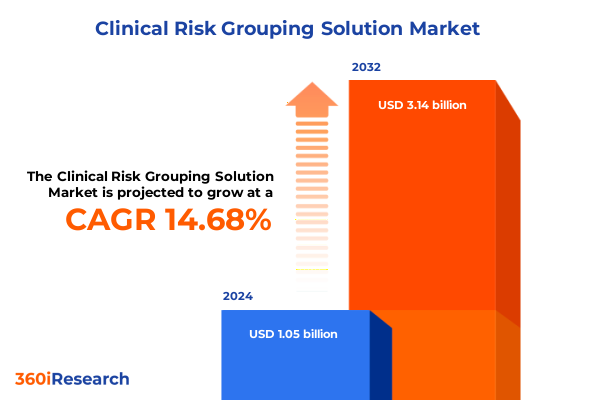

The Clinical Risk Grouping Solution Market size was estimated at USD 1.20 billion in 2025 and expected to reach USD 1.38 billion in 2026, at a CAGR of 14.72% to reach USD 3.14 billion by 2032.

Revolutionary Dynamics of Clinical Risk Grouping Platforms Redefining Healthcare Efficacy with Advanced Analytics and Predictive Interventions

The clinical risk grouping solution arena is witnessing a profound evolution as healthcare providers and payers increasingly prioritize data-driven decision-making and value-based outcomes. In an era where precision medicine and cost containment are paramount, these platforms are redefining how patient populations are stratified, risk is assessed, and care pathways are optimized. Underpinned by advancements in predictive analytics, machine learning models, and electronic health record integration, the ecosystem now offers robust capabilities that extend beyond traditional retrospective analyses to real-time risk scoring and proactive intervention triggers.

Driven by the quest to balance ever-growing healthcare expenditures with quality metrics, stakeholders are embracing risk grouping solutions to identify high-risk cohorts early, tailor intervention protocols, and allocate resources with greater efficiency. These developments are also catalyzed by regulatory imperatives around population health management and the shift toward alternative payment models. As a result, clinical risk grouping platforms are no longer niche analytical tools but foundational components of modern care management infrastructures, paving the way for more personalized, efficient, and sustainable healthcare delivery.

Groundbreaking Regulatory Reforms and Technological Innovations Propelling Clinical Risk Grouping into a Future of Proactive Population Health Management

Over the past few years, landmark regulatory reforms, technological breakthroughs, and shifting reimbursement paradigms have collectively propelled the clinical risk grouping market into a period of remarkable transformation. Notably, the integration of artificial intelligence and deep learning algorithms has enabled more granular risk stratifications, seamlessly ingesting heterogeneous data sources ranging from claims and clinical notes to wearable device metrics. Furthermore, the advent of interoperable health information exchanges has dismantled traditional data silos, granting risk grouping applications unprecedented access to longitudinal patient histories.

Simultaneously, the industry’s transition to value-based care arrangements has intensified the demand for outcome-centric risk assessment methodologies. Payers and providers are now incentivized to demonstrate improved patient outcomes and reduced cost burdens, elevating the strategic importance of predictive risk models. Moreover, as cloud-native architectures gain prominence, solution providers are introducing scalable, secure offerings that can adapt rapidly to evolving clinical workflows and regulatory requirements. Collectively, these shifts underscore a trajectory toward holistic, proactive population health management that emphasizes prevention and early intervention.

Navigating the Ramifications of 2025 U.S. Tariffs on Clinical Risk Grouping Solutions Driving Strategic Shifts in Deployment and Sourcing

In 2025, a series of tariff adjustments implemented by U.S. authorities have introduced new considerations for providers and technology vendors within the clinical risk grouping market. The levies, primarily targeting imported software services and specialized analytics hardware, have driven an uptick in procurement costs, prompting organizations to reassess supply chain strategies and cost management frameworks. While tariffs have applied pressure on traditional on-premise deployments reliant on imported servers and analytics appliances, they have concurrently accelerated the shift toward cloud-based models that minimize hardware dependencies and leverage global service infrastructures.

Consequently, solution providers are reexamining licensing and delivery models to mitigate cost impacts for end users. Hybrid cloud deployments have emerged as a strategic compromise, enabling organizations to balance data sovereignty requirements with the cost efficiencies of public cloud platforms. Furthermore, some vendors are localizing data centers and forging domestic partnerships to alleviate tariff burdens. These adaptive measures illustrate the sector’s resilience and underscore the imperative for flexible architecture choices and diversified sourcing to safeguard continuity and cost-effectiveness.

