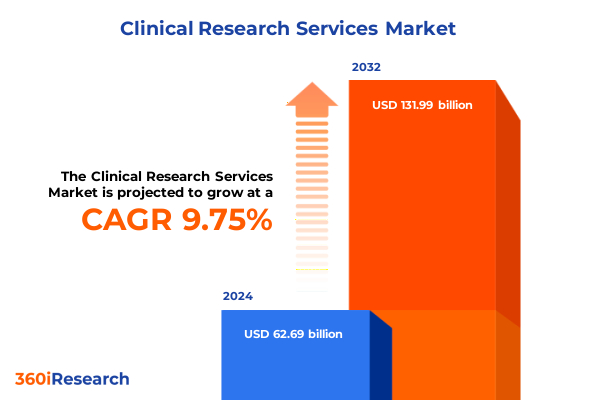

The Clinical Research Services Market size was estimated at USD 68.70 billion in 2025 and expected to reach USD 75.07 billion in 2026, at a CAGR of 9.77% to reach USD 131.99 billion by 2032.

Introduction That Frames the Clinical Research Services Landscape Through the Lens of Innovation, Compliance, and Strategic Stakeholder Dynamics

The clinical research services sector stands at the intersection of rapid technological innovation, heightened regulatory scrutiny, and shifting stakeholder expectations. As sponsors and service providers navigate an increasingly complex ecosystem, an informed perspective is essential to identify strategic pathways and emerging opportunities. This executive summary lays the foundation by contextualizing the current market drivers, regulatory influences, and competitive forces that define clinical research services today. It illuminates the pivotal themes shaping how organizations deliver, manage, and optimize studies-from early phase safety assessments to post-marketing surveillance. Moreover, the introduction frames the significance of integrating digital transformation, advanced analytics, and patient-centric modalities as sponsors strive to accelerate timelines, control costs, and enhance data integrity while maintaining the highest standards of compliance and patient safety.

Through a concise yet comprehensive overview, this introduction also highlights the critical role of stakeholders-from biotechnology innovators and academic research centers to full-service and specialty outsourcing partners-in advancing therapeutic pipelines. By setting the stage with key definitions, such as the delineation between core scientific offerings in biostatistics and medical writing or operational functions within data management and trial management, readers gain clarity on the scope of this analysis. This structured opening prepares decision-makers for an in-depth exploration of transformative shifts, tariff implications, segmentation insights, and regional dynamics, all of which converge to inform strategic planning and competitive positioning in clinical research services.

Charting the Technological and Regulatory Revolution That Is Redefining Efficiency, Patient Engagement, and Data Integrity in Clinical Research Services

Over the last few years, clinical research services have undergone a radical metamorphosis driven by breakthroughs in digital technology, artificial intelligence, and decentralized trial models. Traditional site-centric approaches have been augmented with remote monitoring platforms, telehealth integrations, and patient app ecosystems that collectively boost recruitment, retention, and real-time data visibility. Concurrently, regulators across key jurisdictions have calibrated guidance to accommodate these innovations, issuing new frameworks for risk-based monitoring, electronic informed consent, and adaptive trial designs. This regulatory evolution has enabled sponsors to deploy flexible protocols while maintaining rigorous oversight, creating a virtuous cycle of continuous improvement and accelerated development timelines.

Additionally, the advent of advanced analytics and machine learning has redefined the data management paradigm. Automated data cleaning, natural language processing for medical coding, and predictive modeling for patient safety trends have transformed how clinical data is captured, validated, and interpreted. These capabilities are further enhanced by cloud-based electronic data capture systems that seamlessly integrate with decentralized trial components to ensure data integrity and security at scale. As platforms become more interoperable, cross-functional teams can extract richer insights from diverse data sources, driving more informed decision-making and adaptive study adjustments.

Moreover, the increasing emphasis on patient engagement has fostered novel trial designs that prioritize patient convenience and inclusivity. Site monitoring has expanded beyond physical visits to include virtual site assessments, allowing project teams to maintain rigorous oversight while reducing travel burdens and geographic constraints. This shift not only broadens access for underrepresented populations but also accelerates enrollment in challenging patient segments. Together, these technological and procedural innovations are reshaping the clinical research services landscape, forging a new era of efficiency, resilience, and patient-centered evidence generation.