Illuminating Critical Market Segments from Deployment Paradigms to Organization Profiles to Enhance Strategic Solution Positioning

Effective market segmentation is foundational to understanding diverse customer requirements and tailoring solutions that resonate across use cases. When deployment mode is considered, cloud offerings spanning hybrid configurations, private clouds, and public clouds have captured provider interest due to scalability and minimal infrastructure overhead, while on-premise solutions remain relevant for organizations with stringent data governance mandates. In terms of solution type, the fusion of software and services-encompassing implementation support and ongoing maintenance-continues to be a preferred choice for clients seeking turnkey deployments and expert guidance, although standalone software licenses still appeal to entities with robust internal IT capabilities.

The payment model dimension further illustrates this trend: fee-for-service arrangements cater to traditional billing structures, while value-based care frameworks place a premium on solutions that demonstrate direct impact on patient outcomes and cost containment. Organizational size also informs solution preferences; large enterprises frequently require enterprise-grade integration, advanced customization, and extensive support, whereas small and medium entities prioritize rapid implementation cycles and cost-effective subscription models. Lastly, end users differ in their clinical and administrative imperatives: while hospitals-both large tertiary centers and smaller community facilities-focus on patient throughput and readmission prevention, payers, whether private or public, emphasize underwriting precision and population health analytics, and research institutes leverage grouping tools for epidemiological studies and trial cohort identification.

This comprehensive research report categorizes the Clinical Risk Grouping Solution market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Mode

- Solution Type

- Payment Model

- Organization Size

- End User

Dissecting Regional Adoption Patterns and Regulatory Landscapes to Identify High-Potential Markets across the Americas EMEA and Asia-Pacific

Regional nuances significantly influence adoption patterns and strategic priorities in the clinical risk grouping space. In the Americas, regulatory emphasis on interoperability and value-based reimbursement has fueled demand for cloud-native platforms that can seamlessly integrate with existing health information exchanges across states. Moreover, payer-provider collaborations in mature North American markets have led to joint ventures and data-sharing consortia, amplifying the need for risk grouping tools capable of handling large-scale, diverse data streams.

Meanwhile, Europe, Middle East & Africa display a mosaic of adoption drivers shaped by national health system structures and data privacy mandates. In Western Europe, robust public healthcare frameworks and stringent GDPR requirements have directed attention toward private and hybrid cloud deployments, whereas markets in the Middle East and Africa are witnessing accelerated uptake driven by digital transformation initiatives and strategic partnerships with technology vendors. Finally, in Asia-Pacific, the convergence of rising healthcare expenditures, expanding insurance coverage, and government-led population health strategies has created fertile ground for both service-led and software-led risk grouping solutions, particularly within rapidly scaling hospital networks and payer organizations.

This comprehensive research report examines key regions that drive the evolution of the Clinical Risk Grouping Solution market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiles of Market Leaders Driving Innovation through Advanced Analytics Research Collaborations and Global Expansion Strategies

A select group of innovators has emerged as pivotal drivers of progress within the clinical risk grouping ecosystem. These companies distinguish themselves by delivering comprehensive platforms that blend advanced analytics, user-friendly interfaces, and modular architectures. They have invested heavily in research and development to refine predictive accuracy, integrating natural language processing for unstructured clinical data and embedding closed-loop referral pathways to facilitate clinician engagement.

Strategic alliances and targeted acquisitions have also been instrumental in expanding solution portfolios and geographical footprints. Several leading firms have strengthened their presence in underserved regions through joint ventures and localized service models. Additionally, partnerships with academic medical centers and research institutions have enabled ongoing validation of risk models, ensuring that algorithms remain current with evolving clinical guidelines and emerging disease patterns. This collaborative approach not only enhances product credibility but also accelerates time-to-market for cutting-edge features.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Risk Grouping Solution market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Allscripts Healthcare Solutions, Inc.

- Cognizant Technology Solutions Corporation

- Conduent, Inc.

- Cotiviti, Inc.

- Epic Systems Corporation

- Evolent Health, Inc.

- HBI Solutions, Inc.

- Health Catalyst, Inc.

- HMS Holdings Corp.

- Lightbeam Health Solutions

- Oracle Corporation

- R1 RCM Inc.

- UnitedHealth Group Incorporated

Strategic Roadmap for Accelerating Adoption and Driving Sustainable Growth through Innovation Collaboration and User-Centered Design

Industry participants poised for success must prioritize agility and collaboration to navigate dynamic market conditions. Firstly, leaders should foster partnerships with cloud service providers and technology integrators to accelerate deployment timelines and reduce total cost of ownership. By adopting containerized, microservices-based architectures, organizations can achieve rapid feature rollouts and seamless updates while ensuring high availability and security compliance.

In parallel, investing in user-centric design and clinician workflow integration will be critical to drive adoption and maximize return on investment. Solutions that embed risk insights directly into electronic medical records and clinical decision support systems can minimize friction and deliver actionable recommendations at the point of care. Further, establishing dedicated centers of excellence for data governance and analytics can reinforce the credibility of risk scores and expedite stakeholder buy-in. Ultimately, a balanced focus on technical innovation, user experience, and strategic partnerships will empower industry leaders to capture emerging opportunities and deliver measurable value.

Comprehensive Multi-Phase Research Methodology Integrating Secondary Analysis Interviews and Data Triangulation for Robust Insights

This analysis is grounded in a rigorous research framework that synthesizes diverse data streams and stakeholder perspectives. Secondary research phases involved the systematic review of peer-reviewed journals, regulatory filings, and thought leadership publications to map industry trends, technology advancements, and policy shifts. Concurrently, primary research was conducted through in-depth interviews with healthcare executives, IT decision-makers, risk management specialists, and academic researchers to validate key findings and uncover emerging use cases.

Quantitative data was triangulated across multiple sources to ensure accuracy and relevance, while qualitative insights helped contextualize the nuances of deployment preferences and value drivers. A multi-layered peer review process engaged subject matter experts to refine risk assessment criteria and verify methodological consistency. Through this comprehensive approach, the report delivers an unbiased, forward-looking perspective on the clinical risk grouping market and equips stakeholders with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Risk Grouping Solution market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Risk Grouping Solution Market, by Deployment Mode

- Clinical Risk Grouping Solution Market, by Solution Type

- Clinical Risk Grouping Solution Market, by Payment Model

- Clinical Risk Grouping Solution Market, by Organization Size

- Clinical Risk Grouping Solution Market, by End User

- Clinical Risk Grouping Solution Market, by Region

- Clinical Risk Grouping Solution Market, by Group

- Clinical Risk Grouping Solution Market, by Country

- United States Clinical Risk Grouping Solution Market

- China Clinical Risk Grouping Solution Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Looking Beyond Today’s Analytics to Anticipate the Evolution of Clinical Risk Grouping and Drive Next-Generation Population Health Strategies

As the healthcare industry continues its transformative march toward value-based care and data-centric operations, clinical risk grouping solutions will remain instrumental in shaping outcomes and operational efficiencies. The confluence of regulatory incentives, technological breakthroughs, and shifting reimbursement models underscores the imperative for organizations to adopt proactive risk stratification tools. Entities that embrace cloud-based scalability, AI-driven analytics, and seamless interoperability will unlock new pathways to improve patient outcomes, optimize resource utilization, and manage cost pressures.

Looking ahead, sustained innovation in predictive algorithms, real-time data integration, and user experience design will further enhance the strategic value of risk grouping platforms. Organizations that proactively refine their deployment strategies and forge collaborative ecosystems will be best positioned to navigate emerging challenges and capture growth opportunities. Ultimately, the evolving clinical risk grouping landscape holds the promise of transforming population health management and delivering truly personalized care at scale.

Engage Directly with Associate Director of Sales & Marketing to Unlock Tailored Clinical Risk Grouping Market Insights and Drive Strategic Growth

To explore deeper insights into the clinical risk grouping solution market and learn how your organization can leverage this intelligence for strategic advantage, connect with Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the comprehensive report, discuss customized requirements, and demonstrate how this analysis can support your decision-making frameworks. Reach out today to secure your copy and gain the foresight needed to stay ahead in a landscape defined by rapid innovation and evolving regulatory demands.

- How big is the Clinical Risk Grouping Solution Market?

- What is the Clinical Risk Grouping Solution Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?