Analyzing How 2025 United States Tariff Adjustments Have Reshaped Supply Chains, Contractual Frameworks, and Strategic Procurement in Clinical Research Services

Recent adjustments to United States tariff policies in 2025 have introduced multifaceted implications for the clinical research services sector, particularly in the procurement of specialized equipment, laboratory materials, and outsourced operational support. As tariffs on certain laboratory instruments and diagnostic reagents rose, service providers have been compelled to reassess supply chain strategies, diversifying vendor partnerships and accelerating negotiations for long-term procurement contracts to mitigate cost volatility. This proactive approach has heightened collaboration with domestic manufacturers while also exploring strategic alliances with tariff-exempt regions to ensure uninterrupted access to critical trial supplies.

Beyond material costs, the tariff environment has influenced the structuring of cross-border service agreements. Negotiations now include detailed clauses addressing potential tariff pass-through, currency hedging mechanisms, and contingency planning for sudden policy shifts. Clinical trial management operations, particularly those involving patient recruitment services in regions reliant on imported medical devices, have recalibrated budgets to incorporate dual-sourcing strategies and localized monitoring solutions. Concurrently, data management platforms leveraging cloud-based infrastructures have exhibited resilience, given their reduced dependency on physical imports, although hardware maintenance support agreements have been revisited to ensure compliance with new duties.

These cumulative effects have also prompted sponsors to intensify scenario planning, incorporating tariff risk assessments into feasibility analyses for new trial sites and therapeutic areas. Economic modeling now extends beyond traditional cost-per-patient metrics to include duty-driven supply chain margins, influencing phase selection priorities and end-user engagement models. In this evolving landscape, tariff considerations are no longer peripheral but central to strategic decision-making in clinical research services, underscoring the need for agile procurement, diversified sourcing, and comprehensive risk management frameworks.

Uncovering Distinct Strategic Imperatives by Service Offering, Trial Phase, Therapeutic Specialization, and End-User Priorities in Clinical Research Services

A granular examination of market segmentation reveals distinct strategic imperatives across service type, clinical trial phase, therapeutic area, and end-user profiles. Based on service type, demand for biostatistics and medical writing remains robust as sponsors generate increasingly complex protocols and regulatory submissions, while clinical trial management has evolved to favor patient recruitment and site monitoring solutions that blend virtual and on-site capabilities. Within data management, innovations in database design and electronic data capture are complemented by advanced data cleaning techniques that streamline real-time analytics and reporting workflows. Regulatory affairs services continue to be pivotal, guiding global compliance strategies and ensuring adherence to evolving guidance.

Segmenting by trial phase uncovers nuanced operational and resourcing requirements. Phase I studies require intensive safety monitoring and small cohort management, while Phase II trials demand adaptive statistical modeling to refine dosing and endpoint selection. As trials progress to Phase III, sponsors lean on full-scale patient recruitment and project management frameworks to manage larger datasets and diverse geographies, with Phase IV post-marketing surveillance focusing on long-term safety monitoring and real-world evidence generation. These phase-specific dynamics inform targeted investments in specialized service offerings and partnership models.

Therapeutic area segmentation highlights oncology’s continued prominence, driven by both hematologic malignancy trials that leverage biomarker-driven patient stratification and solid tumor studies optimized for adaptive designs. Infectious disease research has surged in response to global health priorities, requiring rapid scale-up of site operations and accelerated data submission pathways. Cardiovascular and neurology studies, while more established, are increasingly integrating patient wearable data and remote monitoring to capture nuanced safety and efficacy metrics. Finally, end-user insights demonstrate that academic research organizations value full-service clinical management partnerships, whereas biotech innovators often engage specialty CROs for niche capabilities, and large pharma companies seek consolidated offerings from full-service CROs to streamline global program execution.

This comprehensive research report categorizes the Clinical Research Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Trial Phase

- Therapeutic Area

- End User

Exploring How Regional Regulatory Landscapes, Infrastructure Investments, and Patient Access Dynamics Shape Clinical Research Services Across Major Global Markets

Regional dynamics in the clinical research services market exhibit unique drivers and adoption trajectories across the Americas, Europe, the Middle East and Africa, and Asia-Pacific. In the Americas, a mature regulatory framework and robust funding landscape have cultivated a thriving ecosystem of full-service CROs and academic research institutions, with the United States leading in advanced therapeutic trials. Sponsors leverage well-established site networks while increasingly adopting decentralized trial components to optimize patient reach across diverse demographics.

Europe, the Middle East and Africa present a heterogeneous environment where regulatory harmonization efforts under the EU Clinical Trials Regulation coexist with localized requirements in emerging markets. Strategic collaborations often involve leveraging specialized CROs to navigate region-specific compliance landscapes, particularly for oncology and infectious disease studies. Similarly, medical writing and regulatory affairs services are in high demand to interpret complex, multi-jurisdictional guidelines. Growth in the Middle East and Africa is spurred by investments in clinical research infrastructure and partnerships with international sponsors seeking cost-efficient trial sites.

In Asia-Pacific, the convergence of large patient populations, expanding healthcare budgets, and supportive government initiatives has accelerated the region’s prominence in global clinical research. Countries such as China, India, and Japan serve as primary hubs for late-phase trials, driven by the availability of treatment-naïve patient cohorts and accelerated regulatory review pathways. Regional CROs and data management providers are scaling local operations while forging alliances with global sponsors to deliver hybrid trial models that integrate on-site expertise with remote monitoring capabilities. Across all regions, tailored service portfolios, regulatory intelligence, and localized partnerships are crucial to capturing regional growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Clinical Research Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Global and Regional Players Demonstrating Strategic Differentiation, Digital Innovation, and Collaborative Growth in Clinical Research Services

Leading organizations in the clinical research services domain are distinguished by their depth of therapeutic expertise, breadth of global service networks, and strategic investments in digital platforms. Parexel and IQVIA stand out for their comprehensive offerings that span biostatistics, regulatory affairs, and full-scale trial management, bolstered by proprietary analytics that accelerate protocol optimization and patient stratification. Syneos Health has differentiated its portfolio through end-to-end solutions that integrate clinical and commercial insights, while ICON emphasizes strategic partnerships that enhance its data management and post-marketing surveillance capabilities.

Mid-tier and niche players such as PRA Health Sciences and Charles River Laboratories have secured competitive positioning by focusing on specialized service lines. PRA’s expansion into decentralized trial technology and home health partnerships underscores its commitment to patient-centric designs, whereas Charles River’s preclinical and diagnostic expertise complements late-stage clinical offerings. Meanwhile, regional specialists in Asia-Pacific and EMEA have forged alliances with global sponsors to fill gaps in local regulatory navigation and site management, often collaborating with full-service CROs to deliver hybrid solutions.

Emerging entrants and technology-focused innovators are also reshaping the competitive landscape. Companies offering AI-driven data cleaning tools and e-consent platforms have attracted venture capital backing, positioning themselves as strategic enablers for larger CROs seeking to embed advanced digital capabilities. These collaborations and acquisitions highlight a broader trend toward consolidation and specialization, as organizations aim to differentiate through integrated service models and proprietary technology infrastructure.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Research Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Clinical

- Almac Group Ltd

- Caidya

- Charles River Laboratories International Inc.

- CTI Clinical Trial and Consulting Services Inc.

- Ergomed plc

- Eurofins Scientific SE

- Fortrea Inc.

- Hangzhou Tigermed Consulting Co., Ltd.

- ICON plc

- IQVIA Holdings Inc.

- Laboratory Corporation of America Holdings

- Medpace Holdings Inc.

- Novotech Health Holdings Pty Ltd

- Parexel International Corporation

- Pharmaceutical Product Development, LLC

- Pharmaron Beijing Co., Ltd.

- Premier Research Group Limited

- PSI CRO AG

- SGS SA

- Syneos Health Inc.

- The Emmes Company LLC

- Thermo Fisher Scientific Inc.

- Worldwide Clinical Trials

- WuXi AppTec Co., Ltd.

Translating Market Insights into Strategic Actions Including Analytics Integration, Regulatory Intelligence, and Regional Expansion to Strengthen Industry Leadership

Industry leaders should prioritize the integration of advanced analytics platforms across service lines to accelerate trial design and patient recruitment processes. By harnessing real-time data visualization and machine learning-driven risk prediction, organizations can proactively optimize site performance and resource allocation. Concurrently, forming strategic alliances with specialized technology providers-particularly those offering decentralized trial solutions and patient engagement applications-will enable sponsors to deliver more flexible, patient-centric study models that adapt to evolving trial requirements.

In parallel, it is essential to establish robust regulatory intelligence functions that monitor tariff changes, evolving compliance guidance, and cross-border data privacy regulations. Embedding these insights into contract negotiation and feasibility assessments will ensure more resilient supply chain strategies and reduce the risk of unexpected cost escalations. To address the complexity of multi-phase trials, cross-functional task forces should be empowered to synchronize operational planning across biostatistics, data management, and trial management teams, fostering agility and minimizing silos.

Finally, expanding footprints in high-growth regions through selective partnerships or strategic acquisitions will position organizations to capitalize on increasing demand in Asia Pacific and emerging EMEA markets. Tailored regional service offerings-supported by local regulatory expertise and culturally sensitive patient outreach programs-will differentiate providers in competitive landscapes. By aligning investment priorities with these strategic imperatives, industry leaders can drive sustainable growth and reinforce their competitive edge in a rapidly evolving clinical research services ecosystem.

Outlining a Robust Mixed Methodology Combining Primary Executive Interviews, Secondary Data Analysis, and Segmentation Validation for Comprehensive Market Insights

This analysis employs a rigorous mixed-methodology approach, combining primary research through in-depth interviews with senior executives at biotech sponsors, academic research organizations, and contract research providers, with comprehensive secondary research from peer-reviewed journals, regulatory publications, and reputable industry white papers. Quantitative data was triangulated across multiple sources, including patent filings, clinical trial registries, and government tariff schedules, to capture the latest operational trends and tariff impacts.

Qualitative insights were derived from thematic analysis of expert interviews and roundtable discussions, providing context to emerging technologies, regulatory adaptations, and patient engagement models. The segmentation framework was validated through cross-functional workshops that included representatives from biostatistics, medical writing, data management, and trial management teams to ensure alignment with real-world service delivery dynamics. Regional considerations were assessed by consulting local market experts and evaluating country-specific regulatory guidance and infrastructure developments.

This methodology ensures that the findings presented herein are both comprehensive and actionable, reflecting the complex interplay of innovation, compliance, and commercial drivers shaping the clinical research services landscape. By integrating diverse data streams and stakeholder perspectives, the report provides a 360-degree view designed to inform strategic decision-making and optimize service delivery across phases, therapeutic areas, and geographies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Research Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Research Services Market, by Service Type

- Clinical Research Services Market, by Trial Phase

- Clinical Research Services Market, by Therapeutic Area

- Clinical Research Services Market, by End User

- Clinical Research Services Market, by Region

- Clinical Research Services Market, by Group

- Clinical Research Services Market, by Country

- United States Clinical Research Services Market

- China Clinical Research Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Synthesis of Technological, Regulatory, Segmentation, and Competitive Forces Underscoring Strategic Imperatives for Clinical Research Services Market Success

The clinical research services market stands at a transformative juncture where technological innovation, regulatory evolution, and shifting stakeholder priorities converge to create both challenges and opportunities. Technological advancements in decentralized trials, machine learning-enhanced data management, and patient engagement platforms are redefining operational paradigms, enabling more efficient and patient-centric studies. Regulatory frameworks continue to adapt, requiring service providers to maintain agile compliance strategies that account for emerging guidance, tariff fluctuations, and data privacy considerations.

Segmentation analysis underscores the importance of tailoring service portfolios to phase-specific and therapeutic-area needs, while regional insights reveal that capturing growth requires localized expertise and strategic partnerships. Competitive dynamics are driven by established full-service CROs, nimble niche providers, and technology innovators, highlighting the ongoing need for differentiating through integrated solutions and proprietary capabilities. Industry leaders who embrace integrated analytics, proactive regulatory intelligence, and targeted regional expansion will be best positioned to navigate uncertainty and deliver value to sponsors, patients, and other stakeholders.

As organizations chart their strategic roadmaps, the interplay of service specialization, digital transformation, and global market dynamics will continue to shape the competitive landscape. By synthesizing these core insights, decision-makers are equipped to prioritize investments, optimize operational models, and foster collaborations that accelerate the development of next-generation therapies. The future of clinical research services hinges on the ability to adapt swiftly, innovate responsibly, and align offerings with the evolving needs of a diverse and dynamic industry.

Empower Your Organization with Expert Guidance by Engaging with Ketan Rohom for Exclusive Access to the Comprehensive Clinical Research Services Analysis

If you are ready to elevate your strategic planning with an in-depth understanding of clinical research services, reach out today to connect with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with a dedicated expert who is deeply familiar with the nuances of service segmentation, regulatory dynamics, and emerging regional drivers, you will gain immediate access to the comprehensive market research report that can inform critical business decisions. Engage with Ketan to schedule a personalized briefing, obtain sample insights tailored to your specific needs, and explore flexible licensing options that align with your organizational priorities. Seize the opportunity to transform intelligence into action and secure a competitive advantage by leveraging detailed analysis that covers service type performance, therapeutic area trends, tariff impacts, and more. Contact Ketan Rohom today to unlock the full potential of your strategic initiatives and drive sustainable growth in the evolving clinical research services landscape.

- How big is the Clinical Research Services Market?

- What is the Clinical Research Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?